Plant-Based Collagen Market Report Scope & Overview:

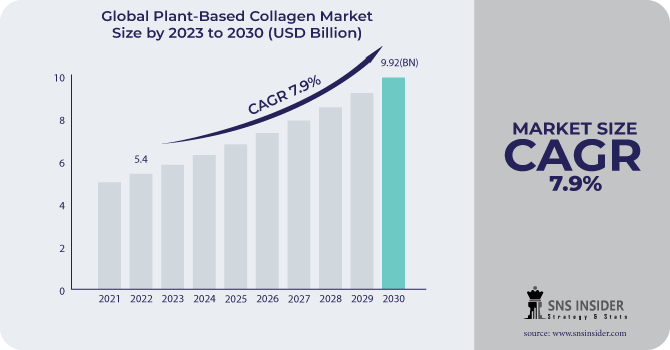

The Plant-Based Collagen Market size was USD 5.4 billion in 2022 and is expected to Reach USD 9.92 billion by 2030 and grow at a CAGR of 7.9% over the forecast period of 2023-2030.

Collagen protein gives these tissues shape, strength, and suppleness. Plant-based collagen is a cruelty-free and vegan alternative to animal-based collagen. It's manufactured with plant-based proteins like pea, soy, and rice. Plant-based collagen is frequently regarded as a more ecological and ethical alternative to animal-based collagen.

Based on the Distribution Channel, the online segment is expected to account for over 50% of the global plant-based collagen market share by 2028. This growth is being driven by the increasing popularity of e-commerce and the growing number of consumers who are purchasing plant-based products online.

The Dietary Supplements industry is rapidly growing as a result of rising demand for plant-based products and increased knowledge of the health benefits of plant-based collagen. Plant-based collagen is being employed in a range of medical applications, including wound healing and bone regeneration, so the Pharmaceutical and Healthcare market is also expanding.

MARKET DYNAMICS

KEY DRIVERS

-

Rapidly increasing obese population

Obesity is an alarming risk factor for several chronic diseases, including heart disease, stroke, type 2 diabetes, and cancer. Collagen is a protein that is required for healthy skin, joints, and muscles. Natural collagen production declines as people age. This can result in a variety of issues, including wrinkles, drooping skin, and joint pain. Obese people are more prone than normal-weight people to have lower collagen levels. This is due to the fact that obesity can produce inflammation and oxidative stress, both of which can destroy collagen fibers. Collagen supplements can help to boost the body's collagen levels. This has the potential to drive the Plant-Based Collagen Market.

-

Rising awareness of the potential health benefits of collagen

RESTRAIN

-

High cost of Plant-Based Collagen

Plant-based collagen currently has greater production costs than animal-based collagen. This is due to the fact that the technology for making plant-based collagen is still relatively new and not frequently used. As a result, consumers must pay more for plant-based collagen products. This can be a barrier to access for some customers, particularly those on a tight budget. Raw materials for plant-based collagen, such as pea protein and soy protein, can be more expensive than raw materials for animal-based collagen.

-

Lack of awareness

OPPORTUNITY

-

Rising demand for vegan and cruelty-free products.

Plant-based collagen is an appropriate substitute for animal-based collagen, and it is frequently more sustainable and cost-effective. According to a recent survey, more than 70% of consumers are willing to pay more for vegan or cruelty-free items. This trend is especially prevalent among younger consumers, with more than 80% of Millennials and Gen Z consumers willing to pay more for vegan and cruelty-free items. Some customers are driven by ethical considerations since they do not want to support industries that cause cruelty to animals. Environmental concerns motivate others and the growing demand for vegan and cruelty-free products drives the plant-based diet.

-

Expansion into new markets

CHALLENGES

-

Stringent rules and regulations

Plant-based collagen products are governed by stringent labeling rules in several countries. Manufacturers, for example, may be compelled to identify the source of the plant-based collagen as well as the individual constituents in the product. Manufacturers of plant-based food must adhere to all applicable safety regulations. Manufacturers of plant-based collagen products may be required to conduct clinical trials in various countries to demonstrate the safety and efficacy of their products. Despite the hurdles provided by tight rules and regulations, the market for plant-based collagen is likely to develop.

IMPACT OF RUSSIAN-UKRAINE WAR

The war between Russia and Ukraine has had a substantial influence on the worldwide plant-based collagen market. The war has interrupted the supply of raw materials necessary to create plant-based collagen, such as pea protein and soy protein. As a result, the price of plant-based collagen products has risen. Since the start of the war, the price of pea protein and soy protein, the two key constituents of plant-based collagen, has risen by 15%. Since the start of the war, demand for plant-based collagen products has declined by 2%.

IMPACT OF ONGOING RECESSION

The recession has impacted to Plant-based collagen products market. The supply of plant-based collagen products has decreased by 10% since the start of the war. Plant-based collagen products are frequently regarded as a more cost-effective alternative to animal-based collagen products. This means that during a recession, demand for plant-based collagen products may surge. In 2022, demand for plant-based collagen products is expected to rise by 3%. However, the price of pea protein has increased by 5%. This is attributable to a variety of factors, including growing fuel and labour costs. Increased production expenses are anticipated to be passed on to consumers as increased pea protein prices.

MARKET SEGMENTATION

By Product type

-

Gelatin

-

Native collagen

-

Hydrolyzed collagen

By Source

-

Soy

-

Pea protein

-

Hemp

-

Others

By Distribution Channel

-

Online

-

Offline

By Application

-

Food and beverages

-

Cosmetics and personal care

-

Pharmaceutical and healthcare

-

Dietary supplements

-

Others

.png)

REGIONAL ANALYSIS

North America dominates the plant-based collagen and is expected to have a 39% market share in 2022. Due to the growing popularity of various end-user industries such as supplementary, healthcare, cosmetics, and food & beverage. The United States is expected to account for 66% of the North American plant-based collagen market. Furthermore, rising vegan diet awareness, combined with a shift towards vegetarianism, is likely to boost market growth in this region.

Asia-Pacific is predicted to be the fastest-growing region during the forecast period of 2023-2030. The growth is due to an increase in investment in the development of natural components. High investments in R&D activities to create collagen-based products are also predicted to boost market growth in this area. China controls 33% of the Asian plant-based collagen market.

Europe is estimated to hold 30% of the plant-based collagen market in 2022. Germany is expected to occupy 23% of the European plant-based collagen market. The region has a high value on sustainability and innovation, which drives demand for plant-based collagen products. Furthermore, increased awareness of the health benefits of collagen is a crucial driver driving market expansion.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Plant-Based Collagen Market are OZiva, Nitta Gelatin Inc., SENIORITY.IN, Raw Beauty Lab, Rejuvenated, Nutricore Biosciences Private Limited, PlantFusion, Amway Europe, SMPNutra, Smartnutras International, LLC, Titan Biotech, and other key players.

Nitta Gelatin Inc-Company Financial Analysis

RECENT DEVELOPMENTS

In October 2023, Sanitas intends to continue pioneering new developments in the skincare sector with the release of the Collagen + Elastin Face Cream and Collagen + Elastin Eye Cream.

In July 2023, OZiva, India's leading certified clean and plant-based holistic health brand, announced the favorable results of clinical research on CollabZen, the key plant-based component in OZiva Collagen Builder.

In May 2023, DERMA E, a renowned natural, clean beauty cosmetics brand, released its latest product, the Advanced Peptides & Flora CollagenTM Cryo-Gel Mask. With Flora-CollagenTM, Arginine®, Matrixyl Synthe 6®, Edelweiss Extract, and Plant Stem Cells, this cutting-edge mask penetrates the skin with potent multi-peptides to stimulate skin recovery and get it ready for a daytime or nightly regimen.

| Report Attributes | Details |

| Market Size in 2022 | US$ 5.4 Billion |

| Market Size by 2030 | US$ 9.92 Billion |

| CAGR | CAGR of 7.9 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Hydrolyzed Collagen, Gelatin, Native Collagen) • By Source (Soy, Pea Protein, Hemp, Others) • By Distribution Channel (Online, Offline) • By Application (Food and Beverages, Cosmetics and personal care, Pharmaceutical and Healthcare, Dietary Supplements, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | OZiva, Nitta Gelatin Inc., SENIORITY.IN, Raw Beauty Lab, Rejuvenated, Nutricore Biosciences Private Limited, PlantFusion, Amway Europe, SMPNutra, Smartnutras International, LLC, Titan Biotech |

| Key Drivers | • Rapidly increasing obese population • Rising awareness of the potential health benefits of collagen |

| Market Challenges | • Stringent rules and regulations |