Portable Ultrasound Market Size and Overview:

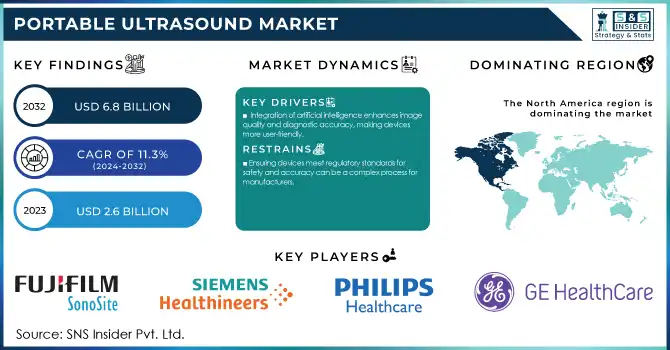

The Portable Ultrasound Market Size was valued at USD 2.6 billion in 2023 and is expected to reach USD 6.8 billion by 2032, growing at a CAGR of 11.3% over the forecast period 2024-2032.

Get More Information on Portable Ultrasound Market - Request Sample Report

The growth of the global portable ultrasound market is majorly driven by the, growing incidences of chronic disease and growing global geriatric population are few of the key drivers. As per the World Health Organization (WHO), the share of the world's population over 60 years is expected to double from 12% to 22% between 2015 and 2050. This demographic change is anticipated to augment the need for portable ultrasound devices for faster and effective diagnostics. Moreover, rapid developments of technology like artificial intelligence (AI) and machine learning algorithms are augmenting the abilities of portable ultrasound devices. The U.S. Food and Drug Administration (FDA) has been responding by approving portable ultrasound devices embedded with new AI-enabled software with multiple clearances in recent years.

Market growth is bolstered by government initiatives aimed at enhancing healthcare infrastructure and expanding medical imaging accessibility in rural and remote locations. The Indian government's National Health Mission has, for example, been encouraging portable ultrasound devices in primary health-care centers to improve maternal and child health. The outbreak of COVID-19 pandemic has further expedited adoption of portable ultrasound devices, which provide a safer and flexible option for patients assessment. In the United States, the CDC recommended point-of-care ultrasound for COVID-19 patients to reduce exposure risk and conserve personal protective equipment. In addition, growing accessibility of point of care diagnostics and increasing utilization of ultrasound in critical care and emergency medicine field are contributing to market expansion.

Market Dynamics:

Drivers

-

Integration of artificial intelligence enhances image quality and diagnostic accuracy, making devices more user-friendly.

-

Increased cases of cardiovascular diseases and cancers boost demand for portable ultrasound systems for early detection and monitoring.

-

Need for immediate results in emergency and outpatient settings drives adoption of portable ultrasound devices.

Technological improvements have played a major role in driving the portable ultrasound market, with manufacturers now able to provide devices that are smaller, more efficient, and easier to use. Current portable ultrasound scanners are equipped with higher imaging quality, higher portability grade, and more friendly interface system, thus becoming more appealing to healthcare providers. For example, the use of artificial intelligence (AI) and machine learning algorithms has allowed for real-time image optimization, increasing their positive diagnostic yield. One prominent example is the ATUSA system developed by iSono Health, the first automated, portable, and 3D breast ultrasound system, built to work in synergy with machine learning models to enable physicians to have a comprehensive solution for diagnosis.

Such advancements have widened the scope of portable ultrasound applications beyond emergency medicine, having found utility in multiple other domains such as cardiology and obstetric applications. These devices provide the ideal blend of portability and sophisticated functionality, enabling healthcare practitioners to perform point-of-care diagnostics more quickly and accurately, which leads to better outcomes for patients and improved efficiency in clinical workstreams. Consequently, the utilization of portable ultrasound has grown significantly, and almost 80% of hospitals in the United States have incorporated such systems into their clinical workflows associated mainly with emergency departments and outpatient clinic settings.

Restraints

-

The substantial initial investment required for portable ultrasound devices can hinder adoption, especially in resource-limited settings.

-

Effective use of portable ultrasound systems necessitates adequate training for healthcare professionals, which may require additional resources.

-

Ensuring devices meet regulatory standards for safety and accuracy can be a complex process for manufacturers.

High equipment costs are one of the significant restraints in the portable ultrasound market. Portable ultrasound machines, while smaller and more convenient than other systems, still involve a cost. These devices can therefore be very expensive for healthcare providers to use, particularly in lower income countries which may therefore not have access to the same level of technology, as the technology and the miniaturisation required for portability is often expensive. For smaller clinics, rural healthcare facilities, or hospitals in developing countries, the expense can be hard to justify, especially with many battling ever-tightening budgets. Moreover, there is a huge part of budget for maintenance and training as well. The high costs can also slow the adoption of these devices in lower-income regions or in smaller medical facilities that may already have tight budgets. As a result, providers are reluctant to put money into a portable ultrasound modality.

Segment Analysis:

By Type

In 2023, the portable ultrasound market was dominated by the built-in console segment with a 79% revenue share. Several factors contribute to this supremacy such as the segment holds better image rendition abilities, advanced features, and broader applications as compared to the handheld devices. B-portable ultrasound systems have a built-in console, and find their niches in wards, emergency departments and hospital out-pt clinics, which are more modular than transportable but less portable than the true, point-of-care devices. From a report by the National Center for Health Statistics, the number of an ultrasound procedures performed in the United States is steadily increasing, most ultrasound procedures are performed with built-in-console ultrasound systems. They are most widely used in hospital radiology departments, outpatient clinics, and in-site imaging centers. Another reason built-in-console segment covered a larger market share is the acceptance of built-in console in market and preference among numerous healthcare provides for systems that come with an existing workflow.

Accordingly, relentless government efforts to develop the diagnostic capabilities of hospital facilities have also been often markedly accompanied by considerablly accelerated procurement of options like built-in-console portable ultrasound systems. As a case in point, the U.S. Department of Veterans Affairs has been outfitting its medical centers with new portable probably ultrasound systems to better treat veterans. Driving the segment's growth is an endless cycle of technological development, including the introduction of AI-assisted imaging and integrated workflow element designed to improve diagnostic precision and efficiency.

By end user

In 2023, the hospital's segment accounted for the largest share of the market, as hospitals have a higher patient volume, greater breadth and depth of specialties, and more financial resources. In 2023, the US had about 6,093 hospitals, which are carrying out millions of ultrasound procedures every year. When hospitals acquire many ultrasound devices for their different departments such as emergency rooms, intensive care units, and specialized clinics, it complexifies their purchases, operations, and reviews. According to the U.S. Centers for Medicare & Medicaid Services, outpatient hospital visits, including a large number of diagnostic imaging, have been climbing with regularity for the last 10 years.

Nevertheless, the clinic segment is expected to grow at a very healthy rate throughout the forecast period. owing to growing trend of outpatient care and the surge in specialized diagnostic centers. According to data from the CDC's National Ambulatory Medical Care Survey, the use of imaging in office-based physician practices and ultrasound procedures has increased dramatically. Reasons behind this outpatient migration include more affordable healthcare expenses, patient convenience, and miniaturized sonography technology that is able to provide excellent diagnostic images in multiple locations, including smaller practices.

Regional Analysis:

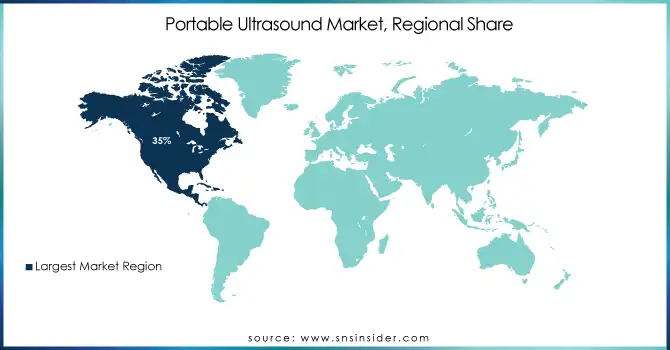

The North America region dominated the portable ultrasound market in 2023, which held an approximate share of 35% of the total market share of portable ultrasound across the globe. The region's superior healthcare system, high healthcare expenditure, and early uptake and penetration of technologically advanced medical devices have attributed to this leadership position. U.S. healthcare spending cost $4.3 trillion in 2023, according to the Centers for Medicare & Medicaid Services, much of it on diagnostic imaging. In addition, growing research and development in ultrasound along with top ultrasound devices manufacturers in the region helps in the increasing market share in others market.

On the other hand, the market in the Asia-Pacific region is anticipated to witness the highest CAGR over the forecast period. The phenomenal growth of this region can be attributed to improving healthcare infrastructure, rising healthcare expenditure, and a large patient population. The implementation of the Healthy China 2030 plan introduced by the Chinese government to upgrade medical devices in hospitals across the country is also expected to drive the rapid growth of portable ultrasound devices. Demand for portable ultrasound in rural healthcare in India has increased after the National Health Mission stressed improving maternal and child health. Meanwhile, burgeoning demand for healthcare services to meet the needs of Japan's rapidly aging population including government initiatives to address healthcare issues arising from this demographic trend are also fuelling growth in the region. Moreover, the increasing prevalence of chronic diseases, combined with rising awareness of early diagnosis in South Korea and Australia, is driving the growth of the portable ultrasound device market in the Asia-Pacific region.

Get Customized Report as per Your Business Requirement - Enquiry Now

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 2.6 billion |

|

Market Size by 2032 |

US$ 6.8 billion |

|

CAGR |

CAGR of 11.3% From 2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

|

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Samsung Medison, Mindray Medical International, Fujifilm SonoSite, Esaote, Clarius Mobile Health, Butterfly Network, Inc. |

|

Key Drivers |

|

|

Market Restraints |

• Portable Ultrasound devices are costly as compare to traditional devices in the market. |