PCB Design Software Market Report Scope & Overview:

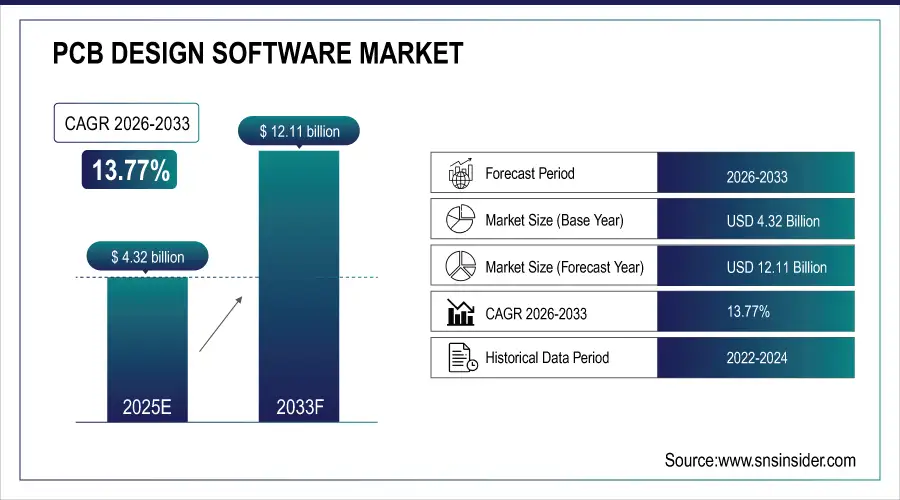

The PCB Design Software Market Size was valued at USD 4.32 Billion in 2025E and is expected to reach USD 12.11 Billion by 2033 and grow at a CAGR of 13.77% over the forecast period 2026-2033.

The PCB Design Software Market analysis, due to the spontaneous production of compact and high-performance electronic devices, especially semiconductors and embedded electronics. Furthermore, the PCB Design Software Market is projected to boom given the rise in automation implementation in PCB design and increased electronic circuit complexity necessitating sophisticated design software. According to study, The IoT and automotive electronics segment collectively contribute to 40% of new PCB design demand globally.

Market Size and Forecast:

-

Market Size in 2025: USD 4.32 Billion

-

Market Size by 2033: USD 12.11 Billion

-

CAGR: 13.77% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on PCB Design Software Market - Request Free Sample Report

PCB Design Software Market Trends

-

Increasing adoption of high-density interconnect (HDI) and multilayer PCB designs.

-

Growing demand for 3D visualization and real-time design collaboration tools.

-

Rising integration of AI for automated routing and error detection.

-

Expanding use of cloud-based PCB design for remote team collaboration.

-

Accelerating development of compact, power-efficient consumer and automotive electronics.

-

Enhanced focus on simulation-driven design for performance and thermal optimization.

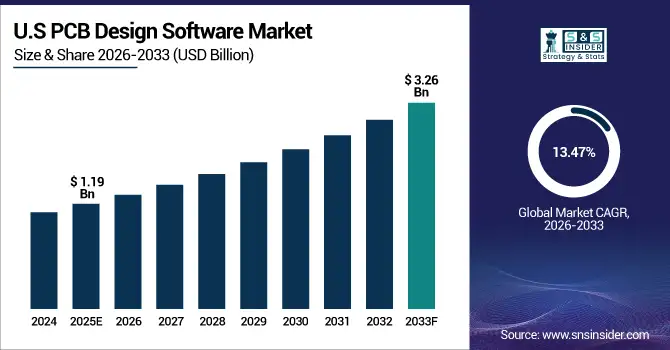

The U.S. PCB Design Software Market size was USD 1.19 Billion in 2025E and is expected to reach USD 3.26 Billion by 2033, growing at a CAGR of 13.47% over the forecast period of 2026-2033, driven by strong R&D capabilities, rapid integration of AI and cloud-based tools, and demand for high-speed, miniaturized electronics. Its leadership in semiconductor design and advanced manufacturing continues to propel market growth and global competitiveness.

PCB Design Software Market Growth Drivers:

-

Miniaturization Trend Fuels Demand for Advanced High-Performance PCB Tools

The growing demand for miniaturization in consumer electronics, wearables, and automotive systems has been driving the need for sophisticated PCB design software. With individual devices shrinking in size while enhancing in scale, designers need their PCB designs capabilities to visualize high-density interconnect layouts, multilayered boards and involve thermal management simulations. The latest PCB design software platforms offer 3D visualization, signal integrity analysis, and real-time cooperation, enabling engineers to create a smaller package that meets the technological requirements.

Nearly 68% of new consumer electronics launched in 2025 incorporate HDI or multilayer PCB designs.

PCB Design Software Market Restraints:

-

High Licensing Costs Challenge PCB Software Adoption Among SMEs

Despite its advantages, the cost of purchasing advanced PCB design tools limits the widespread use of the tools by small and medium-sized enterprises. The premium software solutions such as Altium Designer, Cadence Allegro, and Mentor Graphics require huge initial licensing and annual maintenance fees. For instance, by adding the training costs and new hardware, it proves impossible for smaller design teams and tech startups creating a path toward open-source or less capable tools that have a limitation on innovation and industry reach.

PCB Design Software Market Opportunities:

-

AI and Cloud Integration Transform Future of PCB Design Industry

The increased application of artificial intelligence and cloud computing within PCB design is the biggest market opportunity. Routing can be automated, design flaws can be discovered, and designs can be optimized for power and thermal efficiency using AI algorithms. The general design cycle has to be shortened significantly. In addition, cloud-based platforms enhance collaboration; real-time co-design is possible across global teams. The afore-described required real-time computing power and accessibility promoted by this market shift is scalable across every other design-related element, even distributed engineering and promising hardware enterprises.

AI-driven PCB design tools are estimated to reduce manual routing time by 40–60% through automated optimization.

PCB Design Software Market Segmentation Analysis:

-

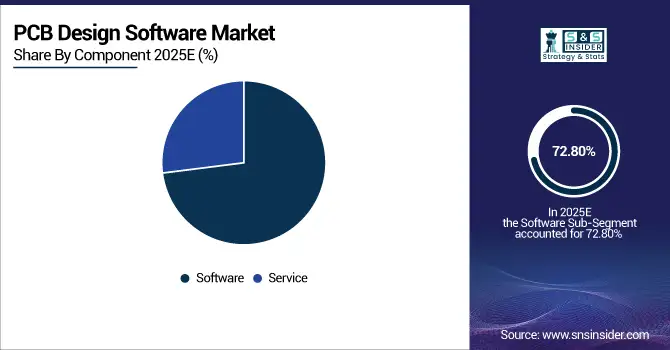

By Component: In 2025, Software led the market with a share of 72.80%, while Service is the fastest-growing segment with a CAGR of 13.60%.

-

By Technology: In 2025, High-end Software dominated the market with a share of 46.50%, while Mainstream Software is the fastest-growing segment with a CAGR of 14.1%.

-

By Deployment: In 2025, On-premises led the market with a share of 58.70%, while Cloud is the fastest-growing segment with a CAGR of 15.4%.

-

By Application: In 2025, Computer & Consumer Electronics held the largest share of 34.60%, while Automotive Components is the fastest-growing segment with a CAGR of 15.80%.

By Component, Software Leads Market and Service Fastest Growth

The Software lead the market in 2025, due to increase adoption of advanced design automation tools, AI – powered routing, and simulation abilities that improve design precision and productivity.

In Meanwhile, the services segment is growing fastest due to the increasing demand for cloud-based support, training, and maintenance solutions. As businesses transition to integrated digital workflows, the need for managed and customization services has increased, helping optimize PCB design and accelerate product innovation.

By Technology, High-end Software Leads Market and Mainstream Software Fastest Growth

The High-end Software lead the market in 2025, due to their critical features in supporting complex, multilayer, and high-density interconnect designs used in the automotive, aerospace, telecom industries. They offer high performance under high speed, simulation accuracy, and 3D capabilities.

In Meanwhile, the mainstream software segment highest CAGR. The rise will be driven by the growing adoption among SMEs looking for affordable but feature-rich solutions for applications such as consumer electronics and industrial equipment. SMEs depend on this software due to their high innovation and design cycle.

By Deployment, On-premises Leads Market and Cloud Fastest Growth

The on-premises segment is lead in 2025, This growth can be attributed to the high control offered by these solutions to large enterprises in terms of customization, data security, and integration with other business solutions. On-premises platforms are mainly used in businesses with large volumes of design data and complex workflows.

In Meanwhile, the cloud-based segment is anticipated to grow the fastest due to cost savings, flexibility, scalability, and the need to deploy real-time collaboration across multiple users. Subscription-based models and cloud-native EDA tools are rapidly evolving the global PCB design ecosystem.,

By Application, Computer & Consumer Electronics Leads Market and Automotive Components Fastest Growth

The computer & consumer electronics segment leads in 2025, due to growing production of small, high-performance devices including smartphones, laptops, and wearables that need sophisticated PCB layouts and miniaturization abilities. This segment gains from the ongoing chip integration and power efficiency.

In Meanwhile, the automotive components segment is fastest growing driven by the rise in electronics usage in electric vehicles and ADAS systems and the deployment of infotainment technology, which necessitates reliable and thermally capable PCB layouts.

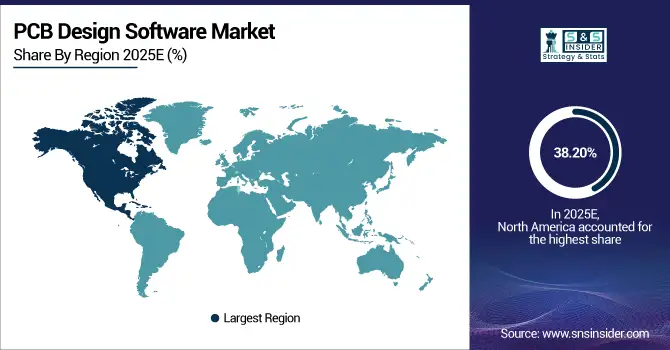

PCB Design Software Market Regional Analysis:

North America PCB Design Software Market Insights:

The North America dominated the PCB Design Software Market in 2025E, with over 38.20% revenue share, owing to the high penetration of advanced electronic design automation tools and surging investments in high-speed, multilayer PCB technologies. The region hosts one of the most mature electronics ecosystems and ensures consistent innovation in design automation, integrated with AI and cloud-based design platforms. The demand for small, high-performance devices and proliferation of simulation and 3D visualization tools would further enhance its market hold, making North America the center of excellence for advanced PCB design development and technology innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. PCB Design Software Market Insights

The U.S. and Canada lead the PCB Design Software Market due to their advanced electronics ecosystem, strong R&D infrastructure, and early adoption of AI and cloud-based EDA tools. High investment in automation, aerospace, and automotive electronics further reinforces their market dominance and technological innovation.

Asia Pacific PCB Design Software Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 14.92%, due to the rapid growth of electronics manufacturing and automation in PCB design processes. Large demand for smartphones, IoT devices, and automotive electronics, in addition to high investments in semiconductor and PCB fabrication facilities, support the region’s expansion. Simultaneously, increasing demand for miniaturized and high-density circuit design solutions and rising adoption of cloud-based EDA and AI-driven design optimization are accelerating technology developments in the Asia Pacific market.

China and India PCB Design Software Market Insights

China and India are witnessing rapid growth in the PCB Design Software Market due to expanding electronics manufacturing, increasing adoption of automation, and rising demand for smartphones, EVs, and IoT devices. Government initiatives supporting digitalization and semiconductor development further boost market growth in both countries.

Europe PCB Design Software Market Insights

Europe holds a significant position in the PCB Design Software Market, supported by its strong focus on innovation, sustainability, and state-of-the-art electronic system design. The market growth in Europe is buoyed by increasing PCB design tools installations in automotive electronics, industrial automation, and renewable energy applications. European producers are relying on simulation-driven, AI-enhanced PCB design platforms to enhance performance and energy efficiency and better comply with stringent environmental policies. Increased focus on digitalization and high-speed connectivity makes Europe a driving force behind the rise of PCB design technologies.

Germany and U.K. PCB Design Software Market Insights

Germany and the U.K. are experiencing steady growth in the PCB Design Software Market driven by advancements in automotive electronics, industrial automation, and renewable energy systems. The increasing adoption of AI-assisted design tools and emphasis on precision engineering and digital manufacturing enhance their market expansion and competitiveness.

Latin America (LATAM) and Middle East & Africa (MEA) PCB Design Software Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) PCB Design Software Market are emerging regions showing steady growth owing to the rise in adoption of automation, and the use of digital design tools primarily in the industrial, telecom, and consumer electronics sectors. LATAM is witnessing investments in electronics manufacturing and smart device production, creating the demand for low-cost PCB design programs. In Meanwhile, MEA’s technological modernization, increasing industrial automation, and interest in IoT and renewable energy have surged the interest in advanced PCB design and simulation software for improved efficiency and innovation.

PCB Design Software Market Competitive Landscape:

Cadence leads with comprehensive PCB and chip-package-system co-design tools that prioritize signal/power integrity, high-speed analysis, and GPU-accelerated simulation. Allegro and OrCAD integrate with Sigrity and other simulation suites to deliver performance-driven layouts and verification workflows for complex multilayer boards. Cadence targets tier-1 OEMs and semiconductor companies, enabling rapid iteration, accurate modeling, and scalable teams working on cutting-edge consumer, networking, and automotive electronics.

-

In May 2025 Cadence unveiled the Millennium M2000 Nvidia-GPU supercomputer and boosted GPU-accelerated simulation performance, cutting large simulation runtimes dramatically to accelerate complex PCB and chip-level verification workflows.

Siemens EDA (Mentor Graphics) targets large, regulated industries with scalable PCB platforms that enable multi-domain collaboration and rigorous verification. Xpedition and PADS provide advanced routing, constraint-driven design, and manufacturability checks, while cloud and team features support distributed engineering. Siemens emphasizes integration with systems engineering and PLM, making its offerings attractive for automotive, aerospace, and defense customers requiring compliance, reliability, and full-lifecycle traceability.

-

In May 2025 Siemens launched Xpedition Standard, a scaled Xpedition offering that brings enterprise-grade PCB capabilities to growing teams, emphasizing AI features, cloud connectivity, and multi-board collaboration for faster design cycles.

Zuken’s PCB design focus emphasizes system-level engineering and seamless ECAD/MCAD co-design for complex, multi-board products. Its tools prioritize high-speed signal integrity, thermal analysis, and PLM integration to streamline enterprise workflows. Zuken serves automotive, industrial, and telecom customers with solutions that reduce iteration cycles and improve first-pass yields, supporting companies that need heavyweight automation and traceable data flows across product development and manufacturing environments.

-

In May 2025 Zuken launched CR-8000 Release 2025, introducing AI-enhanced schematic automation, improved multi-board 3D co-design, faster simulation flows, and tighter PLM synchronization to boost first-pass success rates

PCB Design Software Market Key Players:

Some of the PCB Design Software Market Companies are:

-

Cadence Design Systems

-

Siemens EDA (Mentor Graphics)

-

Altium Limited

-

Autodesk, Inc.

-

Zuken Inc.

-

Ansys, Inc.

-

Synopsys, Inc.

-

KiCad

-

OrCAD

-

Pulsonix

-

DownStream Technologies

-

DipTrace

-

EasyEDA

-

ExpressPCB

-

Upverter

-

Labcenter Electronics (Proteus)

-

Forte Design Systems

-

PCB-Investigator

-

Target 3001!

-

WSCAD

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.32 Billion |

| Market Size by 2033 | USD 12.11 Billion |

| CAGR | CAGR of 13.77% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Service) • By Technology (High-end Software, Mainstream Software, Low-end Software) • By Deployment (Cloud, On-premises) • By Application (Computer & Consumer Electronics, Telecommunication Equipment, Medical Devices, Industrial Equipment, Automotive Components, Others – Aerospace & Defense, Safety and Security Equipment) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cadence Design Systems, Siemens EDA (Mentor Graphics), Altium Limited, Autodesk, Inc., Zuken Inc., Ansys, Inc., Synopsys, Inc., KiCad, OrCAD, Pulsonix, DownStream Technologies, DipTrace, EasyEDA, ExpressPCB, Upverter, Labcenter Electronics (Proteus), Forte Design Systems, PCB-Investigator, Target 3001!, WSCAD, and Others. |