Peppermint Tea Market Report Scope & Overview:

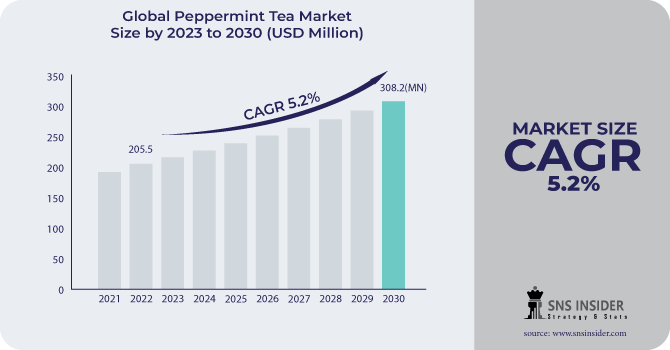

The Peppermint Tea Market size was USD 205.5 million in 2022 and is expected to Reach USD 308.2 million by 2030 and grow at a CAGR of 5.2% over the forecast period of 2023-2030.

Peppermint tea, a popular herbal tea made by steeping peppermint leaves in hot water, is a popular herbal drink. It has a pleasant, minty flavor and is naturally calorie and caffeine-free.

Based on Type, the blended peppermint tea segment dominates the peppermint tea market. Blended peppermint tea stems are popular because they provide a delicious fusion of peppermint with different additional fruits, spices, and herbs, providing a distinctive and refreshing flavor profile. The global market's rising emphasis on the variety of products and consumer preferences is considerably contributing to the increasing popularity of blended peppermint tea as the market's leading category.

MARKET DYNAMICS

KEY DRIVERS

-

Rising awareness of the health benefits of peppermint tea

Natural and herbal items are becoming ever more popular as people become more health-conscious. Due to its cooling and calming effects, peppermint tea is well-suited for health-conscious consumers, which has increased consumer demand for it. The market for peppermint tea is expected to rise due to its reputation for curing digestive health issues, such as reducing gastrointestinal discomfort and enhancing overall digestive well-being. Also, the ease of availability of peppermint tea at a supermarket or online stores makes it more convenient for consumers to purchase. The demand for peppermint tea as a stress-relieving beverage is anticipated to increase as awareness rises of the health benefits of peppermint tea driving the market growth.

-

Rising Demand for Functional Beverages

RESTRAIN

-

Competition from Other Herbal Teas

Customers' preferences are shifting away from peppermint tea in favor of trying out new and interesting options as they experiment with various herbal tea flavors and blends. The market growth for peppermint tea may be constrained by this altering consumer behavior. There are several possibilities available in the herbal tea market, such as lemon, lavender, chamomile, ginger, and other teas. Since there are so many herbal tea options, peppermint tea faces fierce rivalry, which could affect its market share.

OPPORTUNITY

-

Growing Demand for Blended Peppermint Tea's Refreshing Flavor

Due to consumer preferences for a variety of flavor experiences, the market for blended peppermint tea is expanding considerably. To meet this need, manufacturers are producing creative mixes that target certain market segments. Due to its adaptability and broad appeal, blended peppermint tea is becoming increasingly popular among tea connoisseurs all over the world. In China, peppermint tea is normally drunk as a single-ingredient tea. Traditional Chinese medicine also makes use of peppermint to cure several conditions, such as nausea, indigestion, and headaches. This tea is commonly provided to visitors as a gesture of hospitality in Morocco where it is used as a revitalizing and refreshing beverage.

CHALLENGES

-

Price sensitivity of consumers

Compared to other drinks like coffee and soda, peppermint tea can cost more. Before peppermint tea can be offered to consumers, it needs to be processed and bottled. The product's price may go up as a result of this process. Price-conscious consumers could be less inclined to buy peppermint tea, especially if they are unaware of its health advantages.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine a major importers of peppermint tea. The primary component of Moroccan Mint tea is peppermint. The world's top producer of peppermint, accounting for 92.7% of global production, is Morocco. The output of peppermint reached 48,437 tonnes in 2021, with Morocco leading the way with 83% of the global total and Argentina coming in at 14%. Imports of peppermint tea have been hampered by the war, which has increased prices and caused shortages. The price of peppermint tea is being impacted by the rising expenses of wheat and peppermint oil.

IMPACT OF ONGOING RECESSION

The COVID-19 pandemic followed by Russia Ukraine war has indirectly led to inflation. Also, the war has led to disruption in tea exports in some countries. The high cost of labor, production units, and operating costs have led to an increase in prices for peppermint tea During a recession, demand for peppermint tea is predicted to fall by 5-10%. This is because consumers are likely to cut back on non-essential purchases such as peppermint tea. Peppermint tea is getting more expensive for consumers, which is likely to reduce demand.

MARKET SEGMENTATION

by Type

-

Blended Peppermint Tea

-

Unblended Peppermint Tea

By Nature

-

Organic

-

Conventional

By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Sales

-

Others

.png)

REGIONAL ANALYSIS

The North American region is dominating the peppermint tea market. North America is witnessing significant consumer awareness and demand for herbal and specialty teas, including peppermint tea. The region's population is increasingly health-conscious, seeking natural and caffeine-free beverage options, which is boosting the demand for peppermint tea in the market. Due to its popularity among consumers who are health-conscious and its benefits for digestion and relaxation, peppermint tea enjoys a dominant position in the market.

In the North African region in the Middle East and Africa, Moroccan country is known for peppermint tea. The world's top producer of peppermint, accounting for 92.7% of global production, is Morocco. This type of tea is more popular than other herbal teas in the area among consumers. However, it is anticipated that increasing consumer preference for herbal and flavored tea, particularly peppermint tea, will spur market expansion globally. This tea is used traditionally by people to welcome guests.

Europe has a significant market share in the peppermint market. The growth is attributed to the increasing demand for natural and organic products and the growing popularity of peppermint tea as a functional beverage. Peppermint tea is a popular beverage in Europe due to its refreshing taste and its perceived health benefits.

Asia Pacific is fast fast-growing region for the peppermint market share. The growth of the peppermint tea market in Asia Pacific is attributed to the increasing disposable income and the growing awareness of the health benefits of peppermint tea. Peppermint tea is one of the popular beverages in Asia Pacific due to its refreshing taste and its perceived health benefits, such as improving digestion and boosting immunity.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Peppermint Tea Market are Associated British Foods plc, Bigelow, Tata Consumer Products, Stash Tea Company, Unilever N.V., Orientis Gourmet SAS, The Hain Celestial Group, Dilmah Ceylon Tea Co. Plc, Harney & Sons Tea Company, Yamamotoyama Co. Ltd, The Republic of Tea, Newby Teas, and other key players.

Associated British Foods plc-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Sheffield’s Pulp launched a line of teabags and announced that the singles from their chapter on Island Records would be arriving on streaming services.

In 2022, The tea range at NOW has been rebranded. With the launch of the new "Give A Tea" brand, NOW commits to donating one box of tea to the Chicago Food Repository for every two boxes of tea purchased by merchants. This program strives to make a good impact by supporting the community and providing customers with the opportunity to donate to a charity organization with each tea purchase.

| Report Attributes | Details |

| Market Size in 2022 | US$ 205.5 Million |

| Market Size by 2030 | US$ 308.2 Million |

| CAGR | CAGR of 5.2 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Blended Peppermint Tea, Unblended Peppermint Tea) • By Nature (Organic, Conventional) • By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Sales, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Associated British Foods plc, Bigelow, Tata Consumer Products, Stash Tea Company, Unilever N.V., Orientis Gourmet SAS, The Hain Celestial Group, Dilmah Ceylon Tea Co. Plc, Harney & Sons Tea Company, Yamamotoyama Co. Ltd, The Republic of Tea, Newby Teas |

| Key Drivers | • Rising awareness of the health benefits of peppermint tea • Rising Demand for Functional Beverages |

| Market Restrain | • Competition from Other Herbal Teas |