Practice Management System Market Overview

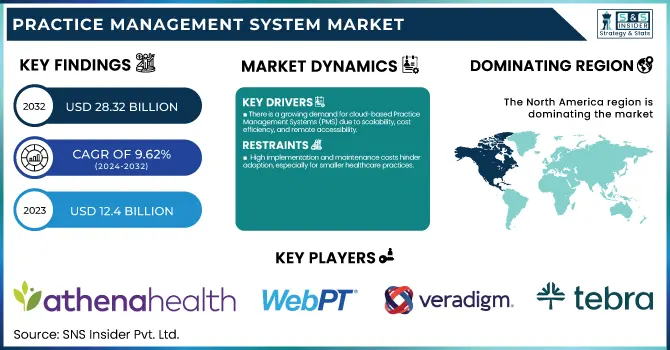

The Practice Management System Market was valued at USD 12.4 billion in 2023 and is expected to reach USD 28.32 billion by 2032, growing at a CAGR of 9.62% over the forecast period of 2024-2032.

The Practice Management System Market report provides key statistical insights and trends shaping the industry. It also examines adoption rates among hospitals, clinics, and independent practitioners, as well as cloud-based vs. on-premises deployment trends. The report also discusses government, private provider and insurer spending on practice management solutions in healthcare. It also examines interoperability trends about integration with EHRs, telehealth, and billing platforms. A. User demographics breakdown and insight overview User demographics give insight into adoption trends by healthcare professionals vs administrative staff. In addition, the paper analyzes regulatory compliance and security measures while assessing conformity with HIPAA, GDPR, and other regional regulations. This in-depth research provides stakeholders with the necessary information to make informed decisions about the changing practice management system environment. The need for effective healthcare administration, supported by government initiatives to improve healthcare IT infrastructure, is driving the practice management system market. For example, the U.S. government has taken steps to increase the uptake of electronic health records (EHR) , and this has smooth operatorized processes in health care.

To Get more information on Practice Management System Market - Request Free Sample Report

Practice Management System Market Dynamics

Drivers

-

There is a growing demand for cloud-based Practice Management Systems (PMS) due to scalability, cost-efficiency, and remote accessibility.

Cloud-based Practice Management Systems (PMS) are gaining momentum due to their scalability, cost-effectiveness, and remote accessibility, providing many benefits over traditional on-premise systems. According to a recent survey, 73% of healthcare organizations used multiple IT infrastructures this year, compared to just 53% last year. This change shows the increasing demand for cloud solutions that offer cross-platform compatibility, thus improving overall operational efficiency. This trend is further reinforced by technological developments. Microsoft recently introduced Dragon Copilot, its own AI assistant, to help reduce administrative overhead by automating tasks such as taking notes and filling out clinical documentation. Streamlining these processes ensures that healthcare providers not only have more time to be spent on patient care but also leads to lesser burnout and an improved patient experience. In addition, since a cloud-based PMS works within open principles and standards, it integrates easily with advanced tech like AI and ML, allowing for predictive analytics and personalized patient experience. This integrated system can result in real-time data analytics, better decision-making, and improved patient outcomes.

Restraint

-

High implementation and maintenance costs hinder adoption, especially for smaller healthcare practices.

There are many challenges associated with implementing a Practice Management System (PMS) in healthcare settings, especially for smaller practices. The upfront investment covers software purchase, hardware upgrades, and staff training. For instance, in 2019, the UK's Maidstone and Tunbridge Wells NHS Trust invested in TeleTracking’s cloud-structured system, which provides bed management services and integrates patient care logistics. Though there was a significant financial investment, the trust reported annual cost savings of around £2.1 million and enhanced standards of care. Besides the primary setup, there are also ongoing expenses like subscription fees, system maintenance, and updates that add to the cost. Such ongoing expenses create a burden on the budgets of smaller healthcare systems, which can spread resources thin. In addition, interfacing PMS with existing Electronic Health Records (EHR) and any legacy setups leads to an investment in Information Technology infrastructure and trained personnel, adding to the overall cost. Costs associated with complying to a PMS deter smaller practices from adapting to such systems & that in turn limits their efficiency and quality in delivering patient care. Addressing these cost-related barriers is an even more pressing issue for healthcare providers of all sizes and ensuring they can take advantage of the advancements afforded by Practice Management Systems.

Opportunity

-

Integration with telehealth services enhances patient management and expands PMS functionalities.

The practice management system is a big opportunity to enhance Healthcare delivery while streamlining the operation & improving patient outcomes. 83% of physicians support telemedicine as a permanent part of their clinical practice, highlighting its increased acceptance among physicians, according to a recent survey. Patients have also welcomed telehealth, with 76% wanting to continue using it, a sign of satisfaction, as well as a belief in the convenience of virtual care. Besides, the implementation of telehealth significantly improves clinical workflows once combined with Electronic Health Records (EHR) systems as it enables providers to seamlessly schedule and conduct video visits from EHRs that help to minimize the administrative burden and errors. The widespread adoption of telehealth is further evidenced by platforms like doxy.me, which, as of 2024, has facilitated over 400 million sessions, accounting for nearly 10 billion minutes of telehealth, reflecting the increasing reliance on virtual consultations. Enabling telehealth features within PMS allows healthcare providers to deliver more convenient and accessible care, enhancing patient satisfaction and streamlining operations. This trend is not only in line with the changing attitudes of patients and providers but also enables healthcare practices to adjust to the digital transformation in delivering healthcare.

Challenge

-

Ensuring robust data security and privacy compliance amid rising cyber threats in healthcare.

Healthcare organizations struggle with strong data security and privacy compliance while implementing Practice Management Systems (PMS). The U.S. Department of Health and Human Services Office for Civil Rights has reported 720 healthcare data breaches affecting nearly 186 million user records in 2024. Such attacks frequently compromise sensitive data, including names, contact information, Social Security numbers, and medical records, highlighting the sector’s susceptibility to cyber threats. The financial impact is significant, with the average cost of a healthcare data breach at an all-time high of nearly $9.8 million in 2024. This amount includes costs for things like business disruptions, customer support, and remediation efforts. 84% of healthcare organizations experienced a cyberattack in the last year, and 69% of them had financial losses. These incidents are not only a drain on financial resources but also undermine patient trust and can be legally actionable in the event of a data breach. Specific attacks also underscore the healthcare sector's vulnerability. In September 2024, the Texas Tech Health Sciences Center had a breach hit more than 1.4 million patients, exposing personal and medical information, for instance. These incidents highlight the critical need for healthcare organizations to strengthen their cyber defenses. In turn, regulators are proposing tougher cybersecurity rules. A Senate bill proposed late in 2024 would rework cybersecurity processes, mandating multifactor authentication and regular audits for healthcare providers beginning in 2025. While these measures aim to protect patient data, they also present implementation challenges, particularly for smaller practices with limited resources.

Practice Management System Market Segmentation Analysis

By Product

In 2023, the integrated systems segment generated the highest revenue share of 73%, owing to its holistic approach to the management of healthcare. Integrated systems are a single unified system that includes EHR/EMR integration, laboratory management, patient portals, and telemedicine system. This allows this integration to facilitate operational efficiency as it automates tasks and offers better communication between departments. Government initiatives to promote interoperability and health information exchange also encourage integrated systems, as these systems provide seamless data sharing and help to comply with regulatory requirements. The U.S. government’s initiatives for increasing electronic health records (EHR) adoption have certainly streamlined healthcare operations, as 88.2% of office-based physicians had adopted EHR systems as of 2021. Furthermore, the incorporation of telehealth services into these platforms is right in line with the rising need for remote healthcare services, which is also further driving their adoption. The combination of features within one platform provides financially viable, user-friendly solutions that address the changing demands of healthcare providers. With the introduction of stricter regulations around data sharing and interoperability, healthcare organizations are increasingly turning to integrated systems for compliance and greater operational efficiency.

By Component

In 2023, the software segment generated the highest revenue share of 67% and played an important role in enabling humanitarian ENDs. Practice management software encompasses key functions for patient scheduling, billing, coding, and record-keeping, making it an integral function for any healthcare provider. Driving demand for practice management software is the need for better data management and improved patient outcomes. It has also promoted the use of EHR systems through government incentives, thereby further encouraging healthcare providers to invest in software solutions that enable value-based care models that improve patient data management and reporting processes. With the addition of AI and predictive analytics, software is continuously evolving to facilitate better operational efficiency and patient care, thereby increasing the software segment's market share. Technological developments in the software segment, including AI and automation, drive its data analysis and decision-making capabilities. This technological advancement fuels the transition to more patient-focused care models, leading to even greater demand for these certain software solutions.

By Delivery Mode

In terms of these delivery modes in 2023, the web-based delivery mode segment held the largest share, accounting for 46% of the overall market, as the web-based delivery mode is flexible and scalable. Healthcare is one of those sectors that can easily adopt the web-based platforms that allow medical providers to access practice management systems from anywhere which help in delivering better services and smoother operations particularly in multi-location practises, The growing use of mobile devices in healthcare facilitates the move to web-based systems, enabling access to real-time data and access to patient records from any location. Supportive government measures for enhanced digital literacy and the development of IT infrastructure have led to the demand for web-based solutions as they are easier to enter and less costly. Changes automatically flow into web-based systems, and there is no need to halt workflows to apply updates, supporting the development of efficient data sharing and remote access, which is becoming indispensable. They are usually hosted on a server with no local installations, making them an ideal solution in areas where IT infrastructure is scarce due to their low start-up costs as well.

By End-use

In 2023, the physician back-office segment accounted for a larger share of revenue of 55%, resulting from the growing need for efficient administrative and operational support in medical practices. Billing, insurance claims and scheduling, and patient records are equally important, especially when efficient processes can be consolidated through advanced practice management systems. Since many of the initiatives launched by the government are focused on improving efficiency and reducing costs with care, the need for digital solutions in the physician's office has grown. Striving for the efficient coordination of clinical and administrative processes will increase the framework that practice management systems bring to the physician back offices as healthcare continues to transition to value-based care models. The dominant position of the physician back-office segment is also driven by the increasing focus on minimizing administrative costs and optimizing patient service. These processes can be streamlined using practice management systems, enabling healthcare providers to devote more attention to patient care.

Practice Management System Market Regional Insights

North America accounted for the largest market share, 44% in 2023, owing to a strong healthcare IT infrastructure and a high adoption rate of healthcare software among physicians. Market growth has been supported by a favourable healthcare infrastructure and government-led initiatives, like EHR incentive programs. However, Asia Pacific is witnessing the highest CAGR, owing to an increasing aging population and economic expansion in countries such as China and India. The market is growing due to rising awareness about efficient healthcare management and government initiatives to strengthen healthcare infrastructure. Asia Pacific is all set for enormous growth due to its rapid digital transformation spearheaded by rising investments in the healthcare infrastructure. Countries such as India and China have launched government initiatives to develop healthcare services which is expected to lead to the adoption of advanced practice management systems to improve patient care and operational efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Practice Management System Market

Key Service Providers/Manufacturers

-

Athenahealth (athenaCollector, athenaClinicals)

-

WebPT (WebPT EMR, WebPT Billing)

-

Veradigm (Veradigm EHR, Veradigm Practice Management)

-

Tebra (Kareo Clinical, PatientPop Practice Growth)

-

Splose (Splose Practice Management, Splose Telehealth)

-

Doximity (Doximity Dialer, Doximity Talent Finder)

-

Clio (Clio Manage, Clio Grow)

-

TeleTracking (TeleTracking XT, SynapseIQ)

-

Smartsheet (Smartsheet Platform, WorkApps)

-

Change Healthcare (InterQual, ConnectCenter)

-

Waystar (Waystar Revenue Cycle Platform, Waystar Clearinghouse Services)

-

Availity (Availity Essentials, Availity Authorizations)

-

Inovalon (Inovalon ONE Platform, ScriptMed Cloud)

-

AdvancedMD (AdvancedMD EHR, AdvancedMD Practice Management)

-

eClinicalWorks (eClinicalWorks EHR, eClinicalWorks Practice Management)

-

NextGen Healthcare (NextGen Office, NextGen Enterprise)

-

Greenway Health (Intergy EHR, Prime Suite)

-

Practice Fusion (Practice Fusion EHR, Practice Fusion PM)

-

DrChrono (DrChrono EHR, DrChrono Practice Management)

-

CareCloud (CareCloud Central, CareCloud Charts)

Recent Developments

-

In February 2025, The U.S. government published a report revealing how utilizing digital health records can revolutionize patient care, stressing the role of practice management systems in optimizing the operations in health care.

-

In January of 2025, the Centers for Medicare and Medicaid Services (CMS) released updated guidelines for healthcare providers to enhance billing and insurance claims processing, which practice management systems can improve greatly.

Practice Management System Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.4 Billion |

| Market Size by 2032 | USD 28.32 Billion |

| CAGR | CAGR of 9.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Product (Integrated {EHR/EMR, e-Rx, Patient engagement, Others}, Standalone) • By Delivery Mode (Web-based, Cloud-based, On-premise) • By End-user (Physician Back Office {Ambulatory Settings, Others}, Diagnostic Laboratories, Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Athenahealth, WebPT, Veradigm, Tebra, Splose, Doximity, Clio, TeleTracking, Smartsheet, Change Healthcare, Waystar, Availity, Inovalon, AdvancedMD, eClinicalWorks, NextGen Healthcare, Greenway Health, Practice Fusion, DrChrono, CareCloud |