Peptic Ulcer Drugs Market Report Scope & Overview:

Get More Information on Peptic Ulcer Drugs Market - Request Sample Report

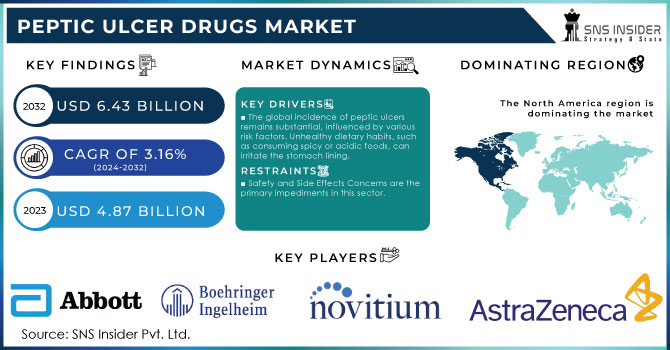

The Peptic Ulcer Drugs Market size was USD 4.87 Billion in 2023 and is expected to reach USD 6.43 Billion by 2032 and grow at a CAGR of 3.16% over the forecast period of 2024-2032.

The peptic ulcer drugs market refers to the pharmaceutical industry segment dedicated to the development, manufacturing, and sale of medications used in the treatment of peptic ulcers. Peptic ulcers are open sores that can develop on the lining of the stomach, small intestine, or oesophagus, and they are often caused by the erosion of the protective mucous layer in these areas due to the presence of stomach acid.

The peptic ulcer drugs market includes a range of medications that help manage and heal peptic ulcers by reducing stomach acid production, protecting the lining of the digestive tract, or eradicating the bacteria Helicobacter pylori, which is associated with the development of many peptic ulcers. Proton pump inhibitors are drugs that inhibit the enzyme responsible for acid production in the stomach, reducing acid levels and promoting ulcer healing.

One of the major drivers driving market expansion is the rising frequency of peptic ulcers, particularly among the elderly. Furthermore, bad living choices and an increase in stomach cancer cases are leading to an increase in the number of people suffering from peptic ulcers. This, combined with the evolving customer preference for different peptic ulcer-curing medications over invasive operations, is contributing to market expansion. In keeping with this, as compared to surgical methods, certain steroidal anti-inflammatory drugs are less intrusive, less expensive, and allow for speedier recovery while minimizing blood loss.H2-receptor blockers also reduce stomach acid production but act through a different mechanism compared to PPIs. Antacids are fast-acting drugs that neutralize stomach acid, providing short-term relief from ulcer-related symptoms. Antibiotics are When Helicobacter pylori infection is present, antibiotics may be prescribed in combination with other ulcer medications to eradicate the bacteria. Cytoprotective agents are drugs that help protect the lining of the stomach and intestines, promoting healing and preventing further damage. The peptic ulcer drugs market is influenced by factors such as the prevalence of peptic ulcers, the adoption of advanced treatment options, research and development activities for new drugs, and the regulatory environment in different regions.

MARKET DYNAMICS

DRIVERS:

-

The incidence of peptic ulcers remains significant globally. Factors such as unhealthy dietary habits, stress, smoking, excessive alcohol consumption, and infection with Helicobacter pylori bacterium contribute to the development of peptic ulcers.

-

Increasing Geriatric Population are the biggest driver of this market.

Peptic ulcers are more prevalent among older adults. As the global population ages, the number of people at higher risk of developing peptic ulcers also increases, leading to a greater need for effective drugs for treatment and management.

RESTRAIN:

-

Many peptic ulcer treatments have been on the market for a long time, and their parents may have expired, allowing generic drug makers to create and sell less expensive copies of these medications.

-

Safety and Side Effects Concerns are the primary impediments in this sector.

Some peptic ulcer drugs, especially long-term use of certain medications like proton pump inhibitors (PPIs), have been associated with potential side effects. These may include increased risks of kidney disease, fractures, and nutrient deficiencies. Safety concerns can lead to reduced patient adherence to treatment and hesitancy among healthcare providers to prescribe certain drugs.

OPPORTUNITY:

-

As economies expand and healthcare costs rise, there is a potential for increased healthcare investment, including the procurement of sophisticated and new peptic ulcer medications.

-

Biotechnology advancements represent a significant possibility in this sector.

Advances in biotechnology and drug delivery systems can lead to the development of novel formulations and drug delivery methods, potentially improving the efficacy and safety of peptic ulcer drugs.

CHALLENGES:

-

Helicobacter pylori, a common cause of peptic ulcers, can develop resistance to antibiotics used for treatment.

-

The key obstacles of this industry include side effects and safety concerns.

Some peptic ulcer drugs, such as proton pump inhibitors (PPIs) and long-term use of certain medications, have been associated with potential side effects, including kidney problems, fractures, and nutrient deficiencies. Managing these side effects and ensuring patient safety are ongoing challenges.

IMPACT OF RUSSIAN UKRAINE WAR

Asia shipped more than $2.01 billion in pharmaceutical items to Ukraine in FY21, an almost 52% decrease was observed over the period of 2022. while Russia contributed nearly $6.2 Billion last fiscal year, representing a 7.21 % increase over the previous year. Pharmaceuticals are facing the brunt of the damage. Russia and Ukraine are significant pharmaceutical export markets. Some Asian pharmaceutical businesses have a significant presence in these markets. The current Russian-Ukrainian war has had a huge impact on the Indian pharmaceutical business.

Asia is Ukraine's third-largest pharmaceutical exporter, and the conflict has affected global commerce, leading to higher manufacturing and shipping costs, inflation, and trade payment concerns. A lot of raw material goes from Russia to the whole world for pharmaceuticals, but due to this war, there has been an increase in the raw material and its supply chain, there is also a 6-7% increase in the prices of peptic ulcer drugs.

IMPACT OF ONGOING RECESSION

Pharma has traditionally been seen as one of the few recession-proof businesses, bowing less under economic downturns and stress than others. However, according to a recent poll, it is not immune to macroeconomic challenges. According to a recent Global Data poll, the top problem for the pharmaceutical business in 2022-23 is inflation, followed by medication price and reimbursement. Pharma's yearly prescription price increases, which occur in January, have seen a 4-6% increase in list prices so far this year, remaining below the national consumer inflation rate of roughly 7-9% in 2022.

That medicine price increase is slightly smaller than in prior years, indicating that the pharmaceutical sector isn't yet attempting to adjust for a new Inflation Reduction Act rule that went into effect on January 1. All the databases peptic ulcer drugs market are increasing their prices.

KEY MARKET SEGMENTS

By Drugs Type

-

H2 Antagonists

-

Proton Pump Inhibitor

-

Others

By Ulcer Type

-

Duodenal Ulcer

-

Gastric Ulcer

By Distribution Channel

-

Retail Pharmacies

-

Hospital Pharmacies

-

Online Pharmacies

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

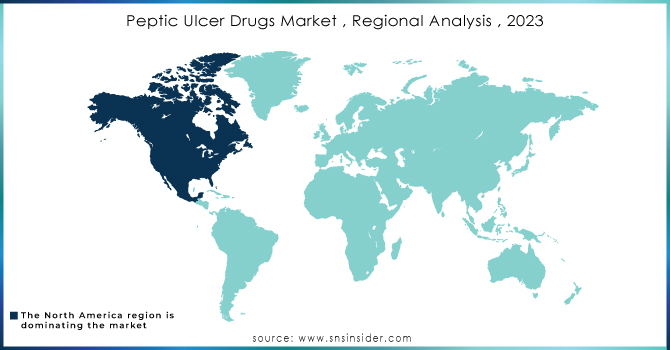

North America: North America has the market's highest revenue share. The high frequency of peptic ulcers, a big older population base, and improved healthcare infrastructure can all be related to segment expansion. North America's market is rising as a result of high healthcare spending, quick development in R&D activities, and technological advancement. A large number of market participants and a rise in unique product approvals are also expected to enhance the sector.

Asia Pacific: The Asia Pacific market is predicted to develop at a quicker rate due to improved healthcare infrastructure, more population awareness, and the increasing prevalence of peptic ulcer disease. Latin America, the Middle East, and Africa are expected to increase at a slower rate due to unmet healthcare requirements, poor awareness, and a growing healthcare industry.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major players in Peptic Ulcer Drugs Market are AstraZeneca plc, Abbott Laboratories, Novitium Pharma LLC, Boehringer Ingelheim International GmbH, PharmaKing Co. Ltd., Pfizer Inc., Yuhan Corporation, RedHill Biopharma Ltd, Zydus Lifesciences Limited., Viatris Inc., and other players

RECENT DEVELOPMENTS

In 2021: Famotidine, a common treatment for stomach ulcers, is being studied as a potential cure for the coronavirus at Northwell Health in New York City.

In 2021: The FDA approved RHB-105, a three-drug combination of omeprazole, amoxicillin, and rifabutin in one capsule that successfully eradicates Helicobacter pylori infection in adults, developed by researchers at the Michael E. De-Bakey Veterans Affairs Medical Centre.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.87 Bn |

| Market Size by 2032 | US$ 6.43Bn |

| CAGR | CAGR of 3.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drugs Type (Antibiotics, H2 Antagonists, Proton Pump Inhibitor, Others) • By Ulcer Type (Duodenal Ulcer and Gastric Ulcer) • By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AstraZeneca plc, Abbott Laboratories, Novitium Pharma LLC, Boehringer Ingelheim International GmbH, PharmaKing Co. Ltd., Pfizer Inc., Yuhan Corporation, RedHill Biopharma Ltd, Zydus Lifesciences Limited, etc., Viatris Inc. |

| Key Drivers | • The incidence of peptic ulcers remains significant globally. Factors such as unhealthy dietary habits, stress, smoking, excessive alcohol consumption, and infection with Helicobacter pylori bacterium contribute to the development of peptic ulcers. • Increasing Geriatric Population are the biggest driver of this market. |

| Market Restraints | • Many peptic ulcer treatments have been on the market for a long time, and their parents may have expired, allowing generic drug makers to create and sell less expensive copies of these medications. • Safety and Side Effects Concerns are the primary impediments in this sector. |