Pin Insertion Machine Market Size & Growth:

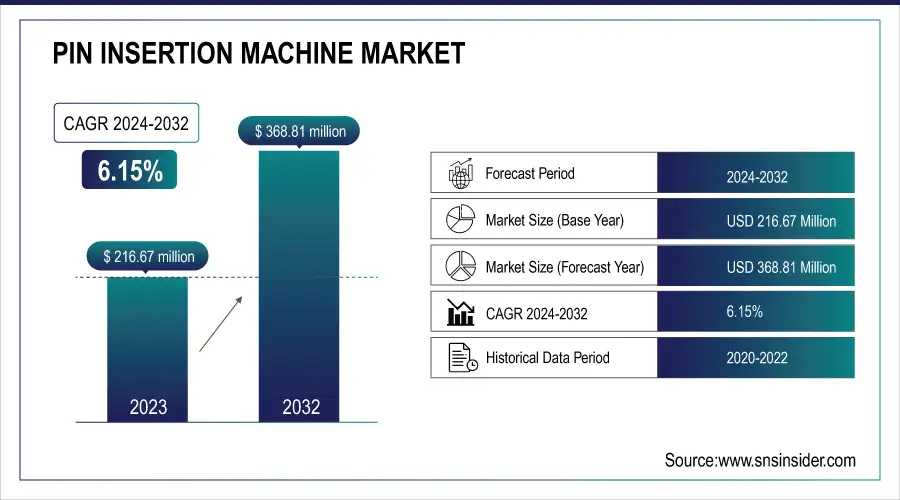

The Pin Insertion Machine Market was worth USD 216.67 million in 2023 and will reach USD 368.81 million by 2032, growing at a CAGR of 6.15 % during the forecast period 2024-2032. The Pin Insertion Machine market is growing steadily due to rising automation in electronics production. Increased demand for miniaturization of devices, improved precision, and increased production speed drives adoption. Technological innovation and Industry 4.0 integration are increasing efficiency further, and these machines are now a necessity in contemporary PCB assembly and electronic components manufacturing.

To Get more information on Pin Insertion Machine Market - Request Free Sample Report

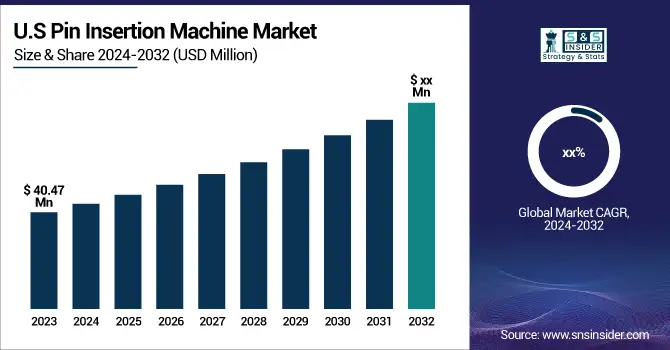

The market for U.S. Pin Insertion Machines is estimated at USD 40.47 million in 2023 and is forecast to grow consistently at a CAGR of 3.17%. Increasing electronics manufacturing automation and the growing necessity for precision PCB assembly are stimulating growth. Evolution in insertion technology and compatibility with smart manufacturing platforms are also fostering market growth. American manufacturers are making investments in automating their production lines with better solutions to support increased quality and volume requirements, and pin insertion machines become a necessary asset in this regard. This is a reflection of the larger shift toward efficient, scalable, and cost-effective electronic component manufacturing in the American market.

Pin Insertion Machine Market Dynamics

Key Drivers:

-

Rising Demand for Automated and High-Speed Assembly Solutions Fuels Growth in the Pin Insertion Machine Market.

The increasing demand for more efficient production, accuracy, and miniaturization in electronics manufacturing is strongly promoting the demand for automated pin insertion machines. They facilitate quicker production cycles and eliminate the possibility of human error, which makes them perfect for applications such as automotive, consumer electronics, and industrial automation. Firms are increasingly investing in intelligent manufacturing technologies to enhance productivity, and pin insertion machines perfectly fit the bill with their dependability and uniformity. The trend is supplemented by Industry 4.0 integration, which encourages robotics and automation throughout assembly lines worldwide, enhancing the market outlook.

Restrain:

-

High Initial Investment and Maintenance Cost Restrains Small and Medium Enterprise Adoption of Pin Insertion Machines.

Despite the benefits, the cost of the initial investment and ongoing maintenance involved in pin insertion machines is a huge deterrent, particularly for small and medium businesses (SMEs). The reason is that such companies tend to lack the capital to purchase sophisticated equipment as well as the qualified personnel to handle and maintain the machines efficiently. Furthermore, the cost-to-benefit ratio might not be feasible for low-volume manufacturers and hence will end up using manual or semi-automatic alternatives. Such a constraint dampens the potential of the market, especially in developing economies where budget limitations play a greater role throughout the manufacturing industry.

Opportunity:

-

Expansion of Electric Vehicle Manufacturing Presents Significant Growth Opportunities for Pin Insertion Machine Market

The fast-growing demand for electric vehicle (EV) manufacturing around the world provides huge growth opportunities for the market of pin insertion machines. EVs need intricate and high-density electronic control units, batteries, and connectivity components, all of which need high-precision PCB assembly. Pin insertion machines make it possible to assemble these parts reliably and at high speed, and hence are an essential piece of equipment in EV manufacturing facilities. As governments and car manufacturers invest a lot of money in EV technology, the need for scalable, automated electronic assembly solutions will keep increasing. This is a profitable trend for pin insertion machine manufacturers to increase their customer base and worldwide presence.

Challenges:

-

Integration with Smart Factory Systems and Industry 4.0 Poses Technical and Operational Challenges for Market Players

As manufacturing is transitioning towards digitalization and smart factory concepts, pin insertion machine manufacturers are seriously challenged to make their machines integrate with cutting-edge IoT, AI, and data analytics solutions. Ensuring flawless interoperability, real-time monitoring, and predictive maintenance capabilities requires enormous R&D expenditure and technical skill. Furthermore, back-fitting older systems or making it compatible with the current production setup may hinder adoption. Businesses also need to train staff to operate and diagnose such integrated systems, further contributing to operational complexity. Such technical challenges may retard deployment and minimize the benefits of smart manufacturing in plants that are not properly geared.

Pin Insertion Machine Industry Segmentation Overview

By Method

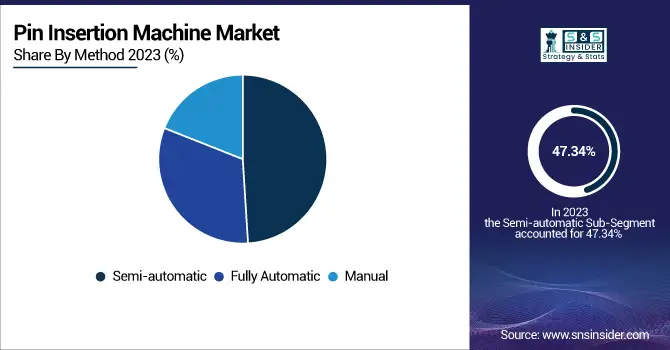

In 2023, the semi-automatic segment had the highest revenue share of 47.34% in the pin insertion machine market due to its balance of automation and manual control that provides adaptability and cost savings. Automotive and electronics industries prefer semi-automatic machines for their versatility to different production quantities and custom requirements. TE Connectivity and Autosplice have come up with semi-automatic models with advanced control systems to improve precision and efficiency. These innovations are in line with the increasing need for flexible manufacturing solutions, making the semi-automatic segment a preferred option for companies looking to maximize production without switching to fully automated systems.

The fully automatic sector is estimated to grow at the highest CAGR of 7.71% during the period 2024-2032, driven by the growing demand for high-speed, high-precision assembly in mass production settings. Fully automatic pin insertion machines have several key benefits, such as lower labor costs and uniform quality. Some of the key players include Panasonic Holdings Corp. and YAMAHA Motor Pvt. Ltd. are making investments in fully automated equipment with sophisticated vision systems and AI integration to address the needs of consumer electronics and automotive manufacturing. This reflects a more general move towards Industry 4.0, with automation and intelligent technologies as part of manufacturing efficiency and scale.

By Technology

In 2023, the Press-fit technology segment dominated the pin insertion machine market with a 45.31% revenue share based on its superiority in delivering heavy-duty mechanical and electrical connections without soldering. The process is especially preferred in automotive and industrial applications for their reliability and efficiency. Firms like Autosplice have launched innovations such as the 0.4 mm press-fit pin, intended to substitute soldered terminals on PCBs to provide good connections in harsh temperature environments. Likewise, SPIROL has diversified its manufacturing capacity to meet the increased needs for press-fit solutions. Press-fit technology use fits the industry trend towards more efficient and greener manufacturing technologies, cementing its leadership in the industry.

The Surface-mount technology (SMT) market is expected to grow at the highest CAGR of 7.82% during the forecast period of 2024 to 2032, driven by growing demand for high-performance and miniaturized electronic devices. SMT makes it possible to mount components on the surface of PCBs, which enables dense and efficient designs. Firms such as Panasonic have introduced high-end SMT equipment, including the NPM-G Series, with high-speed placement functions and integration with smart factory systems for real-time monitoring and data analysis. Such developments meet the increasing demands of consumer electronics and automotive companies for accurate and scalable manufacturing solutions, making SMT a primary growth driver in the pin insertion machine market.

By Insertion Platform

In 2023, the PCB (Printed Circuit Board) segment dominated the pin insertion machine market with a 38.64% share in revenue due to the growing complexity and miniaturization of electronic devices. Advanced pin insertion machines specifically designed for PCBs by companies such as TE Connectivity and Autosplice have increased precision and efficiency in electronic assembly processes. These advances address the increasing need in consumer electronics, automotive, and telecommunications markets, where compact and dependable PCB assemblies are essential. The leadership of the PCB segment reflects its central position in contemporary electronics production, necessitating ongoing innovations in pin insertion technologies to address changing industry needs.

The Plastic Connector market is expected to witness the highest CAGR of 9.12% during the period from 2024 to 2032, driven by the increasing need for light and strong connectors in automotive and consumer electronics sectors. Companies such as Eberhard and UMG Technologies are developing pin insertion machines specifically for plastic connectors with a focus on precision and versatility to different connector designs. These innovations meet the requirements for high-speed assembly processes in high-volume manufacturing environments. Expansion of this market segment is in line with the overall industry movement towards miniaturization and integration, where plastic connectors are an essential element for making reliable electrical connections in miniature electronic devices.

By Application

The Consumer Electronics segment dominated the pin insertion machine market with a revenue share of 30.49% in 2023 due to the rising need for compact, high-performance electronic devices. The spread of IoT-enabled devices, smartphones, and wearable tech creates a need for accurate and high-speed PCB assembly processes. Businesses such as TE Connectivity have come up with innovative pin insertion machines designed specifically for high-density PCB applications to boost assembly speed and accuracy. Autosplice's creation of the 0.4 mm press-fit pin provides a solution for dependable connections in miniaturized products. Such innovations highlight the importance of pin insertion machines to address the changing needs of the consumer electronics industry, achieving product reliability and efficiency in manufacturing.

The Automotive segment is expected to have the highest CAGR of 8.56% during the period from 2024 to 2032, driven by the increasing use of electronic components in vehicles. The growth in electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment systems raises the complexity and size of automotive PCB assemblies. Such original equipment manufacturers as Autosplice have also developed pin insertion machines specifically designed to accommodate the harsh conditions faced by automotive electronics, which provides reliability and performance. TE Connectivity's concentration on solderless press-fit terminals is a response to the industry's demand for efficient and dependable assembly solutions. All these developments are keeping in pace with the automotive industry's drive towards greater safety, connectivity, and electrification, which creates a demand for advanced pin insertion technology.

Pin Insertion Machine Market Regional Analysis

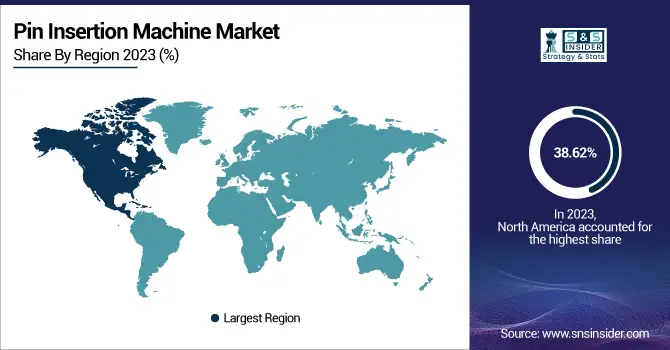

North America dominated the Pin Insertion Machine Market in 2023 with a massive 38.62% revenue share, spurred by its robust base of high-end manufacturing industries like aerospace, automotive, and consumer electronics. The emphasis of this region on automation and precision assembly has spearheaded demand for efficient insertion systems. TE Connectivity and Amphenol are some players who have made investments to upgrade automated connector assembly lines in the U.S., fueling this market momentum. Moreover, government policies promoting smart manufacturing and Industry 4.0 implementation have also contributed to driving equipment upgrades, further solidifying North America's dominant position in the pin insertion technology market.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific is experiencing the quickest growth in the Pin Insertion Machine Market, growing at a CAGR of 8.28% during the forecast period. This growth is primarily due to the burgeoning electronics manufacturing clusters in China, Japan, South Korea, and India. Fast industrialization, increasing automotive manufacturing, and consumer demand for affordable consumer electronics have prompted companies such as Panasonic and Foxconn to implement fully automated pin insertion technologies. Further, local governments' focus on smart factories and digital infrastructure also favor more investment in precision assembly solutions, making Asia Pacific the most rapidly growing market in this field.

Key Players Listed in the Pin Insertion Machine Market are:

-

TE Connectivity Ltd. – (P8 Pin Insertion Machine, P300 Pin Insertion Machine)

-

Autosplice Inc. – (APEX 3T Pin Insertion System, APEX 4T Pin Insertion System)

-

Spirol International Corporation – (Series PR Pin Insertion Machine, Series HP Pin Insertion Machine)

-

Fohrenbach Application Tooling N.V. – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

-

CMS Electronics GmbH – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

-

Finecs Co., Ltd. – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

-

Assembly & Automation Technology – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

-

Colibri Technologies Pte. Ltd. – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

-

Visumatic Industrial Products – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

-

Zierick Manufacturing Corp. – (Automatic Pin Insertion Machine, Semi-Automatic Pin Insertion Machine)

Pin Insertion Machine Market Trends

-

March 2025, Autosplice introduced the AIS 5000 high-speed pin insertion machine, designed to meet the increasing demand for efficient and precise pin insertion in various applications. This machine offers enhanced speed and accuracy, catering to industries requiring high-volume production capabilities.

-

February 2025, Spirol released the Series PR Pin Insertion Machine, a semi-automatic solution designed for precise and repeatable pin insertion. This machine addresses the need for flexibility and efficiency in assembly processes across various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 216.67 Million |

| Market Size by 2032 | USD 368.81 Million |

| CAGR | CAGR of 6.15 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Method – ( Manual, Semi-automatic, Fully Automatic) •By Technology – ( Press-fit, Through-hole , Surface-mount ) •By Insertion Platform – ( PCB , Coil Frame, Lead Frame , Transformer, Plastic Connector, Metal Component ) •By Application – ( Telecommunications, Consumer Electronics, Aerospace & Defense, Automotive, Medical, Industrial, Energy & Power, Others ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TE Connectivity Ltd. , Autosplice Inc , Spirol International Corporation , Fohrenbach Application Tooling N.V. , CMS Electronics GmbH , Finecs Co.Ltd. , Assembly & Automation Technology , Colibri Technologies Pte. Ltd , Visumatic Industrial Products , Zierick Manufacturing Corp. |