Piperidine Market Analysis & Overview:

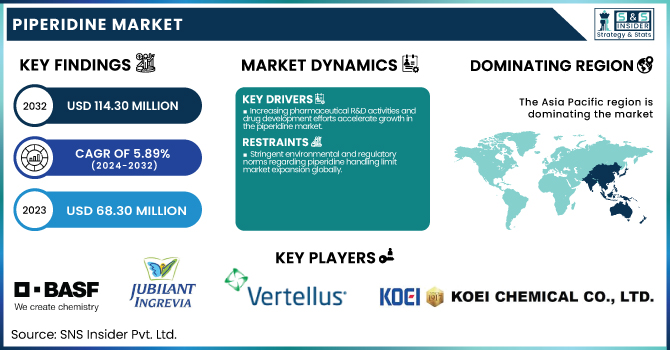

The Piperidine Market size was USD 68.30 million in 2023 and is expected to reach USD 114.30 million by 2032 and grow at a CAGR of 5.89% over the forecast period of 2024-2032.

To Get more information on Piperidine Market - Request Free Sample Report

The report offers a comprehensive analysis of production capacities and utilization rates by country and piperidine type for 2023. It includes detailed pricing trends of key feedstocks across major manufacturing nations, as well as regulatory developments impacting market dynamics globally. The report also presents environmental metrics such as emissions and waste management practices by region, highlighting the industry's sustainability initiatives. Innovation trends and R&D investments in piperidine derivatives are examined, alongside adoption patterns and performance benchmarks of digital tools used in chemical synthesis and tracking.

The United States held the largest share in the Piperidine Market in 2023, with a market size of USD 12.79 million, projected to reach USD 22.51 million by 2032, growing at a CAGR of 6.49% during 2024–2032. The United States held the largest market share in the piperidine market in 2023 due to its well-established pharmaceutical and agrochemical manufacturing base, combined with strong R&D investments and favorable regulatory frameworks. The country's advanced chemical processing infrastructure and presence of major players like BASF, Vertellus, and Sigma-Aldrich contribute significantly to local production and innovation in piperidine derivatives. Furthermore, the U.S. has seen consistent demand from the pharmaceutical industry, where piperidine is a crucial intermediate in drug synthesis, especially in treatments related to central nervous system disorders. The rising emphasis on crop protection and the growing domestic consumption of agrochemicals have also bolstered the demand for piperidine. Supportive government policies and technological advancements have further positioned the U.S. as a dominant force in the global market.

Piperidine Market Dynamics

Drivers

-

Increasing pharmaceutical R&D activities and drug development efforts accelerate growth in the piperidine market.

The growing emphasis on research and development in the pharmaceutical industry is a key driver boosting the Piperidine Market. Piperidine is a crucial building block in the synthesis of various drugs, including analgesics, antipsychotics, and antivirals. With increasing healthcare investments globally and a rise in chronic disease prevalence, the demand for effective and innovative drug formulations is climbing. Additionally, piperidine’s role in the development of next-generation therapeutics has made it highly sought-after by pharmaceutical companies. In countries like the U.S., China, and India, government-backed initiatives and funding support for pharmaceutical research further amplify the market's momentum. As pipeline projects expand and global health concerns rise, the need for high-purity intermediates like piperidine continues to grow, thereby propelling market demand throughout the forecast period.

Restrain

-

Stringent environmental and regulatory norms regarding piperidine handling limit market expansion globally.

Despite the rising demand, stringent environmental regulations and handling guidelines for piperidine present a significant restraint to the market’s growth. Piperidine is classified as a hazardous and flammable compound, requiring careful storage, transportation, and disposal. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA) have imposed strict norms to manage emissions and prevent environmental contamination, which adds complexity and cost to operations. Additionally, manufacturers must comply with REACH registration and other chemical safety frameworks, which can delay production timelines and increase compliance expenses. Smaller firms, in particular, may find it financially burdensome to meet these regulatory standards, potentially discouraging market entry or expansion. These limitations collectively hamper the pace at which the Piperidine Market can grow, especially in regions with stricter environmental policies.

Opportunity

-

Surging demand for sustainable agrochemical solutions presents growth opportunities for piperidine manufacturers.

As agriculture shifts towards higher productivity and sustainability, the demand for efficient agrochemical solutions has opened new opportunities for the Piperidine Market. Piperidine is widely used in the synthesis of herbicides and pesticides, which are vital for boosting crop yields. The expanding population and rising food demand are pushing governments and agricultural companies to invest in improved crop protection technologies. In regions like Asia-Pacific and Latin America, emerging economies are heavily adopting modern farming practices, leading to increased use of piperidine-based compounds. Additionally, ongoing innovation in green chemistry and eco-friendly formulations aligns well with piperidine derivatives, making it a key ingredient in sustainable agrochemical product pipelines. This emerging demand, combined with favorable policy support for agricultural innovation, presents substantial growth prospects for piperidine producers.

Challenge

-

Health hazards and toxicological concerns regarding piperidine usage pose operational and reputational challenges.

Health and safety concerns regarding piperidine exposure remain a significant challenge for manufacturers and end-users alike. Piperidine is associated with a range of toxicological risks, including respiratory irritation, skin burns, and central nervous system effects upon prolonged exposure. These hazards necessitate strict occupational safety protocols, including the use of personal protective equipment (PPE) and adequate ventilation systems in manufacturing facilities. Failure to comply with health safety standards can lead to workforce health incidents, legal liabilities, and damage to company reputation. Moreover, increased public scrutiny of chemical safety and a growing preference for less hazardous alternatives could put additional pressure on companies using or producing piperidine. These factors make operational handling complex and increase overhead costs, presenting challenges to sustained market growth.

Piperidine Market Segmentation Analysis

By Type

99% purity segment held the largest market share around 68% in 2023. It is owing to extensive utilization of 99% pure piperidine in high-precision applications, especially pharmaceuticals and agrochemicals. Because even trace impurities can compromise the efficacy of an API or high-performance agrochemical formulation, 99% pure piperidine is an essential building block for both types of products. The pharmaceutical industry has very high quality and regulatory expectations; drug development in this area, particularly for neurological and infectious diseases, relies heavily on high-purity intermediates such as 99%-pure piperidine. Moreover, agencies such as the FDA and EMA also promote the deployment of higher purity chemicals during the production process, thereby supporting growth. The lab-level purity also provides consistency during industrial scale applications, which contributes to the reliability and reproducibility of the processes, therefore making this level of purity a favorable among manufacturers, and leading this segment in terms of market share.

By End-Use Industry

Pharmaceutical held the largest market share around 37% in 2023. It is wide range of active pharmaceutical ingredients (APIs), is expected to account for the major market share in terms of application. Piperidine is widely employed in preparations of drugs for CNS disorders, anticancer, analgesics, etc. This stable heterocyclic formation makes this compound an advantageous building block in medicinal chemistry. The global demand for novel therapeutics and the rise in chronic diseases have substantially broadened the horizon of drug formulations based on piperidine. This has also contributed to the demand, since pharmaceutical companies are conducting extensive research and development in recent times, while there is an increasing trend among the emerging countries to produce generic drugs with new drug delivery systems such as piperidine. This has only further entrenched its position as the market leader in pharmaceutical manufacturing as regulators continue to steadily prioritize high-purity intermediates and compliance standards.

Piperidine Market Regional Outlook

Asia Pacific held the largest market share around 42% in 2023. It is due to availability of inexpensive raw materials, skilled labor, favorable government policies supporting chemical manufacturing. These intermediates have piperidine, which accounted for the significant use owing to the rise in demand for generic drugs and the increasing investments in drug development across the region. Also, an increase in the agricultural sector in countries like India and China has fueled the need for agrochemicals where many products are made in piperidine derivatives especially to be used in different pesticide formulations. In addition to this, the North America region also has mediocre of CMOs available in and around it to increase scalability and efficiency of production; this too plays an increasing role in addition to the previously mentioned, which adds to North America regions positioning in the global piperidine market.

North America held a significant market share. It is demand for piperidine has stemmed from the region’s inclination towards advanced drug discovery, intensive R&D spending coupled with a well-developed regulatory framework. Moreover, the growing presence of key chemical corporations and contract research organizations (CROs) have led to continuous production and development of piperidine derivatives. Technological development of synthetic chemistry in North America, in addition to strong agrochemical industry in U.S. and Canada, with piperidine application in herbicide and pesticide formulations will also support the business growth. Additionally, the diversification of production processes specifically surrounding specialty chemicals and sustainable methods are reinforcing this region as an important global component of the piperidine market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Piperidine, 4-Piperidone)

-

Jubilant Ingrevia (Piperidine Anhydrous, 1-Boc-piperidine)

-

Vertellus Holdings LLC (Piperidine, 2,6-Lutidine)

-

Koei Chemical Co., Ltd. (Piperidine, Aminopiperidine)

-

Sanonda Chemical Group Co., Ltd. (Piperidine, Methylpiperidine)

-

Shandong Efirm Biochemistry Co., Ltd. (Piperidine, 1-Benzylpiperidine)

-

Zhengzhou Alfa Chemical Co., Ltd. (Piperidine, N-Methylpiperidine)

-

Hengan Biochemistry (Piperidine, Piperidine Hydrochloride)

-

Tianjin Zhongxin Chemtech Co., Ltd. (Piperidine, 4-Piperidinol)

-

Suzhou Dongrui Pharmaceutical Co., Ltd. (Piperidine, 2-Chloropiperidine)

-

Alfa Aesar (Piperidine, 2,6-Dimethylpiperidine)

-

Tokyo Chemical Industry Co., Ltd. (Piperidine, Piperidinecarboxylic acid)

-

Loba Chemie Pvt. Ltd. (Piperidine, 1-(2-Hydroxyethyl) piperidine)

-

Aarti Drugs Ltd. (Piperidine, Diethylpiperidine)

-

Haihang Industry Co., Ltd. (Piperidine, Isopropylpiperidine)

-

Synasia Inc. (Piperidine, Tert-butyl piperidine)

-

Chemieliva Pharmaceutical Co., Ltd. (Piperidine, Piperidine-4-carboxylic acid)

-

Finetech Industry Ltd. (Piperidine, 1-Phenylpiperidine)

-

Ningbo Inno Pharmchem Co., Ltd. (Piperidine, Hexahydropyridine)

-

VWR International (Piperidine, 1-Ethylpiperidine)

Recent Development:

-

In June 2024: BASF revealed plans to expand production capacity for essential intermediates, including piperidine derivatives, at its Ludwigshafen facility. This initiative aims to address the rising demand from the pharmaceutical and agrochemical sectors.

-

In March 2024: Vertellus finalized the acquisition of a specialty chemicals firm, broadening its portfolio in pyridine and piperidine derivatives and reinforcing its presence in the global market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 68.30 Million |

| Market Size by 2032 | USD 114 .30 Million |

| CAGR | CAGR of 5.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (99% Purity, 98% Purity) •By End Use Industry (Pharmaceutical, Agrochemicals, Rubber, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Jubilant Ingrevia, Vertellus Holdings LLC, Koei Chemical Co., Ltd., Sanonda Chemical Group Co., Ltd., Shandong Efirm Biochemistry Co., Ltd., Zhengzhou Alfa Chemical Co., Ltd., Hengan Biochemistry, Tianjin Zhongxin Chemtech Co., Ltd., Suzhou Dongrui Pharmaceutical Co., Ltd., Alfa Aesar, Tokyo Chemical Industry Co., Ltd., Loba Chemie Pvt. Ltd., Aarti Drugs Ltd., Haihang Industry Co., Ltd., Synasia Inc., Chemieliva Pharmaceutical Co., Ltd., Finetech Industry Ltd., Ningbo Inno Pharmchem Co., Ltd., VWR International |