Dry Age-Related Macular Degeneration Market Size

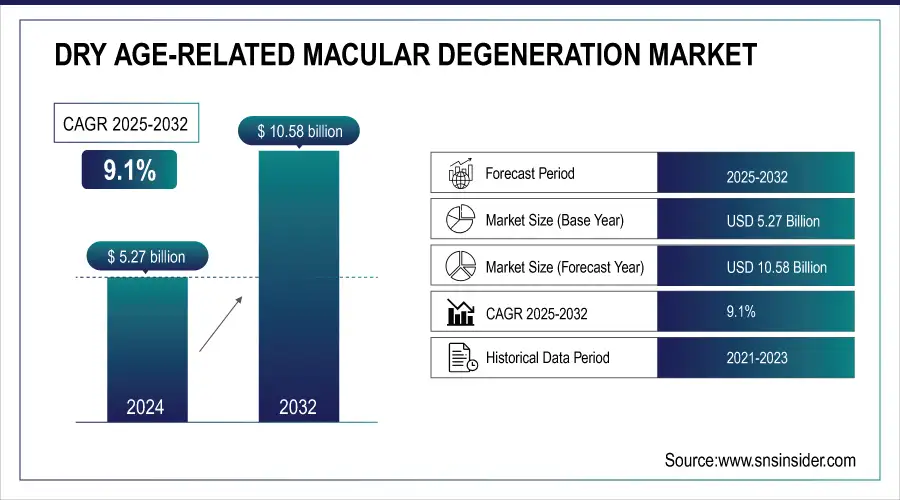

The Dry Age-Related Macular Degeneration Market was valued at USD 5.27 billion in 2024 and is expected to reach USD 10.58 billion by 2032, growing at a CAGR of 9.1% from 2025-2032.

Get more information on Dry Age-Related Macular Degeneration Market - Request Sample Report

The dry age-related macular degeneration (AMD) market is poised for significant growth, driven by a rising elderly population and increasing AMD incidence. In the U.S., adults aged 65+ are projected to grow from 58 million in 2022 to 82 million by 2050, fueling demand for effective treatments. Lifestyle and dietary factors, including smoking, alcohol use, and inactivity, further increase AMD risk. Market expansion is supported by robust R&D, novel drug developments, improved reimbursement policies, and clinical trials. However, challenges such as off-label drug use and high treatment burden from intravitreal injections may temper growth, presenting both opportunities and constraints.

Dry Age-Related Macular Degeneration Market Size and Forecast:

-

Market Size in 2024: USD 5.27 Billion

-

Market Size by 2032: USD 10.58 Billion

-

CAGR: 9.1% from 2024 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2022

Dry AMD Market Trends

-

Rising prevalence of age-related macular degeneration (AMD) is driving market growth.

-

Advances in diagnostic imaging and early detection are improving disease management.

-

Increasing focus on novel therapeutics, including anti-inflammatory and neuroprotective agents, is boosting treatment options.

-

Growing geriatric population and awareness of eye health are expanding market adoption.

-

Integration of teleophthalmology and digital monitoring is enhancing patient care and follow-up.

-

Research on gene therapy and stem cell treatments is accelerating innovation in dry AMD management.

-

Collaborations between biotech firms, research institutions, and healthcare providers are fostering development of new therapies.

Dry Age-Related Macular Degeneration Market Growth Drivers

-

Growing Geriatric Population, Increased Healthcare Spending, and Advances in Long-Acting Therapies

The rapidly growing worldwide population of geriatric patients is mainly driving the increasing incidence of Dry AMD. A UN report published in December 2020 lists population figures for those aged 65 years or older as having grown to 727 million in 2020 and is expected to double to 1.5 billion by 2050. The proportion of people above age 65 years is going to increase from 9.3% in 2020 to 16% in 2050, with China alone holding a share of its increased elderly population growth from 12% to 26% within the same period. The primary influence for the increasing prevalence of age-related macular degeneration, which encompasses Dry AMD, is the rapidly growing elderly population, especially in developed and emerging markets.

Increasing health expenditure is one of the catalysts driving the market forward as low- and middle-income countries invest more in health. In 2019, the World Health Organization published a report, which stated that healthcare spending rose 6% in low and middle-income countries and 4% in high-income countries with evolving funding models. However, only just short of 40% of government expenditure goes into primary health care indicating further investment in treatment of AMD for age-related conditions.

Another major factor is that long-acting anti-VEGF therapies are a huge relief from the burden of repeated intraocular injections. The sustained drug delivery with drugs such as Beovu and Vabysmo would enhance compliance and outcomes, thus driving growth in the market. Biosimilars, including BYOOVIZ, approved in 2021, continue to help drive the market forward by offering affordable treatment alternatives.

Dry Age-Related Macular Degeneration Market Restraints

-

High Treatment Burden and Patient Non-Adherence as Key Restraints Limiting Growth of the Dry Age-Related Macular Degeneration (AMD) Market

The dry AMD market faces significant restraints due to the high treatment burden associated with current therapies, particularly intravitreal injections that require frequent administration. This intensive regimen can lead to patient fatigue, discomfort, and reduced willingness to continue treatment over time. Non-adherence to prescribed therapies further diminishes treatment effectiveness and clinical outcomes, creating challenges for market growth. Additionally, logistical difficulties, such as regular clinic visits and monitoring, exacerbate the issue. Collectively, these factors limit the uptake of therapies and act as a critical restraint on the expansion of the dry AMD market.

Dry Age-Related Macular Degeneration Market Segmentation Analysis

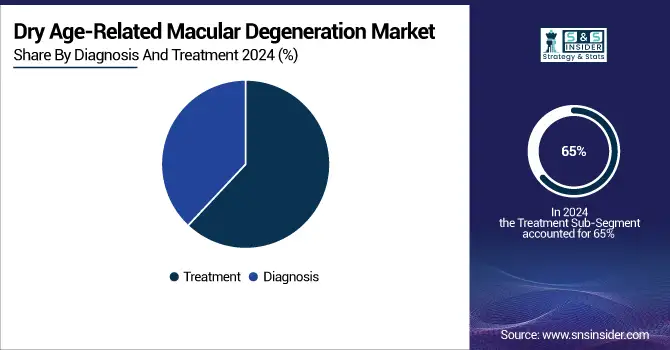

By Diagnosis & Treatment: Treatment dominated while Diagnosis is projected to grow fastest

The Treatment segment held more than 65% of the overall market share in the year 2024. Intermediate Dry AMD treatment is rapidly progressing with advanced therapeutic options using vitamins and antioxidants, in addition to new treatment options, thus driving growth in this segment. A plethora of therapies are under investigation for Dry AMD, thus constantly evolving the treatment landscape of the disease, which further supports growth in the market share of this segment. The Diagnosis segment is likely to witness a growth rate of around 7.5%. Advanced technologies like OCT, which place increased significance on early diagnosis in the case of Dry AMD, are propelling the rapidly growing trend in this segment.

By Stages: Intermediate Dry AMD dominated while Late Dry AMD is projected to grow fastest

Intermediate dry age-related macular degeneration held the largest share of the market in 2024 in Dry AMD. This is the most common stage with which to start as some symptoms start occurring, but the disease has not yet reached its worst stage. This leads to a massive market share of more than 45% from Intermediate Dry AMD. This has also been made prominent by the increasing awareness and early diagnosis at this stage, with many patients receiving treatment to slow the progression to late-stage AMD. The Late Dry Age-Related Macular Degeneration segment is expected to be the fastest-growing, at an 8% growth rate. This is because the number of patients progressing to late-stage Dry AMD is increasing, plus the emergence of new therapies addressing the advanced stages of dry age-related macular degeneration.

By Age Group: Above 60 years led while Above 75 years is expected to grow fastest

The Above 60-year-old age group was the market leader in 2024 securing more than 50% share of the Dry AMD market. Given that the condition is strongly related to old age, those above 60 years have accounted for the highest incidence rates. The aging population, particularly those over 60 years across developed countries and specifically amplified by lifestyle risk factors, explains much of the demand for Dry AMD therapy within this segment. This is going to be the dominant age group, given the aging of the global population. The Above 75 Years segment is anticipated to grow at the fastest rate, through a CAGR of more than 9%. As life expectancy increases, the prevalence of AMD for this elderly population is projected to rise, and thus demand for Dry AMD treatments will increase.

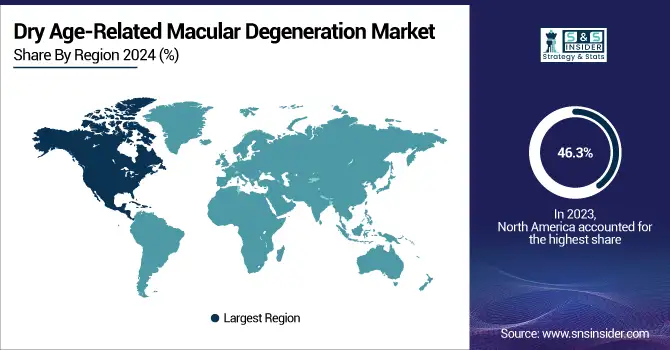

Dry Age-Related Macular Degeneration Market Regional Analysis

North America Dry AMD Market Insights

The Dry Age-Related Macular Degeneration market was dominated by North America in 2024 with a 46.3% share. Strong awareness levels and well-established healthcare infrastructure are the key factors in this region. According to the American Academy of Ophthalmology, approximately 1.5 million Americans suffer from late-stage AMD, whereas 18.3 million cases are diagnosed with early-stage AMD. Enhanced public awareness has increased earlier diagnosis and treatment, resulting in increased market demand. The market share accounted for a significant volume with 92.1% of the total North American market in 2023 due to the high penetration of developed eye care facilities.

Need any customization research on Dry Age-Related Macular Degeneration Market - Enquiry Now

Europe Dry Age-Related Macular Degeneration Market Outlook

Europe is one of the key growth regions in terms of Dry AMD, as the aging population only looks upwards. According to an article by the British Journal of Ophthalmology, 67 million people in the EU are afflicted with AMD. The number will increase by 15% by 2050 as a result of demographic changes in the aged population. Advancement of life and living standards has increased the treatment demand for Dry AMD in the region.

Asia Pacific Market Insights

The Asia Pacific dry AMD market is anticipated to grow at the fastest pace, driven by a rapidly aging population, increasing prevalence of AMD, rising healthcare awareness, and improving healthcare infrastructure. Expanding access to advanced therapies, growing government initiatives, and increasing clinical trials in the region are further boosting market growth, making Asia Pacific a key driver in the global dry AMD landscape.

Middle East & Africa and Latin America Market Insights

The Middle East & Africa and Latin America markets are emerging regions for dry AMD, driven by improving healthcare infrastructure, growing awareness, and increasing prevalence of age-related eye disorders. However, limited access to advanced therapies and economic constraints may slow growth compared to developed regions, presenting both opportunities and challenges for market expansion.

Competitive Landscape of Dry Age-Related Macular Degeneration Market

Iveric Bio

Iveric Bio is a key player in the dry AMD market, focusing on developing innovative therapies targeting retinal diseases. The company’s pipeline includes advanced candidates aimed at slowing or halting disease progression. By leveraging strong R&D capabilities and strategic collaborations, Iveric Bio is positioned to address unmet medical needs, enhance treatment options, and contribute significantly to the growth and evolution of the global dry AMD market.

-

In August 2023, Iveric Bio (Astellas Pharma) received FDA approval for Izervay (avacincaptad pegol), the first intravitreal treatment for geographic atrophy, marking a major advancement in the dry AMD market.

Apellis Pharmaceuticals

Apellis Pharmaceuticals is a leading innovator in the dry AMD market, focusing on complement-targeted therapies to slow geographic atrophy progression. Its flagship candidate, Pegcetacoplan, has shown promising clinical results and regulatory approvals, addressing critical unmet needs. Through strong R&D efforts and strategic partnerships, Apellis aims to expand treatment options, improve patient outcomes, and solidify its position as a key player driving growth in the global dry AMD market.

-

In February 2023, Apellis Pharmaceuticals received FDA approval for Syfovre (pegcetacoplan), the first treatment targeting complement-mediated geographic atrophy in dry AMD patients, marking a groundbreaking advancement in addressing unmet medical needs.

Genentech

Genentech is a prominent player in the dry AMD market, leveraging its expertise in ophthalmology and biologics. The company focuses on developing innovative therapies aimed at slowing or halting geographic atrophy progression. Through strong R&D initiatives, clinical trials, and strategic collaborations, Genentech seeks to address unmet patient needs, expand treatment options, and maintain a leading position in the evolving global dry AMD market.

-

Genentech is advancing its gene- and cell-based therapies, with Roche’s OpRegen Phase 1/2a 24-month data for geographic atrophy (dry AMD) highlighted at the 2024 Retinal Therapy Summit, showcasing progress in innovative treatment development.

Dry Age-Related Macular Degeneration Market Key Players

Some of the Dry Age-Related Macular Degeneration Market Companies

Treatment Providers

-

Amgen Inc.

-

F. Hoffmann-La Roche Ltd

-

Samsung Bioepis

-

Bausch Health Companies Inc.

-

Regeneron Pharmaceuticals Inc.

-

Santen Pharmaceuticals Inc.

-

Allergan plc

-

Alimera Sciences Inc.

-

Phio Pharmaceuticals Corp

-

Iveric Bio

-

Belite Bio Inc.

Diagnosis Providers

-

Bausch Health Companies Inc.

-

Alimera Sciences Inc.

-

Ocumension Therapeutics Co. Ltd

-

Iveric Bio

Device Manufacturers

-

Bausch Health Companies Inc.

-

Regeneron Pharmaceuticals Inc.

-

Biogen

-

Eyestem Research Pvt Ltd

-

Kubota Vision Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.27 Billion |

| Market Size by 2032 | US$ 10.58 Billion |

| CAGR | CAGR of 9.1% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Stages (Early AMD, Intermediate AMD, Late AMD) • by End User (Hospitals & Clinics, Diagnostic Centers, Academic Research Institutes, Others) • by Age Group (Above 40 Years, Above 60 Years, Above 75 Years) • by Diagnosis & Treatment (Treatment, Diagnosis) • by Route of Administration (Oral, Injectables) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bayer AG, Pfizer Inc., Amgen Inc., Biogen, Novartis AG, F. Hoffmann-La Roche Ltd, Samsung Bioepis, Bausch Health Companies Inc., Regeneron Pharmaceuticals Inc., Santen Pharmaceuticals Inc., Allergan plc , Alimera Sciences Inc. , Phio Pharmaceuticals Corp , Iveric Bio , Belite Bio Inc. , Ocumension Therapeutics Co. Ltd, Eyestem Research Pvt Ltd, Kubota Vision Inc and other players |