Tiller Machines Market Report Scope & Overview:

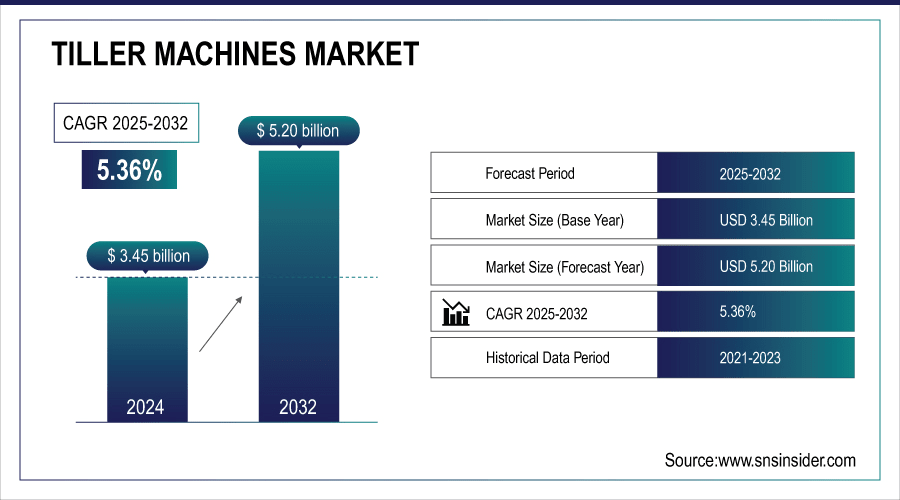

The Tiller Machines Market size was valued at USD 3.45 Billion in 2024 and is projected to reach USD 5.20 Billion by 2032, growing at a CAGR of 5.36% during 2025-2032.

Tiller machines Market is growing on the account of increasing usage of small and medium scale farmers who are influenced by the economic aspects and low, initial investment for tractors. Rising requirement for effective soil preparation, weed control, and land cultivation equipment is also contributing to adoption in developing as well as developed regions. The increasing popularity of rental services and online retail channels is also boosting accessibility for smallholder farmers and landscaping companies.

Over 500 million smallholder farms exist globally (mostly in Asia, Africa, and Latin America), representing over 80% of farms worldwide (FAO).

To Get More Information On Tiller Machines Market - Request Free Sample Report

Tiller Machines Market Trends

-

Small and medium holder farmers are increasingly adopting the use of mechanized tillers so as increase on their time use efficiencies. This is leading to an increasing demand for both diesel-driven as well as electric machines.

-

Electric/battery powered tiller machines with adjustable depth settings and ergonomic designs are boosting the productivity. These are the type of innovations that are drawing the attention of farmers and commercial operators in search of versatile solutions.

-

New tillers will also be used in business farms and landscaping companies. This development also mirrors the growing demand for productivity and labor savings at volume sites.

-

Rental services and e-commerce operations are making tillers more accessible to small-scale farmers and urban gardeners. These avenues are expanding viewership, particularly in price-sensitive, urban markets.

-

Gas powered or electric tillers are more popular now as they emit lesser gases thus good for environment. Even in niche markets such as nurseries and hobby farming, compact, lightweight machinery are also creating new opportunity.

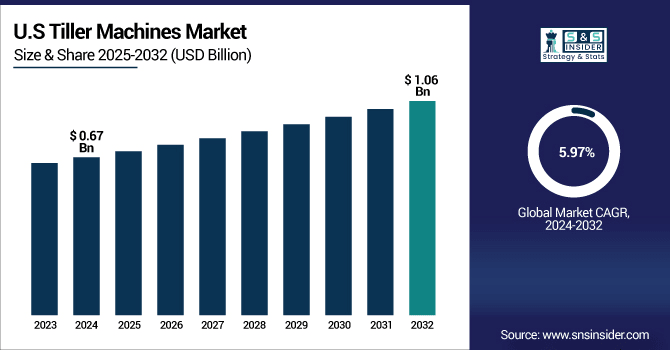

The U.S. Tiller Machines Market size was valued at USD 0.67 Billion in 2024 and is projected to reach USD 1.06 Billion by 2032, growing at a CAGR of 5.97% during 2025-2032. Tiller Machines Market are closely related to the changes taking place in the overall agricultural practices across the globe. Due to the increasing mechanization in agriculture, including amongst small and medium scale farmers, the need for cost effective soil preparation and cultivation implements is on the rise. The rapid acceptance of more sophisticated Tiller with features such as adjustable tilling depth, electric/battery 7 driven tilling process, GPS/IoT in order to enhance productivity and reduce the drudgery of labor work.

Market towards the low-emission electric and hybrid models is also driven by raising environmental awareness. Government schemes, grants and rural development programmes in Asia-Pacific, Latin America, and Africa are driving the trend for mechanized farming.

Tiller Machines Market Growth Drivers:

-

Rising Mechanization and Technological Advancements Driving Global Adoption of Efficient Tiller Machines.

Rising mechanization in small to medium farmers globally is one of the key drivers of the tiller machines industry. Electric, battery and adjustable-depth tillers used today are becoming advanced and increasing productivity. Commercial agriculture and horticulture industries are increasingly using modern tiller’s to achieve more work in less time. The demand for flexible and easy to use machines is also fueling the market growth.

Advanced tillers equipped with electric, battery, and adjustable-depth features account for approximately 12% of new models produced annually, significantly improving productivity.

Tiller Machines Market Restraints:

-

High Initial Cost and Maintenance Challenges Limiting Adoption in Price-Sensitive Markets

Diesel and modern electric tillers are relatively expensive to purchase, and this can be an obstacle for small farmers. Life Cycle costs are a problem and still seriously lacking are maintenance and spare parts which are not easily available, especially outside country centers. Operating costs are so high that farmers are discouraged from replacing existing machinery.

Tiller Machines Market Opportunities:

-

Growing Demand for Eco-Friendly, Electric, and Rental Tiller Solutions Across Regions

Electric/hybrid tillers are very low emission, which makes them a draw for eco-minded users. Rental services are growing and becoming available also for small scale (urban) farmers who cannot invest in a tractor. Increasing adoption of tillers in e-commerce channels around the world is increasing their sales in developing as well as developed markets. Moreover, advancements in miniature and portable tillers are opening up opportunities in the niche markets including nurseries and hobby farms.

-

Electric and hybrid tillers currently account for approximately 12% of total new tiller production. Rental services cover nearly 15% of smallholder farmer users globally. Online retail channels contribute to about 10% of total tiller sales worldwide.

Key Tiller Machines Market Segment Analysis

-

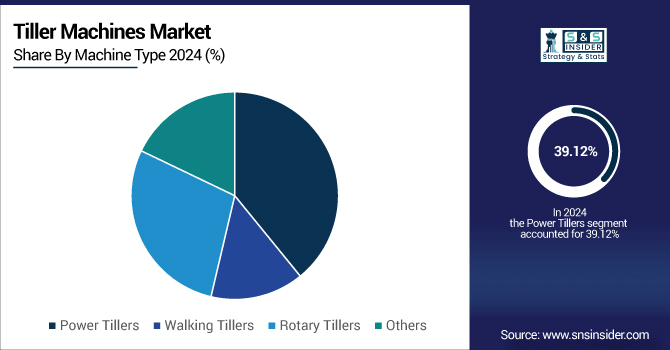

By Machine Type, Power Tillers led with ~39.12% share in 2024; Rotary Tillers fastest growing (CAGR 5.91%).

-

By Application, Soil Preparation dominated ~40.88% in 2024; Weed Management fastest growing (CAGR 6.05%).

-

By Power Source, Gasoline Powered led ~56.13% in 2024; Electric Powered fastest growing (CAGR 6.21%).

-

By End-User, Small-Scale Farmers held ~41.19% in 2024; Commercial Agriculture fastest growing (CAGR 5.88%).

-

By Distribution Channel, Agricultural Equipment Dealers held ~40.61% in 2024; Online Retail fastest growing (CAGR 5.73%).

By Machine Type, Power Tillers Leads Market While Rotary Tillers Registers Fastest Growth

In 2024, the Tiller Machines market is led by the power tillers, as they are extensively used by the small and medium-scale farmers and commercial operations to the widespread use of the same. They are highly durable and have a high torque of working in all kinds of soil. Meanwhile, rotary tillers are witnessing the strongest expansion, supported by rising demand in the compact farm, nursery and urban gardening sectors.

By Application, Soil Preparation Dominate While Weed Management Shows Rapid Growth

By application, the tiller machines market has been classified into soil preparation, with soil preparation emerging as the largest application in 2024 due to growing demand for creating efficient seedbed and better crop yield. Tillers are used extensively by farmers for soil breakup and aeration, and this is the largest segment in terms of usage. On the other hand, the market for weed control is witnessing a hard growth supported by the increasing need for mechanical weed control in sustainable and chemical-free farming.

By Power Source, Gasoline Powered Lead While Electric Powered Registers Fastest Growth

In 2024, gasoline fuelled tiller machines sales are most, due to their low price, more convenience to be available everywhere and suitable to small to medium scale farming. They are still popular among regions with a good fuel network and traditional tillage. At the same time, electric tillers will post the most rapid gains, supported by heightened interest in environmentally friendly products with low emissions, and by the popularity of cordless models.

By End-User, Small-Scale Farmers Lead While Commercial Agriculture Grow Fastest

In 2024, the tiller machines market as the end-users, small scale framers dominate the tiller machines market, where farmers are dependent on tillers for the soil preparation, crop planting, and general farm operations. The great affordability and accessibility to farm machinery and government mechanization programs have made their adoption common. And among them, commercial agriculture is growing most rapidly, where large farms are looking for high-efficiency and versatile tillers to cut labor and boost production.

By Distribution Channel, Agricultural Equipment Dealers Lead While Online Retail Grow Fastest

In 2024, the tiller machines market, farm equipment dealers account for the largest share in the tiller machines distribution segments, with their providing specialized product knowledge and provide access to professionals trained to enable the handlers to support with a purchase. They offer a platform with a huge network and regional presence, which is why they are popular among small and big vendors. And its online retail is expanding most rapidly, fed by the explosion of e-commerce and the attraction of doorstep delivery.

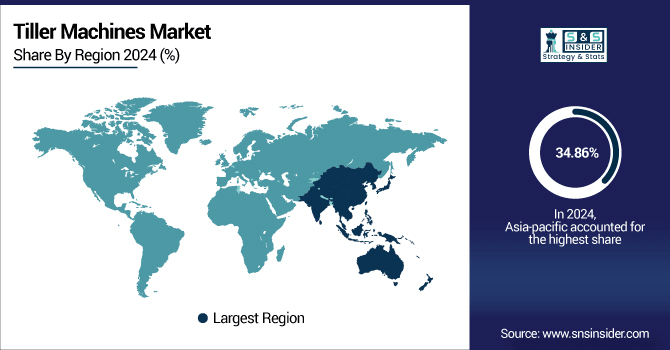

Asia-pacific Tiller Machines Market Insights

In 2024 Asia-Pacific dominated the Tiller Machines Market and accounted for 34.86% of revenue share, this leadership is due to high adoption among small- and medium-scale farmers and strong agricultural mechanization programs. Growing demand in countries like India, China, and Southeast Asia continues to support market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Tiller Machines Market Insights

The China Tiller Machines Market is one of the largest globally, driven by high levels of mechanization and government programmes to modernize the agricultural machinery fleet. Modern cultivators, such as diesel and electric ones, are used more for soil preparation than for the crop itself. Increasing trending towards sustainable farming practices and urban gardening are adding to the growth of the market in the country.

North America Tiller Machines Market Insights

North America is anticipated to see the largest growth on the Tiller Machines Market over the period 2025-2032 as compact and electric tillers are being demanded by small farmers and urban gardens and the figure is expected to be 6.03%. The growth of online retail and rental options are also increasing access throughout the region. Moreover, increasing demand for sustainable and eco-friendly agricultural practices is driving the market growth.

U.S. Tiller Machines Market Insights

The U.S. Tiller Machines Market is a significant part of North America market, where gas-powered and diesel tillers are popular in smaller farms and landscaping. Strong demand is reinforced by high adoption rates among small- and medium-scale farmers. Electric and hybrid tillers are increasingly popular and spurring a wave of innovation in smaller models and sustainable options.

Europe Tiller Machines Market Insights

The Europe region became the one of the bright spots in the Tiller Machines Market in 2024, considering higher level of mechanization in farming. Diesel or electric tiller is commonly used for soil processing, crop planting and landscaping. Stimulus from European campaigns for sustainable and low-emission machinery are driving sales of electric and hybrid models. Furthermore, the expansion of online retail and rental services is increasing availability for smallholder farmers and commercial users in the region.

Germany Tiller Machines Market Insights

The Germany Tiller Machines Market is an established farm equipment market with high penetration of diesel and electric tillers in agriculture as well as landscaping industry. Market growth is further aided by high degree of mechanization and incorporation of other features including adjustable-depth options and compact size.

Latin America (LATAM) and Middle East & Africa (MEA) Tiller Machines Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Tiller Machines Market is growing steadily due to increasing moderately with the burgeoning adoption by small and medium farmers. Most of the tillers are diesel, the preference being for an economical fuel and versatility across a wide range of soil types. Increasing popularity of small and electric tillers generating new opportunities, particularly in urban farming and landscaping.

Tiller Machines Market Competitive Landscape:

Honda Power Equipment is a global leader in development of low-emission and fuel efficient 4-stroke engines for use in lawnmowers, generators, pumps, tillers, and snow blowers. The company's tillers are equipped with the GX commercial-grade engine from Honda for high performance and superior reliability.

-

In April 2024, Honda introduced the FC600 model, featuring a 20" tilling width and a powerful GX160 engine, designed for both residential and commercial use.

Husqvarna Group outdoor power products, including tillers, are powerful, efficient and ergonomic, and bear the hallmark of Swedish design and quality that is famous the world over. The company has a vast selection of tillers to meet the needs of everyone, from a homeowner looking to create a garden to a professional landscaper.

-

In January 2024, Husqvarna introduced the 330iK Combi Switch, a versatile powerhead compatible with over 15 attachments, including a tiller, enhancing the flexibility of their battery-powered lineup.

MTD Products Inc., a worldwide leader in outdoor power equipment, is under various iconic brands such as Troy-Bilt, Yard Machines and Cub Cadet. The company has multiple tiller options for different gardening and farming requirements - from beginner to professional though home gardening even commercial farming weighing on budget affordable priced options.

-

In May 2024, MTD announced the expansion of its tiller product line, introducing new models with enhanced features to meet the growing demand for efficient and versatile tilling solutions.

Yanmar Co., Ltd., a prominent Japanese company that produce heavy machinery (including tiller machines). The company manufactures a variety of tillers, including power tillers for professional farmers, as well as walk-behind tillers for residential and commercial use. Yanmar tillers are widely used and trusted by farmers, and known by their durability, ease of operation and advanced features to deal with any kind of soil and region.

-

In May 2025, Yanmar Compact Equipment officially launched a full line of compact equipment, including compact track loaders, mini excavators, and compact wheel loaders, enhancing its product offerings in North America.

Tiller Machines Market Key Players:

Some of the Tiller Machines Market Companies

-

Honda Power Equipment

-

Husqvarna Group

-

MTD Products Inc.

-

Yanmar Co., Ltd.

-

Kubota Corporation

-

Deere & Company

-

Mahindra & Mahindra Ltd.

-

STIHL Holding AG & Co. KG

-

Emak S.p.A.

-

AL-KO Kober SE

-

Ariens Company

-

Briggs & Stratton Corporation

-

King Kutter Inc.

-

BCS America LLC

-

Earthquake (Ardisam, Inc.)

-

Troy-Bilt LLC

-

VST Tillers Tractors Ltd.

-

Zhejiang Changjiang Machinery Co., Ltd.

-

Texas A/S

-

Farm King (Buhler Industries Inc.)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.45 Billion |

| Market Size by 2032 | USD 5.57 Billion |

| CAGR | CAGR of 6.27% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Machine Type (Power Tillers, Walking Tillers, Rotary Tillers and Others) • By Application (Soil Preparation, Weed Management, Crop Cultivation and Land Preparation) • Power Source (Gasoline Powered, Electric Powered and Diesel Powered) • By End-User (Small-Scale Farmers, Commercial Agriculture, Gardening Enthusiasts, Landscaping Companies and Nurseries) • By Distribution Channel (Agricultural Equipment Dealers, Online Retail, Farm Supply Stores, Direct Sales and Rental Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Honda Power Equipment, Husqvarna Group, MTD Products Inc., Yanmar Co., Ltd., Kubota Corporation, Deere & Company, Mahindra & Mahindra Ltd., STIHL Holding AG & Co. KG, Emak S.p.A., AL-KO Kober SE, Ariens Company, Briggs & Stratton Corporation, King Kutter Inc., BCS America LLC, Earthquake (Ardisam, Inc.), Troy-Bilt LLC, VST Tillers Tractors Ltd., Zhejiang Changjiang Machinery Co., Ltd., Texas A/S and Farm King (Buhler Industries Inc.) |