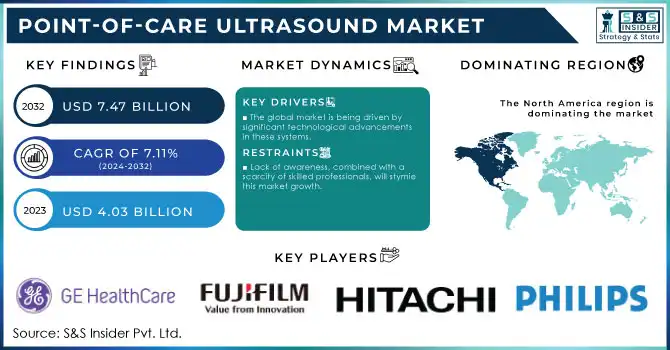

Point-of-care Ultrasound Market Size & Trends:

The Point-of-care Ultrasound Market size was USD 4.03 billion in 2023 and is expected to Reach USD 7.47 billion by 2032 and grow at a CAGR of 7.11% over the forecast period of 2024-2032.

Get more information on Point-of-care Ultrasound Market - Request Sample Report

This report emphasizes the growing use of these devices for rapid, non-invasive diagnosis. The research points out regional prescription trends for POCUS devices, citing differences in demand fueled by healthcare infrastructure and technological innovation. It also looks into device volume by region, demonstrating the broad usage of POCUS in both developed and emerging markets. The report also examines trends in healthcare expenditure by regions, such as government, commercial, private, and out-of-pocket spending, which are defining market trends as well as the adoption trends in various sectors of healthcare, with a focus on the increasing incorporation of POCUS in emergency medicine, primary care, and hospital care.

Point-of-care Ultrasound Market Dynamics:

Drivers

-

Rising Demand for Portable and Real-Time Diagnostic Imaging

The rising use of point-of-care ultrasound (POCUS) is spurred by expanding demand for compact, real-time imaging solutions for emergency medicine, critical care, and primary care. POCUS devices provide instantaneous diagnosis, breaking the reliance on conventional radiology departments and enhancing patient outcomes. Advances in wireless ultrasound technology, including the development of AI-powered imaging and portable devices like Butterfly iQ+ and Philips Lumify, have further accelerated use. In addition, the increasing incidence of chronic conditions, including cardiovascular conditions and pregnancy complications, has amplified the demand for rapid and precise imaging solutions. Research indicates that approximately 17.9 million individuals lose their lives due to cardiovascular diseases each year, highlighting the importance of early diagnosis.

Restraints

-

The High Costs and Limited Reimbursement Policies hinder market growth

New, advanced, and portable handheld ultrasound machines may cost a great deal of money, with devices that cost from USD 5,000 up to more than USD 50,000, being out of reach for small clinics and clinicians operating in tight-budget environments. Furthermore, uneven reimbursement policies in various nations cap the economic incentives for healthcare professionals to invest in POCUS technology. In contrast to conventional imaging modalities, most insurance companies do not cover handheld ultrasound procedures comprehensively, hindering widespread use.

Opportunities

-

AI Integration and Expanding Applications in Home Healthcare present significant opportunities

The use of artificial intelligence (AI) in ultrasound imaging offers tremendous growth potential by increasing diagnostic quality and workflow efficiency. AI-driven ultrasound offerings, including GE Healthcare's Venue Go and Clarius AI, are enhancing workflow efficiency by making accurate ultrasound images available to non-specialist users. In addition, the development of telemedicine and home healthcare services is growing the application of POCUS in distant and ambulatory facilities. Portable ultrasound machines are finding more applications in tele-prenatal care, musculoskeletal imaging, and critical care monitoring, cutting down on the number of hospital visits. The home healthcare market worldwide is expected to expand considerably, fueling demand for portable diagnostic tools even more.

Challenges

-

A major challenge in POCUS adoption is the lack of standardized training programs and skill variability among healthcare professionals.

In contrast to radiologists, primary care providers and emergency responders can have restricted ultrasound training, which results in diagnostic variability and misinterpretations. Research suggests that almost 30% of misdiagnoses using ultrasound result from operator mistakes or inexperience. Furthermore, the lack of common guidelines for image interpretation and accreditation among diverse healthcare systems leads to variability in diagnostic precision. Countering this challenge means comprehensive training packages, AI-guided imaging applications, and conformity certification processes so that POCUS technology can be utilized effectively.

Point-of-care Ultrasound Market Segmentation Analysis:

By Portability

Portable and handheld ultrasound systems dominated the market in 2023 with a huge revenue share of 59.2%. The success of this sector is driven by the fact that they are small in size, are easy to operate, and have an increasing demand for portable diagnostic solutions across various healthcare environments. They are now more in demand in emergency medicine, critical care, and primary care facilities, where there is a need for instant and mobile diagnosis. Their capacity to offer real-time imaging on-site is a major reason for their widespread use.

The cart/trolley-based ultrasound systems segment is also anticipated to undergo substantial growth in the forecast period. Although hand-held systems reign supreme, cart-based ultrasound systems remain important for larger healthcare centers, providing increased image quality and sophisticated features. As technology drives further improvement in the performance of these systems, hospitals, and imaging centers are poised to invest increasingly in this segment.

By Technology

The 3D/4D ultrasound technology segment commanded the largest revenue share of 41.5% in 2023. This is because it can deliver more precise and detailed imaging, which is particularly essential in obstetrics and gynecology to see fetal growth in real time. 3D/4D ultrasound also offers substantial benefits in other areas such as cardiology and radiology, where accurate imaging is crucial for diagnosis and treatment planning.

The 2D ultrasound technology segment is projected to grow at the highest rate based on its affordability and effectiveness in routine diagnostic procedures, especially in emergency care and primary care. Although its imaging resolution is lower than that of 3D/4D, 2D ultrasound continues to be favored because of its established reliability, portability, and affordability for rapid diagnostics.

By Application

Radiology was the leading application segment in 2023, with a revenue share of 23.8%. Ultrasound is extensively utilized in radiology because it is non-invasive, can visualize soft tissues, and is used for guiding interventional procedures. The utilization of ultrasound in radiology for the diagnosis of conditions such as abdominal disorders, liver disease, and other soft tissue abnormalities remains a driving force for the segment's leadership.

The obstetrics/gynecology application market is expected to see the fastest growth, driven by the mounting demand for prenatal imaging and fetal imaging. To offer high-quality imaging to track fetal growth and the well-being of mothers, this market is expected to grow big. The focus on early diagnosis and non-invasive testing is driving ultrasound adoption in this sector.

By End Use

Hospitals led the point-of-care ultrasound systems market with a revenue share of 41.4% in 2023. The large share is an indication of the critical role that ultrasound has in different clinical departments, such as emergency medicine, cardiology, and obstetrics. Hospitals are advantaged by the flexibility and rapid results of POCUS, which makes it a core diagnostic tool in a broad array of environments, ranging from emergency departments to intensive care units.

Imaging centers are anticipated to be the most rapidly expanding end-use segment because of the growing demand for outpatient imaging and diagnostic services. With patients demanding more convenient, less expensive ways of receiving diagnostics instead of traditional hospital clinics, imaging centers are at the forefront of point-of-care ultrasound adoption. The potential to offer specialized diagnostic imaging on-site is expanding this segment.

Point-of-care Ultrasound Market Regional Insights:

North America was the leading region with a 30.5% market share in 2023 with the U.S. as the leader, driven by extensive usage in emergency departments, hospitals, and outpatient clinics. The U.S. is the leader due to sophisticated healthcare facilities, extensive adoption of new technologies, and supportive reimbursement policies. Europe ranks second, with Germany, the UK, and France having large market shares. The expansion in Europe is due to the rising usage of POCUS in radiology, cardiology, and obstetrics, complemented by efforts from governments facilitating portable diagnostic units for primary as well as emergency care.

Asia-Pacific region is growing at a high pace as a result of improving healthcare infrastructure, mounting awareness about portable diagnostic devices, and increased demand for low-cost medical imaging devices. India and China are the two dominant players who are contributing predominantly because of having massive populations, a large and growing hospital chain, and increasing government efforts toward enhancing the reach of healthcare facilities. China has been witnessing POCUS adoption growing at a rapid pace in the fields of emergency medicine, primary care, and rural healthcare on the back of domestic manufacturers who provide affordable options. Likewise, India's heightened emphasis on fetal and maternal health and rising demands for point-of-care diagnostics across critical care and anesthesia are also fueling the growth of the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in the Point-of-care Ultrasound Market:

-

GE HealthCare – LOGIQ e, Vivid i

-

Koninklijke Philips N.V. – Lumify

-

FUJIFILM Sonosite, Inc. – Sonosite PX, M-Turbo

-

ALPINION MEDICAL SYSTEMS Co., Ltd. – E-Cube 8, E-Cube i7

-

Hitachi Ltd. – Arietta 50, Arietta 65

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. – M7, M9

-

EDAN Instruments – U50, U60

-

TERASON DIVISION TERATECH CORPORATION – Terason t3200

-

CHISON Medical Technologies Co., Ltd. – Q9, ECO5

-

Healcerion Co., Ltd. – SONON 300C, SONON 300L

-

Butterfly Network, Inc. – Butterfly iQ

-

Becton, Dickinson, and Company – BD Veritor Plus System (Ultrasound component for diagnostics)

-

Zimmer MedizinSysteme GmbH – Ultrasound Devices (Various models)

-

Teknova Medical Systems Co., Ltd. – Teknova POC Ultrasound

-

Advanced Instrumentations (Florida) – Portable Ultrasound Systems (Various models)

-

DRE Medical – DRE Compact Ultrasound

-

DRAMIŃSKI S. A. – Dramiński UDS-2

-

Shenzhen AnaSonic Bio-Medical Technology Co., Ltd. – AnaSonic Portable Ultrasound

-

Clarius – Clarius Ultrasound Scanner (Various models)

Recent Developments in the Point-of-care Ultrasound Market:

In Feb 2025, AISAP partnered with Amavita Heart and Vascular Health to expand its AISAP Cardio POCUS software platform beyond hospitals, targeting underserved communities in South Florida. This collaboration aimed to enhance access to cardiac ultrasound diagnostics in non-traditional healthcare settings.

In Sep 2024, GE HealthCare launched enhanced Venue point-of-care ultrasound solutions, including the new tablet-based Venue Sprint, designed for maximum portability and advanced imaging. The company also introduced Venue family upgrades, featuring advanced software and wireless integration with Vscan Air probes to enhance scanning efficiency.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.03 billion |

| Market Size by 2032 | USD 7.47 billion |

| CAGR | CAGR of 7.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Portability [Cart/Trolley-based Ultrasound Systems, Handheld/Portable Ultrasound Systems] • By Technology [2D, 3D/4D, Doppler] • By Application [Cardiology, Obstetrics/Gynecology, Radiology, Orthopedics, Anesthesia, Emergency Medicine, Primary Care, Critical Care] • By End Use [Hospitals, Imaging Centers, Research Centers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Koninklijke Philips N.V., FUJIFILM Sonosite, Inc., ALPINION MEDICAL SYSTEMS Co., Ltd., Hitachi Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., EDAN Instruments, TERASON DIVISION TERATECH CORPORATION, CHISON Medical Technologies Co., Ltd., Healcerion Co., Ltd., Butterfly Network, Inc., Becton, Dickinson, and Company, Zimmer MedizinSysteme GmbH, Teknova Medical Systems Co., Ltd., Advanced Instrumentations (Florida), DRE Medical, DRAMIŃSKI S. A., Shenzhen AnaSonic Bio-Medical Technology Co., Ltd., Clarius. |