Order Consolidation Robots Market Report Scope & Overview:

The Order Consolidation Robots Market size was valued at USD 2.44 Billion in 2025E and is projected to reach USD 8.85 Billion by 2033, growing at a CAGR of 17.48% during 2026–2033.

The Order Consolidation Robots Market is witnessing significant growth, driven by rising e-commerce demand and the need for faster, more efficient warehouse operations. Automated solutions, including autonomous mobile robots (AMRs), are increasingly deployed to handle order sorting, consolidation, and delivery tasks, addressing labor shortages and enhancing operational efficiency. Real-time inventory management, dynamic rack placement, and goods-to-person picking improve accuracy and reduce fulfillment times. Modular and scalable systems enable businesses to adapt to fluctuating order volumes, streamline supply chains, and optimize workforce productivity. These trends are fueling widespread adoption of order consolidation robots across global e-commerce and logistics sectors.

In December 2025, Hikrobot’s AMRs and intelligent logistics solutions help e-commerce businesses tackle rapid fulfillment, labor shortages, and inventory management while enabling scalable, automated operations.

Order Consolidation Robots Market Size and Forecast:

-

Market Size in 2025E: USD 2.44 Billion

-

Market Size by 2033: USD 8.85 Billion

-

CAGR: 17.48% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Order Consolidation Robots Market - Request Free Sample Report

Order Consolidation Robots Market Highlights:

-

Rising labor shortages are driving adoption of order consolidation robots to improve efficiency and reduce manual errors

-

Advanced automation solutions like Linde RoCaP automate labor-intensive picking tasks, enhancing accuracy and minimizing workforce strain

-

High costs and integration complexity remain key barriers to adoption, especially for small and medium-sized enterprises

-

Robots streamline consolidation processes, increase throughput, and lower reliance on human labor, supporting warehouse modernization

-

Growing emphasis on autonomous systems across industries creates opportunities for broader deployment and market expansion

-

Lessons from defense and logistics, such as Navy RAS initiatives, demonstrate scalable adoption strategies for robotic systems

The U.S. Order Consolidation Robots Market, valued at USD 0.46 Billion in 2025E, is projected to reach USD 1.91 Billion by 2033, growing at a CAGR of 19.40%. Rapid e-commerce growth, increasing warehouse automation, and the adoption of advanced robotics are driving efficiency, reducing labor costs, and improving order accuracy, fueling widespread market expansion across logistics and retail sectors.

Order Consolidation Robots Market Drivers:

-

Rising Labor Shortages Boost Adoption of Order Consolidation Robots

The growing shortage of skilled warehouse workers is driving companies to invest in order consolidation robots. As warehouses face increasing pressure to fulfill orders quickly and accurately, manual order picking becomes labor-intensive and error-prone. Autonomous robots, equipped with advanced multi-axis grippers and intelligent navigation, automate the consolidation of products on pallets or carriers, reducing physical strain on employees while minimizing errors. Consequently, companies experience higher operational efficiency, faster throughput, and lower reliance on human labor, making these robots a critical solution for modern warehouse automation.

In November 4, 2025 – At the Linde Automation Summit, Linde Material Handling and ROSSMANN unveil the Linde Robotic Case Picker (RoCaP) for autonomous warehouse order picking.The multi-axis gripper vehicle automates labor-intensive tasks, reduces errors, and addresses workforce shortages in warehouses.

Order Consolidation Robots Market Restraints:

-

High Costs and Complex Integration Limit Adoption of Order Consolidation Robots

The significant upfront investment required for order consolidation robots, including hardware, software, and integration into existing warehouse systems, remains a major barrier for many companies. Small and medium-sized enterprises often struggle to justify the expenditure, particularly when ROI timelines are long. Additionally, the complexity of integrating these robots with legacy warehouse management systems can lead to operational disruptions and require specialized technical expertise. As a result, despite their efficiency and labor-saving potential, the adoption of order consolidation robots is restrained, particularly in cost-sensitive or low-volume warehouse operations.

Order Consolidation Robots Market Opportunities:

-

Strategic Investments in Autonomous Systems Drive Adoption of Order Consolidation Robots

The increasing emphasis on autonomous and robotic systems across industries highlights a significant growth opportunity for order consolidation robots. As organizations prioritize operational efficiency, workforce optimization, and error reduction, investment in advanced robotic solutions becomes essential. Lessons from large-scale autonomous system deployments, such as in defense and logistics, demonstrate that structured program management and streamlined integration accelerate adoption. Consequently, companies can deploy multi-axis robotic order consolidation systems to improve throughput, reduce labor dependency, and enhance accuracy, creating a favorable environment for market expansion in warehouses and distribution centers.

In September 4, 2025 – Secretary of the Navy John Phelan orders a major reorganization of the Navy’s robotic and autonomous systems enterprise to enhance acquisition and readiness.The plan creates new leadership roles, consolidates RAS programs, and streamlines operations to improve mission-critical autonomy and maintain strategic advantage.

Order Consolidation Robots Market Segment Highlights:

-

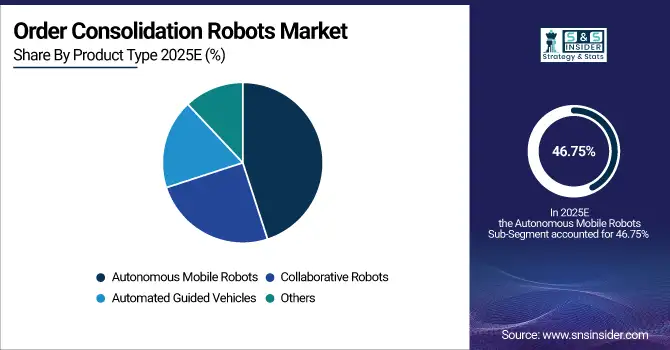

By Product Type: Dominant – Autonomous Mobile Robots (46.75% in 2025 → 51.25% in 2033); Fastest-Growing – Collaborative Robots (CAGR 19.93%)

-

By Application: Dominant – E-commerce (38.88% in 2025 → 44.13% in 2033); Fastest-Growing – E-commerce (CAGR 19.34%)

-

By Payload Capacity: Dominant – Medium (37.88% in 2025 → 43.13% in 2033); Fastest-Growing – High (CAGR 18.95%)

-

By End User: Dominant – Third-Party Logistics Providers (41.63% in 2025 → 45.38% in 2033); Fastest-Growing – Third-Party Logistics Providers (CAGR 18.74%)

Order Consolidation Robots Market Segment Analysis:

By Product Type, Autonomous Mobile Robots Dominating and Collaborative Robots Fastest-Growing

Autonomous Mobile Robots continue to lead the market due to their versatility, reliability, and ability to handle diverse warehouse operations with minimal human intervention. Their adaptability across industries and compatibility with advanced automation systems make them the preferred choice for logistics and manufacturing. Meanwhile, collaborative robots are the fastest-growing segment, driven by increasing demand for flexible, AI-enabled, human-robot integrated solutions that enhance efficiency, safety, and real-time responsiveness in dynamic operational environments.

By Application, E-commerce Dominating and Fastest-Growing

E-commerce continues to lead the market by application due to its widespread adoption and critical role in driving demand for efficient and reliable logistics solutions. Its rapid growth is supported by the increasing need for scalable and streamlined operations across the online retail sector.

By Payload Capacity, Medium Dominating and High Fastest-Growing

Medium-capacity solutions dominate the market thanks to their versatility and suitability for a wide range of warehouse operations. High-capacity solutions are the fastest-growing segment, driven by the need for robust handling capabilities in large-scale and complex logistics operations.

By End User, Third-Party Logistics Providers Dominating and Fastest-Growing

Third-party logistics providers hold a leading position among end users, supported by their extensive adoption of automation and advanced operational solutions. This segment is also the fastest-growing, fueled by the increasing demand for efficient, scalable, and flexible logistics services.

Order Consolidation Robots Market Regional Highlights:

-

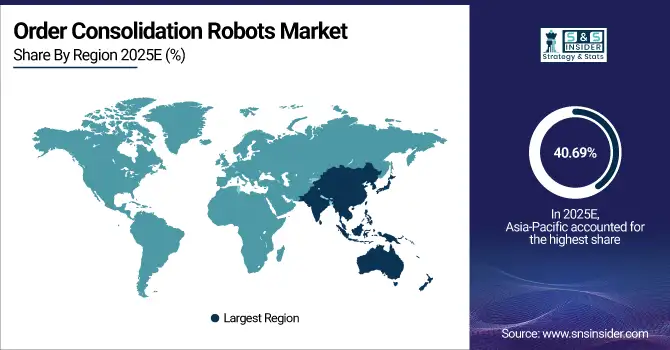

Asia-Pacific: In 2025E 40.69% → 37.31%, Dominating Region (CAGR 16.21%)

-

North America: In 2025E 28.75% → 33.25%, Fastest-Growing Region (CAGR 19.61%)

-

Europe: In 2025E 20.44% → 21.56%, Stable & Mature Market (CAGR 18.26%)

-

South America: In 2025E 5.34% → 3.66%, Steady Growth (CAGR 11.92%)

-

Middle East & Africa: In 2025E 4.78% → 4.22%, Stable Share (CAGR 15.64%)

Order Consolidation Robots Market Regional Analysis:

Asia-Pacific Order Consolidation Robots Market Insights:

Asia-Pacific leads the Order Consolidation Robots Market, driven by rapid e-commerce growth, rising warehouse automation, and advanced logistics infrastructure. High adoption of smart technologies in countries like China, Japan, and South Korea boosts operational efficiency and reduces labor costs, reinforcing the region’s dominance in the global market landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Order Consolidation Robots Market Insights:

China dominates the Order Consolidation Robots market, fueled by booming e-commerce, advanced warehouse automation, and strong government support, driving efficiency, cost reduction, and widespread adoption across logistics and retail sectors.

North America Order Consolidation Robots Market Insights:

North America is the fastest-growing region in the Order Consolidation Robots market, driven by increasing e-commerce demand, technological advancements in robotics, and investments in smart warehouses. Companies adopt automation to enhance efficiency, reduce labor costs, and meet rising consumer expectations, accelerating the market’s rapid regional growth.

U.S. Order Consolidation Robots Market Insights:

The U.S. leads the Order Consolidation Robots market, driven by advanced warehouse automation, high e-commerce demand, and strong technological adoption, boosting operational efficiency and widespread deployment across logistics and retail sectors.

Europe Order Consolidation Robots Market Insights:

The Europe Order Consolidation Robots Market is witnessing steady growth, driven by increasing warehouse automation, rising e-commerce activities, and government initiatives promoting Industry 4.0 adoption. Advanced logistics infrastructure and demand for operational efficiency are encouraging businesses to deploy robots, enhancing productivity and reducing labor costs across the region.

Germany Order Consolidation Robots Market Insights:

Germany is the country dominating the Order Consolidation / warehouse robotics market with the largest share of installations and revenue among European nations, thanks to its strong industrial base and advanced automation infrastructure.

Latin America Order Consolidation Robots Market Insights:

The Latin America Order Consolidation Robots Market is steadily expanding, driven by growing e-commerce, increasing warehouse automation, and investments in logistics infrastructure. Companies are adopting robotics to improve efficiency, reduce labor costs, and enhance order accuracy, supporting the region’s gradual yet consistent market growth across key countries.

Brazil Order Consolidation Robots Market Insights:

Brazil dominates the Order Consolidation Robots market, fueled by rising e-commerce, expanding warehouse automation, and strategic investments in logistics technology, driving efficiency, accuracy, and widespread adoption across retail and distribution sectors.

Middle East & Africa Order Consolidation Robots Market Insights:

The Middle East and Africa Order Consolidation Robots Market is witnessing moderate growth, supported by increasing e-commerce, expanding logistics infrastructure, and gradual adoption of automation technologies. Businesses are implementing robots to enhance operational efficiency, reduce labor costs, and improve order accuracy, driving steady market development across the region.

Saudi Arabia Order Consolidation Robots Market Insights:

Saudi Arabia dominates the Middle East and Africa Order Consolidation Robots Market, driven by rapid e-commerce growth, investments in advanced logistics infrastructure, and adoption of automation technologies, enhancing operational efficiency, reducing labor costs, and improving order accuracy across the region.

Order Consolidation Robots Market Competitive Landscape:

Swisslog (Established 1900) Swisslog is a global leader in warehouse automation and intralogistics solutions, offering AMRs, ASRS, robotic picking systems, conveyor systems, and AI-driven fleet management software. The company provides scalable, flexible solutions for industries including food & beverage, retail, and manufacturing, enhancing efficiency, throughput, and operational agility.

-

In August 2025, Swisslog launched its IntraMove series of AMRs for pallet transport, capable of carrying up to 3,000 kg, featuring AI-powered fleet management, SLAM navigation, and flexible deployment for dynamic warehouse operations.

GreyOrange (Established 2012) — GreyOrange is a global leader in warehouse automation and robotics, offering AI-powered solutions like GreyMatter DeepNav for fleet orchestration, AMRs, and inventory optimization. The company provides hardware-agnostic, cloud-based systems that enhance efficiency, reduce costs, ensure worker safety, and support scalable, intelligent warehouse operations.

-

In August 2025 — GreyOrange, in collaboration with Google Cloud, launched GreyMatter DeepNav, an AI-powered orchestration platform that dynamically manages and optimizes large autonomous robot fleets for scalable warehouse operations.

Order Consolidation Robots Market Key Players:

-

GreyOrange

-

Geek+

-

Locus Robotics

-

6 River Systems (Shopify)

-

Fetch Robotics (Zebra Technologies)

-

KUKA AG

-

ABB Ltd.

-

Honeywell Intelligrated

-

Dematic (KION Group)

-

Knapp AG

-

Swisslog (KUKA Group)

-

Vecna Robotics

-

IAM Robotics

-

Magazino GmbH

-

inVia Robotics

-

RightHand Robotics

-

Boston Dynamics

-

Quicktron Robotics

-

Hikrobot

-

Mobile Industrial Robots (MiR)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.44 Billion |

| Market Size by 2033 | USD 8.85 Billion |

| CAGR | CAGR of 17.48% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Autonomous Mobile Robots, Collaborative Robots, Automated Guided Vehicles and Others) • By Application (E-commerce, Retail, Warehousing, Logistics, Manufacturing and Others) • By Payload Capacity(Low, Medium and High) • By End User(Retailers, Third-Party Logistics Providers, Manufacturers and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | GreyOrange, Geek+, Locus Robotics, 6 River Systems (Shopify), Fetch Robotics (Zebra Technologies), KUKA AG, ABB Ltd., Honeywell Intelligrated, Dematic (KION Group), Knapp AG, Swisslog (KUKA Group), Vecna Robotics, IAM Robotics, Magazino GmbH, inVia Robotics, RightHand Robotics, Boston Dynamics, Quicktron Robotics, Hikrobot, Mobile Industrial Robots (MiR) |