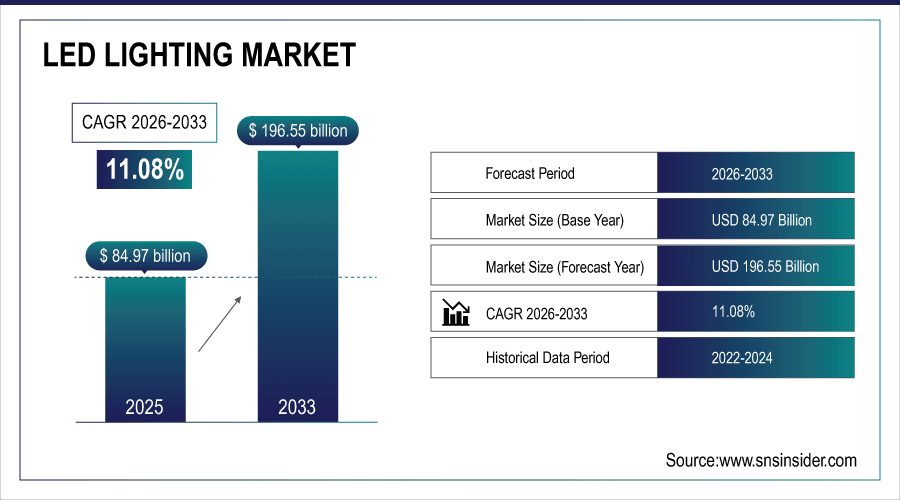

LED Lighting Market Size & Growth:

The LED Lighting Market size was valued at USD 84.97 Billion in 2025E and is projected to reach USD 196.55 Billion by 2033, growing at a CAGR of 11.08% during 2026-2033.

The LED Lighting Market is expanding due to the global demand for energy-efficient and low-cost lighting systems. Government programs and regulations banning energy-wasting incandescent and halogen lamps are driving LED uptake in residential, commercial, and industrial applications. The quick adoption of technology (smart and connected lighting systems) is inspiriting the industry players in adding value to their products and resonating with consumer aspiration.

Over 70% of lighting manufacturers are investing in IoT-enabled or smart lighting solutions to differentiate products.

To Get More Information On LED Lighting Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 84.97 Billion

-

Market Size by 2033: USD 196.55 Billion

-

CAGR: 11.08% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

LED Lighting Market Trends

-

With a larger variety of shapes and glass types, LED lights are filling gaps where incandescent and halogen predecessors once dominated.

-

From technological advancements such as IoT-ready and smart lighting systems, consumer demand and market penetration is pushing forward.

-

Reduction in manufacturing costs is making LEDs cost-effective in the residential, commercial and industrial segments.

-

Consumer interest in tunable, human-centric lighting is driving innovation in LED lighting options.

-

The new market growth opportunities are increasingly opening up due to significant smart city programs and everything fast wandering off online.

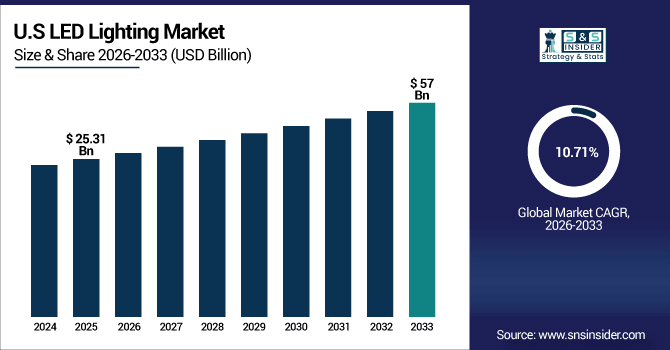

The U.S. LED Lighting Market size was valued at USD 25.31 Billion in 2025E and is projected to reach USD 57 Billion by 2033, growing at a CAGR of 10.71% during 2026-2033. LED Lighting Market growth is driven by rising consumer inclination towards energy-efficient lighting solutions for residential, commercial, and industrial purposes. Government legislation and energy policy such as subsidies and rebates LED demand is growing and this will drive the replacement from conventional lighting to LED. A fast pace of urbanization and infrastructure construction is driving the demand for smart, connected and human-centric lighting. Technological developments in LEDs, such as tunable white and IoT-capable fixtures, are increasing functionality and versatility.

LED Lighting Market Growth Drivers:

-

Rising Energy Efficiency Needs, Government Regulations, and Smart Technology Adoption Fuel LED Lighting Market Growth.

LED Lighting Market is majorly driven by the global demand for energy-efficient solutions. Ban on ineffcient incandescent and halogen technology lights the way to LED. The technological breakthroughs, such as smart and connected lighting, add to the consumer attractiveness and penetration. Decreasing costs of production are making LEDs cost-effective for all industries. In general, LEDs are goal of the sustainable and cost-effective world.

LEDs now dominate over 60% of global lighting sales in 2024, driven by surging demand for efficiency amid rising energy costs.

LED Lighting Market Restraints:

-

High Initial Investment, Limited Consumer Awareness, and Supply Chain Challenges Restrain LED Lighting Market Expansion

The LED Lighting Market faces several restraints that high initial investment for LED systems could limit the expansion of the market. Awareness is minimum in rural and entrepreneurs’ areas hence delay in accepting them. The volatility of prices rises as a result of supply chain failures and dependence on raw materials. Obstacle of retrofitting into old infrastructure are compatibility problems with fixtures in place already. These factors taken together contribute to adoption barriers for some customer segments.

LED Lighting Market Opportunities:

-

Growing Smart Cities, IoT Integration, and Sustainability Goals Unlock New Opportunities in LED Lighting Market

Growing emphasis on smart city projects is leading to huge prospects with respect to LED deployment. The adoption of I-IoT systems can enable integration for both energy monitoring and adaptive lighting. The growing adoption of human centric and tunable lighting drives innovation. Adoption in commercial and industrial is product of corporate sustainability commitments. Growing e-commerce and online distribution routes also create new opportunities for growth.

78% of Fortune 500 companies are piloting or deploying tunable white LED systems in 2024 to boost employee well-being and productivity.

LED Lighting Market Segment Analysis

-

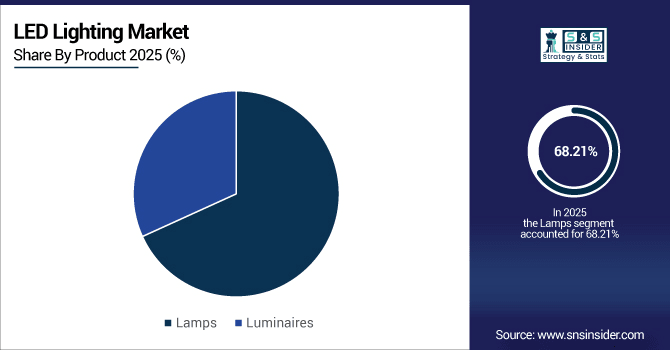

By Product: Lamps led the LED lighting market with a 68.21% share in 2025E, while luminaires are expected to be the fastest-growing segment with a CAGR of 11.59%.

-

By Application: Indoor lighting dominated the market with a 65.11% share in 2025E, whereas outdoor lighting is projected to grow the fastest at a CAGR of 11.34%.

-

By Technology: Basic LEDs accounted for the largest share at 38.23% in 2025E, while high brightness LEDs are anticipated to expand at the highest CAGR of 11.86%.

-

By End-Use: The commercial sector held the largest share at 51.45% in 2025E, while the residential sector is forecasted to register the fastest growth with a CAGR of 11.77%.

By Product, Lamps Leads Market While Luminaires Registers Fastest Growth

Lamps will remain the most widespread products in LED lighting sector considering their popularity in households and in commercial spaces. Since they are cheap and easily replaceable, have been the option for consumers to supply brains in products. They have a place beside strong distribution that you can find even in "little one horse towns" covering entire states. But luminaires are fast gaining ground, as integrated lighting systems become more commonplace. Luminaires are anticipated to exhibit the fastest growth owing to enhanced efficiency and aesthetic advantages.

By Application, Indoor Dominate While Outdoor Shows Rapid Growth

In 2025E, the Indoor lighting is the largest segment, growing based on the needs of homes, offices and industries. This domination is further entrenched by the continual needs for replacement and changing interior design trends. The energy-saving potential and integration in modern smart lighting are also the advantages for indoor application. Outdoor lighting, though, is growing rapidly, largely in response to new infrastructure projects and smart city efforts. This is what is making the outdoor lighting as the fastest growing application segment in the industry.

By Technology, Basic Lead While High Brightness Registers Fastest Growth

In 2025E, the basic LEDs are still the most popular type of technology in the market, for their cost saving factor and versatility. They are commonly found in home and commercial applications. On the contrary, high brightness LEDs are in a stage of rapid growth owing to its excellent performance. The fact that discharge lamps are suitable for challenging operation conditions such as outdoor, industrial and special requirements establishes them as the most rapidly growing technology.

By End-Use, Commercial Lead While Residential Grow Fastest

Commercial dominates the scene with companies, offices, and institutions that are increasingly turning over to LED for savings. Backing up the leadership are massive installations, as well as the requirement for long-lifetime parts. And commercial environments benefit as well with savings in larger facilities where lighting is a significant operation expense. But fastest adoption rates have been in the residential sector. Increasing environmental awareness and energy savings are leading more households to the adoption of LED lights.

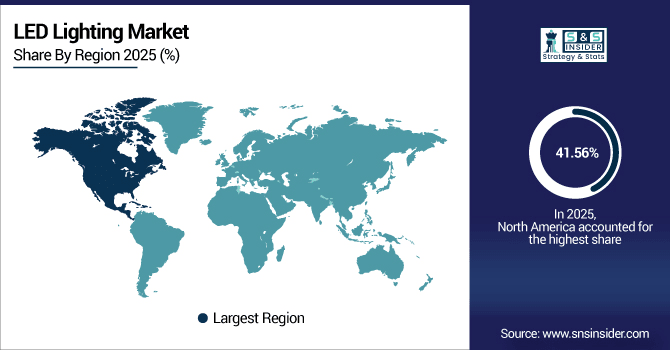

North America LED Lighting Market Insights

In 2025E North America dominated the LED Lighting Market and accounted for 41.56% of revenue share, this leadership is due to the country’s strong government policies for energy efficiency and sustainability. The use of smart and connected lighting solutions are also increasingly being adopted throughout the region, enhancing its attractiveness. Urbanization and infrastructure building across various fields has led to the growth of advance lighting market. Furthermore, rising customer demand for products that are cost-effective and long-lasting also favor North America’s lead.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. LED Lighting Market Insights

U.S. LED Lighting Market is leading, driven by government regulations for energy saving, and rebate programs. Solid uptake in the residential, commercial and industrial segments provides for stable demand expansion. Smart and connected lighting solutions are developing to improve functionality and user adoption. The replacement of old lighting in infrastructure and outdoor lighting projects further drives momentum.

Asia-pacific LED Lighting Market Insights

Asia-pacific is expected to witness the fastest growth in the LED Lighting Market over 2026-2033, with a projected CAGR of 11.88% due to high pace of urbanisation and the increasing infrastructure development in the developing nations. Government measures to adopt energy-saving solutions and eliminate traditional lights drive the product adoption. Booming smart city construction projects and industrial upgrading also drive market demand. Moreover, surging consumer awareness and low cost of LEDs make the region a significant growing center.

China LED Lighting Market Insights

China is one of the world’s leading manufacturers, capable of producing in very high volumes and at low cost. The market penetration is being facilitated by improved smart and connected lighting technologies. There is a global market for LED lighting both for export and domestic consumption and China is certainly at the heart of that.

Europe LED Lighting Market Insights

In 2025E, Europe LED lighting market outlook will register substantial gain on account of intensive government stimulus across member nations in 2025E. The area’s strict prohibitions on the use of incandescent and halogen lamps hastened the move to LED acceptance. The development in smart, connected and human-centric lighting is also boosting the demand from both consumers and commercial lighting. Increasing trend of green buildings and sustainable infrastructure favours market to grow steadily. Strong manufacturers and cutting-edge R&D facilities also make Europe strong at the global level.

Germany LED Lighting Market Insights

Germany is key markets led by stringent energy efficiency measures and sustainable development Environment conservation is key for the future, thus the use of LEDS is encouraged and there are measures taken to save energy and to reduce carbon emissions. Strong Demand in Commercials, Public and Industry Sectors Propel Growth. Rising penetration of smart and connected lighting solutions drive market growth.

Latin America (LATAM) and Middle East & Africa (MEA) LED Lighting Market Insights

The LED Lighting Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing awareness towards energy efficient products. Enforcement of government programs and legislation promoting sustainability is slowly facilitating a take up. These new opportunities are being fuelled by infrastructure projects such as the building new commercial complexes and Smart Cities. But steep upfront investment and relatively low consumer awareness in some geographies hold back broad penetration. Nevertheless, increasing urbanization and the fall in LED prices are likely to sustain modest regional growth.

LED Lighting Market Competitive Landscape:

Signify Holding is one of the world’s leading LED lighting companies and has a broad product portfolio worth of energy efficient lighting solutions. It is a company that provides smart and connected lighting solutions for residential, commercial and industrial applications. Its robust R&D program and human centered and tunable lighting technologies mark this commitment to innovation. Signify’s international reach and broad distribution give it an edge in the industry.

-

In June 2025, Signify launched the Philips Green Power 4-channel LED top lighting force, enhancing crop growth and energy efficiency in greenhouses.

Digital Lumens is a leader in innovative Smart Building IoT applications that are simple to install, easy to use, and work better than legacy systems. It's offerings are highly accepted by the industry and commercial enterprises for energy savings and process improvement. It specializes in IoT-connected light for data analytics and automation. Digital Lumens has carved out a nice position in the smart LED market with its innovations about technology-based products.

-

In June 2025, Digital Lumens expanded its horticulture portfolio with new 4-channel LED lights of the Philips Greenpower top lighting force (TLF), enabling growers to further unlock lighting intelligence.

OSRAM GmbH is one of the world's leading lighting manufacturers in the LED and high-tech sector. The company focuses on high-performance LED, and high-power LED for industrial, commercial, and automotive applications. Osram researches and develops a variety of innovative products, such as intelligent smart lighting as well as environmentally friendly and energy-saving systems. A long corporate brand history as a user and telecare product technology expert also provides a strong market position worldwide.

-

In September 2024, OSRAM introduced the NIGHT BREAKER LED, a legal LED lamp for car headlights, offering up to 330% more brightness and up to 6 times longer lifetime compared to traditional halogen lamps.

General Electric (GE) has a wide range of LED lighting products, from lamps and luminaires, to smart lighting. The company serves the commercial, industrial and residential markets with a portfolio of innovative products and services based on LED and other advanced technologies. GE has concentrated on innovation by incorporating IoT and smart lighting controls into its LED business.

-

In January 2025, GE Lighting, a Savant company, introduced new smart lighting and easy-to-install shades designed specifically for the professional installer residential channel.

LED Lighting Companies are:

-

Digital Lumens, Incorporated

-

OSRAM GmbH

-

General Electric

-

Toshiba Corporation

-

Eaton

-

Koninklijke Philips N.V.

-

EVERLIGHT ELECTRONICS CO. LTD.

-

Lumigrow

-

Samsung

-

Savant Systems Inc.

-

Syska

-

Sharp Corporation

-

Dialight

-

Zumtobel Group

-

Illumitex Inc.

-

Acuity Brands

-

Havells India Ltd.

-

Nichia Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 84.97 Billion |

| Market Size by 2033 | USD 196.55 Billion |

| CAGR | CAGR of 11.08% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Lamps and Luminaires) • By Application (Indoor and Outdoor) • By Technology (Basic, High Brightness, Organic Light-Emitting Diode (OLED), Ultra Violet, and Polymer) • By End-Use (Commercial, Residential, Industrial, and Others ) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Signify Holding, Digital Lumens, Incorporated, OSRAM GmbH, General Electric, Toshiba Corporation, Eaton, Koninklijke Philips N.V., Cree LED, EVERLIGHT ELECTRONICS CO. LTD., Lumigrow, Samsung, Savant Systems Inc., Syska, Sharp Corporation, Dialight, Zumtobel Group, Illumitex Inc., Acuity Brands, Havells India Ltd., Nichia Corporation. |