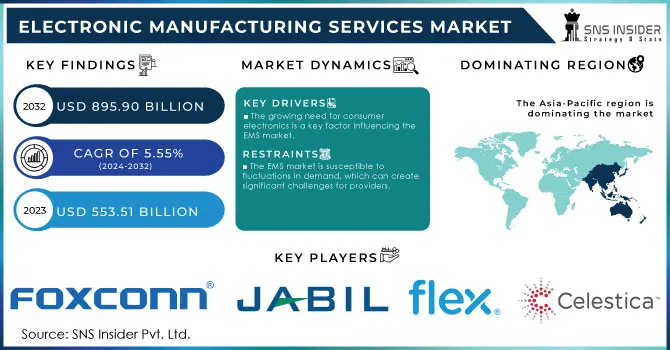

Electronic Manufacturing Services (EMS) Market Size

Get more information on Electronic Manufacturing Services Market - Request Free Sample Report

The Electronic Manufacturing Services Market Size was valued at USD 553.51 Billion in 2023 and is expected to reach USD 895.90 Billion by 2032, growing at a CAGR of 5.55% over the forecast period 2024-2032.

The electronic manufacturing services (EMS) market has grown significantly over recent years, driven by the increasing demand for electronics manufacturing across sectors such as heavy industrial manufacturing, automotive electronics, healthcare devices, consumer electronics, and industrial automation solutions. As electronic products become more sophisticated, original equipment manufacturers (OEMs) increasingly depend on EMS companies to manage intricate manufacturing processes, reduce production costs, and maintain time-to-market deadlines.

The automotive industry is a significant application area within the EMS market. A staggering 95% of car shoppers rely on online resources to gather information, bypassing dealerships as their starting point, effectively doubling their digital research efforts before engaging with dealers. The average automotive shopper spends an impressive 14 hours online during their search, visiting approximately 4.2 websites. In 2024, more than 40 million electric vehicles (EVs) on the road worldwide, a dramatic rise from fewer than 200,000 in 2012. This includes both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), which have shown substantial growth over the past decade, with total electric vehicle numbers increasing from 17,368 in 2010 to 40.8 million in 2023. As the automotive sector undergoes a transformation driven by electric vehicles, autonomous driving technologies, and connected car systems, the demand for specialized electronic components has surged. EMS providers play a crucial role in producing complex electronic control units (ECUs), battery management systems, sensors, and in-vehicle infotainment systems that are essential for modern automobiles. This sector's shift toward electrification and digitalization requires EMS companies to deliver high-reliability components that meet stringent quality and safety standards in the EMS supply chain.

Electronic Manufacturing Services Market Dynamics

Drivers

-

The growing need for consumer electronics is a key factor influencing the EMS market.

With the progression of technology, changes in consumer tastes drive an increase in the desire for modern and creative electronic gadgets. This pattern is especially evident in smartphones, tablets, wearables, and smart home gadgets. Consumers are increasingly interested in purchasing advanced technology devices that improve their daily routines, leading to a higher demand for dependable and effective manufacturing services. The increasing popularity of the Internet of Things (IoT) is also driving the request for consumer electronics. IoT devices are increasingly prevalent, linking different devices for smooth communication and automation. This level of connectivity necessitates specific manufacturing capabilities, leading companies to seek out EMS providers capable of providing top-notch, adaptable, and scalable manufacturing solutions. Furthermore, the fast rate of technological advancement requires regular updates and the introduction of new products. EMS providers are frequently more prepared to meet these needs because of their well-established production procedures and abilities in supply chain management. Through collaborating with EMS companies, OEMs can concentrate on product development and marketing, leaving manufacturing partners to efficiently deliver high-quality products.

-

Another important factor driving the EMS market is the growing emphasis on adhering to regulatory compliance and quality standards in the electronics sector.

With increasing strictness in regulations, companies must follow different safety, environmental, and quality standards. EMS providers play a critical role in assisting OEMs in dealing with these challenges. Manufacturers must adhere to regulations like RoHS and REACH to ensure they comply. EMS companies are frequently knowledgeable about these laws, guaranteeing that the items they produce adhere to all essential standards. by teaming up with an EMS provider, OEMs can reduce the dangers linked with non-compliance, which may result in penalties, product recalls, and harm to brand reputation. EMS providers shine in quality assurance, which is a crucial aspect of manufacturing. Numerous EMS companies have obtained ISO certification to showcase their dedication to quality management systems. This certification guarantees that products are produced consistently and adhere to defined quality criteria. OEMs can improve product reliability and customer satisfaction by utilizing the quality control knowledge of EMS providers. As the electronics industry grows more cutthroat, it is crucial to uphold top-notch standards to set oneself apart from competitors. EMS providers can assist OEMs in achieving this goal by integrating strong quality assurance procedures during every stage of the manufacturing process.

Restraints

-

The EMS market is susceptible to fluctuations in demand, which can create significant challenges for providers.

Market instabilities, caused by factors like economic recessions, evolving consumer tastes, and technological changes, may result in unforeseeable fluctuations in demand. EMS providers need to manage these fluctuations while keeping their operational efficiency and profitability intact. Economic recessions can greatly affect how much consumers spend on electronics, resulting in a decrease in orders for EMS providers. Businesses need to be ready to reduce their activities when demand decreases, leading to higher expenses and inefficient use of resources. Furthermore, unexpected changes in consumer preferences, like a sudden shift towards sustainable or smart technologies, can make demand forecasting more challenging. Additionally, technological progress can make specific items outdated, affecting the need for associated production services. EMS providers need to remain aware of market trends and evolving technologies to adjust their offerings. Not predicting changes in demand can lead to surplus stock, wasted resources, and decreased profits.

Electronic Manufacturing Services Market Segmentation

by Service

Electronics Manufacturing Services (EMS) led in 2023 with a 38% market share in the electronic manufacturing services market. EMS providers offer comprehensive services, including designing, assembling, and testing electronic components for original equipment manufacturers (OEMs). This segment is crucial for industries like consumer electronics, automotive, healthcare, and heavy industrial manufacturing, where high-quality, cost-efficient production is needed. Leading companies like Foxconn and Jabil offer end-to-end EMS solutions, helping brands like Apple, Dell, and HP scale their production.

Engineering Services is projected to grow at a faster CAGR during 2024-2032. These services encompass product design, prototyping, and process optimization, which are increasingly in demand as companies seek to accelerate product development cycles. The growth is driven by technological advancements such as IoT, 5G, and AI, which require expertise in the design and integration of new electronic components. For instance, Wipro and Tata Elxsi provide specialized engineering solutions, including PCB design and embedded software development for automotive and medical device manufacturers.

by Industry

The consumer electronics segment dominated the electronic manufacturing services (EMS) market in 2023 with a 32% market share, driven by high demand for devices such as smartphones, laptops, tablets, and wearables. EMS companies collaborate with major consumer electronics manufacturers to provide cost-effective and quick production, assembly, and testing services for mass production. One example is how Foxconn plays a crucial role as a manufacturing collaborator for Apple, making iPhones and other products for the company.

The automotive segment is to become the fastest-growing in the EMS market during 2024-2032, fueled by the rapid adoption of electric vehicles (EVs), autonomous driving technologies, and connected car systems. Automotive manufacturers are relying more and more on EMS providers to produce electronic components such as control units, sensors, infotainment systems, and battery management systems. For instance, Jabil offers manufacturing services to big automakers like Tesla and General Motors, producing important electronic parts for electric vehicles and self-driving cars.

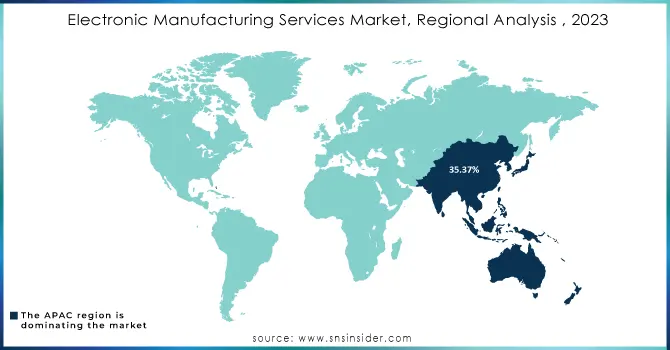

Electronic Manufacturing Services Market Regional Analysis

APAC dominated in 2023 with a 35.37% market share in the market, due to its robust manufacturing infrastructure, cost-effective labor, and access to advanced technology. Nations such as China, Japan, and South Korea play a crucial role in this dominance, offering extensive manufacturing capacities and robust supply chain connections. APAC is favored by global EMS providers due to its high concentration of semiconductor and electronics manufacturing hubs. Leading corporations like Foxconn and Flex have large-scale operations in various regions, backing sectors like consumer electronics, automotive, and Heavy Industrial Manufacturings. The increasing need for smart devices and IoT solutions is boosting the growth of the EMS market in APAC, solidifying its top position.

Europe is anticipated to become the fastest-growing region in the market during 2024-2032, driven by increasing demand for advanced electronics in sectors like automotive, aerospace, and industrial automation. The area is making significant investments in sustainable production methods and innovative manufacturing technologies like Industry 4.0, which are opening up chances for EMS providers. Germany, France, and the UK are at the forefront of automotive electronics due to their focus on electric vehicles and renewable energy in the region. Major companies such as Zollner Elektronik and Asteelflash offer personalized solutions for premium electronic products to European industries. The region's emphasis on innovation and sustainable production methods is driving its growth in the EMS market.

Need any customization research on Electronic Manufacturing Services Market - Enquiry Now

Key Players

The major key players in the Electronic Manufacturing Services Market are:

-

Foxconn Technology Group (iPhone Assemblies, Motherboards)

-

Jabil Inc. (Medical Devices, Automotive Electronics)

-

Flex Ltd. (Consumer Electronics, Industrial Automation Solutions)

-

Celestica Inc. (Heavy Industrial Manufacturings Equipment, Aerospace Components)

-

Sanmina Corporation (High-Performance Computing, Defense Electronics)

-

Benchmark Electronics (Industrial Control Systems, Networking Products)

-

Korea's Samsung Electronics (Smartphones, Semiconductor Products)

-

Plexus Corp. (Healthcare Devices, Heavy Industrial Manufacturings Equipment)

-

Nexstar Broadcasting Group (Broadcast Equipment, Video Transmission Solutions)

-

Venture Corporation Limited (Medical Technology, Automotive Electronics)

-

MiTAC Holdings Corporation (PCs, Cloud Computing Solutions)

-

SIIX Corporation (Electronic Components, Automotive Electronics)

-

Envision AESC (Battery Modules, Energy Storage Solutions)

-

TTM Technologies (Printed Circuit Boards, RF Components)

-

Zollner Elektronik AG (Medical Devices, Industry 4.0 Solutions)

-

Wistron Corporation (Laptops, Servers)

-

Viasystems Group (Printed Circuit Boards, Electronic Assemblies)

-

Lite-On Technology Corporation (LED Products, Power Supplies)

-

Cypress Semiconductor Corporation (Microcontrollers, Memory Chips)

-

AT&S (Austria Technologie & Systemtechnik AG) (Printed Circuit Boards, IC Substrates)

Suppliers of Raw Materials/Components

-

Bourns Inc. (Resistors, Potentiometers)

-

Texas Instruments (Semiconductors, Integrated Circuits)

-

Avnet (Electronic Components, Distribution Services)

-

Murata Manufacturing Co., Ltd. (Capacitors, Inductors)

-

Rohm Semiconductor (Transistors, Diodes)

-

Analog Devices, Inc. (Analog Signal Processors, Sensors)

-

STMicroelectronics (Microcontrollers, Sensors)

-

ON Semiconductor (Power Management ICs, Sensors)

-

NXP Semiconductors (Microcontrollers, RF Solutions)

-

Digi-Key Electronics (Electronic Components, Distribution Services)

Recent Development

-

In December 2023, Kaynes Technology Ltd, a top electronics manufacturer in India, purchased Digicom, a leading integrated electronics company. Digicom is a company that provides electronics manufacturing services and is located in the California Bay Area. The purchase will strategically enhance Kaynes Technology's footprint in the United States.

-

In June 2024, TVS Electronics Limited (TVS-E), a leading player in the electronics manufacturing sector, offering integrated end-to-end electronic solutions encompassing design, manufacturing, sales, services, warranty solutions, and end-of-life services, has launched Electronics Manufacturing Services (EMS) capability.

-

In July 2024, Haryana-based Systrome Technologies, specializing in advanced telecom equipment design and manufacturing, launched its electronics manufacturing facility in the state capital.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 553.51 Billion |

| Market Size by 2032 | USD 895.90 Billion |

| CAGR | CAGR of 5.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Electronics Manufacturing Services, Engineering Services, Test & Development Implementation, Logistics Services, Others) • By Industry (Consumer Electronics, Automotive, Heavy Industrial Manufacturing, Aerospace and Defense, Healthcare, IT and Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Foxconn Technology Group, Jabil Inc., Flex Ltd., Celestica Inc., Sanmina Corporation, Benchmark Electronics, Samsung Electronics, Plexus Corp., Nexstar Broadcasting Group, Venture Corporation Limited, MiTAC Holdings Corporation, SIIX Corporation, Envision AESC, TTM Technologies, Zollner Elektronik AG, Wistron Corporation, Viasystems Group, Lite-On Technology Corporation, Cypress Semiconductor Corporation, AT&S |

| Key Drivers | • The growing need for consumer electronics is a key factor influencing the EMS market. • Another important factor driving the EMS market is the growing emphasis on adhering to regulatory compliance and quality standards in the electronics sector. |

| RESTRAINTS | • The EMS market is susceptible to fluctuations in demand, which can create significant challenges for providers. |