Prescription Drugs Market Report Scope & Overview:

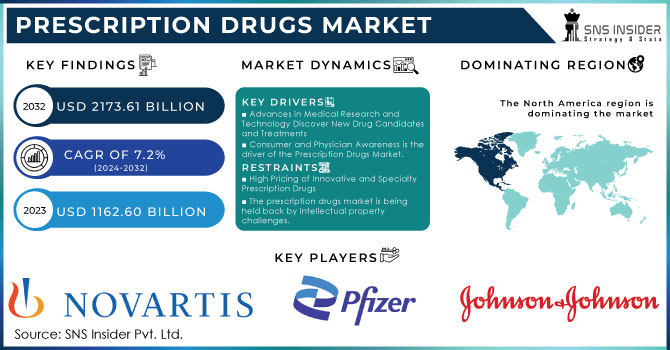

The Prescription Drugs market size was USD 1162.60 billion in 2023 and is expected to reach USD 2173.61 billion by 2032 and grow at a CAGR of 7.20% over the forecast period of 2024-2032. This report provides comprehensive insights into the Prescription Drugs Market, offering detailed analysis beyond traditional metrics such as market size and growth rate. It explores market penetration by therapeutic area, highlighting key segments like oncology, cardiovascular, and neurology. The report also delves into drug pricing trends and the impact of regulatory approvals on market dynamics. Additionally, it examines the shift between generic and branded drugs, prescription drug utilization, and spending trends across various regions. Key factors such as R&D investments, patient adherence, and the role of healthcare insurance are also discussed.

Get More Information on Prescription Drugs Market - Request Sample Report

The U.S. held the largest market share in the prescription drugs market, accounting for 72% of the global market in 2023, with a market size of USD 385.05 billion. This dominance can be attributed to several key factors, including the size of the healthcare system, advanced medical infrastructure, and high spending on pharmaceuticals in the country. The U.S. has one of the largest and most developed healthcare markets, with significant demand for prescription drugs across various therapeutic areas such as oncology, cardiology, and neurology. The presence of major pharmaceutical companies and increased R&D investments have further fueled innovation and drug development. Additionally, the insurance system, which covers a significant portion of the population, drives access to medications; while aging demographics and the rise of chronic diseases contribute to higher prescription drug consumption. With regulatory bodies like the FDA ensuring rigorous drug approvals, the U.S. remains a leader in both drug innovation and consumption.

Market Dynamics

Drivers

The growing prevalence of chronic diseases and the aging population drive the prescription drugs market growth.

The growing prevalence of chronic diseases such as diabetes, hypertension, and cancer, coupled with the aging population, is a major driver of the Prescription Drugs Market. As the global population continues to age, particularly in developed regions like North America and Europe, there is an increasing demand for medications to manage age-related health conditions. Chronic diseases, which require long-term medication, are becoming more prevalent due to lifestyle changes, environmental factors, and longer life expectancies. This demographic shift is creating a larger patient base that requires continuous pharmaceutical care, thus boosting the demand for prescription drugs across various therapeutic areas such as oncology, cardiology, and neurology. As healthcare systems adapt to accommodate these rising needs, pharmaceutical companies are focusing on developing new treatments, particularly for chronic conditions, which will further accelerate market growth over the coming years.

Restrain

-

Rising drug costs and affordability issues act as a restraint for the prescription drugs market.

One of the significant restraints in the Prescription Drugs Market is the rising drug costs, which pose affordability challenges, especially in low- and middle-income countries. The high cost of branded medications, coupled with long treatment durations for chronic diseases, makes it difficult for a significant portion of the population to access necessary treatments. In particular, the price of specialty drugs and biologics has been escalating, putting pressure on both patients and healthcare systems. While generic drugs have provided some relief, their availability is limited in certain regions due to intellectual property regulations and market access restrictions. In addition, stringent pricing regulations in some countries may lead to lower reimbursement rates, restricting access to newer, more effective prescription medications. This affordability gap is a critical issue, and unless addressed, it may slow down the market's growth potential in the coming years.

Opportunity

-

Expanding demand for personalized medicine and precision drugs presents a significant opportunity for market growth.

The rise of personalized medicine and precision drugs presents a significant growth opportunity for the Prescription Drugs Market. As advancements in genomics, biotechnology, and pharmacogenomics continue to evolve, personalized treatments are becoming more effective in treating a wide range of conditions, particularly in oncology and rare genetic diseases. Personalized medicine allows for drugs tailored to an individual's genetic makeup, leading to more effective and targeted therapies with fewer side effects. This approach not only improves patient outcomes but also drives pharmaceutical companies to invest in biomarker discovery, companion diagnostics, and innovative drug formulations. Additionally, personalized medicine is transforming the way healthcare providers approach treatment plans, focusing on specific molecular targets rather than a one-size-fits-all solution. This trend is expected to fuel the growth of the market, offering patients more effective options and creating new opportunities for pharmaceutical companies in both established and emerging markets.

Challenge

Regulatory hurdles and drug approval delays pose challenges for the prescription drugs market growth.

One of the primary challenges facing the prescription drugs market is the lengthy and complex drug approval process required by regulatory agencies like the FDA and EMA. Despite the rising demand for new medications, the drug development process is time-consuming and costly, with many drugs failing at various stages of clinical trials. Regulatory requirements for clinical data, safety assessments, and post-market surveillance can delay the time to market, limiting the availability of essential drugs. Additionally, the global regulatory landscape is fragmented, with different approval procedures across regions, creating barriers for pharmaceutical companies seeking to introduce drugs in multiple markets. The complexity of ensuring regulatory compliance and gaining approval for new drugs, especially for innovative therapies and biologics, poses a significant challenge to the industry. This results in prolonged development timelines and increased costs, ultimately affecting overall market growth.

Segmentation Analysis

By Product Type

Prescription Drugs dominate the market in 2023, with 58%. It is owing to rising healthcare needs, growing research and developments in the field of medicine, and an increase in healthcare access. The rise in global population, as well as the dramatic increase in the prevalence of chronic diseases including cancers, diabetes, and cardiovascular diseases, has led to a corresponding increase in demand for prescribed medications. These medicines form the pillar of modern healthcare systems to treat both acute and chronic conditions through the promotion of their function in managing the disease. It addresses the futuristic innovations in drug development, i.e., biologics and personalized medicine, which have boosted the available treatment options, thereby fueling the market.

By Therapy

Oncology held the largest market share, around 28% in 2023. It is due to the growing prevalence of cancer worldwide and significant advancements in cancer treatment therapies. As cancer continues to be one of the leading causes of death globally, there is an increasing demand for more effective treatments. Oncology drugs, including chemotherapies, immunotherapies, and targeted therapies, are essential in managing various forms of cancer, which has led to a substantial market growth in this segment. Additionally, innovations in immuno-oncology, the development of biologics, and personalized medicine have significantly improved treatment outcomes, expanding the therapeutic options available for patients. The rising focus on early diagnosis, coupled with the growing investment in oncology drug development, has further fueled this market segment. Government initiatives and private sector investments in cancer research, along with increasing healthcare access, have collectively contributed to oncology's position as the largest therapeutic area in the prescription drugs market.

By Distribution Channel

Hospital pharmacies held the largest market share at around 44% in 2023. Hospitals are the centers where these conditions are treated: major surgeries, cancer, cardiovascular diseases, and chronic conditions, all of which require heavy reliance on prescription drugs. Because hospital pharmacies are set up to manage the high volume of prescriptions received at hospitals, they can tailor their offerings to include more specialized medications that are often in retail stores, such as chemotherapies, biologics, immunotherapies, and more. Also, hospitals tend to place integrated care teams where pharmacists collaborate closely with physicians to customize drug therapies for individual patients, which improves patient outcomes. The market share of prescription drugs is the largest for hospital pharmacies due to an increasing number of hospitals (especially in the developing regions) and a rising demand for complex and high-cost drugs.

Regional Analysis

North America held the largest market share, around 46% in 2023. It is due to strong healthcare infrastructure, high healthcare expenditures, and world-class pharmaceutical innovation. Compared to the rest of the region, notably the U.S., there is a better-established, more complex, and expansive healthcare system with widespread private insurance and access to prescription drugs via federally financed programs like Medicare and Medicaid. The FDA is dispensing drug approvals at a steady pace, bolstered by ongoing innovations being made by dominant players in the pharmaceutical market in North America. The U.S. is where many of the largest global pharmaceutical firms are headquartered and is also positioned at the center of drug manufacture, development, distribution, and innovation. Additionally, the growing geriatric population and rising cases of chronic conditions, including diabetes and heart disease, are also generating high precursors for prescription medications across North America. All this taken into account, the prescription drug market across the globe is still predominantly led by North America

Europe held the significant market share. This is owing to the well-established healthcare systems of the region, strict regulatory frameworks, and the rising need for innovative treatment options. In many instances, the higher coverage that universal healthcare offers in various countries means that they provide widespread access to prescription medications for tens of millions. This is particularly the case for member nations of the European Union. Moreover, Europe also hosts some of the world's broadest pharmaceutical companies and research centers, which increases a more substantial level of drug innovation, including oncology, neurology, and cardiovascular diseases. Consumer confidence is boosted, leading to market growth, as regulatory bodies such as the European Medicines Agency (EMA) test new drugs on human beings to assess whether they are safe and effective for the general public. In addition, rising mandatory medicine demand in the region is influenced by an ageing population and increasing burden from chronic diseases. Such access to healthcare and pharmaceutical innovation, along with an increasing need for these treatments, have contributed towards Europe capturing a notable share in the global prescription drugs market.

Key Players

-

Novartis AG (Gleevec, Cosentyx)

-

F. Hoffmann-La Roche Ltd (Herceptin, Avastin)

-

Pfizer, Inc. (Ibrance, Prevnar)

-

Johnson & Johnson Services, Inc. (Remicade, Xarelto)

-

Sanofi (Lantus, Dupixent)

-

AbbVie, Inc. (Humira, Rinvoq)

-

AstraZeneca (Tagrisso, Farxiga)

-

Merck & Co., Inc. (Keytruda, Januvia)

-

GlaxoSmithKline pic. (Advair, Sensodyne)

-

CELGENE CORPORATION (Revlimid, Otezla)

-

Bristol-Myers Squibb (Opdivo, Eliquis)

-

Eli Lilly and Co. (Trulicity, Humalog)

-

Amgen Inc. (Enbrel, Neulasta)

-

Bayer AG (Xarelto, Eylea)

-

Gilead Sciences, Inc. (Harvoni, Remdesivir)

-

Abbott Laboratories (Humira, Freestyle Libre)

-

Mylan N.V. (EpiPen, Lipitor)

-

Teva Pharmaceutical Industries Ltd. (Copaxone, ProAir)

-

Baxter International Inc. (Advantage, Prandial)

-

Sandoz (Zolmitriptan, Enoxaparin)

Recent Development:

-

In 2023, Novartis received FDA approval for Kymriah, a CAR T-cell therapy designed to treat relapsed or refractory large B-cell lymphoma. This approval marks a significant advancement in personalized cancer treatment. Kymriah offers a promising option for patients who have not responded to other therapies.

-

In 2023, Roche announced the FDA approval of Evrysdi for treating spinal muscular atrophy (SMA) in infants and toddlers. This approval strengthens Roche's pediatric treatment portfolio. Evrysdi offers a new therapeutic option for young patients affected by SMA.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD1162.60 Billion |

| Market Size by 2032 | USD 2173.61 Billion |

| CAGR | CAGR of7.20 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Prescription Drugs, Orphan, Generics) • By Therapy (Immunosuppressants, Oncology, Sensory Organs, Vaccines, Anticoagulants, Anti-diabetics, Others) • By Distribution Channel (Retail Pharmacies & Drug Stores, Hospital Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novartis AG, F. Hoffmann-La Roche Ltd, Pfizer, Inc., Johnson & Johnson Services, Inc., Sanofi, AbbVie, Inc., AstraZeneca, Merck & Co., Inc., GlaxoSmithKline pic., CELGENE CORPORATION, Bristol-Myers Squibb, Eli Lilly and Co., Amgen Inc., Bayer AG, Gilead Sciences, Inc., Abbott Laboratories, Mylan N.V., Teva Pharmaceutical Industries Ltd., Baxter International Inc., Sandoz |