Display Technology Market Report Scope & Overview:

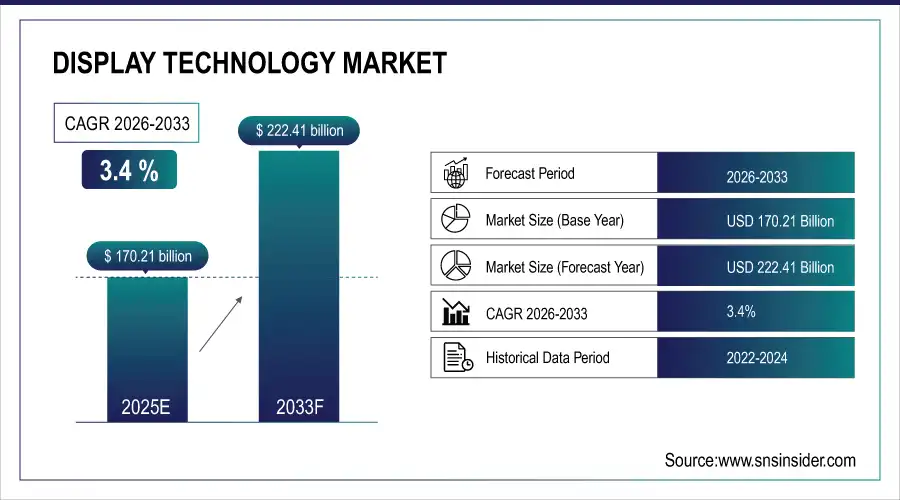

The Display Technology Market size was valued at USD 170.21 Billion in 2025E and is expected to grow to USD 222.41 Billion by 2033 and grow at a CAGR of 3.4 % over the forecast period of 2026-2033.

AET Displays has quickly established a solid presence, thanks to smart investments and personalized strategies that suit each specific region. We have made significant investments in grasping regional market intricacies, such as consumer preferences and regulatory environments, to successfully tailor our products. This method has allowed us to effectively serve a wide range of industries including government agencies, broadcasting, retail, and entertainment, which has greatly impacted our revenue sources. Furthermore, our commitment to establishing a strong supply chain and supportive infrastructure results in smooth operations, on-time deliveries, and exceptional customer service nationwide. We have built a strong base for expansion with 80 partners and distributors across the country and have installed over 25,000 square meters of LED displays in 20 different sectors. In 2024, our goal is to surpass 5,000 deployments, supported by our growing range of more than 50 products and strategic presence with one assembly plant, three offices, three customer experience centres, and five service centres strategically located throughout India.

The display technology market is growing quickly, primarily driven by the automotive and smartphone industries. The move towards electric and autonomous vehicles in the automotive industry has led to an increased need for high-tech displays, highlighted by Tesla's big touchscreens and Mercedes-Benz's MBUX systems. At the same time, the smartphone industry's fondness for AMOLED screens, known for their vivid colors, strong blacks, and low power consumption, has driven expansion. These companies are rapidly growing their market presence through technology improvements and higher production capabilities. In 2023, the total market size for small and medium AMOLED displays saw an 11% growth from the previous year, reaching 842 million shipments. This increase was fueled by the revival of outdoor activities post-pandemic and the introduction of high-performance smartphones such as the iPhone 15 series.

Display Technology Market Size and Forecast:

-

Market Size in 2025E: USD 170.21 Billion

-

Market Size by 2033: USD 222.41 Billion

-

CAGR: 3.4% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Display Technology Market - Request Free Sample Report

Display Technology Market Highlights:

-

Foldable smartphone demand surge with shipments rising 49% YoY in Q1 2024, intensifying competition between Huawei and Samsung and boosting adoption of flexible OLED technology

-

Shifting market leadership as Huawei surpassed Samsung in foldable device shipments by rapidly integrating 5G, while Samsung’s share declined from 80% in 2022 to below 70% in 2023

-

Market expansion outlook with the global foldable phone market projected to grow 11% to reach 17.7 million units in 2024, supported by mass production of components such as UTG and hinges

-

OLED market boost from Apple iPad with the launch of OLED iPad Pro models in 2024 expected to drive a 4% YoY revenue increase, strengthening OLED adoption beyond smartphones and tablets

-

Industry complexity limiting growth as industrial and public display markets face constraints due to product customization, diverse performance needs, and complex supply chains involving OEMs, panel makers, and system integrators

-

Manufacturing and inspection challenges as display makers face quality assurance difficulties in scaling submicron inspection over large surfaces, pushing adoption of advanced microscope-integrated line-scan sensor systems to maintain precision and reduce costs

Display Technology Market Drivers:

-

Competition for dominance in the foldable smartphone market.

The market for foldable smartphones is rapidly expanding, with shipments increasing by 49% year-over-year in Q1 2024. Huawei has taken the lead in the market by surpassing Samsung, thanks to its quick embrace of 5G technology in foldable devices. Despite being the top player, Samsung's market dominance has decreased from 80% in 2022 to below 70% in 2023. It is estimated that the worldwide foldable phone market will increase by 11% to 17.7 million units by 2024. Nevertheless, obstacles like expensive upkeep and higher price points are slowing down rapid expansion. In order to face these challenges, manufacturers are concentrating on lowering costs by mass producing important components such as UTG and hinges. Samsung's goal is to uphold a 60% market share, while Huawei is ambitiously aiming for a share of over 20%. The growing popularity of foldable smartphones is fueling the need for cutting-edge display technologies like flexible OLED panels, crucial for developing the foldable design.

-

Market growth in the OLED display technology industry has been sparked by the introduction of Apple's iPad.

The OLED display market is set for a notable comeback in 2024, mainly due to the expected release of Apple's iPad Pro models with OLED screens. DSCC predicts a 4% year-on-year rise in revenue with the move to tablets driving significant growth. Although smartphones continue to play a significant role, the arrival of OLED iPads is expected to boost market growth and increase the need for better displays in different devices. Therefore, the display technology market as a whole will profit from the growing use of OLED technology.

Display Technology Market Restraints:

-

Navigating through customization and complexity in the industrial and public display market.

The industrial and public display market is encountering major obstacles because of the intricate business models and highly personalized products. In contrast to consumer electronics, these screens are used for a variety of purposes, such as aviation and retail, requiring specific specifications for each scenario. For example, a medical display needs a greater contrast ratio and broader operating temperature range than an indoor signage display, affecting production expenses and complexity. In addition, this sector consists of a variety of parties, such as companies, original equipment manufacturers, touch screen manufacturers, and assembly facilities, forming complex supply networks. Successfully navigating a variety of needs and working closely with numerous collaborators is essential for thriving in this industry.

-

Conquering Obstacles in the Inspection Process of Display Production

The display manufacturing sector encounters major challenges in maintaining accurate quality assurance. Despite improvements, inspection cameras face challenges in maintaining submicron resolution over expansive display surfaces. Nevertheless, the combination of microscope technology and advanced line-scan sensors is transforming inspection capabilities, allowing for submicron precision and precise color testing. Modern high-resolution cameras increase efficiency by replacing multiple cameras, cutting expenses, and enhancing throughput. With advancements in display technology focusing on bigger screens and better image quality, the importance of creating state-of-the-art inspection solutions grows. Cooperation between display manufacturers and inspection technology providers is necessary to meet increasing consumer demands for top-quality and cost-effective products.

Display Technology Market Segment Analysis:

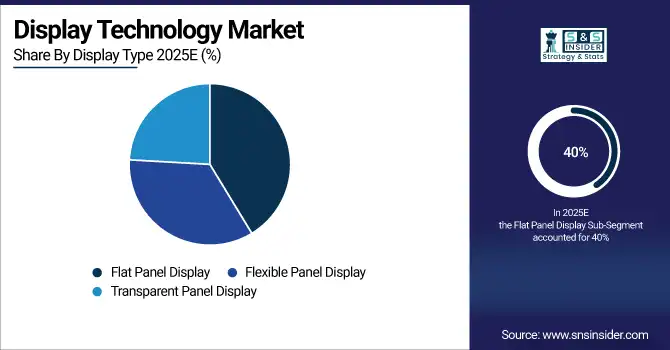

By Display Type

Based on Display Type, Flat Panel Display is dominated for Display technology Market with 40% of share in 2025. Their prevalence in a range of consumer electronics, such as TVs, monitors, and smartphones, is the main reason for their dominance. Flat panel displays have numerous benefits, such as slim designs, excellent resolution, and energy efficiency, which make them a popular choice for various uses.LG Display and Samsung Display are among the top companies that are driving the flat panel display market. Renowned for its cutting-edge LCD and OLED panels, LG Display provides screens for various gadgets, including TVs and mobile phones. Samsung Display, a key player in the sector, is well-known for its top-notch AMOLED and QLED screens, found in its Galaxy line of phones and premium TVs. The significant market share of flat panel displays is due to their widespread use in consumer electronics and ongoing technological improvements.

By Application

In 2025, Smartphone and Tablet controlled 31% of the Display Technology market share, according to their application. The reason for his success is the rising need for high-quality, big-screen gadgets with advanced visual characteristics. The fast progress of display technology in these applications involves improvements like increased resolutions, improved color accuracy, and energy efficiency. Apple and Samsung are major players in this sector, known for their advanced display technologies. Apple's iPhone lineup, which features advanced Super Retina and OLED screens, sets a high standard for smartphone displays, providing vivid colors and detailed images. The ongoing improvements in screen technology and consumer demand for premium mobile devices are key factors in the segment's strong market dominance. With the advancement of the industry, the growing need for more complex display features in smartphones and tablets is predicted to spur additional growth, solidifying the segment's top spot in the display technology market.

Display Technology Market Regional Analysis:

Asia-Pacific Display Technology Market Trends:

Asia Pacific dominated the Display Technology Market in 2025 with a market share of 31%. The Asia Pacific region leads the display technology market because of rapid advancements and increasing consumer interest in top-notch screens. In the forefront are major companies from South Korea, Samsung and LG, with their advanced AMOLED and OLED technologies. Samsung's modular Micro LED displays demonstrate the area's dedication to pushing limits. Japan's Sony, well-known for its BRAVIA televisions, bolsters the area's standing with high-definition OLED options. China's BOE Technology Group cements Asia Pacific's leadership by making progress in LCD and OLED panels. The strong supply chain and increasing number of consumers in the region make Asia Pacific the center of display technology innovation worldwide.

Need any customization research on Display Technology Market - Enquiry Now

North America Display Technology Market Trends:

North America is the fastest growing in Display Technology Market with 28% of share in 2025. North America excels in display technology, fueled by a focus on innovation and high demand for top-quality screens from consumers. Apple and Microsoft are at the forefront of innovative display technologies, such as Apple's Retina and ProMotion displays and Microsoft's PixelSense Applications. Moreover, companies such as Corning play a significant role in the area's leading position by providing innovative materials like Gorilla Glass. North America's dominant position in the global display market is strengthened by the swift uptake of OLED, MicroLED, and high-resolution displays, along with strong research and development efforts.

Europe Display Technology Market Trends:

Europe holds a significant share in the Display Technology Market in 2025, driven by strong demand from automotive, industrial, and professional display applications. Countries such as Germany, the UK, and France lead adoption, supported by advanced manufacturing and R&D ecosystems. Companies like Philips, Bosch, and Barco are key contributors, particularly in medical imaging, automotive dashboards, and digital signage. Europe’s emphasis on energy-efficient, high-resolution, and sustainable display solutions strengthens its position in the global market.

Latin America Display Technology Market Trends:

Latin America is witnessing steady growth in the Display Technology Market, supported by rising consumer electronics demand and expanding digital infrastructure. Brazil and Mexico dominate the region due to higher smartphone penetration, growing TV replacement cycles, and increasing use of digital signage in retail and advertising. Global manufacturers such as Samsung, LG, and TCL are strengthening their presence through local partnerships and production facilities, contributing to gradual adoption of OLED and advanced LCD technologies.

Middle East & Africa Display Technology Market Trends:

The Middle East & Africa Display Technology Market is experiencing moderate growth, driven by smart city projects, retail digitization, and increasing demand for large-format displays. Countries such as the UAE and Saudi Arabia dominate the region, supported by investments in digital signage, control rooms, and entertainment venues. Adoption of high-brightness LED, LCD, and OLED displays is rising, particularly in commercial and public infrastructure projects, positioning the region for long-term market expansion.

Display Technology Market Competitive Landscape:

Samsung Display, established in 2012, is a global leader in OLED and advanced display technologies, supplying panels for smartphones, TVs, laptops, monitors, and automotive applications. The company is renowned for innovations in AMOLED, QD-OLED, and IT OLED, driving premium visual experiences through continuous R&D and strong global partnerships.

- In September 2025, Samsung Display hosted the Samsung OLED IT Summit 2025 in Taipei, unveiling its IT OLED vision, showcasing 20+ technologies, highlighting ecosystem collaboration, and reporting a 74% IT OLED market share in Q2 2025 with the market projected to grow fourfold by 2029.

AUO Corporation, established in 1996, is a leading global display manufacturer specializing in TFT-LCD, Mini LED, Micro LED, and smart display solutions. The company serves consumer electronics, automotive, industrial, and retail markets, with a strong focus on AI integration, sustainable technologies, and high-performance next-generation displays.

- In May 2025, AUO announced at SID Display Week 2025 its advancements in large-sized and transparent Micro LED displays, AI-integrated automotive and retail applications, and energy-efficient FSC LCD and HiRaso ChLCD technologies, reinforcing its leadership in next-generation and sustainable display innovation.

Display Technology Market Key Players:

-

Leyard Optoelectronic Co., Ltd

-

AUO Corporation

-

Sharp Corporation

-

Innolux Corporation

-

Japan Display Inc.

-

Panasonic Corporation

-

Sony Corporation

-

NEC Corporation

-

Samsung Electronics Co., Ltd

-

BOE Technology Group Co., Ltd

-

LG Display Co., Ltd

-

TCL Technology Group Corporation

-

Hisense Group

-

Vizio Holding Corp.

-

Barco NV

-

Christie Digital Systems

-

Daktronics, Inc.

-

Absen Optoelectronic Co., Ltd

-

Unilumin Group Co., Ltd

-

EIZO Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 170.21 Billion |

| Market Size by 2033 | USD 222.41 Billion |

| CAGR | CAGR of 3.4% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Display Type (Flat Panel Display, Flexible Panel Display, Transparent Panel Display) • By Industry Vertical (Healthcare, Consumer Electronics, BFSI, Retail, Military, And Defense, Automotive, Others) • By Technology (OLED, Quantum Dot, LED, LCD, E-Paper, Others) • By Application (Vehicle Display, Smartphone And Tablet, Smart Wearable, Television, And Digital Signage, Pc And Laptop, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The major players include Leyard Optoelectronic Co., Ltd, AUO Corporation, Sharp Corporation, Innolux Corporation, Japan Display Inc., Panasonic Corporation, Sony Corporation, NEC Corporation, Samsung Electronics Co., Ltd, BOE Technology Group Co., Ltd, LG Display Co., Ltd, TCL Technology Group Corporation, Hisense Group, Vizio Holding Corp., Barco NV, Christie Digital Systems, Daktronics, Inc., Absen Optoelectronic Co., Ltd, Unilumin Group |