Plastic Antioxidants Market Report Scope & Overview:

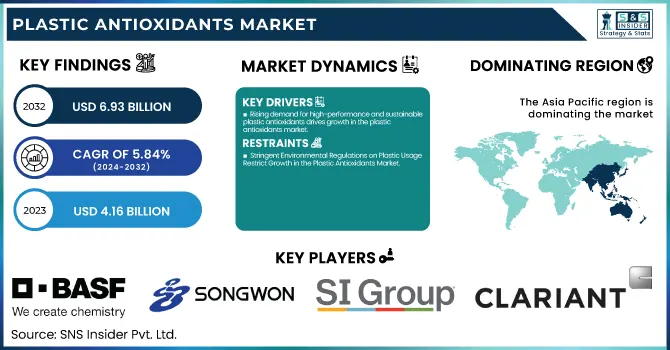

The Plastic Antioxidants Market size was USD 4.16 billion in 2023 and is expected to reach USD 6.93 billion by 2032 and grow at a CAGR of 5.84% over the forecast period of 2024-2032.

To Get more information on Plastic Antioxidants Market - Request Free Sample Report

The report provides an in-depth analysis of global production capacity and utilization by country and antioxidant type, offering insights into supply dynamics. It examines feedstock prices and cost trends, highlighting regional variations affecting manufacturing. The report covers regulatory compliance and environmental impact, analyzing government policies and sustainability initiatives. Innovation and R&D trends are explored, focusing on advancements in bio-based and high-performance antioxidants. It evaluates market adoption across plastic types, detailing demand in PE, PP, PVC, PS, and engineering plastics. Additionally, the study assesses sustainability metrics, including emissions data, waste management, and circular economy strategies. These insights provide a comprehensive view of market dynamics, cost factors, regulatory challenges, and future growth opportunities.

The United States dominated the plastic antioxidants market in 2023, holding a significant market share of 78% with a market size of around USD 810 million. This dominance is primarily driven by the country’s well-established plastic manufacturing industry, strong demand from packaging, automotive, and electronics sectors, and stringent regulatory frameworks promoting the use of high-performance additives. The U.S. benefits from a robust production infrastructure, access to advanced raw materials, and continuous innovation in antioxidant formulations, particularly in sustainable and high-performance solutions. Additionally, the presence of key players and ongoing investments in R&D for eco-friendly plastic stabilizers further reinforce the country’s leadership in the market. The growing adoption of recyclable and bio-based plastics, coupled with government initiatives to enhance sustainability in the plastics industry, has also contributed to the increasing demand for plastic antioxidants in the region.

Plastic Antioxidants Market Dynamics

Drivers

-

Rising demand for high-performance and sustainable plastic antioxidants drives growth in the plastic antioxidants market.

The increasing demand for durable, high-performance plastics across industries such as packaging, automotive, and electronics is a key driver for the Plastic Antioxidants Market. With stringent environmental regulations and growing consumer preference for sustainable materials, manufacturers are focusing on advanced antioxidant formulations that enhance plastic longevity while minimizing environmental impact. The shift toward bio-based and non-toxic stabilizers is further fueling market expansion. Additionally, the rise in recyclable plastics and circular economy initiatives is prompting companies to develop innovative antioxidant solutions that maintain polymer integrity over multiple recycling cycles. The strong presence of key market players in developed economies, along with ongoing R&D investments, is expected to further support market growth. The U.S., in particular, leads in demand due to its advanced manufacturing capabilities and emphasis on sustainability-driven innovations in the plastics industry.

Restrain

-

Stringent Environmental Regulations on Plastic Usage Restrict Growth in the Plastic Antioxidants Market

Governments worldwide are enforcing strict regulations on plastic production, disposal, and recycling, which is acting as a major restraint for the Plastic Antioxidants Market. The banning of single-use plastics, along with mandates for biodegradable and compostable materials, has led to a decline in conventional plastic production. Regulatory agencies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are imposing stringent guidelines on plastic additives, including antioxidants, due to concerns over their potential environmental and health impacts. Additionally, the shift toward green chemistry and sustainable alternatives is pressuring manufacturers to reformulate products and invest in eco-friendly plastic stabilizers. This transition is costly and requires extensive R&D efforts, leading to challenges for companies that rely heavily on traditional plastic antioxidant solutions for market stability.

Opportunity

-

Technological advancements in antioxidant formulations present growth opportunities in the plastic antioxidants market

The rising focus on next-generation plastic antioxidant solutions is creating significant growth opportunities for the Plastic Antioxidants Market. Companies are actively developing high-performance and multifunctional antioxidants that offer superior thermal stability, oxidation resistance, and extended polymer lifespan. The trend toward nanotechnology-based antioxidants is gaining traction, as these materials provide enhanced dispersion properties and higher efficiency with lower dosage requirements. Additionally, the development of biodegradable and bio-based antioxidants is addressing regulatory concerns while supporting sustainability goals. Research initiatives in polymer stabilization technologies are also contributing to product advancements, particularly in automotive, packaging, and medical applications. With increasing investments in R&D and strategic collaborations, market players are expected to capitalize on these advancements and expand their portfolios with innovative, environmentally friendly solutions, fostering long-term industry growth.

Challenge

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Challenge the Plastic Antioxidants Market

The volatility of raw material prices and disruptions in global supply chains present a major challenge to the plastic antioxidants market. Key raw materials, including phenols, phosphites, and thioesters, are subject to price fluctuations due to varying demand, geopolitical tensions, and regulatory restrictions on chemical manufacturing processes. Additionally, dependence on imported raw materials, particularly from Asia-Pacific regions, has made manufacturers vulnerable to logistics bottlenecks and trade restrictions. Companies are now exploring regional sourcing strategies and sustainable alternatives to reduce reliance on volatile markets. However, transitioning to cost-effective and eco-friendly solutions requires significant investments, making it a complex challenge for manufacturers in the competitive plastic antioxidants industry.

Plastic Antioxidants Market Segmentation Analysis

By Type

In 2023, Phenolic held the plastic antioxidants market at 42% of total revenue share, owing to their excellent thermal stability and oxidation resistance. Because of their ability to extend the life of polymers, phenolic antioxidants are indispensable additives in the packaging, automotive, and consumer goods industries. BASF SE announced Irgastab, a sustainable, high-performance phenolic antioxidant, for plastic applications. In a like manner, Songwon Industrial Co., Ltd., on the method worked aftermarket stage, extended its antioxidant product line to cater to increased efficiency and recyclability. Manufacturers are emphasizing sustainable low-VOC and non-toxic alternatives to meet regulatory mandates, given the rising demand for green stabilizers. The leading share of this segment adheres to the overall plastic antioxidants market trends as longer-lasting & high-performance materials are in constant demand across industries to provide sustainable polymer solutions.

By Polymer Resin

The Polyethylene (PE) segment is estimated to possess the largest market share of 32% in the Plastic Antioxidants Market. To provide durability and recyclability, antioxidants are incorporated into the PE-based plastics to prevent its thermal degradation and oxidation. Solvay S.A. has just introduced a higher-performance antioxidant solution for PE films that supports sustainability while improving mechanical properties. A high-efficiency antioxidant additive for use in PE-based applications was also introduced to improve UV stability by ADEKA Corporation. The rising penetration of recycled and bio-based PE plastics is also fueling demand for high-performance antioxidant solutions, further cementing the segment's leadership in the market.

By Application

The plastic antioxidants market is anticipated to have a 38% share in the Food & Beverage segment, owing to increasing requirements of food packaging solutions to prolong the shelf life of products and retain their integrity. The presence of antioxidants in the stabilization of polymers in food-grade plastics prevents polymer degradation from exposure to heat and light, as well as its interaction with oxygen. The story continues below the advertisement. Clariant AG introduced an FDA-compliant plastic antioxidant for food contact applications with safety and sustainability in mind. In another, SI Group launched a low-VOC antioxidant for use in food packaging films, suitable for compliance with international food safety standards. The growth of the segment can be attributed to the ongoing transition toward sustainable high-barrier packaging materials for food products, wherein the plastic antioxidant is essential in providing food quality and increasing recyclability of materials, which further augments the relevance of this segment across the market space.

Plastic Antioxidants Market Regional Outlook

Asia Pacific held the largest market share, around 38%, in 2023. It is owing to rapid industrialization, high plastic production, and increasing demand for polymer-based applications. China is at the top of the list, along with China, India, Japan, and several other countries. Demand for plastic stabilizers in the region has spiked massively, driven by the booming packaging, automotive, and electronics sectors, where improving the durability of the material is a critical need. Moreover, increasing penetration of recycled plastics and bio-based polymers, along with governmental measures for sustainable plastic production, is catalyzing the market growth. To meet rising demand from regional end-use sectors, firms such as BASF, Songwon, and ADEKA Corporation are expanding their antioxidant production plants in the Asia-Pacific. The abundance of low-cost raw materials, low-cost skilled labor, and better manufacturing capabilities further position the region as a key player in the market.

North America held a significant market share in the plastic antioxidants market. It is driven by high polymer consumption in packaging, automotive, and construction industries. Organic antioxidant development from well-known plastics manufacturers in Canada and the United States (SI Group, BASF Corporation, and Dow Inc.) has led to a growing ecosystem for plastic manufacturing in North America. In particular, the stringent environmental regulations in the region [EPA and FDA] are likely to accelerate the use of high-performance low-VOC antioxidants in food packaging and medical applications. Demand for efficient stabilizers has witnessed an increase due to circular economy practices in North America, i.e., through recycled and bio-based plastics. The region has a well-cemented infrastructure of sophisticated R&D facilities and an industrial base, which makes it beneficial for driving growth for plastic antioxidants.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Irganox 1010, Irgafos 168)

-

Songwon Industrial Co., Ltd. (SONGNOX 1076, SONGNOX 1135)

-

SI Group, Inc. (WESTON 705, ETHANOX 330)

-

Clariant AG (Hostanox O3, AddWorks PKG 902)

-

Solvay S.A. (CYASORB UV-3853, CYANOX 1790)

-

Adeka Corporation (ADEKA STAB AO-60, ADEKA STAB AO-80)

-

Everspring Chemical Co., Ltd. (Evernox 10, Everfos 168)

-

Dover Chemical Corporation (Doverphos S-9228, Doverphos S-480)

-

Milliken & Company (Millad NX 8000, Hyperform HPN-68L)

-

Sumitomo Chemical Co., Ltd. (SUMILIZER GA-80, SUMILIZER GM)

-

Trigon Antioxidants Pvt. Ltd. (TRIGONOX 1010, TRIGONOX 168)

-

Double Bond Chemical Ind., Co., Ltd. (DBOX 10, DBOX 168)

-

Lycus Ltd. (Lycus Antioxidant 1010, Lycus Antioxidant 168)

-

Valtris Specialty Chemicals (VANOX 10, VANOX 168)

-

Omnova Solutions Inc. (Omnox 1010, Omnox 168)

-

Oxiris Chemicals S.A. (IONOL 103, IONOL 152)

-

Dongguan Baoxu Chemical Technology Ltd. (BX Antioxidant 1010, BX Antioxidant 168)

-

Shandong Linyi Sunny Wealth Chemicals Co., Ltd. (SW AO-1010, SW AO-168)

-

Nanjing Union Rubber & Chemicals Co., Ltd. (URC AO-1010, URC AO-168)

-

Rianlon Corporation (Rianox 1010, Rianox 168)

Recent Development:

-

In December 2023, BASF launched Irgastab PUR 71, a cutting-edge antioxidant aimed at improving performance and ensuring regulatory compliance in polyols and polyurethane foams. This advancement aligns with the industry's growing emphasis on environmental, health, and safety standards.

-

In June 2023, Eastman Chemical Company expanded its production capacity for Hindered Amine Light Stabilizers (HALS), reinforcing its commitment to addressing the rising demand for HALS in the plastics market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.16 Billion |

| Market Size by 2032 | USD 6.93 Billion |

| CAGR | CAGR of 5.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Phenolic, Phosphite & Phosphonite, Antioxidants, Other), • By Polymer Resin (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Acrylonitrile Butadiene Styrene, Others) • By Application (Automotive, Food & Beverages, Pharmaceuticals, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Songwon Industrial Co., Ltd., SI Group, Inc., Clariant AG, Solvay S.A., Adeka Corporation, Everspring Chemical Co., Ltd., Dover Chemical Corporation, Milliken & Company, Sumitomo Chemical Co., Ltd., Trigon Antioxidants Pvt. Ltd., Double Bond Chemical Ind., Co., Ltd., Lycus Ltd., Valtris Specialty Chemicals, Omnova Solutions Inc., Oxiris Chemicals S.A., Dongguan Baoxu Chemical Technology Ltd., Shandong Linyi Sunny Wealth Chemicals Co., Ltd., Nanjing Union Rubber & Chemicals Co., Ltd., Rianlon Corporation. |