Patient Registry Software Market Report Scope & Overview:

Get more information on Patient Registry Software Market - Request Sample Report

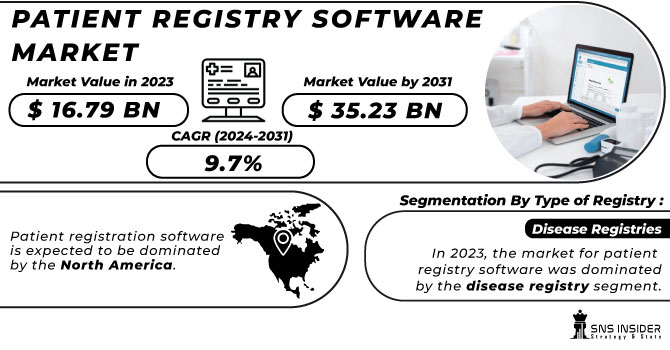

The Patient Registry Software Market Size was valued at USD 1.75 Billion in 2023 and is expected to reach USD 5.23 Billion by 2032, growing at a CAGR of 12.93% over the forecast period of 2024-2032.

The Patient Registry Software Market is expanding as healthcare providers seek efficient data management solutions. Our report examines the reimbursement and financial impact, analyzing how policies shape adoption. A cost analysis and ROI estimation reveal the long-term benefits of these systems. The evolution of electronic health records and interoperability standards is transforming patient data exchange, with frameworks like HL7 and FHIR enhancing connectivity. Navigating the regulatory framework and compliance, including HIPAA, GDPR, and FDA regulations, remains crucial for market players. Additionally, the analysis of open-source vs. proprietary patient registry software highlights key adoption trends, comparing flexibility, security, and cost-effectiveness. These insights equip stakeholders with essential knowledge to navigate the evolving landscape of patient data management.

Market Dynamics

Drivers

-

Growing Adoption of Real-World Evidence (RWE) and Big Data Analytics Fuels the Patient Registry Software Market Expansion

The increasing reliance on real-world evidence and big data analytics is a major driver for the Patient Registry Software Market. Pharmaceutical companies, regulatory agencies, and healthcare providers use real-world data collected through patient registries to evaluate treatment efficacy, monitor adverse events, and support regulatory decisions. The integration of big data analytics allows healthcare organizations to analyze large datasets, identifying patterns and trends in patient outcomes. Real-world evidence is becoming essential for drug development, clinical trials, and post-market surveillance, ensuring data-driven decision-making. Governments and regulatory bodies such as the FDA and EMA encourage the use of RWE to supplement clinical trial data, expediting drug approvals and improving public health initiatives. The ability of patient registry software to aggregate and analyze large-scale patient data enhances clinical research, supports personalized medicine, and aids in developing targeted therapies. As big data technologies continue to evolve, their application in patient registries is set to transform healthcare analytics and decision-making.

Restraints

-

Data Privacy Concerns and Regulatory Compliance Challenges Limit the Adoption of Patient Registry Software

Data security and privacy concerns present significant challenges in the adoption of patient registry software. With increasing incidents of data breaches and cyberattacks, healthcare organizations must ensure robust security measures to protect sensitive patient information. Compliance with stringent regulatory frameworks, including HIPAA in the U.S., GDPR in Europe, and other regional data protection laws, adds complexity to software implementation. Organizations face challenges in maintaining compliance with evolving regulations, requiring continuous updates and audits. Additionally, patient consent management and ethical considerations regarding data usage further complicate registry operations. Non-compliance can lead to legal penalties, reputational damage, and loss of patient trust. Overcoming these challenges requires advanced encryption technologies, stringent access controls, and compliance-focused software development, ensuring data integrity and regulatory adherence.

Opportunities

-

Expansion of Patient Registries for Rare Diseases and Orphan Drug Development Drives Market Growth

The growing focus on rare diseases and orphan drug development is creating new opportunities for the Patient Registry Software Market. Rare disease registries play a crucial role in collecting comprehensive patient data, aiding in research, treatment development, and regulatory approvals. Pharmaceutical companies leverage these registries to study disease progression, identify potential therapeutic targets, and evaluate treatment outcomes. Governments and healthcare organizations are investing in rare disease registries to improve diagnosis and patient care. Additionally, regulatory incentives such as the Orphan Drug Act in the U.S. encourage drug developers to utilize patient registries for clinical trials and post-marketing studies. The expansion of these registries facilitates data-driven insights, accelerating advancements in precision medicine and addressing unmet medical needs in rare disease treatment.

Challenge

-

Lack of Standardization and Interoperability Hinders Data Integration in the Patient Registry Software Market

One of the critical challenges in the Patient Registry Software Market is the lack of standardization and interoperability among different healthcare systems. Many hospitals and research institutions use varied electronic health record platforms, making seamless data exchange difficult. Inconsistent data formats, proprietary software limitations, and differing regulatory requirements further complicate integration. This lack of interoperability hinders real-time data sharing, affecting the effectiveness of patient registries in tracking treatment outcomes and supporting research. Standardization initiatives such as FHIR and HL7 are being developed to address these challenges, but widespread adoption remains slow. Overcoming this issue requires collaboration among software developers, healthcare providers, and regulatory agencies to establish uniform data-sharing protocols and enhance interoperability in patient registries.

Segmental Analysis

By Type of Registry

In 2023, the Disease Registries segment dominated the Patient Registry Software Market with a market share of 55.2%. Within this segment, Cancer Registries emerged as the leading subsegment. The growing prevalence of cancer, along with increased government funding for cancer research, has fueled the adoption of patient registries dedicated to oncology. These registries play a crucial role in tracking disease trends, evaluating treatment efficacy, and enhancing patient outcomes. For instance, the National Program of Cancer Registries (NPCR) in the United States and the Surveillance, Epidemiology, and End Results (SEER) Program work together to collect and analyze nationwide cancer data, guiding public health policies and treatment innovations. Similarly, the European Network of Cancer Registries (ENCR) supports cancer surveillance across Europe, ensuring comprehensive and standardized data collection. The rising number of cancer cases worldwide and the growing integration of artificial intelligence in registry software to analyze vast datasets further contribute to the dominance of this segment.

By Software

In 2023, the Integrated software segment led the Patient Registry Software Market, holding a market share of 56.9%. Integrated patient registry solutions are widely preferred due to their ability to connect multiple healthcare systems, enhance workflow efficiency, and support real-time data sharing across various departments. This seamless interoperability reduces redundancy, enhances clinical decision-making, and ensures compliance with regulatory requirements such as HIPAA and GDPR. For instance, the Centers for Disease Control and Prevention (CDC) has integrated multiple public health registries to streamline disease tracking and response. Similarly, hospital networks across North America and Europe are investing in integrated registry solutions to facilitate multi-institutional collaboration and data analytics for research and personalized medicine. As the demand for precision healthcare increases, integrated software solutions remain the preferred choice, enabling institutions to derive meaningful insights from patient data while improving healthcare coordination and patient care efficiency.

By Functionality

In 2023, Population Health Management (PHM) functionality dominated the Patient Registry Software Market with a market share of 42.5%. PHM is essential for healthcare systems aiming to enhance patient outcomes through data-driven insights, disease prevention strategies, and chronic disease management. Patient registry software embedded with PHM capabilities enables providers to identify high-risk patient groups, monitor treatment effectiveness, and optimize resource allocation. For example, the Centers for Medicare & Medicaid Services (CMS) in the U.S. has implemented PHM initiatives to enhance quality care and reduce healthcare expenditures. Additionally, national health programs in Canada and the UK utilize PHM tools to track disease prevalence and implement targeted intervention programs. The increasing focus on value-based healthcare models and the expansion of digital health initiatives, particularly in developing economies, further drive the adoption of PHM-integrated patient registry solutions, ensuring efficient population-wide health management.

By Deployment Model

In 2023, the Cloud deployment model dominated the Patient Registry Software Market, capturing a market share of 62.4%. Cloud-based solutions are gaining widespread adoption due to their scalability, cost-effectiveness, remote accessibility, and ability to facilitate real-time data sharing across multiple stakeholders. Healthcare organizations, particularly in developed economies, are shifting toward cloud-based patient registry solutions to enhance collaboration, reduce IT maintenance costs, and improve data security with advanced encryption techniques. For example, the U.S. Department of Veterans Affairs has adopted cloud-based registry software to enhance healthcare services for veterans, ensuring secure access to patient records from multiple locations. Similarly, several European Union (EU) nations are transitioning to cloud-based healthcare solutions to standardize patient data collection and improve disease surveillance. The increasing adoption of artificial intelligence and machine learning in cloud-based registry solutions further enhances predictive analytics capabilities, making cloud deployment the preferred choice for modern healthcare infrastructure.

By End User

In 2023, Government Organizations & Research Centers were the leading end users in the Patient Registry Software Market, accounting for a market share of 41.7%. These institutions leverage patient registries to track disease patterns, conduct large-scale clinical research, and develop evidence-based healthcare policies. Government-backed health programs, such as those initiated by the National Institutes of Health (NIH) and the World Health Organization (WHO), heavily depend on registry software to collect, standardize, and analyze health data globally. For example, the U.S. FDA Sentinel Initiative utilizes registry software to monitor medical product safety, while the European Medicines Agency (EMA) uses patient registries to track drug efficacy and safety post-market approval. Additionally, research centers focusing on chronic diseases, such as diabetes and cardiovascular diseases, use registry data to develop new treatment protocols and drive innovations in personalized medicine. As global health initiatives expand, the demand for robust patient registry solutions among government and research institutions is expected to rise significantly.

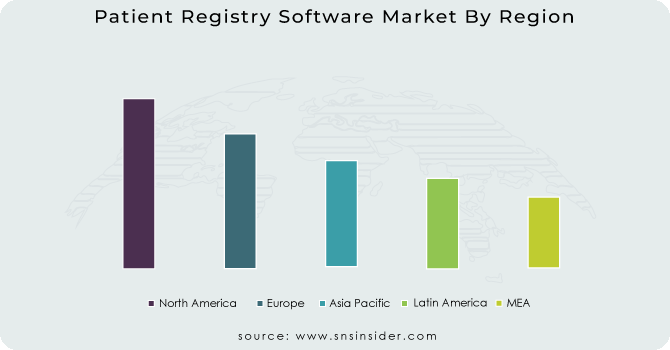

Regional Analysis

In 2023, North America dominated the Patient Registry Software Market with a market share of 48.6%, driven by well-established healthcare infrastructure, strong regulatory frameworks, and significant investments in healthcare IT solutions. The United States emerged as the leading country due to widespread adoption of electronic health records (EHRs) and stringent regulatory mandates like the Health Insurance Portability and Accountability Act (HIPAA) and the 21st Century Cures Act, which emphasize interoperability and data-sharing capabilities. The Centers for Disease Control and Prevention (CDC) and the National Institutes of Health (NIH) actively fund disease registries for chronic conditions like cancer, cardiovascular diseases, and rare disorders, contributing to the rapid expansion of patient registry software. Canada also plays a significant role, with government initiatives like the Canadian Chronic Disease Surveillance System (CCDSS) supporting registry adoption. The presence of key industry players such as IQVIA, IBM Watson Health, and Optum further accelerates market growth by driving innovation in data analytics and artificial intelligence-powered registries.

Moreover, the Asia Pacific region emerged as the fastest-growing market for patient registry software, with a significant CAGR during the forecast period, driven by increasing government initiatives, rising healthcare digitization, and growing investments in disease management programs. China is at the forefront of this growth, propelled by national projects like the Healthy China 2030 initiative, which prioritizes data-driven healthcare strategies and patient registries for chronic diseases. India follows closely, with the government’s Ayushman Bharat Digital Mission (ABDM) accelerating EHR adoption and promoting patient data interoperability. Additionally, Japan is making significant strides, leveraging artificial intelligence in registry software to enhance clinical research and personalized treatment strategies, as seen in initiatives from the Japanese Society of Medical Oncology (JSMO). The rising prevalence of chronic diseases, coupled with increasing funding for healthcare IT solutions, is expected to drive exponential growth in the region’s patient registry software market.

Need any customization research on Patient Registry Software Market - Enquiry Now

Key Players

-

ArborMetrix: (RegistryX, MeasureX)

-

Armus Corporation: (Armus Cloud Platform, Armus Registry Solutions)

-

Cedaron: (Cedaron Connect, Cedaron Clinical)

-

Conduent, Inc.: (Maven Disease Surveillance and Outbreak Management)

-

Dacima Software: (Dacima Clinical Suite, Dacima Survey)

-

Elekta AB: (MOSAIQ Oncology Analytics, METRIQ)

-

ESO Solutions: (ESO Electronic Health Record, ESO Health Data Exchange)

-

FIGmd: (FIGmd Registry Platform, FIGmd DataPro)

-

Global Vision Technologies: (ClinicalPURSUIT, Patient Registry Platform)

-

Health Catalyst: (Data Operating System, Touchstone)

-

IBM Watson Health (Phytel): (Phytel Outreach, Phytel Coordinate)

-

ImageTrend: (ImageTrend Elite, ImageTrend Patient Registry)

-

IQVIA Holdings: (Orchestrated Patient Engagement, IQVIA Registry Platform)

-

Lumdex: (Lumdex Registry Solutions)

-

McKesson Corporation: (McKesson Specialty Health, iKnowMed)

-

OpenText Corporation: (OpenText Magellan, OpenText EMR-Link)

-

Optum, Inc.: (Optum One, OptumIQ)

-

Premier, Inc.: (PremierConnect, TheraDoc)

-

Syneos Health: (Syneos Health Patient Registry Solutions)

-

Velos, Inc.: (Velos eResearch, Velos Patient Management)

Recent Developments

-

February 2025: The Prince Edward Island (PEI) government reported a significant reduction in its patient registry waitlist, decreasing from over 24,000 to approximately 5,500 individuals. This improvement was attributed to the recruitment of more healthcare professionals and the implementation of efficient healthcare delivery models.

-

August 2024: Azra AI announced a strategic partnership with Registry Partners to enhance oncology data management. This collaboration aimed to integrate Azra AI's advanced artificial intelligence capabilities with Registry Partners' expertise in clinical data abstraction, facilitating more efficient and accurate oncology data processes.

-

July 2024: Paradromics was accepted into the FDA's regulatory accelerator program and launched a new patient registry. This initiative was designed to expedite the development and regulatory review of Paradromics' brain-computer interface technology, aiming to improve patient outcomes and advance neurotechnology innovations.

-

April 2024: Synchron launched a patient registry in preparation for its upcoming brain implant trial. The registry aimed to gather comprehensive data to support the clinical evaluation of Synchron's minimally invasive brain-computer interface technology, which enables individuals with paralysis to control digital devices using thought alone.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.75 Billion |

| Market Size by 2032 | USD 5.23 Billion |

| CAGR | CAGR of 12.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type of Registry (Disease Registries [Diabetes Registries, Cardiovascular Registries, Cancer Registries, Rare Disease Registries, Asthma Registries, Chronic Kidney Registries, Orthopedic Registries, Others], Health Service Registries [Hospital-Based Registries, Outpatient & Ambulatory Registries, Emergency & Trauma Registries], Product Registries [Medical Device Registries, Drug Registries]) •By Software (Standalone, Integrated) •By Functionality (Population Health Management (PHM), Health Information Exchange (HIE), Patient Care Management, Clinical Research & Trials, Others) •By Deployment Model (Cloud, On-Premise) •By End User (Government Organizations & Research Centers, Hospitals and Clinics, Pharmaceutical & Biotechnology Companies, Medical Device Companies, Academic & Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArborMetrix, FIGmd, Dacima Software, ImageTrend, Global Vision Technologies, Velos, Inc., ESO Solutions, Phytel (an IBM Watson Health Company), Armus Corporation, Elekta AB and other key players |