Peracetic Acid Market Report Scope & Overview:

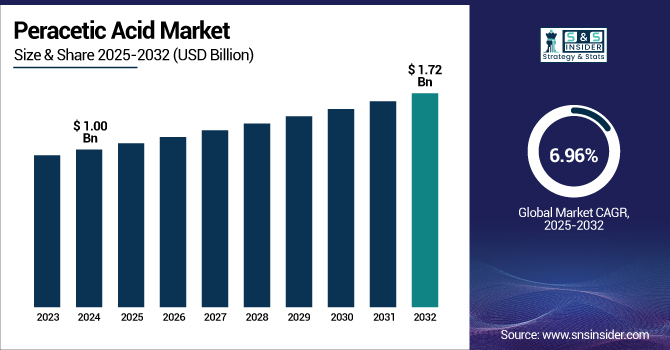

The Peracetic Acid Market size was USD 1.00 billion in 2024 and is expected to reach USD 1.72 billion by 2032 and grow at a CAGR of 6.96% over the forecast period of 2025-2032.

To Get more information on Peracetic Acid Market - Request Free Sample Report

Increased activities of wastewater treatment drive the peracetic acid market growth. It is due to the growing urbanization, industrialization, and elevating environmental regulations concerning water pollution that are some of the key factors driving the growth of the market for wastewater treatment globally. Rapid urbanization also increases the demand for clean, safe water, forcing governments to invest substantial amounts into their wastewater treatment capabilities.

The U.S. Environmental Protection Agency (EPA) has made significant investments in wastewater infrastructure. Community water systems fund a multitude of water quality projects, including municipal wastewater facilities, nonpoint source pollution control, decentralized wastewater treatment systems, and stormwater runoff mitigation, all through low-cost loans.

Over USD 172 billion in low-cost loans have been provided since the inception of the CWSRF program. The program has earmarked USD 11.7 billion in 2023 alone to fund such projects and another USD 1 billion for emerging contaminants.

Moreover, the combination of health concerns, environmental sustainability goals, and stricter government regulations is making wastewater treatment a national priority in many countries, fueling the demand for effective disinfectants like peracetic acid.

Peracetic Acid Market Dynamics

Drivers

-

Growing pharmaceutical and biotechnology sectors drive the market growth

The need for stringent sterilization and contamination control is also increasing to comply with the regulations regulated by the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA). Peracetic acid has gained popularity for its effective antimicrobial activity while breaking down into non-toxic by-products, and it is being used more frequently for cleanroom, medical devices, and bioprocessing sterilization. Furthermore, an increase in biologics production, vaccination manufacturing, and personalized medicines has raised demand for high-level disinfection, thus providing a wider scope for the adoption of peracetic acid.

Moreover, in the U.S., Biopharmaceutical innovation supported over 4.9 million total jobs in the economy, with over 1 million workers hired directly in the biopharmaceutical industry in the United States in 2022. The industry was responsible for more than USD 1.65 trillion in total economic output, about 3.6 percent of the U.S. economy. Furthermore, this may drive the market growth.

Restrain

-

Handling and storage challenges may hamper the market growth.

Peracetic acid is a highly reactive and corrosive chemical that causes difficulty for industry to store and handle. Maintaining these substances is itself another hurdle to resolve: they necessitate unique containers, temperature-monitored spaces, and stringent safety procedures to deter disintegration and calamity. But if harmonization changes happen, the compound quickly breaks down to make it less effective, causing safety problems. This pose added operational costs and operational complexities to the supply chain, in particular for smaller players like manufacturers and end-users. This is an important consideration that plays an integral role in the potential wider adoption of peracetic acid as a type of disinfectant by different industries, but the complexity and cost associated with the safe management of peracetic acid tend to limit its adoption significantly.

Opportunity

-

Rising demand for green disinfectants creates an opportunity in the market.

Increasing application of green disinfectants is anticipated to offer lucrative opportunities to key participants in the global peracetic acid market. Peracetic acid is unique in that it decomposes into harmless end-products: water, oxygen, and acetic acid; no hazardous residues are left over. This eco-friendly profile corresponds with the global governmental trends like the European Union's Green Deal and the United States Environmental Protection Agency's (EPA) Green Chemistry and Safer Choice Program.

In May 2023, Evonik expanded upon its Peraclean product line with a new, improved version. These new formulations will be adopted for long-lasting disinfection applications such as those in the food and beverage industries and municipal water treatment.

Additionally, increasing consumer awareness towards chemical safety and environmental health is compelling companies to use disinfectants that are highly effective with minimal effect on sustainability. This led manufacturers to introduce innovative and low-residue formulations of peracetic acid, which is yielding new opportunities for growth across verticals preferring green and responsible operations.

Peracetic Acid Market Segmentation Analysis

By Grade

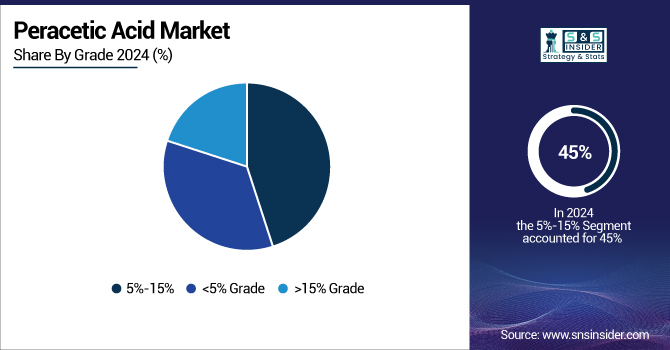

5%-15% Grade held the largest market share, around 45% in 2024. It has an appropriate balance between efficiency and safety for various applications. Such a concentration range provides potent antimicrobial and disinfectant activity, ideal for use in water treatment, food & beverage sanitation, and health care sterilization applications while avoiding the increase of risks associated with high-concentration forms of this compound.

<5% Grade held the significant market share and fastest growing segment during the forecast period. The growing consumer demand for safer, green disinfectants has also increased the appeal of <5% products because these products are seen as effective for daily use, but remain safe because consumers are not exposed to the harsh chemicals in the higher concentration preparations. This grade is also approved for use in household products by regulatory agencies, for instance, the U.S. EPA and EU ECHA, which gives it a sizable piece of the market in regions that stress consumer safety and green products.

By Application

Disinfectant held the largest market share, around 32%, in 2024. Due to its wide applicability in several sectors, including healthcare, food & beverage, and water treatment, the disinfectant segment is projected to dominate the market. Peracetic acid has strong bactericidal, virucidal, and fungicidal properties, which have led to it being widely used for the sterilization of surfaces, equipment, and water supplies. The awareness about disinfectants in hospitals and clinics is also boosting the demand due to various factors, including the growth of the focus on infection control in healthcare systems.

Sanitizer held a significant market share and was the fastest-growing segment over the forecast period. It is because of its importance for hygiene helping in fitness care, food and beverage, and water treatment. Peracetic acid-based sanitizers are widely used owing to their broad-spectrum antimicrobial activity, short contact time, and low toxic residue, making them suitable for food contact surfaces and medical devices.

By End-User

The healthcare segment held the largest market share, around 28%, in 2024. The demand for peracetic acid reflects the growing investment in healthcare infrastructure across the globe and stringent infection control guidelines from organizations such as the World Health Organization (WHO) and the Centers of Disease Control and Prevention (CDC). In addition, the rising prevalence of surgical and medical procedures across the world has widened the scope for effective and highly efficient sterilants, making the healthcare segment the highest revenue contributor in the global market.

The water treatment segment held a significant market share. It is due to increasing global demand for efficient, non-chlorine solutions for municipal and industrial water treatment. Peracetic acid (PAA) is a broad-spectrum antimicrobial that does not form undesirable disinfection byproducts (DBPs) such as trihalomethanes (THMs) or chloramines, which is why PAA is a common choice in heavily regulated environments such as the U.S. and Europe. Also, the changing needs for safe drinking water and tighter regulation of wastewater discharges are driving adoption of peracetic acid.

Peracetic Acid Market Regional Outlook

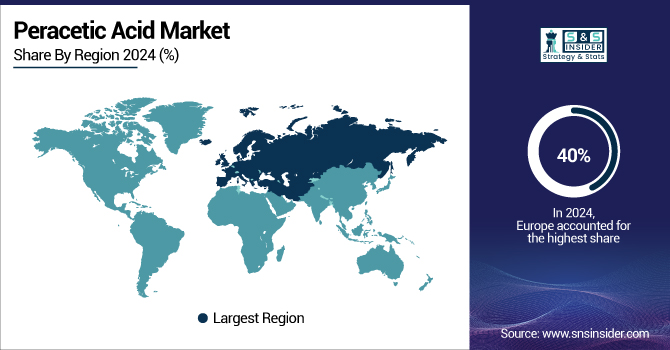

Europe held the largest market share of around 40% in 2024, with stringent environmental regulations and emphasis on sustainable and chlorine-free disinfection practices as its notable features. The regulation has encouraged various industries, especially water treatment, food processing, and healthcare, to transition to safer and more environmentally acceptable biocides such as peracetic acid.

The European Environment Agency (EEA) reported that in 2023, more than 88% of urban wastewater was treated in compliance with the urban wastewater treatment directive in Europe, namely using modern disinfection increasingly for tertiary treatment.

In March 2024, the continuous rise in demand for green disinfectants in areas like water treatment and healthcare has given rise to one of the more important recent developments: the enhancement of peracetic acid production capacity at Evonik Industries AG's Rheinfelden site in Germany.

North America held a significant market share. It is due to well-established wastewater treatment infrastructure in the region, comparatively more stringent regulatory frameworks, and higher consumer demand for safer, eco-non-chlorine-based disinfectants. The use of peracetic acid is based upon its approval for use in municipal water treatment, food processing, and sanitation in healthcare by agencies such as the United States Environmental Protection Agency (EPA) and the Canadian Food Inspection Agency (CFIA).

In 2023, more than 80% of large U.S. wastewater treatment plants used advanced disinfection processes, with peracetic acid preferred over chlorine because of reduced toxic byproducts (U.S. EPA, 2023).

Asia Pacific held a significant market share and is the fastest-growing segment during the forecast period. Rapid industrialization, increasing wastewater treatment projects, and heightened food safety and healthcare hygiene standards across Asia Pacific countries, such as China, India, and Japan, is expected to have a considerable contribution in the peracetic acid market share. Large-scale urbanization and the increasing need for stringent government regulations for environmental safety are key factors.

For instance, in China, the government's 14th Five-Year Plan for Urban Sewage Treatment and Resource Utilization (2021–2025) targets to increase wastewater treatment rates substantially and has attractive and green disinfectants, such as peracetic acid.

Get Customized Report as per Your Business Requirement - Enquiry Now

Peracetic Acid Market Companies

Solvay S.A., Evonik Industries AG, Ecolab Inc., Mitsubishi Gas Chemical Company, Inc., Kemira Oyj, Enviro Tech Chemical Services, Inc., SEITZ GmbH, Aditya Birla Chemicals, Christeyns, National Peroxide Limited

Recent Development:

-

In December 2023, Thai Peroxide Co., Ltd., a joint venture with Aditya Birla Group, Evonik, further consolidated its strong position in the Asia Pacific market. This acquisition strengthens Evonik's specialty peroxides business, including peracetic acid, for applications in microchip production, solar cell manufacture, water treatment and food safety.

-

In 2023, Enviro Tech showcased its peracetic acid formulations at Texas Water 2023. Details: The company presented its Peragreen WW formulations, available in 15% and 22% concentrations, highlighting their effectiveness in wastewater disinfection.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.00 Billion |

| Market Size by 2032 | USD 1.72 Billion |

| CAGR | CAGR of 6.96% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (<5% Grade, 5%-15% Grade, >15% Grade), •By Application (Disinfectant, Sanitizer, Sterilant, Others) •By End User (Food & Beverage, Healthcare, Pulp & Paper, Water Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Solvay S.A., Evonik Industries AG, Ecolab Inc., Mitsubishi Gas Chemical Company, Inc., Kemira Oyj, Enviro Tech Chemical Services, Inc., SEITZ GmbH, Aditya Birla Chemicals, Christeyns, National Peroxide Limited |