The odor control system market size was valued at USD 6.13 billion in 2024 and is expected to reach USD 9.43 billion by 2032, growing at a CAGR of 5.54% over the forecast period of 2025-2032.

The odor control system market growth is propelled by the increase in environmental regulation awareness, public health risks, and industrial effluents. Companies, such as wastewater treatment, manufacturing, petrochemicals, and others, actively invest in advanced air quality management systems for conformity to the emissions standards, improving the well-being of surrounding communities. The technological innovations for biofilters, activated carbon systems, and chemical scrubbers are contributing toward the technological advancement in odor control technologies as this new technology helps in the reduction of overall operational costs and improving the Efficiency of odor control agents. In addition, intelligent monitoring solutions are also being incorporated that offer cloud-based real-time analytics and automated response systems.

A key growth driver in industrial odor control systems is urban extension in proximity to industrial areas, which increases odor complaints against industries and urges them to reduce them. The report contains major odor control system market trends, including eco-friendly and energy-efficient systems, growing IoT in odor monitoring, and investment in R&D, among others. This offers better prospects for designing sustainable products and also collaborative ventures, strengthening the worldwide odor management sector.

In December 2024, the National Green Tribunal (NGT) directed the Central Pollution Control Board (CPCB) to create enforceable standards for Odor pollution from chemical industries, especially after recurring complaints from Taloja MIDC in Maharashtra. The CPCB's earlier 2008 guidelines were non-binding, prompting the NGT to now mandate comprehensive regulations within a year.

In May 2025, BMC collaborated with the Indian Institute of Tropical Meteorology to launch AIRWISE an air quality forecasting and decision support system. It uses data from satellites and monitoring stations to provide 72-hour pollution forecasts, enabling timely action to control air pollution in Mumbai.

Drivers:

Technological Advancements in Odor control systems Enhance Efficiency, Sustainability, and Cost-Savings through IoT and Automation

Advancements in technology are playing an important role in improving the efficiency and sustainability of Odor control systems. Biofiltration, activated carbon adsorption, and chemical scrubbers have been developed to enhance the removal of odorous compounds from industrial emissions. By using Internet of Things (IoT) and automation technologies, real-time monitoring and control is done so that the system functions and optimum level and the operational cost reduces. Smart odor control systems can use real-time data to alter filtration processes, maintaining air quality for customers and ensuring compliance with environmental regulations. Such features amplify the efficacy of these technologies in mitigating Odor, while contributing to energy-efficiency, and improved cost-savings, making them an appealing choice for industries that strive for sustainable strategies.

In December 2024, Microban International launched Freshology, a patent-pending, nature-inspired odor control technology, at ISPO Munich. Designed to neutralize various odors, it’s integrated into synthetic fabrics like polyester, nylon, and spandex, releasing trapped odors during laundering. Freshology™ is heavy metal-free, nonionic, and meets GB/T 33610 and ISO 17299 standards, offering a sustainable solution for the textile industry.

Restraints:

High Costs of Odor Control Systems Strain SMEs and Municipalities, Limiting Adoption and Regulatory Compliance

Odor control systems are at present too expensive to implement and maintain, especially for many small and medium-sized enterprises (SMEs) and municipalities that do not have enough budget for them. Such systems need high capital expenses in terms of specialized equipment, installation, and maintenance. In particular, the City of Conroe awarded 738-thousand-dollar bid permanent odor control system at the Central Wastewater Treatment Plant. Likewise, Smithfield Foods also invested USD 2 million to implement Odor elimination technology at its Pine Ridge facility in Des Moines. Such large investments create a barrier for adoption, particularly in low-income areas. Additionally, the added costs of combining these systems into established frameworks make it difficult for industries adhering to rigorous environmental regulations to do so without costs associated with implementation.

By Type

The Activated Carbon Odor Control segment dominated the market and accounted for 48.02% of the odor control system market share. The dominance of this segment is attributed to the high efficiency for the elimination of gas-phase contaminants, such as hydrogen sulfide, mercury, HCl, and other foul-smelling pollutants from the containing segment. Activated carbon systems have been the most commonly utilized option for those industries to abate odor issues, including wastewater treatment, chemical processing, and food manufacturing. Fortunately, they are economical to purchase, require little upkeep, and draw low power, thus they are a dependable answer for companies whose goals are real-time air quality control while optimizing operating costs and energy consumption.

The Biological Odor Control segment is experiencing rapid growth due to its cost-effectiveness and environmental benefits. The systems rely on microorganisms that decompose malodor compounds, making these odor elimination systems an eco-friendly choice for industries, such as wastewater treatment. Their relatively low installation cost and maintenance requirements are stimulating the growth rate of the technology. Biological odor control systems are now the solution of choice as industries strive to adopt greener and more economical methods for controlling odors. This trend indicates a rising need for eco-friendly solutions that treat odor problems at limited operational costs.

By End-Use

The Power & Energy segment dominated with a market share of over 32% in 2024, owing to high emissions from power plants, refineries, and gas processing units. These sectors release many malodorous compounds, such as sulphur-based gases and nitrogen oxides, into the air, causing environmental pollution. However, to combat these problems, the ultimate solution is the use of odor monitor instruments to negate the effect of these harmful emissions. This is one of the major factors contributing to the leading position of the Power & Energy sector in the odor control systems market as efficient gas treatment solutions are needed to regulate these pollutants.

The Chemical & Petrochemical sector is experiencing significant growth due to the increasing emission of toxic gases that cause unpleasant odors in the environment. The chemical, plastics, and fuel industries are associated with the production of chemicals and precursors that are often little more than purified fossil fuel and are a significant source of malodorous substances, such as sulfur and volatile organic compounds (VOCs). Thus, to meet the regulatory requirement and help in maintaining ambient air quality, the foul smell emissions need to be treated which is where the odor control system steps in. The increasing requirement for more efficient and sustainable odor management solutions has driven this sector to be one of the fastest-growing sectors of the odor control system market.

The Asia Pacific region dominated with a market share of over 45.04% in 2024, driven by rapid industrialization and urbanization. Stringent environmental regulations in this region are expected to create high demand for odor control systems in countries in this region. The strong growth in this region is due to the growing industrial activities especially wastewater treatment, food processing and other manufacturing industries. This has fostered a permanent demand for high-end odor control technologies due to increased demand and actual need for cleaner, more sustainable technologies in these sectors.

China, due to its extreme industrial base and de-urbanization, is one of the largest countries for odor control systems across the Asia Pacific region. It is driven by stricter environmental regulations and rising air quality and health awareness. Meanwhile, the rising industrialisation in China is also expected to significantly increase demand for odor control systems.

North America is projected to be the fastest-growing region in the odor control system market. The U.S., in particular, is witnessing robust growth driven by stringent environmental regulations, growing industrial sectors, and a focus on sustainability. Advanced odor control technologies are being rapidly adopted by industries including wastewater treatment, food processing, and chemical manufacturing. The region is witnessing the fastest growth in this market due to regulatory compliance and demand for cleaner environmental practices coupled with sustainable development.

The U.S. odor control system market is poised for steady growth, with market size expected to expand from USD 1.07 billion in 2024 to USD 1.70 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.92%. Factors, such as the growing industrial sector, strict environmental regulations, and the rise in public awareness about air quality and pollution control account for this growth.

Europe holds a significant share of the global odor control system market, with major contributions from countries such as Germany, the U.K., and France. This market growth is mainly due to the stringent environmental policies and regulations on reducing industrial emissions and improving air quality. Europe shows a stable commitment to environmental sustainability, and the growing demand for odor control technologies in energy, power, chemicals, and manufacturing also reinforces the aforementioned trend in the region. As businesses meet stricter air quality directives, the region must stay on its upward track.

Odor control system Companies are Evoqua Water Technologies LLC (Xylem), DuPont, Tholander Ablufttechnik GmbH, Veolia, Catalytic Products International, Advanced Air Technologies, Inc., Anguil Environmental Systems, Inc., Ecolab, Durr Group, Scotmas Group Ltd.

In April 2024, Anguil Industrial, LLC acquired Young & Bertke Air Systems Company, bolstering its expertise in air pollution control technologies. This strategic acquisition strengthens Anguil Environmental Systems' ability to offer advanced solutions for odor control and environmental compliance.

In March 2025, Ecolab announced major advancements in water stewardship by utilizing AI-driven circular water management solutions. This initiative aims to enhance operational efficiency and promote sustainable water conservation practices across industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.13 Billion |

| Market Size by 2032 | USD 9.43 Billion |

| CAGR | CAGR of 5.54% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Chemical Odor Control, Activated Carbon Odor Control, Biological Odor Control) • By End Use (Cement, Chemical & Petro Chemical, Mining & Metal, Power & Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Evoqua Water Technologies LLC (Xylem), DuPont, Tholander Ablufttechnik GmbH, Veolia, Catalytic Products International, Advanced Air Technologies, Inc., Anguil Environmental Systems, Inc., Ecolab, Durr Group, Scotmas Group Ltd. |

Ans: The Odor control system Market is expected to grow at a CAGR of 5.54% from 2025-2032.

Ans: The Odor control system Market was USD 6.13 billion in 2024 and is expected to reach USD 9.43 billion by 2032.

Ans: Technological advancements in Odor control systems enhance efficiency, sustainability, and cost savings through IoT and automation

Ans: The “Activated Carbon Odor Control” segment dominated the Odor control system Market.

Ans: The Asia-Pacific region dominated the Odor control system Market in 2024.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by Region (2020–2023)

5.2 Utilization Rates, by Region (2020–2023)

5.3 Maintenance and Downtime Metrics

5.4 Technological Adoption Rates, by Region

5.5 Export/Import Data, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Odor Control System Market Segmentation by Type

7.1 Chapter Overview

7.2 Chemical Odor Control

7.2.1 Chemical Odor Control Market Trend Analysis (2021-2032)

7.2.2 Chemical Odor Control Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Activated Carbon Odor Control

7.3.1 Activated Carbon Odor Control Market Trends Analysis (2021-2032)

7.3.2 Activated Carbon Odor Control Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Biological Odor Control

7.4.1 Biological Odor Control Market Trends Analysis (2021-2032)

7.4.2 Biological Odor Control Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Odor Control System Market Segmentation by End Use

8.1 Chapter Overview

8.2 Cement

8.2.1 Cement Market Trends Analysis (2021-2032)

8.2.2 Cement Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Chemical & Petro Chemical

8.3.1 Chemical & Petro Chemical Market Trends Analysis (2021-2032)

8.3.2 Chemical & Petro Chemical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Mining & Metal

8.4.1 Mining & Metal Market Trends Analysis (2021-2032)

8.4.2 Mining & Metal Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Power & Energy

8.5.1 Power & Energy Market Trends Analysis (2021-2032)

8.5.2 Power & Energy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2021-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Odor Control System Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.2.3 North America Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.2.4 North America Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.2.5.2 USA Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.2.6.2 Canada Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.2.7.2 Mexico Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3 Europe

9.3.1 Trends Analysis

9.3.2 Europe Odor Control System Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.3.3 Europe Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.4 Europe Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.5 Germany

9.3.5.1 Germany Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.5.2 Germany Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.6 France

9.3.6.1 France Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.6.2 France Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.7 UK

9.3.7.1 UK Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.7.2 UK Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.8 Italy

9.3.8.1 Italy Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.8.2 Italy Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.9 Spain

9.3.9.1 Spain Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.9.2 Spain Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.10 Poland

9.3.10.1 Poland Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.10.2 Poland Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.11 Turkey

9.3.11.1 Turkey Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.11.2 Turkey Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.3.12 Rest of Europe

9.3.12.1 Rest of Europe Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.3.12.2 Rest of Europe Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Odor Control System Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.4.3 Asia Pacific Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.4 Asia Pacific Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.5.2 China Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.5.2 India Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.5.2 Japan Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.6.2 South Korea Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4.7 Singapore

9.4.7.1 Singapore Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.7.2 Singapore Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

8.4.8 Australia

8.4.8.1 Australia Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

8.4.8.2 Australia Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.4.9 Rest of Asia Pacific

9.4.9.1 Rest of Asia Pacific Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.4.9.2 Rest of Asia Pacific Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.5 Middle East & Africa

9.5.1 Trends Analysis

9.5.2 Middle East & Africa Odor Control System Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.5.3 Middle East & Africa Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.5.4 Middle East & Africa Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.5.5 UAE

9.5.5.1 UAE Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.5.5.2 UAE Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.5.6 Saudi Arabia

9.5.6.1 Saudi Arabia Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.5.6.2 Saudi Arabia Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.5.7 Qatar

9.5.7.1 Qatar Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.5.7.2 Qatar Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.5.8 South Africa

9.5.8.1 South Africa Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.5.8.2 South Africa Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.5.9 Middle East & Africa

9.5.9.1 Middle East & Africa Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.5.9.2 Middle East & Africa Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Odor Control System Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.6.3 Latin America Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.6.4 Latin America Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.6.5.2 Brazil Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.6.6.2 Argentina Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

9.6.7 Rest of Latin America

9.6.7.1 Rest of Latin America Odor Control System Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

9.6.7.2 Rest of Latin America Odor Control System Market Estimates and Forecasts, by End-Use (2021-2032) (USD Billion)

10. Company Profiles

10.1 Evoqua Water Technologies LLC (Xylem)

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 DuPont

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 Tholander Ablufttechnik GmbH

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Veolia

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 Catalytic Products International

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 Advanced Air Technologies, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 Anguil Environmental Systems, Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Ecolab

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 Durr Group

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 Scotmas Group Ltd.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

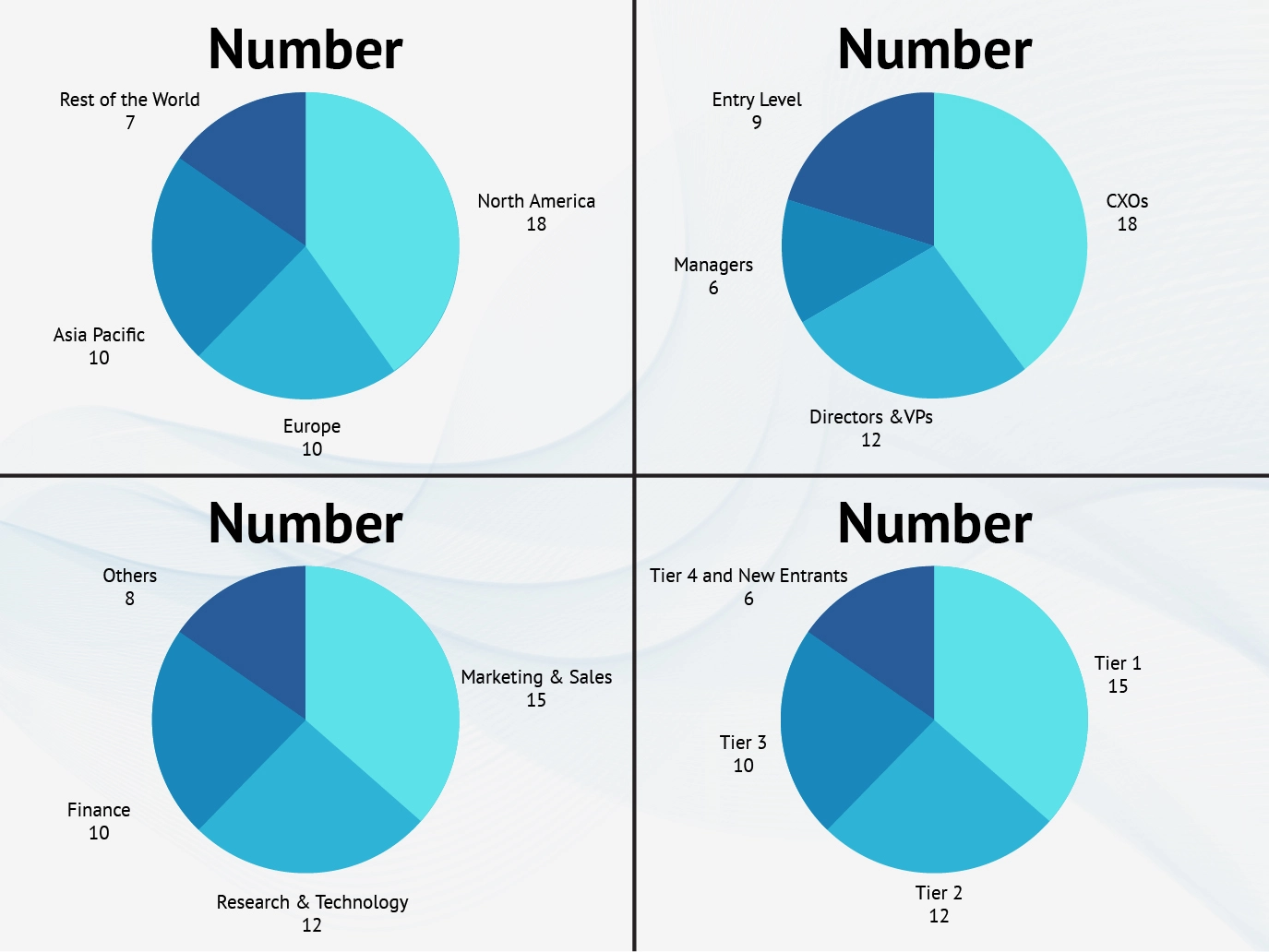

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Chemical Odor Control

Activated Carbon Odor Control

Biological Odor Control

By End Use

Cement

Chemical & Petro Chemical

Mining & Metal

Power & Energy

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players