Point-of-Sale Display Market Report Scope & Overview:

Get More Information on Point Of Sale Display Market - Request Sample Report

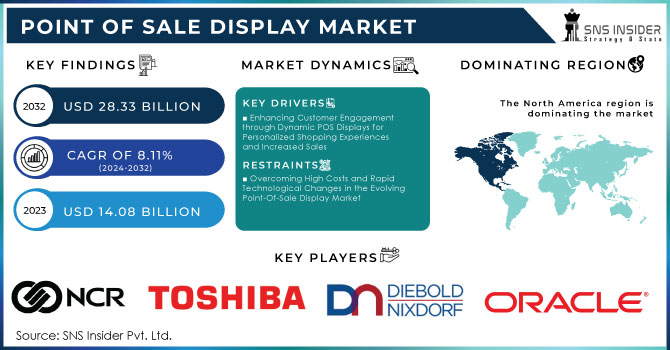

The Point Of Sale Display Market was valued at USD 14.08 Billion in 2023 and is expected to reach USD 28.33 Billion by 2032 and grow at a CAGR of 8.11% over the forecast period 2024-2032.

The point of sale display market is growing due to the increasing adoption of more developed retail technologies, such as in-store digital signage and interactive displays, to engage with customers as well as build improved shopping experiences. Retailers have been investing in novel POS solutions to attract consumers and offer personalized experiences, which will help build sales. Over 70% of purchasing decisions are made in-store at the point of sale, demonstrating how significantly retail displays and visual merchandising impact consumers' buying choices. Additionally, an impressive 76% of shoppers enter a store they haven't visited before just because of its signs, highlighting the essential role that signage plays in drawing in potential customers and increasing foot traffic to retail locations. Online shopping has driven physical stores to increase their competitiveness regarding in-store marketing and, therefore increase the need for POS displays. These will not only be a product display but also messages and offers from the brand to fill the integration gap between online and offline points of sale.

Retailers have been embracing the growing use of mobile displays that are offered on the market because they are flexible and easy to operate, enabling the employees to fully serve every customer in the store. In addition, the shifting consumer preference toward a more engaging and more vibrant experience in shopping leads retailers to invest in advanced POS display technologies. There is an increased use of POS displays in every form of commercial business sector because of the requirement to manage efficient inventories and show products across these businesses.

Point Of Sale Display Market Dynamics

KEY DRIVERS:

-

Enhancing Customer Engagement through Dynamic POS Displays for Personalized Shopping Experiences and Increased Sales

Growth in the point-of-sale display Market will be linked to customer interaction and the use of a personalized shopping experience. With the greater familiarity of consumers towards the digital interface, POS displays can be used by retailers to develop an interesting and interactive shopping environment. For example, a clothing retail establishment would create its content with the help of digital signage and display real-time promotional messages showing new arrivals or target-specific discounts according to the shopping history of customers. What they do is draw attention at the point of sale, thus affecting consumer choices and, consequently sales. Combining data analytics with information on the point-of-sale display enables retailers to chart customer preferences and habits, creating targeted marketing efforts that can appeal to every unique shopper. This feature allows companies to shift their strategies very promptly by defining their content by matching prevailing trends or seasonal demand. This, in turn, has led to increased POS displays across industries: Retail and hospitality are prime examples. Restaurants can upload daily specials or customer reviews on POS displays, thus enriching the experience of consumers at the point of consumption. The best part is that it boosts customer engagement and revenue through the on-time relevance of marketing efforts.

-

Driving Market Growth with Mobile and Contactless Payment Solutions for Enhanced Shopping Experiences and Efficiency

A significant driver of growth in the market is the rising preference for mobile and contactless payment systems. As consumers increasingly favor convenient and fast payment methods, mobile POS displays have gained prominence across various retail outlets. These mobile systems empower sales staff to assist customers directly from the sales floor, effectively reducing wait times at checkout and enhancing overall store efficiency. The growing adoption of mobile payments and smartphone usage has prompted retailers to embrace flexible POS solutions that enhance the shopping experience. Furthermore, the integration of mobile displays with advanced inventory management systems and data analytics has streamlined operations, minimized errors, and enabled personalized customer service. This shift towards mobile and contactless solutions is expected to drive further growth in the POS display market, as businesses adapt to evolving consumer preferences and prioritize efficiency and convenience in their operations.

RESTRAIN:

-

Overcoming High Costs and Rapid Technological Changes in the Evolving Point-Of-Sale Display Market

The installation of expensive digital displays and high-tech mobile POS systems may be prohibitively costly for small and medium-sized enterprises, and even large ones, thus limiting their adoption of the latest technologies. For example, a small boutique would not bother to install interactive displays or mobile POS systems, as this may cost much, but instead adopt very traditional ones that are also cheaper. A further challenging aspect of the market is that modern technology depreciates so rapidly. From day to day, new technologies just pop into existence, leaving customers with little choice other than to shift to a newer version to keep pace with the rest of the world. For instance, if a retail chain has invested in fixed POS displays, they have then to upgrade to mobile or contactless solutions as the consumers' preferences shift toward convenience and flexibility. Such frequent need for upgrades can easily become cost and disruption-intensive, thus challenging the goals of businesses wanting to maintain a modern POS infrastructure.

Point Of Sale Display Market Segmentation Overview

BY PRODUCT

Fixed POS Displays had the largest market share at 64.7% in 2023 primarily due to long-standing demand and ease of take-up by various verticals. The system is very efficient and robust in processing large volumes of transactions at big retail stores, supermarkets, and restaurants. Fixed POS displays are recommended since they come with several functionalities, including inventory management, CRM, and advanced analytics. Their strength and supportability for complex systems make them the popular choice for any business looking to achieve stability and comprehensive functionalities.

Mobile POS Displays are projected to be the fastest-growing segment from 2024 to 2032, and this is because of their convenience and flexibility. With consumers currently shifting to seamless shopping experiences with no touch-orientated engagements, businesses embrace mobile POS systems as a method to boost service levels to their customers. The portable solutions enable one to reach customers in every part of the store since one can easily move around hence reducing waiting times, and having the maximum experience in shopping. The fast growth of mobile payments, further propelled by the quickly increasing users of smartphones and digital wallets, gives mobile POS displays additional grounds for becoming a part of the modern retail environment.

BY COMPONENT

In 2023, the hardware segment dominated the market with a 79.5% share, primarily due to its essential role in providing the physical components necessary for any POS system, such as terminals, displays, scanners, and card readers. Businesses in retail and hospitality rely on reliable hardware for efficient transaction processing and operational performance, minimizing customer wait times. Additionally, hardware is crucial for integrating various modules like printers and cash drawers, which further drives its demand. The significant initial investment in high-quality hardware, coupled with regulatory compliance requirements, reinforces its importance in the POS ecosystem, solidifying its market dominance

The software segment is expected to be the fastest-growing area from 2024 to 2032, mainly due to the growing importance of cloud-based solutions and mobile applications, and insights from data. Businesses are increasingly looking for more flexibility and scalability, which is being met using highly advanced POS software, which enables functionalities such as real-time inventory management, customer analytics, and personalized marketing. It has also led to the same enabling users to take advantage of mobile and contactless payments, which enhances the demand for the usual updates and upgrades of software. Digitization and smarter operations are fueling this movement in the POS market leading to the growth of the software segment.

BY APPLICATION

The Retail segment held the largest market share of 61.3% in 2023 because of the immense and diversified need for point-of-sale POS systems. The range of retail businesses, from supermarkets to specialty stores and others, could use POS systems so that high transaction volumes could be managed easily; inventory tracking might be performed; and personalized customer experience offered. Additionally, they use POS displays to effectively promote the products and manage their loyalty programs, thereby enhancing their operational efficiency. Retail is a high-demand market for fixed POS solutions due to their ability to handle complex processes and excellent integration with various store functions, making them the dominant choice in this segment.

The Hospitality segment is projected to experience the fastest growth rate from 2024 to 2032. This is triggered by increased demand for mobile and flexible POS systems that improve customer care in hospitality, particularly in hotels, restaurants, and cafes. Mobile POS solutions speedily generate orders, process real-time payments, and manage tables with an improvement of the guest experience. As the hospitality sector embraces digital transformation, scalable and adaptive POS solutions are needed in the sector, accelerating their rapid adoption.

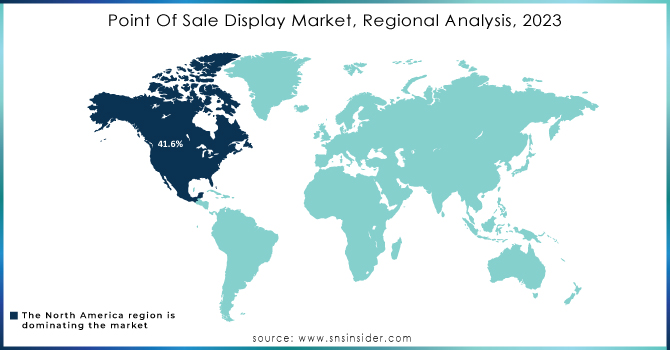

Point Of Sale Display Market Regional Analysis

In 2023, North America dominated the total market share of 41.6% because a developed retail infrastructure exists in this region and acceptance towards POS technologies is high. Its large retail chains, supermarkets, and e-commerce giants in the U.S. and Canada spend money heavily on developing POS systems to enhance customer engagement and operational efficiency. For instance, large box stores like Walmart and Amazon have embraced advanced POS displays to manage their stock, process transactions, and for promotional offers. Similarly, the high technology deployment in this region and the innovation drive towards customer experience have been some of the factors why this region is at the top of the market of POS.

The Asia Pacific region is anticipated to achieve a higher CAGR from 2024 to 2032 as it will be witnessing a fast pace of urbanization and also the increasing retail sector in China and India. The growth in the usage of digital payment solutions by small and medium-sized enterprises is a highly increasing factor for mobile and flexible POS systems. For example, the fast rise of online e-commerce portal sites such as Alibaba has accelerated the adaptation of modern POS systems in the region. Also, there is an increase in contactless payment solutions in China that has increased the adaptation of the modern POS system in the region. In countries like India, government initiatives such as promoting digital payments and achieving financial inclusion have accelerated the region's high growth potential.

Need Any Customization Research On Point Of Sale Display Market - Inquiry Now

Key Players in Point Of Sale Display Market

Some of the major players in the Point Of Sale Display Market are:

-

NCR Corporation (NCR RealPOS 72XRT, NCR SelfServ 90)

-

Toshiba Global Commerce Solutions (TCx 800, SurePOS 700)

-

Diebold Nixdorf (K-One Kiosk, Beetle POS System)

-

HP Inc. (HP Engage One Pro, HP RP9 Retail System)

-

Oracle Corporation (Oracle MICROS Workstation 6, MICROS Compact Workstation 310)

-

Ingenico Group (Lane 5000, Desk/5000)

-

Elo Touch Solutions (EloPOS Z20, I-Series 2.0 for Windows)

-

PAX Technology (A920, PAX E-Series E800)

-

Verifone Systems (Verifone Carbon 10, Verifone M400)

-

Square, Inc. (Square Stand, Square Register)

-

Clover Network, Inc. (Clover Flex, Clover Mini)

-

Samsung Electronics (Samsung Kiosk, Samsung QB55R)

-

Zebra Technologies (Zebra TC21, DS9300 Series Scanner)

-

Panasonic Corporation (Panasonic JS-970, Stingray III POS Terminal)

-

LG Electronics (LG 24CN650N, LG 27TN600V)

-

Casio Computer Co., Ltd. (Casio QT-6600, Casio SE-S100)

-

Fujitsu Limited (Fujitsu TP8, TeamPOS 7000)

-

Posiflex Technology (Posiflex MT-5310A, Posiflex RT-2015)

-

NEC Corporation (TWINPOS G5200, NEC TWINPOS 7)

-

SZZT Electronics (SZZT E850, SZZT X990)

Some of the Raw Material Suppliers for Point Of Sale Display Companies:

-

3M Company

-

Corning Incorporated

-

Samsung SDI

-

LG Chem

-

Sumitomo Chemical

-

DowDuPont

-

Toray Industries

-

Saint-Gobain

-

Nitto Denko Corporation

-

SABIC

RECENT TRENDS

-

In July 2024, Posiflex Technology Inc. introduced its latest flagship POS terminal series, Mozart BT, designed to enhance operational efficiency and customer engagement in retail and hospitality.

-

In June 2024, Epson unveiled the OmniLink® TM-H6000VI, the fastest multifunction hybrid POS receipt printer, setting a new standard in POS printing solutions

-

In February 2024, Rain Technology introduced its Switchable E-Privacy Display Solution, designed to enhance security at point-of-sale (POS) systems by allowing users to toggle between public and private viewing modes. This innovative solution aims to protect sensitive customer information during transactions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.08 Billion |

| Market Size by 2032 | USD 28.33 Billion |

| CAGR | CAGR of 8.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fixed POS Displays, Mobile POS Displays) • By Component (Hardware, Software) • By Application (Retail, Hospitality, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NCR Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, HP Inc., Oracle Corporation, Ingenico Group, Elo Touch Solutions, PAX Technology, Verifone Systems, Square, Inc., Clover Network, Inc., Samsung Electronics, Zebra Technologies, Panasonic Corporation, LG Electronics, Casio Computer Co., Ltd., Fujitsu Limited, Posiflex Technology, NEC Corporation, SZZT Electronics |

| Key Drivers | • Enhancing Customer Engagement through Dynamic POS Displays for Personalized Shopping Experiences and Increased Sales • Driving Market Growth with Mobile and Contactless Payment Solutions for Enhanced Shopping Experiences and Efficiency |

| RESTRAINTS | • Overcoming High Costs and Rapid Technological Changes in the Evolving Point-Of-Sale Display Market |