Opioid Use Disorder (OUD) Market Size & Overview:

The Opioid Use Disorder Market Size was valued at USD 3.7 Billion in 2023 and is expected to reach USD 9.02 Billion by 2032, growing at a CAGR of 10.4% over the forecast period 2024-2032.

Get More Information on Opioid Use Disorder Market - Request Sample Report

The rapid growth of the opioid use disorder (OUD) market is mainly attributed to the catastrophic opioid epidemic as well as increasing efforts by the government to manage the public health crisis of opioid use. As of 2023, the Centers for Disease Control and Prevention (CDC) estimated that roughly 81,083 people died due to an opioid-involved overdose in the United States, demonstrating a significant requirement for effective treatments. The Substance Abuse and Mental Health Services Administration (SAMHSA) reported that in 2022, approximately 3.7% of U.S. adults aged 18 and over needed OUD treatment. Nevertheless, just 25.1% of individuals who want medications for OUD accessibility them, revealing a significant therapy space. This reflects the opportunity for market growth that exists with the ongoing push for improved access to care. The MAT Act, enacted in December 2022, has provided even greater access to evidence-based treatments by allowing all providers with controlled substance certificates to prescribe buprenorphine for OUD2. This change will expose OUD treatment from the stigma as other behavioural healthcare treatments and lead to the broader integration of substance use disorder care into diverse healthcare sectors.

Moreover, the market expansion is likely to include government efforts like the Biden-Harris administration's announcement in August 2023 of more than $450 million to address the overdose epidemic, which will expand prevention, treatment, and recovery services. High-speed adoption of medicinal-assisted remedy (MAT) as a core strategy in the cure of OUD is additionally fueling market growth.

Opioid Use Disorder Market dynamics

Drivers

-

The increasing incidence of opioid addiction globally is fueling the demand for effective treatments.

-

Enhanced government involvement and funding are promoting awareness and preventive programs, contributing to market growth.

-

Innovations such as buprenorphine patches offer effective treatment modes, propelling market expansion.

The increasing rate of opioid use disorder (OUD) is one of the major determinants to drive the Opioid Use Disorder (OUD) market to grow as it raised the demand for effective treatment. In 2022, more than 108,000 people in the U.S. died of drug-involved overdoses, including both illicit and prescription drugs. The surge in opioid-related fatalities has prompted substantial legal actions against pharmaceutical companies. For instance, Purdue Pharma and the Sackler family reached a $7.4 billion settlement to resolve litigation over their involvement in the opioid crisis. Those settlements underscore the realization that the crisis was extreme and represented a lapse with accountability being paramount.

There is a greater effort to increase treatment availability because the burden of OUD has continued to grow. In the U.S., starting October 2, 2024, updated regulations for methadone will enable stable patients to receive 28-days supply of take-home medications. The change in policy is to support treatment compliance and convenience for patients. This underscores a growing recognition of the severity of the OUD epidemic and the urgent need to increase treatment capacity to meet the growing need for treatment.

Restraints

-

Adverse effects like vomiting, respiratory complications, and muscle aches from OUD medications may hinder market growth.

-

The scarcity of certain treatment options can restrict market expansion.

-

Insufficient knowledge about OUD and its treatments among the public poses a challenge to market growth.

The adverse effects of drug remedies offered for the treatment of opioid use disorder (OUD) hamper the growth of this market. Medications such as methadone, buprenorphine, and naltrexone relieve withdrawal and opioid cravings but may also provide undesirable side effects including nausea, vomiting, respiratory depression, constipation, and muscle aches. Such side effects frequently discourage patients from following their treatment schedules, increasing failure rates and hindering recovery. Moreover, some drugs come with the risk of dependency, which makes them subject to suspicion from both the healthcare provider and the patient. This process requires constant monitoring of health status and frequent changes in medication, which is difficult in unsophisticated healthcare systems. This challenge underscores the necessity for ongoing research and development to create safer, more tolerable therapeutic alternatives that can effectively treat OUD without imposing additional physical or psychological burdens on patients.

Opioid Use Disorder Market Segmentation Insights

By Drug Class

In 2023, the market share of the Buprenorphine segment was the highest, contributing 58% of the revenue share. There are several factors responsible for this wide usage such as efficacy, safety, and availability. As a partial opioid agonist, buprenorphine is effective in reducing cravings and withdrawal symptoms while producing much less risk of respiratory depression compared with full opioid agonists. The implementation of the MAT Act in December 2022 has further bolstered buprenorphine's market position by removing barriers to prescribing. regulatory change led to the availability and use of buprenorphine by an expanded variety of healthcare providers.

SAMHSA data indicate for instance that the number of patients receiving buprenorphine for OUD has been rising steadily, with a particularly steep rise in market share from 2020 into 2022. The drug's market dominance is complemented by its formulation flexibility by being available as sublingual tablets, films, and long-acting injectables, which accommodates heterogeneous patient preferences and treatment requirements. Furthermore, government initiatives promoting the use of medication-assisted treatment have particularly emphasized buprenorphine due to its favourable safety profile and potential for office-based treatment, making it more accessible than methadone, which requires specialized clinics.

By Route of Administration

The Injectable route of administration dominated the market in 2023 with approximately 60% of the global revenue share. Several factors are responsible for the substantial market share, all addressing patient comfort as well as meeting the needs of healthcare providers. Injectable formulations, especially LAIs, have benefits related to treatment continuity and a lower risk of abuse or diversion. According to the National Institute on Drug Abuse (NIDA), long-acting formulations can assist in apprehending issues related to daily dosing, which is of great advantage for patients suffering from adherence. The availability of various extended-release injectable buprenorphine formulations has improved treatment options, bolstering the growth of this segment since FDA approval. As an example, Sublocade, a monthly injectable product for buprenorphine, has become popular after its approval.

Injectable formulations can offer more steady drug levels and may help prevent relapse and improve other aspects of care. Furthermore, clinical administration of injectables is intended to reduce the risk of misuse or diversion by allowing controlled administration, which is a key area of concern for both regulators and healthcare providers.

By Distribution Channel

Hospital pharmacies segment dominated the market with a 46% revenue share in 2023. Several reasons contribute to this dominant market share as hospitals play a prominent role in opioid use disorder (OUD) management. Hospitals are ideally suited to be primary care facilities with quality personnel and trained professionals capable of providing comprehensive care for OUD patients, especially for those with complex cases or comorbidities. The growing realization of OUD as a medical illness needing urgent care ("integrated or health care") has coincided with the expansion of hospital-based OUD treatment programs. This explained the continued hospital pharmacy dominance in part because they supplied unique distribution systems for methadone and extended-release forms of oral medications, which can be particularly challenging to ensure proper handling of these controlled substances. The National Survey on Drug Use and Health (NSDUH) paper shows that hospital emergency departments are more commonly used by individuals with OUD (opioid use disorder) seeking treatment, highlighting an opportunity for hospital pharmacies to have a major role in the distribution of medication. In addition to these benefits, or maybe a result of them, hospitals have the infrastructure to deliver the more intensive services required for OUD treatment, such as counselling, behavioural therapies, and management of co-occurring mental health conditions, which is in line with the integrated treatment approach advised for by federal standards.

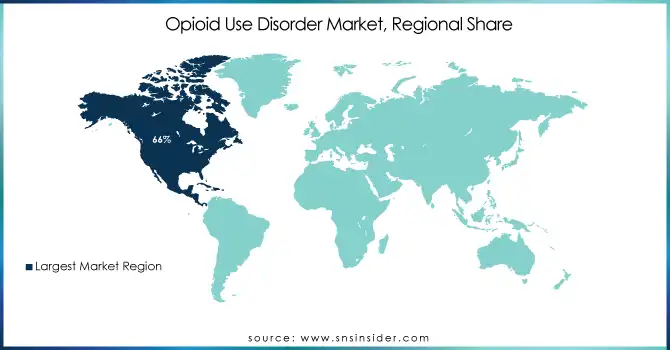

Opioid Use Disorder Market Regional Analysis

North America held the largest share of the opioid use disorder market in 2023, representing about 66% of the overall market. The large share of the region is resulting from the high OUD prevalence, the presence of advanced healthcare infrastructure and a large number of government initiatives for controlling the opioid epidemic. In the United State there were an estimated 81,083 opioid-involved overdose deaths that is according to the Centers for Disease Control and Prevention (CDC), It stresses the potency of the opioid-impact crisis in the US. Market growth is primarily driven by the persistent measures taken by the U.S. government against the epidemic, with an additional about $450 million being allotted in August 2023 to implement wider prevention, treatment, and recovery services. The region's well-established network of healthcare providers and treatment facilities, coupled with robust regulatory frameworks supporting addiction treatment programs, has contributed to its market leadership.

On the other hand, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The soaring rise in the market is due to the rising awareness about OUD treatments, growing healthcare infrastructure, and government initiatives for the treatment of individuals with substance abuse. As an example, in countries such as China and India, there has been a recent prioritization of the approaches to achieving medication-assisted treatment programs for OUD. According to the National Narcotics Control Commission of China, drug users with registered treatment have been on the rise, suggesting that the market for OUD therapies will likely expand overall in China.

Do You Need any Customization Research on Opioid Use Disorder Market - Enquire Now

Recent developments

-

In January 2023, The U.S. Food and Drug Administration (FDA) introduced a new buprenorphine treatment option specific to opioid use disorder (OUD), which broadens dosing options and enhances opportunities for individuals with OUD to achieve long-term recovery.

-

In March 2023, Indivior PLC (UK), announced to acquire of Opiant Pharmaceuticals, Inc. to expand its offering of treatment for opioid addiction and overdose, focusing on strengthening the company's position in the market.

-

In August 2023, The Biden-Harris administration unveiled more than $450 million in funding to address the overdose and addiction crisis, strengthen prevention, treatment, and recovery services, and reduce illegal drug supply. These efforts range from expanding CDC's Overdose Data to Action (OD2A) grants, to rural access to naloxone and access to behavioral healthcare.

Key Players

Service Providers / Manufacturers

-

Indivior PLC (Sublocade, Suboxone)

-

Alkermes plc (Vivitrol, Aristada)

-

Purdue Pharma L.P. (Hysingla ER, Butrans)

-

Braeburn Pharmaceuticals (Brixadi, Probuphine)

-

BioDelivery Sciences International, Inc. (Belbuca, Bunavail)

-

Titan Pharmaceuticals, Inc. (Probuphine Implant, ProNeura)

-

Teva Pharmaceutical Industries Ltd. (Buprenorphine, Naloxone Tablets)

-

Camurus AB (Buvidal, Episil Oral Liquid)

-

Mallinckrodt Pharmaceuticals (Methadose, Roxicodone)

-

Orexo AB (Zubsolv, Abstral)

Key Users

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Hospital

-

Kaiser Permanente

-

Hazelden Betty Ford Foundation

-

American Addiction Centers

-

Acadia Healthcare

-

Universal Health Services (UHS)

-

Summit Behavioral Healthcare

-

The Recovery Village

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.7 Billion |

| Market Size by 2032 | USD 9.02 Billion |

| CAGR | CAGR of 10.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Naltrexone, Buprenorphine, Methadone, Others) • By Route Of Administration (Oral Administration, Injectable Administration, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Indivior PLC, Alkermes plc, Purdue Pharma L.P., Braeburn Pharmaceuticals, BioDelivery Sciences International, Inc., Titan Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Camurus AB, Mallinckrodt Pharmaceuticals, Orexo AB |

| Key Drivers | • The increasing incidence of opioid addiction globally is fueling the demand for effective treatments. • Enhanced government involvement and funding are promoting awareness and preventive programs, contributing to market growth. |

| Restraints | • Adverse effects like vomiting, respiratory complications, and muscle aches from OUD medications may hinder market growth. • The scarcity of certain treatment options can restrict market expansion. |