Photovoltaic Solar Connectors Market: Accelerating Towards a Smarter, Safer Solar Future:

The Powering the Future with Intelligent and Resilient Solar Connectors

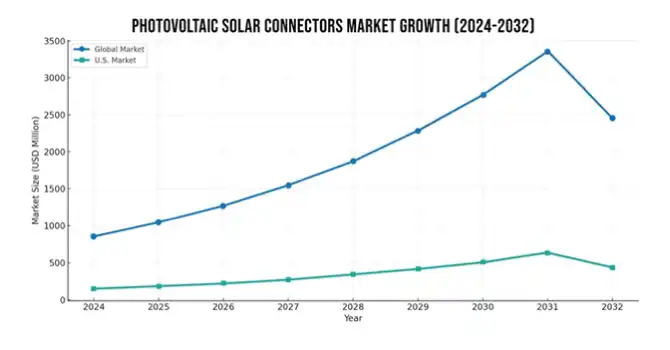

The global photovoltaic solar connectors market, valued at USD 849.26 million in 2024, is projected to reach USD 2,459.16 million by 2032 at a CAGR of 14.22%, fueled by rising solar deployments and demand for efficient, intelligent, and safety-critical MC4 connectors. As grid integration deepens, connectors are evolving from passive links to essential digital enablers of solar infrastructure.

Powering Forward with Innovation, Compliance & Renewable Urgency

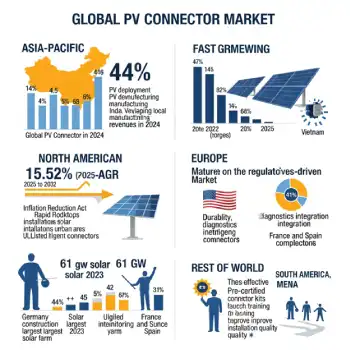

Massive solar deployment and global policy incentives like the IRA and EU Green Deal are boosting demand for scalable, locally made connectors. Innovations in materials and EPC-led compliance are driving safer, high-performance connector adoption worldwide.

Wired for the Future Solar Connector Market Shifts toward Intelligence, Power, and Sustainability

- AI-Enabled Smart Connectors are revolutionizing PV systems with real-time monitoring, predictive diagnostics, and digital twin integration.

- Next-Gen Compatibility is rising as ≥600W modules drive demand for high-load connectors, with Staubli leading new product rollouts.

- Recycling Programs in Motion since April 2023 in the U.S. are boosting sustainability by reclaiming old connectors and cables.

- Manufacturing Momentum in Asia is growing, with India and Vietnam scaling local production to reduce global supply dependence.

Fault Lines in the Solar Backbone Threaten Industry Momentum

|

CHALLENGE |

STAT/FACT |

MARKET IMPACT |

|

System Failures |

83% projects had connector issues; 3% led to shutdowns |

Drives demand for certified, factory-installed connectors and real-time monitoring tools. |

|

Economic Loss |

USD 558,450 revenue loss due to connector fire (June 2025) |

Pushes EPCs and developers toward premium components and stricter quality control. |

|

Supply Chain Dependency |

Heavy reliance on Chinese manufacturing |

Fuels local production push under IRA and diversification strategies. |

|

Labor Shortage |

Poor crimping and mismatched connectors (Solar Power World 2024) |

Spurs training initiatives and demand for smart, plug-and-play solutions. |

|

Legislative Risk |

SEIA warns of USD 286B investment loss, 330,000 job risk if incentives are cut |

Market uncertainty; highlights critical role of policy in supporting connector demand and stability. |

Harnessing the Sun: Connecting the Photovoltaic World

Photovoltaic and Solar Connectors Market Size, Share, Analysis, Trends 2032

Reshaping the U.S. Photovoltaic Connector Landscape with Policy Power and Innovation

The U.S. Photovoltaic Solar Connectors Market, valued at USD 147.55 million in 2024, is expected to reach USD 433.37 million by 2032 at a CAGR of 14.41%, driven by strong policy support, growing safety awareness, and rapid rooftop solar adoption. The market is evolving into a highly regulated, innovation-focused segment within the global solar ecosystem.

Policy Momentum and Urban Growth Driving U.S. Solar Connector Demand

- The Inflation Reduction Act is accelerating domestic production of UL-certified connectors, while urban rooftop and community solar programs are driving demand for compact, high-efficiency solutions.

- EPC firms are enforcing strict safety compliance, and developers are shifting toward connectors with robust safety ratings and integrated diagnostics following major system failures.

Smart Cities and Solar Synergy Powering the Next Wave of U.S. Connector Innovation

The integration of EV chargers, home batteries, and smart monitors is boosting demand for intelligent PV connectors. Urban rooftop solar is expanding due to tax incentives and net metering. Meanwhile, utilities are deploying IoT-enabled connectors to support remote monitoring and predictive maintenance across smart grid infrastructure.

Cost Pressures and Legacy Infrastructure Restraining the U.S. Photovoltaic Solar Connectors Market

In the U.S., legacy procurement habits often favor budget options that don't meet UL standards, accelerating system degradation. Aging solar farms also present compatibility issues, requiring complete rewiring or custom adapters during upgrades.

Critical Fault Lines Undermining Photovoltaic Solar Connectors Reliability in the U.S. Market

A U.S. project reported a 58% revenue loss in June 2025 due to a fire traced back to connector failure. Skilled labor shortages continue to result in poor crimping and mismatched connectors, compromising overall system performance. Additionally, the absence of unified federal standards has led to fragmented adoption and compliance practices across various states.

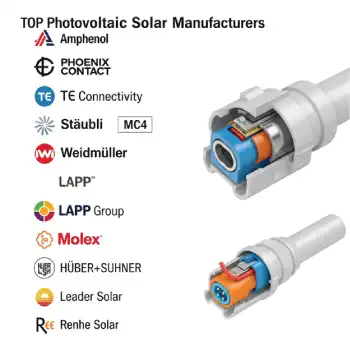

Key Players:

Recent Developments:

- In March 2025, Amphenol Industrial Operations launched the H4 PRO Connector and Saguaro Junction Box on 18th March 2025, offering 1500V-rated, low-resistance, and highly scalable solar connectivity solutions optimized for EPC and utility-scale PV installations.

- In Feb 2025, TE Connectivity, announced its acquisition of Richards Manufacturing for USD 2.3 billion, strengthening its position in North America's energy market by expanding its utility grid solutions and underground distribution portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 849.26 Million |

| Market Size by 2032 | USD 2459.16 Million |

| CAGR | CAGR of 14.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

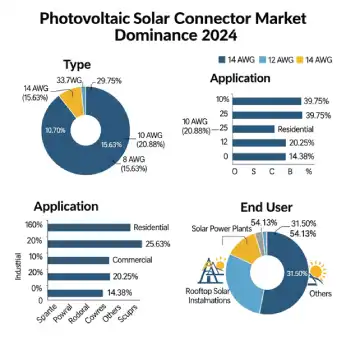

| Key Segments | • By Type(14 AWG, 12 AWG, 10 AWG, 8 AWG) • By Application(Industrial, Residential, Commercial, Others) • By End User(Solar Power Plants, Rooftop Solar Installations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amphenol, Phoenix Contact, TE Connectivity, Stäubli (MC4), Weidmüller, LAPP Group, Molex, HUBER+SUHNER, Leader Solar, Renhe Solar and others. |