PET Foam Market Report Scope & Overview:

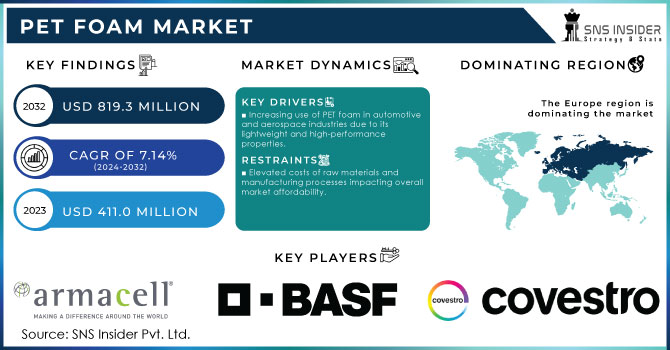

The PET Foam Market Size was valued at USD 411.0 million in 2023, and is expected to reach USD 819.3 million by 2032, and grow at a CAGR of 7.14% over the forecast period 2024-2032.

Get more information on PET Foam Market - Request Sample Report

The large-scale growth of the PET foam market is influenced by technology and the growing need for sustainability. PET foam offers superior mechanical properties, lightweight composition, and flexibility, making it suitable for more diversified applications than other foams. This has led to expanding the pet foam market into different applications such as automotive, aerospace, and marine applications. Innovation leading to increased performance and environmental sustainability has been the hallmark of the market's growth.

In April 2024, 3A Composites announced capacity expansion at its Airex PET foam production facilities. The company will meet the rising demand for high-performance PET foam solutions in the global market by increasing production to a greater extent. This helps 3A Composites to cater better to different applications and thereby represents a direction followed by more and more companies with increasing production capacities, quite in line with growing demands in the market. It marks an achievement for the company to ensure industry commitment toward many end-use applications with solutions addressing the rising demand for PET foam.

Similarly, Magna unveiled in October of 2023 what it calls industry-first innovation: 100% melt-recyclable foam and trim seating solutions. This product marks a significant leap in the evolution of automotive manufacturing and drives recyclability and the environmental footprint. The initiative of Magna sets a new standard in the offerings of the automotive scene, it continues on its journey toward sustainable material use and the production process during the design and phase of manufacturing of the products. Additionally, Sunreef Yachts made waves in the marine segment in October 2023 by using structural foam derived from recycled PET bottles in its yacht structure. On one hand, this kind of approach utilizes recycled materials while enhancing performance and sustainability in marine vessels. The commitment of Sunreef Yachts to sustainability and resource efficiency sets it apart because of using recycled PET foam, which is right in line with a broader industry trend toward more sustainable construction practices.

The introduction of 100% PET trays designed for freight efficiency at Tekniplex marked a significant contribution to sustainable packaging in May 2022. The outcome brings much together into the shift toward more sustainable, more efficient packaging solutions. Taken from the perspective of waste reduction and enhancement of environmental performance, the new trays offered by Tekniplex are reflective of an industry-wide increase in emphasis on sustainability and optimization of the packaging processes. Moreover, in March 2022, Armapet launched Eco50: the world's first Environmental Product Declaration (EPD) for PET-based insulating foam, allowing for transparent information on the environmental effects of the foam, thereby further promoting transparency and sustainability in building materials. The launch of EPD focuses on industry commitment to its philosophy of environmentally friendly products and good practices for sustainable construction and civil engineering.

These trends demonstrate the dynamic PET foam market with innovations that are now always present and the recent emphasis on sustainability. With advancements in production technologies and changes in new material applications, these upgraded industries come into being because the demand for high-performance and eco-friendly products develops.

PET Foam Market Dynamics:

Drivers:

-

Increasing use of PET foam in automotive and aerospace industries due to its lightweight and high-performance properties.

The trends of the use of PET foam in automotive and aerospace tend to be correlated with lightness and performance properties, thus yielding significant advantages in these sectors. In general, the use of PET foam in the automotive industry reduces the weight remarkably, with the low density of the material ensuring better fuel efficiency and performance. For instance, major automobile producers have embraced PET foam for many components, such as interior car panels, trunk linings, and automotive seating systems, for its possible weight saving potential without lowering strength or safety. In addition, it will enhance general vehicle efficiency and also gear towards global environmental policies of reduced carbon emission and more stringent fuel economy standards. The aerospace field extensively uses PET foam in aircraft parts, like cabin panels and structural parts, for the good strength-to-weight ratio. However, it's the maintenance of structural integrity while being lightweight that supports the optimization of aircraft performance and reduction in fuel consumption. For example, the top companies in the aerospace industry have created aircraft interior and sandwich panel structures with PET foam. As a result, fairly important weight reduction targets are achieved, and aerodynamic efficiency is improved. The performance properties like toughness, excellent insulation, and impact resistance for PET foam will promote its further feasibility in many such sectors as a material of critical importance to weight and strength characteristics in the applications.

-

Enhanced focus on eco-friendly and recyclable materials driving innovation and adoption in various applications.

The focus on eco-friendly and recyclable materials has seriously driven the pace of innovation and adoption in the PET foam market as industries increasingly prioritize their own sustainability and environmental responsibility. With an intensification of concerns over climate change and the depletion of natural resources, manufacturers are producing products with PET foam emphasizing recyclability as well as reduced environmental footprint for its objectives. For example, several companies are now producing PET foam from recycled post-consumer plastic bottles. This not only takes waste out of landfills but also decreases the demand for virgin material, supporting international goals for sustainability and environmental consciousness among consumers and businesses. It has truly been a great stride in the use of eco-friendly PET foam during the construction industry for insulation and architectural applications, which prove to ensure high performance rather than presenting a greener alternative than traditional materials. The automotive sector has also accepted PET foam for various other components like interior trims and paneling wherein recycled PET foam has not only ensured fulfilling stringent environmental standards but also the needed durability and functionality. This trend fosters innovation in the development of production techniques, for instance, the improvement in recycling processes and new formulation development that makes PET foam even more environmentally friendly, a factor that seems to boost its consumption amongst different applications.

Restraint:

-

Elevated costs of raw materials and manufacturing processes impacting overall market affordability.

High raw material and production process costs are a major restraint in the PET foam market as their total cost will inhibit penetration in the market. The high-grade PET resins raw material, which is expensive, along with state-of-the-art processing technologies, drive the production process costs up for PET foam. Changes in the petrochemical feedstock prices of PET resins further stress costs to the manufacturers. Such higher-cost production may further be limited by cost-sensitive applications and industries since it will certainly push prices for end-users high. Another factor that contributes to the high price of PET foam is the specialized equipment and energy-intensive processes required for high-quality production. This in turn narrows the market's capacity to compete with other materials that could potentially have a less expensive solution, and so, in fact, impacts the overall growth and affordability of products involving PET foam.

Opportunity:

-

Increasing integration of recycled PET foam in marine construction opens new growth avenues for the market.

Increasing usage of recycled PET foam in marine construction points to a promising prospect for the PET foam market as the marine industry increasingly strives towards sustainability and reduces its environmental footprint. Other uses of recycled PET foam can help manufacturers enhance the ecological profile of final products while taking advantage of excellent durability and lightweight properties by using them in boat hulls, deck structures, and insulation systems. Replacing materials in products with recycled PET foam is compatible with the broader industry practices that shift previous standpoints towards greener practices and meet demands for regulatory requirements in terms of lower environmental impact. The PET foam market for recycled PET foam is likely to keep growing as more marine construction projects adopt sustainable materials, opening up new avenues for the growth and innovation of this market.

Challenge:

-

Stricter environmental regulations and standards may pose challenges for manufacturing and product development.

Stricter environmental regulations and standards are high challenges to the PET foam market, requiring more strict standards on the design of manufacturing processes and products. Governments and regulatory bodies are enforcing stricter rules in capping environmental influences, forcing manufacturers to change techniques of production to agree to the requirements that usually require new technology and process investments. For example, more stringent regulations regarding lower emissions or more eco-friendly usage materials could increase operational expenditures and become somewhat of a hassle within the manufacturing line. Conversely, new regulations regarding recyclability or biodegradability might force major reformulation of PET foam products, making it a long and arduous process at great cost. Such regulatory pressure would then stagnate firms' ability to innovate and maintain cost-effectiveness and subsequently lower their competitiveness and market standing.

PET Foam Market Segments

By Raw Material

In 2023, the virgin PET segment dominated the PET foam market, with an estimated market share of approximately 65%. This comes from the higher availability of virgin PET and its consistency in quality compared to that of recycled PET. Virgin PET foam is widely preferred in heavy industries, particularly in car production and aerospace, where performance and safety standards are rather restricted by the predictability of properties in such materials. For example, automotive suppliers rely on virgin PET because of its very good strength, lightweight nature, and ease of processing; thus, it is significantly used in the manufacture of seat cushions and panels. While recycled PET attracts more consumption to benefit the environment, virgin PET remains highly in demand. This is for situations where strict material characteristics must be adhered to by the manufacturers.

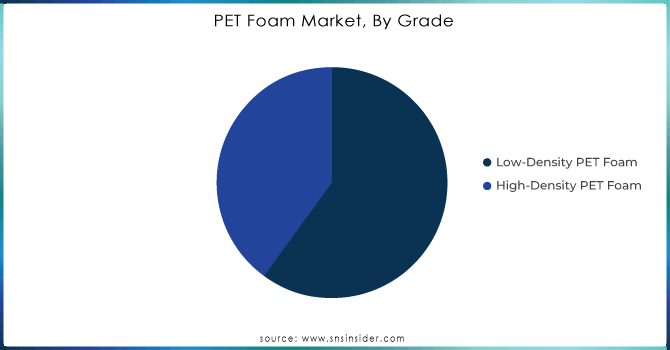

By Grade

The High-Density PET Foam dominated the PET foam market in the year 2023, capturing an estimated market share of around 60%. This dominance is largely based on the better mechanical properties of high strength, rigidity, and resistance to wear and tear, which adds up to heavy-duty applications in various sectors like aerospace, automotive, and wind energy. For example, in aerospace, high-density PET foam is primarily used in structural parts and interiors that demand a high strength level while having minimal weight. Likewise, in wind energy, high-density PET foam is utilized in the turbine blades: its high density ensures durability over a long period and hence will stay in operational performance for a long time. Such applications need materials that can even face heavy loads and other extreme conditions. That is why high-density PET foam is in high demand today.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

In 2023, Wind Energy dominated the PET foam segment, accounting for around 40% market share. The dominant market share of Wind Energy can be attributed to the increasing demand for lightweight, robust, and high-performance materials in the production of wind turbine blades. PET foam, particularly high-density variants, is widely used in the core of turbine blades because of its excellent mechanical properties, such as strength and fatigue resistance, which are crucial for withstanding extreme environmental conditions. As the world continues pushing limits for renewable energy, wind energy production is on the rise, with most wind turbine manufacturers focusing on PET foam as a means to improve efficiency and further lighten up the overall system. In addition, PET foam's recyclability complements wind energy companies' sustainability agendas and pushes it into a greater adoption rate in this application.

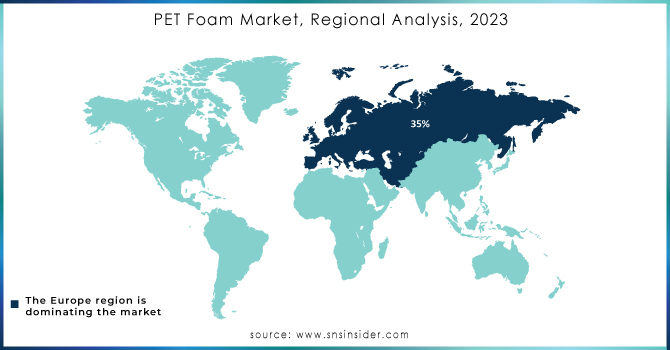

PET Foam Market Regional Analysis

In 2023, Europe dominated the PET foam, accounting for a market share of over 35%. This is attributed to the high emphasis placed on sustainability and renewable energy projects together with advanced manufacturing sectors in this region. Europe has been ranked amongst the premier regional users of wind energy, with an immense related demand for PET foam for use in manufacturing turbine blades. The most critical contributors are Germany, Denmark, and Spain, as they are highly aggressive in the development of wind energy. Besides, the region has strict environmental regulations and exhibits a keen interest in product recyclability, which has resulted in PET foam used in various industries, including the automotive and construction sectors. The reasons for innovation by European manufacturers in recycled PET foam further suggest that this region is going to be a stronghold in the market.

Key Players:

-

3A Composites (Airex, Baltek)

-

A One Packing Co. Limited (PET Foam Board, PET Foam Sheet)

-

Armacell (ArmaFORM, ArmaPET)

-

BASF SE (Basotect, Styrodur)

-

Carbon-Core Corp. (CarbonCore, CarbonCore PET)

-

Changzhou Tiansheng New Materials Co. Ltd. (Tiansheng PET Foam, Tiansheng Core)

-

Corelite Inc. (CoreLite PET, CoreLite Foam)

-

Covestro AG (Baytherm, Baybond)

-

Diab Group (Divinycell, Divinycell H)

-

Evonik Industries AG (Rohacell, Rigid Foam)

-

HEXCEL Corporation (HexWeb, HexLight)

-

Huntsman International Llc (CoreShell, Araldite)

-

J.H. Ziegler Gmbh (Ziegler PET Foam, Ziegler Core)

-

Nitto Denko Corporation (Nitto PET Foam, Nitto Core)

-

Petro Polymer Shargh (Petrofoam, PetroPET)

-

SABIC (Sabic PET Foam, Sabic Core)

-

Saint-Gobain (SG Foam, Saint-Gobain PET)

-

Sekisui Plastics Co. Ltd (Sekisui PET Foam, Sekisui Core)

-

Solvay SA (Solvay PET Foam, Solvay Core)

-

Toray Industries, Inc. (Toray PET Foam, TorayCore)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 411.0 Million |

| Market Size by 2032 | US$ 819.3 Million |

| CAGR | CAGR of 7.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Raw Material (Virgin PET, Recycled PET) •By Grade (Low-Density PET Foam, High-Density PET Foam) •By Application (Wind Energy, Transportation, Marine, Packaging, Building, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Huntsman International Llc, Carbon-Core Corp., Armacell, Nitto Denko Corporation, Diab Group, BASF SE, Sekisui Plastics Co. Ltd, Changzhou Tiansheng New Materials Co. Ltd., Petro Polymer Shargh, 3A Composites, Corelite Inc., A One Packing Co. Limited, J.H. Ziegler Gmbh, Acrylic Depot and other key players |

| Key Drivers | •Increasing use of PET foam in automotive and aerospace industries due to its lightweight and high-performance properties •Enhanced focus on eco-friendly and recyclable materials driving innovation and adoption in various applications |

| Restraints | •Elevated costs of raw materials and manufacturing processes impacting overall market affordability |