Metal Cutting Tools Market Report Scope & Overview:

To get more information on Metal Cutting Tools Market - Request Free Sample Report

The Metal Cutting Tools Market size was valued at USD 82.81 Billion in 2023 and is expected to reach USD 141.09 Billion by 2032 and grow at a CAGR of 6.1% over the forecast period 2024-2032.

The Metal Cutting Tools Market is experiencing robust growth, driven by the increasing demand for precision engineering and the expansion of manufacturing sectors across various industries, including automotive, aerospace, and construction. These tools, essential for machining processes such as turning, milling, drilling, and grinding, are pivotal for enhancing productivity and achieving high-quality surface finishes. The market is witnessing a notable shift toward advanced materials and coatings, such as carbide and ceramic, which offer improved durability and performance, thereby reducing tool wear and increasing efficiency.

The recent trends highlight the integration of digital technologies and automation in manufacturing processes, facilitating smarter operations and reducing lead times. The rise of Industry 4.0 has led to the adoption of smart cutting tools equipped with sensors for real-time monitoring and analytics, enhancing operational efficiency and reducing downtime. Moreover, the growing emphasis on sustainable manufacturing practices is driving innovations in eco-friendly cutting tools and processes that minimize waste and energy consumption. Tool life and performance vary significantly among cutting tools, influenced by material composition, cutting speeds, and industry demands. Carbide cutting tools, composed of approximately 80% tungsten carbide and 20% cobalt, offer an average lifespan of 50 to 200 hours in machining, making them much more wear-resistant than high-speed steel (HSS) tools, which last around 30 to 50 hours. Cermet tools, made from a blend of ceramic and metallic materials, provide exceptional hardness and durability. Cutting speeds also differ; carbide tools can operate at 80 to 120 meters per minute for mild steel and 60 to 90 m/min for harder materials like titanium, whereas HSS tools typically range from 30 to 50 m/min. The cutting tools market is dominated by turning tools (40%), milling tools (30%), and drilling tools (20%). Demand is particularly strong in the automotive (30%) and aerospace industries (15%), with the latter increasingly requiring advanced materials. Tool wear rates, influenced by factors like cutting speed and feed rate, typically range from 0.1 to 0.5 mm/hour, with high-speed machining pushing wear rates to nearly 1 mm/hour for less durable materials.

MARKET DYNAMICS

DRIVERS

- The growing demand for metal cutting tools is driven by the automotive industry's expansion, particularly in electric vehicle production, which requires high-precision tools for manufacturing essential components like engines, transmissions, and body structures.

The rising demand for metal cutting tools is significantly influenced by the expansion of the automotive industry, especially in the realm of electric vehicles (EVs). As automakers shift towards electric mobility, there is an increasing need for high-precision tools that can manufacture critical components such as engines, transmissions, and body structures. Unlike traditional vehicles, electric vehicles have unique design and manufacturing requirements that necessitate advanced machining techniques. The lightweight materials and complex geometries commonly used in EV production demand metal cutting tools capable of delivering superior accuracy and efficiency. Additionally, the growing focus on sustainability and energy efficiency in vehicle manufacturing further accelerates this trend, as manufacturers seek tools that minimize waste and optimize material use. This heightened precision not only enhances the performance and longevity of EV components but also ensures compliance with stringent industry standards. As a result, the metal cutting tools market is poised for robust growth, driven by the ongoing advancements in automotive technology and the escalating production of electric vehicles, highlighting the critical role these tools play in modern manufacturing processes.

- The rise in aerospace manufacturing drives demand for high-performance metal cutting tools due to increased aircraft production and maintenance needs, which require precision machining of tough materials like titanium and composites, as well as specialized tools for lightweight materials.

The rise in aerospace manufacturing significantly boosts the demand for high-performance metal cutting tools, primarily driven by the escalating production and maintenance needs of aircraft. As the aviation industry continues to expand, manufacturers face the challenge of machining tough materials such as titanium and advanced composites, which are essential for ensuring aircraft durability and efficiency. These materials require precision machining capabilities, as they are often hard and abrasive, demanding specialized cutting tools that can withstand rigorous conditions. Moreover, the growing trend toward lightweight aircraft components to enhance fuel efficiency necessitates the use of innovative materials and tailored cutting solutions. Consequently, suppliers of metal cutting tools are increasingly focusing on developing advanced products that cater to these specific requirements, thus supporting the aerospace sector’s need for quality, performance, and reliability in manufacturing and maintenance processes.

RESTRAINTS

- The high initial costs of advanced cutting tools, such as diamond-tipped and carbide tools, along with the investment needed for CNC machines, pose a significant barrier for small and medium-sized enterprises (SMEs), limiting their ability to adopt these technologies in cost-sensitive markets.

The high initial costs associated with advanced cutting tools, such as diamond-tipped and carbide tools, alongside the significant investment required for CNC (Computer Numerical Control) machines, present a considerable barrier for small and medium-sized enterprises (SMEs). These advanced tools, known for their superior precision and durability, can drastically enhance manufacturing efficiency and product quality. However, the substantial upfront costs deter many SMEs, especially in cost-sensitive markets, where budgets are often tight. As a result, these companies may struggle to compete with larger firms that can afford such investments. The inability to adopt these technologies not only limits their operational capabilities but also hampers innovation and growth potential, placing SMEs at a disadvantage in an increasingly competitive landscape. Consequently, addressing these financial challenges is crucial for fostering a more inclusive environment that enables SMEs to thrive and leverage advanced manufacturing technologies effectively.

KEY MARKET SEGMENTATION

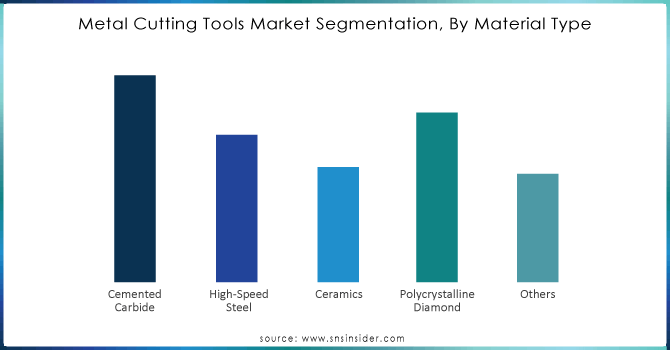

By Material Type

Cemented Carbide segment dominated the market share of over 28.16% in 2023, due to its hardness, wear resistance, and ability to perform high-speed cutting, making it suitable for a wide range of applications, particularly in automotive and aerospace sectors.

Polycrystalline Diamond (PCD) is the fastest growing material type. Its superior cutting performance and longevity, especially in high-precision industries like electronics and aerospace, drive its rapid growth.

Need any customization research on Metal Cutting Tools Market - Enquiry Now

KEY REGIONAL ANALYSIS

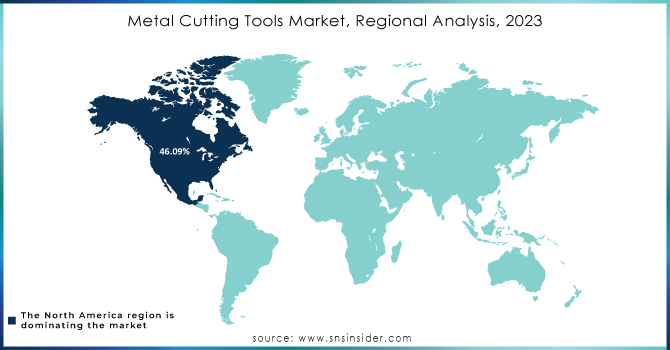

The North America region dominated the market share over 46.09% in 2023. This is due to the increasing amount of construction and manufacturing projects the country is taking on, leading to the growth of the market. The Canadian market is growing due to more investment from leading companies in the country's metal-cutting tool industry. Additionally, the U.S. Metal Cutting Tools market dominated market share, with the Canada Metal Cutting Tools market experiencing the highest growth rate in North America.

In 2023, the European Metal Cutting Tools market held a significant market share. This growth is associated with the increasing industrial and manufacturing industries in Germany. Moreover, the U.K., France, and Italy are expected to generate higher revenue in the forecasted timeframe as they mimic Germany's economic strategy. The Nordic countries, the Netherlands, and central European countries in the remaining parts of Europe are experiencing a slow growth due to limited market opportunities in this region.

KEY PLAYERS

Some of the major key players in Metal Cutting Tools Market

- Fanuc America Corporation: (CNC Machine Tools, Laser Cutting Machines)

- Amada Machine Tools Co. Ltd: (Band Saw Machines, Grinding Machines)

- BIG Kaiser Precision Tooling Inc.: (Precision Tool Holders, Boring Tools)

- Sandvik: (Metal Cutting Tools, Carbide Inserts, Drills, Turning Tools)

- Komatsu Ltd.: (Metal Cutting Machine Tools, Press Machines)

- Kennametal Inc.: (Cutting Inserts, Turning and Milling Tools)

- Doosan Machine Tools Co. Ltd.: (CNC Turning Centers, Vertical and Horizontal Machining Centers)

- Ingersoll Cutting Tool Company: (Milling Tools, Drilling Tools, Cutting Inserts)

- Tiangong International Co.: (High-Speed Steel Cutting Tools, Carbide Cutting Tools)

- Tungaloy Corporation: (Indexable Inserts, Milling Tools, Turning Tools)

- Hitachi Metals: (Specialty Steel, Cutting Tools)

- Mitsubishi Materials Corporation: (Turning, Milling, and Drilling Tools, Indexable Inserts)

- Yamazaki Mazak Corporation: (CNC Turning Centers, Laser Cutting Machines)

- Sumitomo Electric Industries Ltd.: (Diamond Cutting Tools, Carbide Tools)

- Walter AG: (Milling Tools, Drills, Reaming Tools)

- Guhring Inc.: (Drills, Taps, End Mills)

- Dormer Pramet: (Solid Carbide Tools, Indexable Cutting Tools)

- TaeguTec Ltd.: (Turning Tools, Milling Inserts, Drills)

- ISCAR Ltd.: (Metal Cutting Tools, Carbide Inserts)

- Seco Tools: (Precision Milling, Turning, Holemaking Tools)

RECENT DEVELOPMENT

On May 2022: Sandvik AB acquired Preziss, a solutions developer for composite and aluminum machining.

On August 2022: Sandvik acquired Switzerland-based Sphinx Tools Ltd, a provider of precision solid round tools and its subsidiary P. Rieger Werkzeugfabrik AG. Through this acquisition Sandvik aimed to strengthen its position in the round cutting tools space.

On June 2022: Milwaukee Tools launched its innovative wrecker integrated with NITRUS CARBIDE SAWZALL Blad, designed to operate more effectively on a wide range of metals that is ideal to operate in remodeling and demolition jobs at construction sites.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 82.81 Billion |

| Market Size by 2032 | US$ 141.09 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Cemented Carbide, High-Speed Steel, Ceramics, Polycrystalline Diamond, Others) • By Tools Application (Milling, Turning, Drilling, Others) • By Industry (Automotive, Aerospace & Defense, Construction, Oil & Gas, Power Generation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fanuc America Corporation, Amada Machine Tools Co. Ltd., BIG Kaiser Precision Tooling Inc., Sandvik, Komatsu Ltd., Kennametal, Doosan Machine Tools Co. Ltd., Ingersoll Cutting Tool Company, Tiangong International Co., Tungaloy Corporation, Hitachi Metals, Mitsubishi Materials Corporation, Yamazaki Mazak Corporation, Sumitomo Electric Industries Ltd, Walter AG, Guhring Inc, Dormer Pramet, TaeguTec Ltd, ISCAR Ltd, Seco Tools |

| Key Drivers | • The growing demand for metal cutting tools is driven by the automotive industry's expansion, particularly in electric vehicle production, which requires high-precision tools for manufacturing essential components like engines, transmissions, and body structures. • The rise in aerospace manufacturing drives demand for high-performance metal cutting tools due to increased aircraft production and maintenance needs, which require precision machining of tough materials like titanium and composites and specialized tools for lightweight materials. |

| Restraints | • The high initial costs of advanced cutting tools, such as diamond-tipped and carbide tools, along with the investment needed for CNC machines, pose a significant barrier for small and medium-sized enterprises (SMEs), limiting their ability to adopt these technologies in cost-sensitive markets. |