Orthobiologics Market Report Scope & Overview:

To Get More Information on Orthobiologics Market - Request Sample Report

The orthobiologics market size was USD 6.46 Billion in 2023 and is expected to reach USD 10.55 Billion by 2032 and grow at a CAGR of 5.60% over the forecast period of 2024-2032. The report includes the prevalence of musculoskeletal disorders, with osteoarthritis affecting over 500 million people globally. It covers market adoption rates of bone graft substitutes, Visco supplements, and stem cell therapies, highlighting their increasing demand due to minimally invasive procedures. The report examines healthcare expenditure trends, showing a rise in orthopedic treatment costs and insurance reimbursement patterns across key regions. It also presents clinical trial data and R&D investments, showcasing innovation in biologic implants and regenerative medicine advancements. Furthermore, the report includes geographic distribution and accessibility trends, emphasizing disparities in treatment availability and market penetration in emerging economies.

The US held the largest market share 76% in 202. This is owing to the presence of a higher number of musculoskeletal disorders, Infrastructure, and favorable reimbursement policies in the United States. This necessitates the need for orthobiologic treatments such as bone graft substitutes. In addition, the USA is ahead in terms of clinical research and FDA approvals, rapidly pushing these novel regenerative therapies (i.e. Stem Cell and platelet-rich plasma (PRP) therapies) into practice. Moreover, the availability of advanced technology with the accessibility of prominent market players like Medtronic and Stryker will aid in providing product options. The U.S. market also benefits from favorable insurance coverage for orthopedic procedures and an increasing aging population, establishing it as a favorable center for orthobiologics.

Market Dynamics

Drivers

-

Rising prevalence of musculoskeletal disorders and sports injuries accelerates orthobiologics market growth.

The increasing incidence of musculoskeletal disorders, osteoarthritis, and sports-related injuries is a key driver of the Orthobiologics Market. According to the World Health Organization (WHO), musculoskeletal disorders affect approximately 1.71 billion people globally, with osteoarthritis being the most common condition. The rising aging population, particularly in developed countries like the U.S., Japan, and Germany, is further fueling the demand for bone graft substitutes, platelet-rich plasma (PRP) therapy, and stem cell treatments. Additionally, the increasing participation in sports and physical activities has led to a surge in ligament and tendon injuries, driving the adoption of orthobiologic solutions for faster recovery. The demand for minimally invasive procedures has also contributed to market expansion, as orthobiologics offer quicker healing, reduced hospital stays, and improved patient outcomes. Furthermore, advancements in tissue engineering and regenerative medicine have enhanced the effectiveness of orthobiologic products, making them a preferred choice among healthcare professionals. Government initiatives supporting biologic research and increasing FDA approvals for innovative therapies are expected to further propel market growth. With orthopedic injuries and degenerative joint diseases on the rise, the Orthobiologics Market is set for substantial expansion in the coming years.

-

High costs of orthobiologic treatments and limited insurance coverage restrains market growth.

Despite the promising growth of the Orthobiologics Market, the high cost of orthobiologic treatments and limited insurance coverage pose significant challenges to widespread adoption. Orthobiologic procedures, including stem cell therapy, bone graft substitutes, and PRP injections, are expensive and not always covered by insurance providers, making them inaccessible to a large portion of the population. In many countries, including the U.S., insurance companies often classify these therapies as experimental or elective, resulting in out-of-pocket expenses for patients. This lack of reimbursement significantly impacts the adoption rate, especially in developing regions where healthcare affordability is a major concern. Additionally, regulatory challenges and stringent approval processes further limit market expansion, as companies face hurdles in launching innovative biologic solutions. The lack of standardization in treatment protocols and varying clinical outcomes also contribute to the hesitancy among healthcare providers to recommend orthobiologic products. To overcome these restraints, industry players must focus on cost-effective product development, securing insurance approvals, and increasing awareness about the long-term benefits of orthobiologics.

-

Advancements in regenerative medicine and stem cell therapies create lucrative opportunities in the orthobiologics market.

The growing focus on regenerative medicine and stem cell therapies presents a significant opportunity for the Orthobiologics Market. Advances in biotechnology, tissue engineering, and cellular therapies have revolutionized orthopedic treatments by offering natural healing solutions with minimal risk of rejection or complications. Stem cell-based treatments, in particular, have gained widespread interest due to their potential to regenerate damaged cartilage, tendons, and bones. According to recent studies, mesenchymal stem cells (MSCs) have shown promising results in treating osteoarthritis and spinal injuries, leading to increased research and clinical trials in this domain. Additionally, the rising adoption of 3D bioprinting and bioengineered implants has further enhanced the efficacy of orthobiologic treatments, offering personalized solutions for patients. Governments and private organizations are heavily investing in regenerative medicine research, with funding initiatives aimed at accelerating FDA approvals and commercialization of innovative therapies. With an increasing number of clinical studies demonstrating the long-term benefits of orthobiologics, patient acceptance is also expected to rise. As the demand for natural, minimally invasive, and highly effective orthopedic solutions grows, companies investing in stem cell research and next-generation biologics are likely to gain a competitive edge in the market.

-

Stringent regulatory approval processes and product standardization pose challenges for the orthobiologics market.

The Orthobiologics Market faces a major challenge due to stringent regulatory approval processes and the lack of standardized product guidelines. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, impose strict requirements for the approval of orthobiologic products, making it a time-consuming and expensive process for manufacturers. Clinical trials for stem cell therapies, PRP injections, and bone graft substitutes often require extensive safety and efficacy data, leading to delays in product commercialization. Additionally, the lack of standardization in production techniques and treatment protocols further complicates market adoption, as healthcare providers often face difficulties in selecting the most effective therapy. Variability in clinical outcomes, inconsistent regulatory frameworks across different countries, and ethical concerns surrounding stem cell research add to the complexity.

Segmentation Analysis

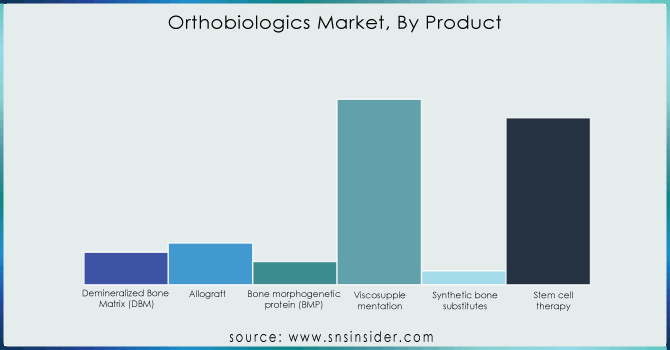

By Product

In 2023, the Viscosupplementation segment dominated the market with a revenue share of over 44.00%, due to the rising prevalence of osteoarthritis (OA) and the availability of advanced hyaluronic acid-based injections. Visosupplements are focused on reducing joint pain and improving mobility as over 32.5 million adults in the U.S. suffer from OA according to the Arthritis Foundation. The higher degree of pain relief achieved with the combined approach gave rise to companies such as Anika Therapeutics introducing CINGAL, the combination of hyaluronic acid and corticosteroid, able to provide longer duration of pain relief. Likewise, Bioventus came out with its own single-injection viscosupplement, DUROLANE to provide the patients with ample convenience. Such innovations tie in with the growth of the Orthobiologics Market, which is seeing a gradual shift from the time-consuming and invasive surgical procedures to minimally invasive biologic treatments a reflection of the larger regenerative medicine trend and the non-surgical joint care solutions.

Do You Need any Customization Research on Orthobiologics Market - Enquire Now

By Application

The spinal fusion segment is projected to hold the largest market share of around 52% during the forecasted period, driven by the growing prevalence of spinal disorders and technological advancements in biologic implants. According to the National Spinal Cord Injury Statistical Center (NSCISC), nearly 17,000 new spinal cord injury cases occur annually in the U.S., increasing the demand for bone grafts and biologic fusion materials. Companies such as Medtronic launched the INFUSE Bone Graft, a recombinant human bone morphogenetic protein (rhBMP-2), promoting bone growth in spinal fusion surgeries. Similarly, Zimmer Biomet introduced the Zyston Strut Open Titanium Interbody Spacer, designed for enhanced fusion rates and stability. These innovations contribute to the Orthobiologics Market, as biologics play a vital role in reducing surgery time, improving fusion success rates, and enhancing patient recovery, making spinal fusion a leading application in orthopedic treatments.

By End Use

The hospital segment is expected to dominate the Orthobiologics Market with a 72% market share during the forecast period, owing to the high volume of orthopedic surgeries, access to advanced biologic treatments, and specialized care facilities. Hospitals serve as primary centers for joint replacement, spinal fusion, and regenerative therapies, increasing the adoption of viscosupplements, stem cell treatments, and bone grafts. Leading hospitals are integrating innovative biologics, such as the Mayo Clinic utilizing stem cell therapies for knee osteoarthritis and the Cleveland Clinic adopting PRP injections for tendon injuries. Additionally, companies like Stryker introduced the BIO4 Viable Bone Matrix, enhancing bone healing in surgical procedures. This dominance aligns with the Orthobiologics Market’s growth, as hospitals remain the preferred setting for complex orthopedic procedures, ensuring safety, efficiency, and advanced biological applications.

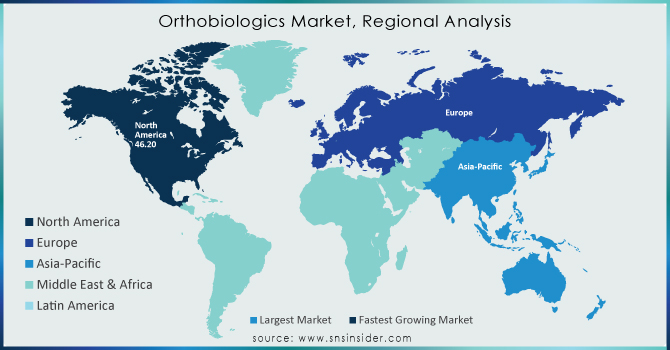

Regional Analysis

North America held the largest market share around 48% in 2023. Rising incidence of musculoskeletal disorders, and key market competitors. Its annual orthopedic surgeries are enormous in the district with over 1.2 million joint replacements directed in total yearly according to CDC. Some of the major players involved in the market are Medtronic, Stryker, Zimmer Biomet, and Bioventus which keep on innovating more advanced orthobiologics offering more efficient results. In addition, agreeable reimbursement policies are paving the way to accessibility along with rising healthcare expenditure, where the U.S. seems to have crossed USD 4.3 trillion in strategic spending in the year 2023, thus driving the demand for telecasting the necessitated need for the orthobiologic treatment market. North America is estimated to exhibit the majority market share in the regenerative medicines market due to prominent research institutes and more clinical trials for regenerative medicine being carried out in North America. Moreover, the USA holds the largest share in the global Orthobiologics

Asia Pacific's significant market share in 2023. This growth is driven by the growing geriatric population, the higher prevalence of orthobiologics disorders, and the rapid expansion of healthcare infrastructure in the Asia Pacific region. With more than 630 million people over the age of 65 years within Asia Pacific, a surge in osteoarthritis, osteoporosis, and spinal disorders is expected in turn, increasing the demand for bone grafts, viscosupplementation, and stem cell therapies according to the growth of the segment, as reported by the United Nations. With healthcare reforms imposed by the government and rising medical tourism, orthopedic procedures are on the rise in Asia, and especially China, Japan, and India. In contrast, other countries such as India have expanded access to orthopedic treatments through schemes such as the Ayushman Bharat scheme while Japan remains at the forefront of research and development in regenerative medicine, stemming the development of novel stem cell-based orthobiologics products. Also, the relatively cheaper price of orthopedic procedures in comparison with Western countries has attracted medical tourism, which in turn increases market demand.

Key Players

-

Bone Biologics Corp. (NELL-1 Bone Regeneration Protein, Urist-3D Matrix)

-

Medtronic PLC (Infuse Bone Graft, Grafton DBM)

-

Anika Therapeutics, Inc. (HYALOFAST, CINGAL)

-

DePuy Synthes (HEALOS Bone Graft, VISTAFIX Craniofacial Implants)

-

Arthrex, Inc. (ArthroFlex, AlloSync Demineralized Bone Matrix)

-

Zimmer Biomet (PrimaGen Advanced Allograft, Puros Demineralized Bone Matrix)

-

Globus Medical (SIGNIFY Bioactive Bone Graft, EXCELSIUS GPS)

-

Stryker Corporation (Vitoss Bone Graft Substitute, BIO4 Viable Bone Matrix)

-

Orthofix, Inc. (Trinity ELITE Allograft, Physio-Stim Bone Growth Stimulator)

-

Bioventus LLC (EXOGEN Ultrasound Bone Healing System, OsteoAMP Allograft)

-

Sanofi (Synvisc-One, Hyalgan)

-

SeaSpine Holdings Corporation (OsteoStrand Demineralized Bone Fibers, Vu aPOD Prime NanoMetalene System)

-

RTI Surgical (map3 Cellular Allogeneic Bone Graft, ViBone Viable Bone Matrix)

-

Kuros Biosciences (MagnetOs Granules, Neuroseal)

-

Xtant Medical (OsteoSponge, OsteoVive)

-

NuVasive, Inc. (AttraX Scaffold, Osteocel Plus)

-

Integra LifeSciences (BioFix Osteoconductive Scaffold, DuraGen)

-

Smith & Nephew (Regeneten Bioinductive Implant, TRUCLEAR System)

-

Terumo Corporation (Aquarius Blood and Fluid Warming System, CAPIOX FX Oxygenator)

-

Seikagaku Corporation (Gel-One, HyLink)

Recent Development:

-

In January 2024, Xenco Medical introduced the TrabeculeX Continuum at the Consumer Electronics Show (CES) in Las Vegas. This groundbreaking innovation integrates orthobiologics with digital health, featuring a regenerative biomaterial designed for 3D bone formation alongside a remote therapeutic monitoring app for virtual physical therapy.

-

In May 2024, Isto Biologics introduced the Fibrant Liberty allograft, a dry allograft blend that combines durable cortical fibers with mineralized cortical cancellous chips. When hydrated, the graft becomes flexible and adaptable, making it suitable for a range of surgical procedures while promoting bone healing and fusion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD6.46 Billion |

| Market Size by 2032 | USD 10.55 Billion |

| CAGR | CAGR of 5.60 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product, (Demineralized Bone Matrix, Allograft, Bone Morphogenetic Protein (BMP), Viscosupplementation, Synthetic Bone Substitutes, Stem Cell Therapy) • By Application (Spinal fusion, Trauma repair, Reconstructive surgery) • By End-Use (Hospitals, Outpatient Facilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bone Biologics Corp., Medtronic PLC, Anika Therapeutics, Inc., DePuy Synthes, Arthrex, Inc., Zimmer Biomet, Globus Medical, Stryker Corporation, Orthofix, Inc., Bioventus LLC, Sanofi, SeaSpine Holdings Corporation, RTI Surgical, Kuros Biosciences, Xtant Medical, NuVasive, Inc., Bone Biologics Corp., Medtronic PLC, Anika Therapeutics, Inc., DePuy Synthes, Arthrex, Inc., Zimmer Biomet, Globus Medical, Stryker Corporation, Orthofix, Inc., Bioventus LLC, Sanofi, SeaSpine Holdings Corporation, RTI Surgical, Kuros Biosciences, Xtant Medical, NuVasive, Inc., Integra LifeSciences, Smith & Nephew, Terumo Corporation, Seikagaku Corporation |