Behavioral Health Market Report Overview & Scope

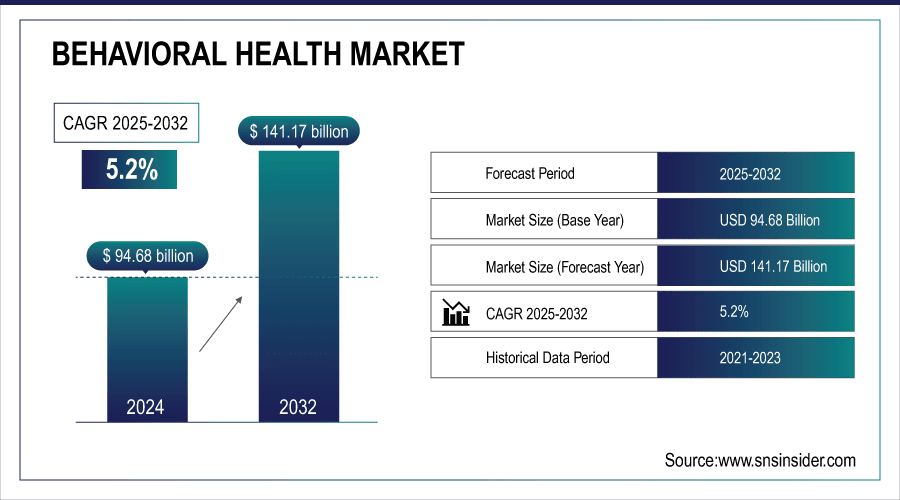

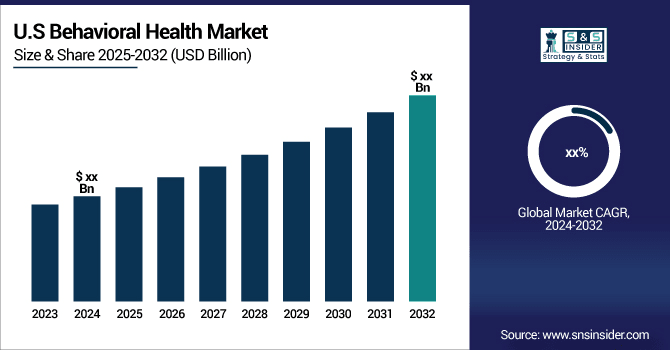

The Behavioral Health Market size was valued at USD 94.68 billion in 2024 and expected to reach USD 141.17 billion in 2032, Growing at a CAGR of 5.2%. during the forecast period 2025-2032.

The Behavioral Health Market is witnessing substantial growth, fueled by increasing awareness of mental health issues, the rising prevalence of behavioral disorders, and improved access to care. Common conditions such as anxiety, depression, bipolar disorder, and addiction are now recognized as critical public health concerns, driven by stress, societal pressures, and lifestyle changes. Expanding telehealth services and supportive policies, such as parity laws ensuring equal mental health coverage, are enhancing care accessibility.

However, the market faces notable challenges, primarily workforce shortages. As of December 2023, over 169 million Americans reside in Mental Health Professional Shortage Areas (HPSAs). Projections indicate a shortage of 138,670 mental health counselors and 82,920 psychiatrists by 2036 under high-demand scenarios. Rural areas are disproportionately impacted, with 69% of counties lacking psychiatric nurse practitioners and 45% without psychologists. Workforce demographics, predominantly non-Hispanic White females, further limit representation for diverse populations. Systemic barriers like provider burnout, limited reimbursement, and lengthy wait times (averaging 48 days) exacerbate access issues. Addressing these challenges requires innovative solutions, including integrated care models, expanding telehealth adoption, and utilizing health support workers to bridge critical gaps, ensuring comprehensive and equitable behavioral health service delivery amidst growing demand.

To Get More Information On Behavioral Health Market - Request Free Sample Report

Behavioral Health Market Report Highlights

-

Public campaigns, celebrity advocacy, and workplace initiatives are normalizing mental health conversations, significantly boosting demand for behavioral health services.

-

Telepsychiatry, mobile apps, AI-driven therapy tools, and virtual platforms are improving accessibility and transforming care delivery worldwide.

-

A lack of qualified psychiatrists, therapists, and counselors continues to limit service capacity, especially in rural and underserved regions.

-

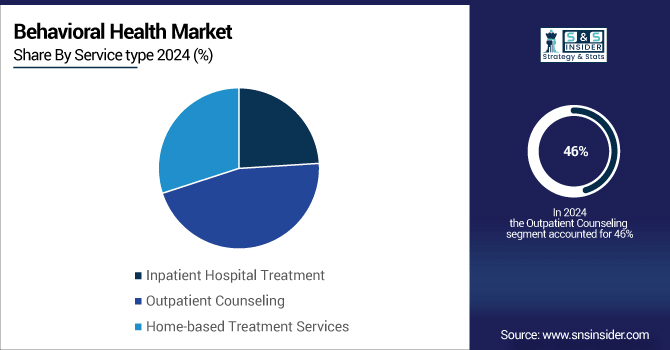

Accounting for 46% of market share in 2024, outpatient counseling remains the preferred flexible and cost-effective treatment option.

-

Severe mental health conditions and substance abuse cases are fueling a projected 6.09% CAGR for inpatient psychiatric facilities.

-

Hospitals, clinics, and rehabilitation centers represented 40% of revenue share, reflecting the rise in specialized service delivery.

-

With a projected CAGR of 6.96%, patients are increasingly turning to self-management platforms, virtual therapy, and mobile apps.

-

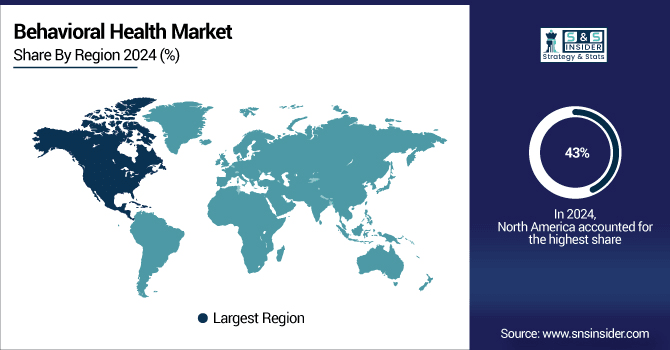

North America dominated with 43% market share in 2024, while Asia Pacific is set to grow fastest at 7.43% CAGR, supported by government initiatives and digital health adoption.

-

Behavioral Health Market Drivers

-

Growing Awareness and Decreasing Stigma Surrounding Mental Health Conditions Boosting Demand for Behavioral Health Services

Increased awareness campaigns, education programs, and open conversations are helping reduce the stigma traditionally associated with mental health conditions. Governments, NGOs, and healthcare organizations are playing an instrumental role in raising awareness about the importance of early intervention and treatment of behavioral disorders like depression, anxiety, PTSD, and addiction. This societal shift is encouraging more individuals to seek professional help, thus driving demand for behavioral health services. Further, celebrities, social influencers, and mental health advocates have added to the momentum by discussing their experiences, normalizing mental health struggles, and encouraging proactive care. Schools and workplaces have also integrated behavioral health initiatives to promote well-being and prevent crises. As a result, the behavioral health market is seeing increased patient engagement and a stronger focus on holistic treatment approaches.

-

Technological Advancements in Telehealth and Digital Platforms Expanding Access to Behavioral Health Services Globally

Digital solutions such as telepsychiatry, mobile mental health apps, virtual therapy sessions, and AI-powered tools enable remote treatment, offering patients convenience and anonymity. This is particularly beneficial for individuals in rural or underserved areas where access to mental health professionals is limited. Post-pandemic, telehealth has become a mainstream tool for behavioral health interventions, driving a shift toward technology-enabled care. Moreover, innovations such as AI-based chatbots, virtual reality therapy, and online support groups are enhancing patient engagement and care continuity. Such platforms help in timely interventions, reduce costs, and allow patients to seek help at their convenience. This technological evolution is transforming the behavioral health market, enabling providers to cater to a broader patient base while ensuring effective care delivery.

Behavioral Health Market Restraints

-

The Shortage Of Qualified Mental Health Professionals Is A Significant Challenge That Restrains The Growth Of The Behavioral Health Market.

The increasing demand for mental health services far exceeds the available supply of psychiatrists, psychologists, therapists, and social workers in many regions. This imbalance is particularly pronounced in rural, remote, and low-income areas, where access to professional care is limited. The lengthy training and certification processes for mental health practitioners further exacerbate the shortage. Additionally, high workloads and burnout among behavioral health professionals often lead to attrition, limiting service delivery capacity. Patients may face long wait times for appointments, delays in diagnosis, and fragmented care due to these workforce challenges. As the demand for behavioral health services continues to rise, addressing the shortage of professionals is critical to ensuring equitable access to care and improving treatment outcomes.

Behavioral Health Market Segmentation Analysis

By Service Type

The Outpatient Counseling segment dominated the Behavioral Health Market in 2024, holding the largest revenue share of 46%. This growth is driven by increasing demand for flexible, cost-effective mental health treatment options that allow individuals to receive care while maintaining their daily routines. For instance, Talkspace expanded its teletherapy platforms, providing accessible virtual counseling services. Additionally, BetterHelp and Mindpath Health have launched innovative digital tools for remote counseling, improving patient engagement. The growth of outpatient counseling aligns with the rise of telehealth, as technological advancements enable seamless virtual therapy.

The Inpatient Hospital Treatment segment is projected to grow at the fastest CAGR of 6.09% during the forecasted period. This growth is fueled by the increasing prevalence of severe mental health conditions and substance use disorders requiring intensive, round-the-clock care. Companies like Acadia Healthcare and Universal Health Services (UHS) have been expanding their inpatient psychiatric facilities to meet rising demand. For example, UHS launched new psychiatric programs with advanced therapeutic interventions to cater to severe cases. Moreover, advancements in treatment protocols, such as integrative therapies combining medical, psychological, and social approaches, are improving patient outcomes.

By End User

The providers segment held the largest revenue share, accounting for 40% of the behavioral health market in 2024, driven by the increasing demand for specialized treatment services, rehabilitation centers, and outpatient care facilities. Providers include hospitals, clinics, behavioral health centers, and professional practitioners delivering tailored solutions for mental health and substance use disorders. Leading companies are enhancing their service delivery through innovative solutions and facility expansions. For instance, Acadia Healthcare launched new treatment centers in key regions to expand access to specialized behavioral health services.

The patients segment is poised to grow at the fastest CAGR of 6.96% during the forecast period, driven by increasing awareness, reduced stigma, and rising access to mental health support tools. Patients are becoming more proactive in seeking behavioral health care, aided by digital health solutions and self-management platforms. Companies such as Talkspace and BetterHelp have launched virtual therapy solutions that empower patients to access mental health care from the comfort of their homes. In addition, Headspace Health has introduced personalized meditation and mental wellness applications that allow users to address stress, anxiety, and depression on a daily basis. The proliferation of mobile apps, wearables, and telehealth services enables patients to take greater control of their mental well-being, further fueling segment growth.

Behavioral Health Market Regional Outlook

North America Leads the Global Behavioral Health Market in 2024

North America dominated the Behavioral Health Market in 2024, with an estimated market share of around 43%, driven by the advanced healthcare infrastructure, strong government initiatives, and high levels of insurance coverage. The United States, in particular, has been a leader in mental health care, with initiatives such as the Mental Health Parity and Addiction Equity Act, which mandates that insurance companies cover mental health services on par with physical health treatments. The presence of major players like Cigna, Aetna, and Optum, which provide comprehensive behavioral health services, further strengthens North America's market leadership.

Moreover, the widespread adoption of digital health platforms like Teladoc Health, which offers telepsychiatry and remote counseling services, has enhanced access to care across the region. The region's strong investment in behavioral health services, the increasing adoption of telehealth, and expanding mental health policies contribute to North America's continued dominance in the market. With further advancements in AI-driven mental health solutions and increased public awareness of mental health, North America is set to maintain its leading position in the global behavioral health market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Emerges as the Fastest-Growing Regional Market

The Asia Pacific (APAC) region is the fastest growing region in the Behavioral Health Market in 2024, with an estimated CAGR of 7.43% during the forecast period. This growth is fueled by increasing mental health awareness, greater access to healthcare services, and changing societal attitudes toward mental health issues. In countries like China, India, and Japan, the growing prevalence of mental health disorders such as depression, anxiety, and substance abuse is driving demand for specialized behavioral health services.

-

For example, in India, initiatives like the National Mental Health Program are actively working to reduce stigma and improve mental health infrastructure, resulting in rising patient demand. Similarly, China has seen an increase in telemedicine adoption and digital health platforms that provide virtual therapy and counseling, which cater to the growing need for accessible care in urban and rural areas.

Strategic Partnerships and Digital Solutions Accelerate Market Expansion in APAC

Additionally, partnerships between local healthcare providers and global players, like Medtronic's collaboration with mental health organizations, are accelerating service expansion in the region. The rise of digital health solutions, combined with economic growth, expanding insurance coverage, and government support, is fueling rapid growth in Asia Pacific's behavioral health market.

Behavioral Health Market Key Players

-

Civitas Solutions Inc. (Sevita)

-

Centene Corporation PLC

-

Magellan Health

-

Bright Harbor Healthcare

-

Acadia Healthcare Co.

-

Pyramid Healthcare, Inc.

-

Core Solutions Inc.

-

Oracle Corporation

-

Welligent Inc.

-

Behavioral Health Services Inc.

-

Cerner Corporation

-

Core Solutions, Inc.

-

Epic

-

Meditab

-

Holmusk

-

Netsmart Technologies

-

Qualifacts Systems, Inc.

-

Welligent, Inc.

-

Moda Health

-

Spring Health

Behavioral Health Market Competitive Landscape

Acadia Healthcare Company, Inc. is a leading U.S.-based behavioral healthcare provider, operating 262 facilities across 39 states and Puerto Rico with approximately 11,850 beds. The company specializes in inpatient psychiatric hospitals, outpatient clinics, residential treatment centers, and specialty programs for mental health and substance use disorders. In 2024, Acadia reported revenues of around $3.27 billion, reflecting robust growth driven by increasing demand for behavioral health services. Strategic initiatives, including facility expansion and telehealth integration, have enhanced accessibility and patient engagement. Despite strong market positioning, regulatory scrutiny and competition from other providers like Lifestance Health present ongoing challenges in sustaining market leadership.

-

In March 2024, Acadia Healthcare Company, Inc. completed the acquisition of three comprehensive treatment centers (CTCs) located in North Carolina. This acquisition strengthens Acadia’s presence in the region and expands its ability to provide specialized behavioral health services to a broader patient base.

Magellan Health, Inc., headquartered in Scottsdale, Arizona, is a leading provider of managed care services with a strong focus on behavioral health, employee assistance programs (EAP), and specialty health management. The company serves a diverse client base, including employers, health plans, and government programs, ensuring comprehensive care delivery through a network of over 110,000 providers. With a reported revenue of $4.82 billion in 2021 and a market capitalization of around $2.5 billion, Magellan Health holds a significant position in the healthcare market. Its continued investment in digital health platforms, telebehavioral solutions, and strategic partnerships drives growth and strengthens its market presence globally.

-

In March 2024, Magellan Health, Inc. introduced two new digital cognitive behavioral therapy (DCBT) programs designed for children and adolescents dealing with anxiety-related symptoms. These DCBT solutions enable young patients to manage their anxiety long-term, allowing clinicians to extend primary care services to a greater number of children.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 94.68 Billion |

| Market Size by 2032 | US$ 141.17 Billion |

| CAGR | CAGR of 5.2% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service type (Inpatient Hospital Treatment, Outpatient Counseling, Home-based Treatment Services) • By Disorder (Anxiety Disorder, Bipolar Disorders, Depression, Eating Disorder) • By End User (Providers, Hospitals and Clinics, Community Centers, Patients) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Elevance Health, LLC, Civitas Solutions Inc. (Sevita), Centene Corporation PLC, Magellan Health , Universal Health Services, Inc., Bright Harbor Healthare, Acadia Healthcare Co., Pyramid Healthcare, Inc., Core Solutions Inc., Oracle Corporation, Welligent Inc., Behavioral Health Services Inc., Cerner Corporation, Core Solutions, Inc., Epic, Meditab, Holmusk, Netsmart Technologies, Qualifacts Systems, Inc., Welligent, Inc., Moda Health, Spring Health |