Data Analytics Outsourcing Market Report Scope & Overview:

To Get More Information on Data Analytics Outsourcing Market - Request Sample Report

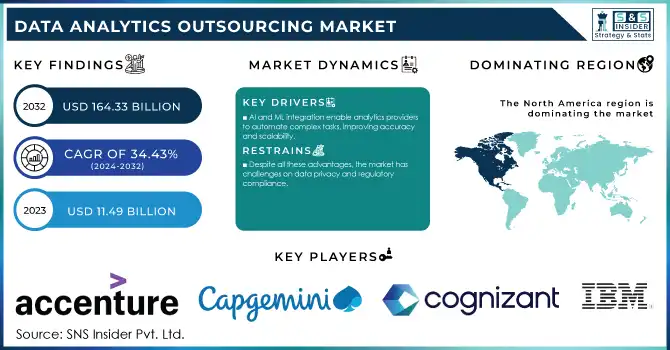

The Data Analytics Outsourcing Market Size was valued at USD 11.49 Billion in 2023 and is expected to reach USD 164.33 Billion by 2032 and grow at a CAGR of 34.43% over the forecast period 2024-2032.

The Data Analytics Outsourcing Market is experiencing highly impressive growth as organizations are increasingly leveraging data-driven strategies to enhance decision-making and operational efficiency. As major economies, including the United States, China, India, Germany, Japan, and France, adopt sophisticated analytics tools, these countries are outsourcing analytics functions to free up resources for strategic priorities. Among them, India stands to be a global hub where almost half of its analytics revenue are from exportations to the United States. This is a growth indication on cost-efficient special analytics servicing in demand globally.

The technological superiority of AI, ML, and analytics on real-time have been major drivers for this market as companies look forward to automating complex analytics tasks using these technologies in order to deliver real-time insights in order to facilitate predictive decision-making. For example, the acquisition of Openstream Holdings by Accenture improves the position in AI-driven analytics solutions for their clients. The acquisition will add over 1,000 digital and cloud experts to Accenture's teams, thereby strengthening the support given to clients in the modernization of systems and adoption of cloud, AI, and IoT technologies.

Governments are also instrumental in shaping the data analytics outsourcing market, especially around the globe. For instance, China using advanced analytics in public health policy and India's growing analytics exports give an outlook on how governmental strategies are now integrating analytics with critical functions. In the United States, regulatory initiatives like the Financial Conduct Authority’s modernization efforts reflect the growing importance of analytics in compliance and policy-making. These developments highlight the diverse applications of analytics outsourcing across public and private sectors.

Data Analytics Outsourcing Market Dynamics

KEY DRIVERS:

-

AI and ML integration enable analytics providers to automate complex tasks, improving accuracy and scalability.

Such technologies enable corporations to analyze vast datasets with unprecedented efficiency and offer real-time insights into predictive capabilities. According to research, most organizations in both the United States and China have adopted advanced analytics technologies as a way of surmounting the challenges of dealing with big data. For instance, TCS's AI and Machine Learning Analytics Solutions earned the company a brand value of USD 2 billion within a single year; there is, thus, potential to transform large industries like BFSI, healthcare, and retail with AI-driven systems.

-

Outsourcing analytics offers cost savings by eliminating the need for expensive in-house setups.

Outsourcing analytics avoids costly in-house setups and saves companies up to 60% of costs involved in their operations. Countries like India, with services at an affordable price, have become the preferential outsource destination for analytics services. Economies of scale and highly advanced technologies, including cloud-based analytics, are capitalized on by specialized providers to provide scalable and efficient solutions. This trend has become dominant in Japan and Germany, due to their requirements for operational efficiency and cost management.

RESTRAIN:

-

Despite all these advantages, the market has challenges on data privacy and regulatory compliance.

Analytics outsourcing companies handle sensitive information regarding the clients' data, thus raising queries on data security and regulatory compliance. The governments of the world impose strict legislations to safeguard data in all ways, like the General Data Protection Regulation for the European Union and the Health Insurance Portability and Accountability Act in the United States. Non-compliance will attract severe penalties, reputational damage, and operation disruptions. For example, cybersecurity laws in China impose strict requirements on data management, hence complicating the outsourcing operations for international companies. Analytical providers must invest in advanced data encryption, masking techniques, and compliance frameworks to mitigate these challenges. However, such investment will increase the cost and deterring factor for smaller organizations that may find outsourcing solutions inaccessible.

Data Analytics Outsourcing Market Segments Analysis

BY TYPE

In 2023, Descriptive Analytics segment dominated the Data Analytics Outsourcing Market with 37% of market share. This form of analytics aims at extracting patterns and insights from historical data, making it a bedrock of most analytics processes. Predictive analytics makes use of AI and ML to analyse large datasets to predict future trends based on past trends.

However, Prescriptive Analytics segment is anticipated to grow with fastest CAGR of 34.89% in 2024-2032, as prescriptive analytics is more than prediction and provides actionable recommendations for optimal decision-making. Some of the main prescriptive solutions that are fast gaining acceptance in industries such as retail and healthcare include improving inventory management and developing personalized medicine.

BY END-USE

Based on End-Use, BFSI segment was the largest in 2023, accounting for 21% of the Data Analytics Outsourcing Market. Banks and financial institutions increasingly adopt analytics outsourcing to improve customer segmentation and detection of fraud and adherence to various regulatory requirements. The retail sector also shows excellent adoption, using analytics for customer targeting and inventory optimization.

Meanwhile, the Healthcare segment is expected to grow at the fastest rate, at a CAGR of 34.94% from 2024 to 2032. Innovations in patient data analysis, precision medicine, and hospital resource optimization are driving demand for outsourced analytics solutions in this sector. Other industries, including telecommunications, manufacturing, and media & entertainment, are also exploring analytics outsourcing to gain competitive advantages and improve operational efficiency.

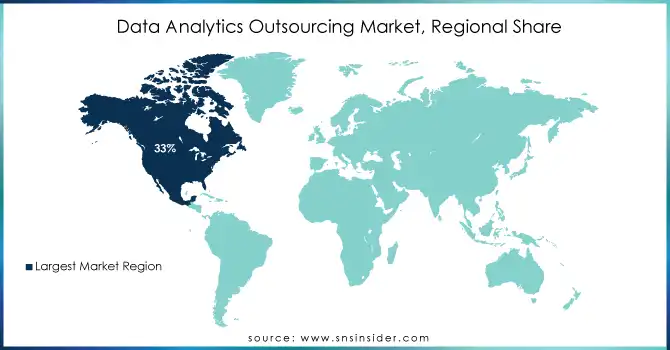

Data Analytics Outsourcing Market Regional Overview

Regionally, the North America region dominated the Data Analytics Outsourcing Market in 2023, with 33% of market share. This dominance is due to high adoption of advanced analytics by key industries, such as BFSI, healthcare, and retail. Within the North America region, the United States and Canada are leaders in the adoption of AI and big data technologies and have an established outsourcing ecosystem.

The Asia-Pacific region is poised to grow at the highest CAGR of 35.44% during the forecast period. Economies of India and China are leading this growth through its rapid digital transformation, cost-effective analytics solutions, and government initiatives. The India focus on AI innovation along with the application of analytics in China for public policy is upping the adoption ante in the region. As the Asia-Pacific market evolves, it appears poised to play a very important role in defining trends in global analytics outsourcing.

Do You Need any Customization Research on Data Analytics Outsourcing Market - Enquire Now

Key Players in Data Analytics Outsourcing Market

Some of the major players in the Data Analytics Outsourcing Market are

-

Accenture (Cloud-based analytics, AI solutions)

-

Capgemini (Digital transformation, big data services)

-

Cognizant (Data visualization, predictive analytics)

-

IBM (Watson Analytics, data management tools)

-

Genpact (AI-driven insights, business process optimization)

-

Deloitte (Audit analytics, risk advisory solutions)

-

TCS (Big data solutions, data engineering)

-

Infosys (Enterprise data management, data modernization)

-

Wipro (AI and analytics platforms, data operations)

-

Google (BigQuery, Google Analytics)

-

SAP (SAP Analytics Cloud, enterprise data solutions)

-

SAS (SAS Visual Analytics, statistical modeling tools)

-

Oracle (Oracle Analytics Cloud, business intelligence)

-

Microsoft (Power BI, Azure Synapse)

-

Salesforce (Einstein Analytics, customer data insights)

-

Alteryx (Data blending, automation solutions)

-

Domo (Data apps, interactive dashboards)

-

Sisense (Integrated analytics platform, data integration)

-

ThoughtSpot (AI-driven analytics, self-service insights)

-

Looker (SQL-based analytics, data visualization tools)

MAJOR SUPPLIERS (Components, Technologies)

-

Intel (processors, AI accelerators)

-

Nvidia (GPUs, AI computing hardware)

-

Cisco (network infrastructure)

-

Seagate (storage solutions)

-

Western Digital (data storage devices)

-

AWS (cloud hosting and infrastructure)

-

Google Cloud (cloud-based infrastructure)

-

Red Hat (open-source software solutions)

-

Cloudera (data management platforms)

-

VMware (virtualization technology)

MAJOR CLIENTS

-

Financial institutions (e.g., JPMorgan Chase, Bank of America)

-

Telecommunications providers (e.g., AT&T, Vodafone)

-

Retail giants (e.g., Walmart, Amazon)

-

Healthcare organizations (e.g., Mayo Clinic, Kaiser Permanente)

-

Manufacturing companies (e.g., General Electric, Siemens)

-

Media and entertainment firms (e.g., Netflix, Disney)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.49 Billion |

| Market Size by 2032 | US$ 164.33 Billion |

| CAGR | CAGR of 34.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Descriptive, Predictive, Prescriptive), • By End-use (BFSI, Telecom, Retail, Healthcare, Media & Entertainment, Manufacturing, Others), • By Application (Sales Analytics, Marketing Analytics, Finance & Risk Analytics, Supply Chain Analytics, Others) • By Deployment Model (On-premises, Cloud-based, Hybrid) • By Data Source (Structured Data, Unstructured Data, Semi-structured Data), • By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Capgemini, Cognizant, IBM, Genpact, Deloitte, TCS, Infosys, Wipro, Google, SAP, SAS, Oracle, Microsoft, Salesforce, Alteryx, Domo, Sisense, ThoughtSpot, and Looker. |

| Key Drivers | • AI and ML integration enable analytics providers to automate complex tasks, improving accuracy and scalability. • Outsourcing analytics offers cost savings by eliminating the need for expensive in-house setups. |

| Restraints | • Despite all these advantages, the market has huge challenges on data privacy and regulatory compliance. |