Polyoxymethylene Market Report Scope & Overview:

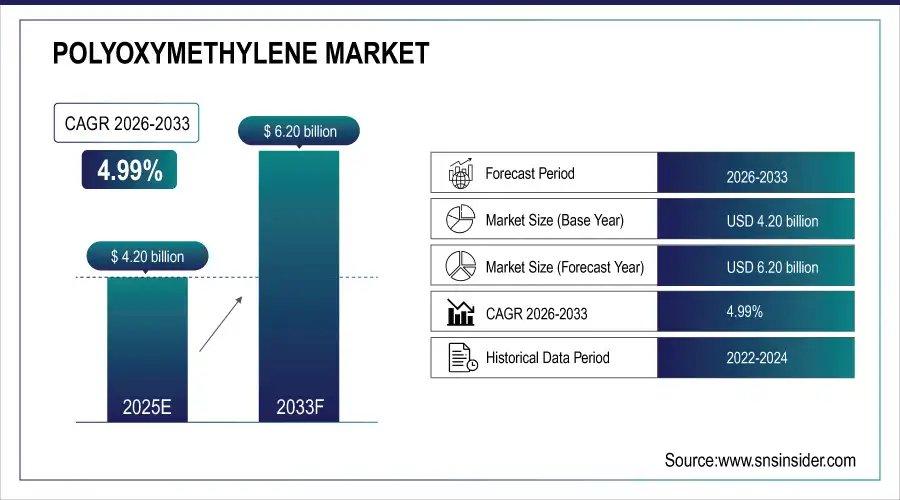

The Polyoxymethylene Market size was valued at USD 4.20 Billion in 2025 and is expected to reach USD 6.20 Billion by 2033, growing at a CAGR of 4.99% over 2026–2033.

The Polyoxymethylene Market is experiencing robust growth driven by industrial modernization and the rising need for high-precision plastic components. Automotive component miniaturization, expansion of electric vehicles, and growth in consumer electronics are fostering wider adoption of POM. Its strength, stiffness, and durability make it ideal for gears, bushings, fuel system parts, and electrical connectors. Growing incorporation of recycled and bio-based variants aligns with environmental compliance policies, further stimulating demand across advanced manufacturing economies.

Polyoxymethylene Market Size and Forecast

-

Market Size in 2025E: USD 4.20 Billion

-

Market Size by 2033: USD 6.20 Billion

-

CAGR: 4.99% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Polyoxymethylene Market - Request Free Sample Report

Key Polyoxymethylene Market Trends

-

Increasing utilization of POM in lightweight automotive designs for fuel efficiency improvements.

-

Rising adoption in electrical & electronics for precision components and thermal stability needs.

-

Advancements in bio-based and recycled POM grades supporting sustainability initiatives.

-

Expansion of end-use applications in industrial and consumer goods.

-

Adoption of advanced compounding and processing technologies for better surface finish and performance.

-

Growing replacement of metal parts in mechanical systems to reduce production cost and weight.

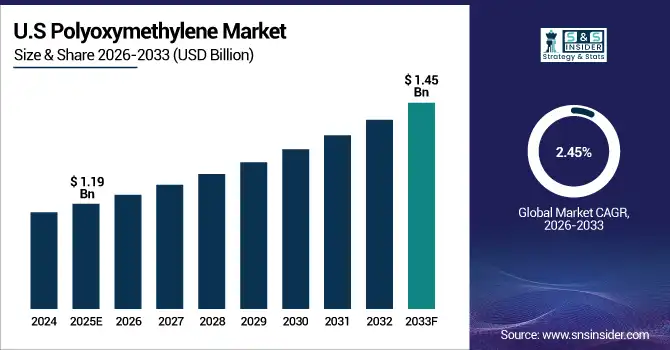

U.S. Polyoxymethylene Market Insights

The U.S. Polyoxymethylene Market size was USD 1.19 billion in 2025 and is expected to reach USD 1.45 billion by 2033, growing at a CAGR of 2.45% over the forecast period of 2025–2033. According to a study, rising automotive production and precision industrial applications are enhancing demand for POM, particularly in fuel systems and mechanical gears. This cause, increased lightweighting strategies, effects accelerated POM usage in emission control and energy-efficient parts. Automation growth and electronics miniaturization are further reinforcing market expansion across the U.S.

Polyoxymethylene Market Drivers

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Polyoxymethylene Market Growth

The rising global focus on sustainability and emission reduction has intensified adoption of eco-friendly engineering plastics such as POM. This cause, stricter environmental regulations, effects rapid material substitution where recyclability and lower lifecycle emissions are prioritized. Manufacturers are increasingly opting for bio-based polyoxymethylene formulations that maintain comparable strength and temperature stability to petroleum-based types. The push toward cleaner production techniques and renewable raw materials in chemical industries further amplifies POM’s expansion. Its applicability in automotive interiors, fasteners, and electric components aligns with green mobility initiatives and energy conservation goals. The continuous R&D efforts by key producers are introducing low-emission and fully recyclable grades, ensuring a balance between performance and sustainability.

In April 2025, BASF SE introduced a partially bio-based grade of POM designed for automotive gear systems, providing a 20% reduction in carbon footprint while maintaining high wear resistance.

Polyoxymethylene Market Restraints

-

Volatility in Raw Material Prices and Supply Chain Constraints Limit Market Stability

Fluctuations in methanol and formaldehyde—the primary feedstocks for POM—pose major challenges to manufacturers. This cause, unstable petrochemical markets and regional raw material shortages, effects rising production costs and constrained profit margins. Moreover, global supply chain disruptions, especially during energy crises or transport bottlenecks, exert pressure on polymer availability and lead times. These factors hinder consistent material supply for critical industries like automotive and electronics, affecting production schedules. The dependency on fossil-derived inputs further restricts scalability in low-carbon economies, prompting firms to seek alternative materials or recycling strategies.

In late 2024, temporary disruptions in methanol supply from Asian refineries led to increased POM prices globally, compelling automotive component manufacturers to delay procurement cycles.

Polyoxymethylene Market Opportunities

-

Rapid Adoption of Smart Manufacturing Creates New Product Development Opportunities

The Industrial 4.0 revolution is driving automation, robotics, and high-precision component needs—areas where POM excels. This cause, growing demand for dimensionally stable engineering plastics in automated systems, effects innovation in high-performance POM grades for gear assemblies, bearings, and conveyor mechanisms. Integration of smart manufacturing with sustainable polymer production enables better quality control, lower waste, and enhanced part reliability. Market players are capitalizing on this by developing specialty copolymers suited for high-speed, low-noise machinery. Strengthened ties between polymer developers and automation firms are expanding new application frontiers in industrial manufacturing and electronics.

In February 2025, Celanese Corporation launched a high-flow POM copolymer tailored for precision robotics assembly parts, improving durability and reducing mechanical noise in production lines.

Polyoxymethylene Market Segmentation Analysis:

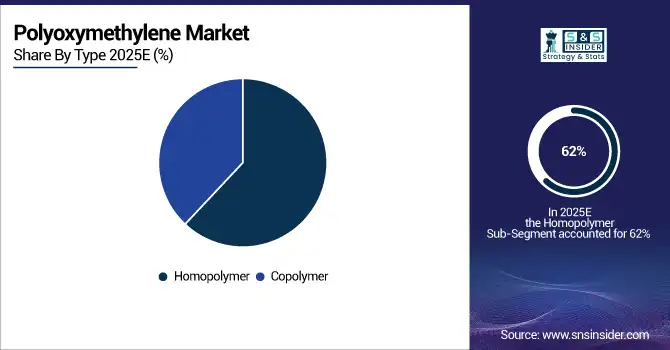

By Type, Homopolymer Grades Lead Market While Copolymer Grades Register Fastest Growth

The Homopolymer segment dominates with a 62% share in 2025E, attributed to superior stiffness, strength, and fatigue resistance necessary for structural mechanical components. This cause, increasing use in precision automotive gears and fuel system parts, effects consistent demand from engineering plastics users. Continuous processing improvements and better oxidation stability are enhancing homopolymer POM applications across industrial machinery.

The Copolymer segment, growing at the largest CAGR of 9.06%, benefits from improved chemical resistance and thermal stability, making it ideal for electrical connectors and pump housings. This cause, better durability under varying humidity, effects expanding use in household appliances and electronic part molding.

By Processing Technique, Injection Molding Leads Market While Extrusion Registers Fastest Growth

The Injection Molding segment holds 59% revenue share in 2025E. This cause, increasing demand for precision-engineered, complex-shaped parts, effects broader utilization in automotive interiors, fasteners, and electronic gears. High-speed injection systems improve surface finish and component consistency, enhancing end-product quality.

The Extrusion segment is growing at a CAGR of 10.33%, driven by rising production of POM sheets, rods, and films for industrial machinery. This cause, growing material customization demand, effects adoption in fabrication of mechanical wear components and guide rails.

By Grade, Standard Grade Dominates While High-Performance Grade Registers Fastest Growth

The Standard Grade segment dominates with 62% revenue share in 2025E, supported by high application in automotive brackets, lock systems, and conveyor components. This cause, strong demand for cost-effective engineering plastics, effects continued reliance on conventional POM formulations.

The High-Performance Grade segment grows fastest due to its enhanced impact strength and heat resistance. This cause, increasing need in automotive safety systems and electrical housings, effects adoption of specialized copolymer blends built for extreme durability.

By End-Use, Transportation Leads Market While Electrical & Electronics Registers Fastest Growth

The Transportation segment holds a 55% revenue share in 2025E, fueled by the push for lightweight automotive materials. This cause, rising EV production, effects higher replacement of metal parts with POM components to enhance fuel efficiency and reduce emissions.

The Electrical & Electronics segment grows fastest due to demand for miniaturized precision parts. This cause, rapid development of consumer gadgets and EV connectors, effects expanded POM usage in switches, sockets, and housing applications.

Polyoxymethylene Market Regional Analysis:

North America Polyoxymethylene Market Insights

North America dominates the Polyoxymethylene Market with an estimated 40% share in 2025E, driven by advanced automotive and electronics industries emphasizing lightweight plastics. Strong demand across the U.S. and Canada is supported by robust industrial manufacturing, extensive R&D in polymer engineering, and widespread electric vehicle adoption. Key producers are heavily investing in high-performance and bio-based POM variants to meet sustainability goals, consolidating the region’s leadership position.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Leads North America Polyoxymethylene Market with Advanced Industrial Adoption

The U.S. dominates the North American POM market, leveraging strong polymer R&D capabilities, large-scale manufacturing, and adoption of electric mobility. Investments in high-performance and sustainable POM products further strengthen the country’s competitive position, supporting innovation across automotive, electronics, and industrial applications.

Asia-Pacific Polyoxymethylene Market Insights

Asia-Pacific is the fastest-growing region with an estimated CAGR of 7.65% in 2025E, fueled by rapid industrial expansion and manufacturing investments in China, Japan, and South Korea. Rising demand for engineering plastics in automotive, electronics, and high-tech equipment is driving regional growth.

-

China Drives Asia-Pacific Polyoxymethylene Market Growth

China dominates the Asia-Pacific POM market through large-scale automotive and electronics production, capacity expansions by domestic polymer manufacturers, and a shift toward electric mobility. High-tech industrial equipment adoption further boosts POM consumption, making China the primary growth engine in the region.

Europe Polyoxymethylene Market Insights

Europe holds a significant share of the POM market due to strict EU emission regulations and lightweighting initiatives in automotive and electronics. Continuous adoption of Polyoxymethylene is supported by rising environmental standards, advanced polymer R&D, and investments in electric mobility and material recycling.

-

Germany Leads Europe Polyoxymethylene Market Expansion

Germany dominates Europe’s POM market, driven by strong automotive engineering, environmental policy compliance, and advanced polymer research. Investments in sustainable mobility and circular material strategies reinforce Germany’s leadership position across the continent.

Latin America (LATAM) and Middle East & Africa (MEA) Polyoxymethylene Market Insights

Latin America and MEA show moderate growth, fueled by expanding manufacturing and automotive assembly operations. Brazil leads Latin America through its automotive and agricultural equipment industries, while the UAE dominates MEA with industrial diversification and adoption of high-performance polymers in construction and infrastructure projects.

Competitive Landscape for the Polyoxymethylene Market:

Celanese Corporation

Celanese Corporation is a global chemical leader specializing in engineering thermoplastics, including acetal copolymers (POM). The company delivers high-strength polymers for automotive gears, fuel systems, and industrial components, emphasizing both mechanical precision and sustainability. Through advanced polymer chemistry and process innovation, Celanese supports performance optimization across critical industries.

-

In February 2025, Celanese launched a next-generation high-flow POM copolymer designed for precision robotics and automotive assemblies, offering improved dimensional stability and reduced processing times.

DuPont de Nemours, Inc.

DuPont is a major U.S.-based science company offering a range of performance materials, including Delrin® POM resins widely used in mechanical and electrical applications. Its POM products combine stiffness, resilience, and durability for automotive, industrial, and electronics applications. DuPont’s deep R&D investment and sustainable formulations make it a benchmark in the POM domain.

-

In April 2025, DuPont unveiled a Delrin® Eco Series featuring 50% certified renewable content, enabling reduced carbon footprint for high-performance plastic applications.

BASF SE

BASF SE, headquartered in Germany, is one of the largest global POM producers, offering a wide range of grades under its Ultraform® series. Its products deliver excellent mechanical performance for automotive, electronics, and consumer goods. BASF integrates sustainability with polymer innovation, enhancing recyclability and bio-content integration.

-

In March 2025, BASF introduced Ultraform® N2320—a POM variant built for high-speed automotive gear applications with improved wear resistance and reduced friction.

Mitsubishi Chemical Corporation

Mitsubishi Chemical Corporation produces high-performance POM materials under its DURACON® brand, developed for precision molding applications. The company’s materials feature superior fatigue endurance, dimensional strength, and chemical stability suitable for automotive and electronics utilization.

-

In January 2025, Mitsubishi Chemical expanded its DURACON® bio-based POM product line, promoting carbon-neutral polymer adoption and improved performance for automotive and industrial customers.

Polyoxymethylene Market Key Players:

-

Celanese Corporation

-

DuPont de Nemours, Inc.

-

BASF SE

-

Mitsubishi Chemical Corporation

-

Polyplastics Co., Ltd.

-

Asahi Kasei Corporation

-

LG Chem Ltd.

-

Korea Engineering Plastics Co., Ltd.

-

Kolon Plastics, Inc.

-

RTP Company

-

Ensinger GmbH

-

Arkema S.A.

-

SABIC

-

LyondellBasell Industries N.V.

-

Toray Industries, Inc.

-

RadiciGroup

-

China National Chemical Corporation (ChemChina)

-

Westlake Plastics Company

-

Schulman, Inc.

-

Röchling Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 4.20 Billion |

| Market Size by 2032 | US$ 6.20 Billion |

| CAGR | CAGR of 4.99 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Homopolymer, Copolymer) • By Processing Technique (Injection Molding, Extrusion, Compression Molding) • By Grade (Standard Grade, High-Performance Grade) • By End-Use Industry (Transportation, Consumer Goods, Electrical & Electronics, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Celanese Corporation, DuPont de Nemours, Inc., BASF SE, Mitsubishi Chemical Corporation, Polyplastics Co., Ltd., Asahi Kasei Corporation, LG Chem Ltd., Korea Engineering Plastics Co., Ltd., Kolon Plastics, Inc., RTP Company, Ensinger GmbH, Arkema S.A., SABIC, LyondellBasell Industries N.V., Toray Industries, Inc., RadiciGroup, China National Chemical Corporation (ChemChina), Westlake Plastics Company, Schulman, Inc., Röchling Group. |