Ocular Drug Delivery Devices Market Size:

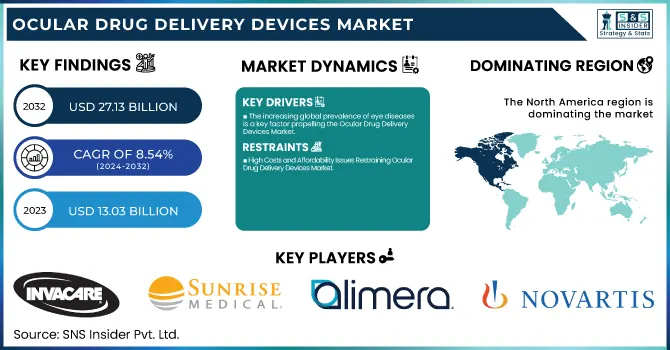

The Ocular Drug Delivery Devices Market was valued at USD 13.03 billion in 2023 and is expected to reach USD 27.13 billion by 2032, growing at a CAGR of 8.54% from 2024-2032.

To Get more information on Ocular Drug Delivery Devices Market - Request Free Sample Report

The Ocular Drug Delivery Devices market is witnessing substantial expansion, propelled by progress in drug delivery technology and the rising incidence of eye ailments. As populations worldwide grow older, the occurrence of eye conditions like glaucoma, macular degeneration, and diabetic retinopathy has significantly increased. As reported by the World Health Organization (WHO) in 2023, approximately 2.2 billion people experience some form of near or distant vision impairment. Of these, at least 1 billion cases could have been prevented or remain unaddressed. The increase in demand for more efficient and accurate treatments is driving the use of ocular drug delivery devices, which provide improved patient results via controlled, prolonged release of medicine.

The market is also gaining from advancements in drug delivery technologies, including biodegradable implants, injectable solutions, and ocular inserts. These innovations enhance drug bioavailability, minimize side effects, and increase the ease of treatment for patients. For example, the advancement of intravitreal implants aimed at the sustained release of anti-VEGF (vascular endothelial growth factor) agents is gaining momentum in treating conditions such as macular degeneration. Recent advancements, including the FDA-approved Ozurdex implant, have greatly improved the treatment of eye conditions by offering extended therapy with fewer injections, tackling a key drawback of conventional eye care.

Advancements in technology are also improving patient adherence. Intelligent ocular drug delivery systems with sensors can monitor dosage usage, making sure that patients follow their recommended treatments. This tackles a major issue in the management of chronic eye diseases, which require regular treatments.

Additionally, pharmaceutical companies have increased their investment in eye drug delivery technologies to offer improved, more effective treatments. In 2024, the authorization of various new ocular drug delivery systems by regulatory bodies suggests a bright outlook for this market. These advancements are anticipated to significantly influence the increasing need for more precise and effective treatment choices for

Ocular Drug Delivery Devices Market Dynamics

Drivers

-

The increasing global prevalence of eye diseases is a key factor propelling the Ocular Drug Delivery Devices Market.

As the global population gets older, the occurrence of eye disorders like age-related macular degeneration (AMD), glaucoma, diabetic retinopathy, and cataracts is increasing. These conditions necessitate regular and at times lifelong management, leading to a significant need for improved drug delivery techniques. In particular, AMD, a primary contributor to vision impairment in seniors, is anticipated to impact more than 196 million individuals by 2020, with projections indicating a substantial rise by 2040.

Diabetic retinopathy, impacting around 1 in 3 people with diabetes, is an increasing worry. With the global increase in diabetes, particularly in low- and middle-income nations, the need for specific eye treatments is growing. According to NCBI, Glaucoma, a prevalent issue for older adults, impacts approximately 60 million individuals globally and is projected to rise to 80 million by 2040. Due to the persistent nature of these ailments, extended treatments are necessary, and traditional oral or topical therapies frequently fail to deliver focused, lasting relief. This creates a demand for advanced ocular drug delivery systems that can guarantee accuracy, and efficacy, and minimize side effects.

-

Technological Advancements in Drug Delivery Systems Propelling Ocular Drug Delivery Devices Market

Technological progress has greatly changed the eye medication delivery scene, enhancing patient results and the ease of treatment. Conventional approaches such as eye drops frequently prove ineffective because of swift drainage from the eye and lack of patient adherence. To tackle these issues, innovative solutions such as sustained-release drug formulations, implantable devices, and micro-needle technologies are currently being created. These devices offer prolonged effects, decreasing the necessity for regular injections or frequent topical applications.

For instance, drug-releasing implants and long-acting formulations can provide medication for weeks or even months, guaranteeing ongoing therapeutic effects with reduced interventions. Additionally, advancements in nanoparticle-driven delivery systems, which enable more precise targeting of medications to the eye tissue, have demonstrated enhancements in bioavailability and therapeutic effectiveness. These developments not only enhance the efficacy of therapies for issues such as AMD and diabetic retinopathy but also render treatments more accommodating for patients, boosting compliance and overall life quality.

Restraint

-

High Costs and Affordability Issues Restraining Ocular Drug Delivery Devices Market

A major limitation in the Ocular Drug Delivery Devices Market is the elevated expenses linked to sophisticated drug delivery technologies. Technologies like drug-releasing implants, micro-needle systems, and injectable formulations necessitate substantial funding in research, development, and production, resulting in high costs for both healthcare providers and patients. This significant expense may restrict access, particularly in low and middle-income nations where healthcare funding is limited. For instance, the price of one anti-VEGF injection for age-related macular degeneration (AMD) may vary between USD 2,000 and USD 2,500, necessitating several injections each year. This financial strain can be difficult for numerous patients, especially those lacking sufficient insurance coverage. Although these sophisticated devices provide improved accuracy and effectiveness, the expense continues to be a major obstacle to their broad use, potentially hindering the expansion of the ocular drug delivery market in some areas.

Ocular Drug Delivery Devices Market Segmentation Analysis

By Type

The ocular insert segment dominates the Ocular Drug Delivery Devices Market due to its superior efficiency, sustained drug release capabilities, and improved patient compliance. Unlike traditional eye drops, ocular inserts deliver medication directly to the eye over an extended period, minimizing frequent application and reducing wastage. This feature makes them particularly effective for chronic conditions like glaucoma and dry eye disease, where treatment adherence is critical for patient outcomes.

Their biocompatible design and ability to bypass systemic absorption ensure targeted therapy, minimizing side effects and enhancing drug efficacy. Moreover, advancements in materials and drug delivery technologies have led to the development of dissolvable and non-dissolvable inserts, further broadening their applicability. Growing adoption in both developed and emerging markets, driven by an increasing prevalence of ocular diseases and a shift toward innovative treatments, cements their dominance in the market.

The topical segment is expected to be the most lucrative growth of around 23% in the ocular drug delivery devices market throughout the forecast period, owing to its high penetration as the most convenient and non-invasive method for treating diseases in the eye. Topical drugs, such as eye drops and ointments, are widely used for glaucoma, dry eye syndrome, and allergic conjunctivitis. The products administer the drug(s) directly to the eye to provide localized treatment with targeted effects and fewer systemic side effects. Topical formulations are favorable drug delivery systems for the patient and health care provider due to ease of use and cost. These solutions are driven by the rising global prevalence of eye disorders. For example, an estimated 2.2 billion people worldwide have vision impairment or blindness, and many of these conditions can be treated with topical drugs. Innovative formulation technologies, such as sustained-release and nanoparticle systems, improve topical treatment performance and reinforce their market superiority.

By Drug Forms

The solution segment dominated the ocular drug delivery devices market with around 40% of the market share in 2023, because of its ease of use, efficiency, and widespread availability. Eye drops and injectable solutions enable straightforward administration, permitting patients to easily self-administer their medications, thereby enhancing patient adherence. These solutions are budget-friendly, rendering them a viable treatment choice for a diverse array of patients. Additionally, they provide fast drug absorption, ensuring faster relief, particularly for ailments such as glaucoma and dry eye syndrome. Improvements in drug formulations, including the application of nanotechnology and innovative excipients, have greatly enhanced the effectiveness and stability of eye solutions. Their extensive clinical application, recognition among healthcare professionals, and capacity to address multiple eye conditions further enhance their market superiority. These elements together contribute to the solution segment being the optimal option for ocular drug delivery.

By End User

The segment of hospital pharmacies leads the Ocular Drug Delivery Devices Market in terms of end-users because of its essential function in delivering specialized and extensive care. Hospitals serve as key facilities for managing intricate and long-term eye disorders such as glaucoma, diabetic retinopathy, and macular degeneration, necessitating sophisticated drug delivery methods. Hospital pharmacies provide quick access to various ocular drug delivery devices, such as inserts, in-situ gels, and iontophoresis systems, which are frequently not found in retail pharmacies.

Moreover, having skilled professionals in hospitals guarantees the correct management, storage, and use of these devices, improving treatment results. Hospitals function as referral hubs for surgeries and advanced treatments, which further increases the need for ocular drug delivery devices. The consistent arrival of patients with severe eye issues reinforces hospital pharmacies as a leading distribution avenue in this market.

The online pharmacies segment is the fastest-growing end-user segment in the Ocular Drug Delivery Devices Market, driven by consumers' rising preference for convenience and accessibility. The increase in e-commerce sites focused on healthcare items has simplified the process for patients to purchase ocular drug delivery devices like topical solutions, ocular inserts, and in-situ gels from the ease of their homes. This trend is especially attractive for patients dealing with chronic eye issues such as glaucoma or diabetic retinopathy, who need frequent refills of their prescription devices.

Moreover, online pharmacies typically offer appealing prices, promotions, and a wider selection of products than conventional physical pharmacies. The growth of telemedicine services, which facilitate online consultations and prescriptions, further enhances the development of this market. These elements together propel the swift uptake of online pharmacies in the ocular drug delivery device market.

Ocular Drug Delivery Devices Market Regional Insights

In 2023, North America dominated the Ocular Drug Delivery Devices Market with around 42% of the market share, driven by its advanced healthcare infrastructure, strong research and development efforts, and key companies such as Regeneron Pharmaceuticals and Bausch + Lomb. The widespread occurrence of eye conditions like glaucoma, macular degeneration, and diabetic retinopathy fuels the need for advanced drug delivery methods. The CDC states that around 12 million people in the U.S. experience various types of vision impairment, highlighting the need for effective treatments. The U.S. gains from substantial healthcare expenditures, a favorable regulatory framework provided by the FDA, and robust funding in ophthalmology research. Furthermore, the elderly population is a factor in the rising prevalence of age-related eye conditions. Elevated awareness, along with improved access to cutting-edge therapies, reinforces North America’s leading position in this swiftly expanding market.

The Asia Pacific region is the fastest-growing market for ocular drug delivery devices market with the highest CAGR throughout the forecast period, due to several factors, including its rapidly expanding population, increasing prevalence of eye-related disorders, and improving access to healthcare. Countries like China and India are witnessing a surge in age-related eye diseases, such as cataracts and macular degeneration, driven by aging populations and rising incidences of diabetes. According to the International Diabetes Federation, Asia accounts for over 60% of the global diabetic population, a key risk factor for vision-related conditions like diabetic retinopathy.

Additionally, government initiatives to enhance healthcare infrastructure and provide affordable eye care solutions are accelerating market growth. The region is also a hub for pharmaceutical manufacturing and innovation, with companies developing cost-effective and advanced ocular drug delivery technologies. Growing awareness about eye health and increasing investments in ophthalmology further bolster the market's expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Ocular Drug Delivery Devices Market Companies

-

Invacare Corporation (TDX SP2 Power Wheelchair, Rollite Rollator Walker)

-

Sunrise Medical (Quickie Q500 M Power Wheelchair, Airgo Comfort-Plus Lightweight Rollator)

-

Alimera Sciences (Iluvien, Yutiq)

-

Regeneron Pharmaceuticals (EYLEA, Ozurdex)

-

Novartis (Lucentis, Beovu)

-

Genentech (Roche) (Avastin, Lucentis)

-

AbbVie (Restasis, Ozurdex)

-

Bausch Health (Xipere, Visudyne)

-

EyePoint Pharmaceuticals (Yutiq, DEXYCU)

-

Envisia Therapeutics (ENV515, ENV105)

-

Lux Biosciences (LX211, Visudyne)

-

Eyenovia (MicroStat, Optejet)

-

Apellis Pharmaceuticals (Empaveli, Syfovre)

-

Kodiak Sciences (KSI-301, KSI-201)

-

Ionis Pharmaceuticals (IONIS-FXIRx, IONIS-TTRRx)

-

Alcon (Systane, AcrySof Natural)

-

Ophthotech Corporation (now IVERIC Bio) (Zimura, IPR-001)

-

Santen Pharmaceutical (Ikervis, Diquas)

-

Imprimis Pharmaceuticals (MiStat, Dexamethasone ophthalmic injectable)

-

TearLab Corporation (TearLab Osmolarity System, TearLab Diagnostic System)

-

Medtronic (Retisert, Micropump)

Recent Developments

-

In June 2023, Novaliq GmbH, a pharmaceutical company, obtained approval from the U.S. Food and Drug Administration (FDA) for VEVYE, an ophthalmic solution designed for the treatment of dry eye disease. VEVYE becomes the first topical cyclosporine solution approved for this condition.

-

February 2023, Regeneron Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) has approved EYLEA (aflibercept) Injection for the treatment of preterm infants with retinopathy of prematurity (ROP). With this first pediatric approval, EYLEA is now authorized to treat five retinal conditions resulting from ocular angiogenesis.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.03 Billion |

| Market Size by 2032 | US$ 27.13 Billion |

| CAGR | CAGR of 8.54 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Topical, Iontophoresis, Ocular Insert, In-Situ Gel, Others) • By Drug Forms (Solution, Suspension, Emulsion, Others) • By Disease Type (Glaucoma, Diabetic Macular Edema, Diabetic Retinopathy, Macular Degeneration, Cataract, Refractive Issues [Myopia, Hypermetropia, Presbyopia], Others) • By End User (Drug Stores and Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Ophthalmic Clinics, Ambulatory Surgical Centers, Homecare Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Invacare Corporation, Sunrise Medical, Alimera Sciences, Regeneron Pharmaceuticals, Novartis, Genentech (Roche), AbbVie, Bausch Health, EyePoint Pharmaceuticals, Envisia Therapeutics, Lux Biosciences, Eyenovia, Apellis Pharmaceuticals, Kodiak Sciences, Ionis Pharmaceuticals, Alcon, Ophthotech Corporation (now IVERIC Bio), Santen Pharmaceutical, Imprimis Pharmaceuticals, TearLab Corporation, Medtronic, and other players. |

| Key Drivers | •The increasing global prevalence of eye diseases is a key factor propelling the Ocular Drug Delivery Devices Market. •Technological Advancements in Drug Delivery Systems Propelling Ocular Drug Delivery Devices Market |

| Restraints | •High Costs and Affordability Issues Restraining Ocular Drug Delivery Devices Market |