Online Trading Platform Market Size & Overview:

Get more information on Online Trading Platform Market - Request Free Sample Report

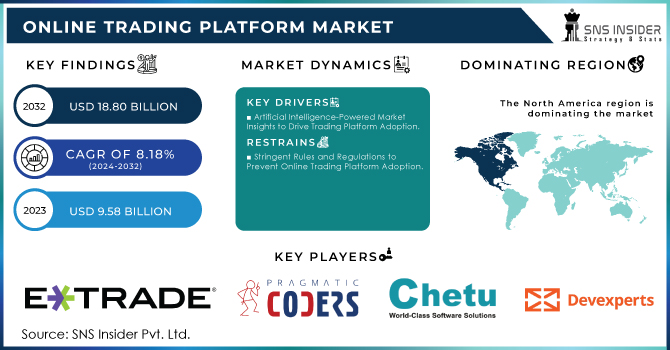

Online Trading Platform Market size was valued at USD 9.58 Billion in 2023 and is expected to grow to USD 18.8 Billion by 2032 and grow at a CAGR of 8.18% over the forecast period of 2024-2032.

Government initiatives to improve digital infrastructure, financial literacy, and inclusion have largely influenced the global online trading platform market. In 2023, the increase in online trading platforms’ adoption rate was reported at 12.5% due to the significant expansion of internet connection and the availability of digital payments as a result of the various government initiatives. For example, the government introduced the “Digital Finance Inclusion Program” to improve the digital financial participation rate by 25% by 2026. In addition, the numerous financial literacy programs initiated by the government were another major factor in the familiarity of retail investors with online trading tools. In the World Bank Global Findex database for 2023, it is reported that 42% of adults in emerging markets are using digital platforms to engage in investment, compared to 35% in 2020. In developed countries, more than 60% of the population is expected to adopt online trading platforms by 2025 as a result of the highly improved cybersecurity systems and the liberalization of access to financial products.

Furthermore, the support through policies by the government of various easements on the use of online investment platforms and the financing of Fintech innovations have largely impacted the market’s growth. With the consumers’ traction towards digital capital and digitization due to the protection of their finances through additional safety measures, and the government’s insight on the creation of stability in the economy for the post-pandemic period has significantly influenced the global demand.

The versatility of online trading platforms makes them indispensable for banks, traders, and individual brokers. These platforms provide a comprehensive suite of tools and features that enable users to analyze financial market opportunities meticulously. By leveraging the wealth of information at their fingertips, users can identify potential investment prospects and devise strategies to maximize their returns. Furthermore, online trading platforms play an important role in mitigating risk concerns, allowing users to make calculated moves and safeguard their investments. online trading platforms revolutionize the way individuals and institutions engage with financial markets. With their user-friendly interfaces, real-time market data, and extensive range of financial instruments, these platforms empower users to navigate the complexities of trading with confidence and precision. Whether you are a seasoned trader or a novice investor, an online trading platform is an invaluable tool that can help you unlock the full potential of the financial world.

Comparison of Leading Online Trading Platforms

|

Platform Name |

Key Features |

User Base |

Mobile App Rating |

Countries Available |

|

eToro |

Social trading, copy trading, multi-asset support |

30+ million |

4.3/5 (iOS/Android) |

100+ |

|

Robinhood |

Commission-free trades, crypto and stock trading |

22+ million |

4.1/5 (iOS/Android) |

US only |

|

TD Ameritrade |

Advanced charting, margin trading, educational tools |

11 million |

4.5/5 (iOS/Android) |

US, Canada |

|

Interactive Brokers |

Low fees, global access to multiple asset classes |

2+ million |

4.7/5 (iOS/Android) |

200+ |

|

Binance |

Cryptocurrency-focused, wide asset variety, staking |

100+ million |

4.6/5 (iOS/Android) |

180 |

Online Trading Platform Market Dynamics

Drivers:

-

A growing number of individual investors are accessing online platforms for trading due to user-friendly interfaces and low barriers to entry.

-

AI and machine learning are enhancing trading experiences with advanced tools like algorithmic trading and predictive analytics.

-

The rising popularity of cryptocurrencies has expanded the user base of platforms offering digital asset trading.

-

With increasing smartphone penetration, mobile-first platforms are enabling users to trade conveniently from anywhere.

The online trading platforms market is currently experiencing some drastic changes associated with the implementation of the latest technologies, namely, Artificial Intelligence and machine learning. The technologies can introduce considerable trading efficiency by enabling the use of predictive analytics and the automation of numerous strategies. The approaches appear particularly advantageous for the trading of financial instruments since modern AI algorithms can process extensive datasets with high speed and make decisions in real time. Moreover, it also simplifies the comprehension of complex financial markets for a broader audience since the technologies significantly decrease the need for manual analysis by relying on automated approaches.

AI found numerous applications in online trading. First, there is a considerable interest in algorithmic trading advanced strategies based on complex instructions that enable the automation of order execution. A 2023 report stated, “the vast majority of equity trading across the world influencing the prices we all see on TV, is done through a mix of algorithmic and high-frequent trading around 60-70% that illustrates the extent of the phenomenon. Currently, leading platforms like Interactive Brokers and TD Ameritrade started offering their customers algorithmic trading tools, which help ordinary traders benefit from the advanced strategy implementations that have been available for institutional traders for years. At the same time, AI can enhance trading not only through the improvement of performance but also via the creation of customized solutions for the users. For example, the service of Robo-advisers provided by such platforms as Betterment and Wealthfront introduced the use of AI for generating personalized portfolios. In addition, eToro implemented an AI-driven solution in the form of chatbots that also revolutionized trading by analytical assistance for the users and simplified order submission processes. Overall, the tendencies improve the efficiency of financial markets from one side, and the experience of interacting with them for the users, on the other.

Restraints:

-

Growing concerns about data breaches and hacking undermine user trust in online trading platforms.

-

Stringent regulations and varying laws across regions, especially in crypto markets, complicate compliance for platform providers.

-

Many retail traders lack the financial knowledge needed to make informed trading decisions, impacting long-term platform engagement.

One significant restraint in the online trading platform market is cybersecurity and data breaches. When companies use online trading platforms, their vast sensitive data on finances becomes a vulnerable target for hackers. The increasing amount of sophisticated cyberattacks is a significant challenge for preserving user data, such as account credentials, personal identification details, and financial transactions. However, a report from the Financial Services Information Sharing and Analysis Center in 2023 noted that financial services organizations experienced a 22% increase in cyberattacks, with an expanding volume of such attacks on online platforms. Consequently, data breaches have multiple implications for online platforms as, first, they cause severe regulatory penalties. Second, companies may lose customers’ trust, which eventually corresponds to lower user engagement. The global decision of online trading platforms, where users from different jurisdictions can participate, increases the threat of losing legal protection. Thus, effective and robust security measures are needed to avoid financial losses and reputation damage.

Online Trading Platform Segment analysis

By Component

The largest segment of the online trading platform market by application in 2023 was the platform segment, which accounted for 65% of worldwide revenue share. Such dominance is due to the increasing preference by both retail and institutional investors for user-friendly interfaces, real-time analytics, and AI-driven trading solutions. In addition, the segment benefited from the rapid development of technologies and could offer the most comprehensive list of services, integrating tools such as algorithmic trading and automated portfolio management. Moreover, governments introduced regulations that stipulated the provision of secure and transparent operations by online trading providers, which was mainly achievable via the usage of platform-based solutions. For example, according to the Government’s Technology Adoption Index, over 70% of the existing financial institutions adopted advanced trading platforms for their operations, solidifying the sector’s critical role.

At the same time, the services segment will likely experience significant growth from 2024 to 2032 due to the rising popularity of managed services, customer support, and financial advisory services. The increasing complexity of available trading options and instruments pushed traders to seek personalized services they can utilize to maximize their portfolios. The growth of the segment was also driven by government-backed initiatives to promote financial advisory services, as the Ministry of Economic Affairs reported a 15% rise in service-based digital solutions in the financial industry in 2023. Thus, the market will continue to be formed around the combination of platform innovation and supportive services.

By Application

In 2023, the institutional investors segment has made a substantial revenue contribution to the online trading platform market. Pension funds, hedge funds, and mutual funds among other institutional investors rely on online platforms for managing their portfolios, trading using algorithms, and making predictions in the market. This trend is supported by the current number of institutional trusts in the reliability and security of their online trading platforms. The acceptance from most institutional investors and further vulnerability to the introduced government’s cybersecurity policies have augmented the reliability of online platforms. A report by the Financial Regulatory Authority for 2023 implies that the institutional trading volumes undertaken on digital platforms rose by 18.7%, with government bonds being the most commonly traded instruments. These institutional investors benefit from online trading platforms through advanced data algorithms, market analysis, and trading systems that support their decision-making process.

The response from regulatory authorities has facilitated the high engagement of these investors with the online trading platform market. Furthermore, regulatory changes, such as the recent reforms by the Government's Financial Services Commission, have made online trading attractive for the institutions due to the reduced transaction costs and the need for these investor’s operations to become more transparent. The increased number of governmental policies, which support the use of digital options in the financial sector implies that the levels of engagement between online trading platforms and institutional investors will increase through 2032, thereby increasing revenues in this market.

By End User

The banking and Financial Institutions segment was the dominant segment in the online trading platform market, in terms of end-users, with accounted 38% of the revenue of the market in 2023. This is due to the dominance of banks and financial institutions in terms of client outreach, established technological infrastructure, and regulatory compliance frameworks that align with government requirements. Banks and financial institutions use online trading platforms for their proprietary trades, trading of customers’ holdings on an agency and principal basis, trend analysis, wealth management, and the mitigation of risks. Government policies such as the Digital Banking Initiative, which prescribes the use of fintech solutions for purposes of complementing the legacy financial systems have boosted the growth of these services in these institutions.

Moreover, the government's stringent cybersecurity regulations, combined with enhanced data protection laws, and cybersecurity legislations, have boosted the confidence of banking and financial institutions in the adoption of online trading platforms to complement the offering. The segment is expected to remain dominant, as more and more banking and financial institutions rely on online solutions to reach customers efficiently and comply with the mandates of the regulatory bodies.

Regional Dominance: North America in 2023

In 2023, North America led in the online trading platforms market where it accounted for over 35.6% of the global market share. The factors that have driven the region to command the market include wide internet penetration, high financial literacy, and a well-developed regulatory framework that encourages the development of fintech solutions. According to the U.S. Securities and Exchange Commission, online trading volumes in the U.S. grew by 9.3% in 2023 driven by a wide range of retail investors in addition to increased institutional efforts in online trading probably through high-frequency trading mechanisms. The market in the region is supported by the availability of leading market players. North America supports digital trading platforms through the same date National Stock Commission in addition to the “Open Market Digitalization Program” which aims to further integrate digital trading solutions into the mainstream financial system by 2025.

Canada has also made significant growth as a result of government efforts that support the use of fintech solutions in the financial sector. The Ministry of Finance reported a 10.8% growth in usage by financial institutions. The region has also had high financial literacy among the young population making it a strong player in the market. All these factors and the development of novel trading platforms in the region have influenced its leadership in the online trading platforms market.

However, Asia-Pacific is expected to be the fastest-growing region, with the highest CAGR throughout the forecast period. Leading businesses are focusing on Asia-Pacific to expand their operations since the area is projected to see rapid development in the adoption of online trading platforms. Banking and financial institutions are growing their investments in specialized trading platforms in China, Japan, India, Oceania, South Korea, and Southeast Asia. These countries have a number of providers of electronic trading platform products and services. Cryptocurrency usage is also supported by governments and enterprises in Japan, South Korea, and Oceania. Acceptance of cryptocurrencies in the future will assist in giving a variety of market opportunities for key players. Growth in South America, the Middle East, and Africa (MEA) is expected to be steady. Companies in these locations have begun to focus on providing trading platform solutions for a variety of banking and financial institutions.

Need any customization research on Online Trading Platform Market - Enquiry Now

Key Players

-

MetaQuotes Software Corp. (MetaTrader 4, MetaTrader 5)

-

TD Ameritrade (thinkorswim, Mobile Trader)

-

Interactive Brokers (Trader Workstation, IBKR Mobile)

-

Charles Schwab Corporation (Schwab Mobile, StreetSmart Edge)

-

E*TRADE (Power ETRADE, ETRADE Pro)

-

Saxo Bank (SaxoTraderGO, SaxoInvestor)

-

Robinhood Markets Inc. (Robinhood Web, Robinhood App)

-

Fidelity Investments (Active Trader Pro, Fidelity Mobile)

-

IG Group (IG Trading Platform, ProRealTime)

-

Plus500 (Plus500 WebTrader, Plus500 App)

-

CMC Markets (Next Generation Platform, CMC Mobile Trading App)

-

eToro (eToro CopyTrader, eToro WebTrader)

-

Binance (Binance Exchange, Binance DEX)

-

Coinbase Global, Inc. (Coinbase Pro, Coinbase Wallet)

-

TradingView (TradingView Web Platform, TradingView Mobile App)

-

Zerodha (Kite, Coin by Zerodha)

-

Ally Invest (Ally Invest LIVE, Ally Invest Mobile)

-

TradeStation (TradeStation Platform, TradeStation Mobile)

-

OANDA Corporation (OANDA fxTrade, OANDA Mobile)

-

IQ Option (IQ Option Platform, IQ Option Mobile) and others

Recent News in the Online Trading Platform Market

-

In June 2024, The U.S. Securities and Exchange Commission approved new cybersecurity guidelines to safeguard online trading platforms. These guidelines are going to protect traders from data breaches and ensure transparent trading. The decision is also a part of the SEC’s “effort to secure all financial transactions occurring in the digital realm”.

-

April 2024, The Financial Conduct Authority included trading platforms for digital assets into its regulatory domain. The UK government said the latest requirement is going to make digital trading safer, with the new rules going to facilitate increasing accountability and mitigating risks.

-

In June 2024, HSBC launched its digital trading brand WorldTrader to provide access to equities, ETFs, and bonds from 77 exchanges in 25 markets demonstrating the highest growing demand for international investments. The operator entered the UAE market on 24 th of June.

-

November 2023, TD Direct unveiled its trading U.S. securities and options platform TD Active Trader in the cloud using Alpaca and Xignite datafeeds. With the platform’s enhanced trading charting, the system allows for workspaces and pre-configured Social Trading. Its modern and smooth Trading frontend offers a responsive layout.

-

In November 2023, Devexperts partnered with FX Blue to deliver turnkey trading solutions for CFD and spread-betting brokers, integrating DXTrade’s backend with FX Blue’s web and mobile interfaces to improve Forex trading performance globally.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.58 Bn |

| Market Size by 2032 | US$ 18.80 Bn |

| CAGR | CAGR of 8.18 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Services) • By Deployment Mode (On-premise, Cloud) • By Type (Commissions, Transaction Fees) • By Application (Institutional Investors, Retail Investors) • By End-Users (Banking and Financial Institutions, Brokers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

MetaQuotes Software Corp., TD Ameritrade, Interactive Brokers, Charles Schwab Corporation, E*TRADE, Saxo Bank, Fidelity Investments, IG Group, Plus500, CMC Markets, Binance, Coinbase Global, Inc., TradingView, Zerodha |

| Key Drivers | • Artificial Intelligence-Powered Market Insights to Drive Trading Platform Adoption • End-user need for customized trading systems, such as government and non-profitable institutions, is expected to fuel demand. |

| Market Opportunities | • Technological developments and trading platform integration on mobile devices. |