Electronic Health Records [EHR] Market Report Scope and Overview:

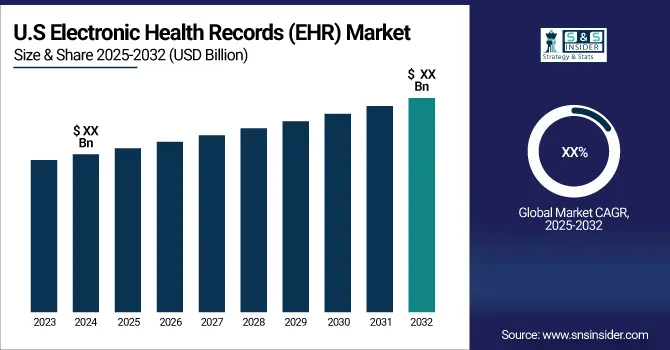

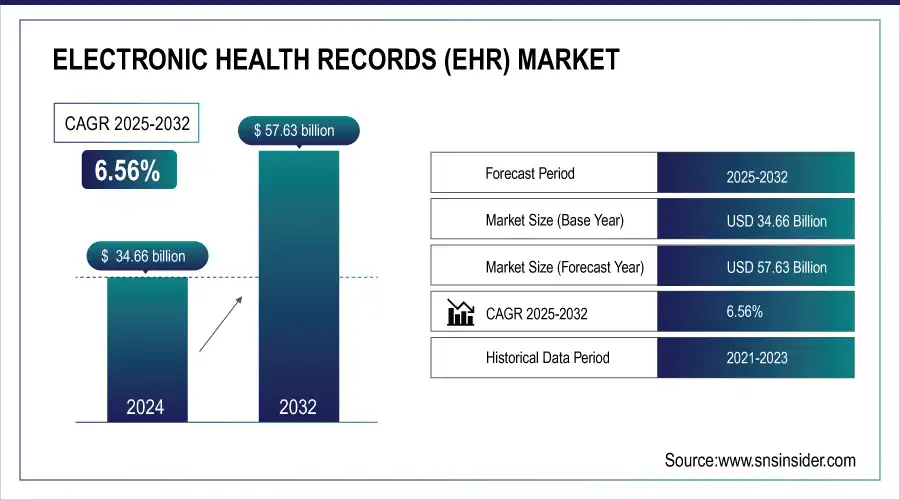

The Electronic Health Records (EHR) Market size, valued at USD 34.66 billion in 2024, is expected to grow up to USD 57.63 billion by 2032, registering a CAGR of 6.56% from 2025 to 2032.

The Electronic Health Records (EHR) represents a major market of growth in the uses for AI to help predict Alzheimer’s, sifting through customer's health records mining data around patients with symptoms and risk factors. This miserable disease has a huge potential for AI early detection and intervention, which could vastly improve patient outcomes. As technology moves forward and personalized medicine becomes the norm i.e. using EHR to identify unique risk factors, hospitals will have increasing needs for sophisticated Electronic Health Records systems.

Using AI, researchers are forecasting Alzheimer Disease through EHR data. Alzheimer's could be predicted with 80% or better accuracy by determined researchers that the risk of developing it was based on running machine learning algorithms on massive amounts of anonymized EHR data ascertained diagnoses, lab test results, demographics and visit history. As an example, certain patterns in medical history associated with the disease were recognized. The risk factors like high blood fat levels, heart failure and vitamin D deficiency, memory loss appeared all over the place in relation to when a stroke showed up on records.

However, as the study indicates, early signs of Alzheimer's may start to show years before an actual clinical diagnosis. A few months to five years before stroke struck, 15% of such patients exhibited high blood fat levels. In men, chest pain had a 20% improvement in the predictor and its prediction accuracy was higher but it showed less association with osteoporosis for women.

Get more information on Electronic Health Records Market - Request Sample Report

Electronic Health Records [EHR] Market Size and Forecast:

-

Market Size in 2024: USD 34.66 Billion

-

Market Size by 2032: USD 57.63 Billion

-

CAGR: 6.56% from 2025 to 2032

-

Base Year: 2023

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Electronic Health Records [EHR] Market Highlights:

-

Linking EHR data to genetic and biochemical databases is enhancing understanding of disease mechanisms and enabling proactive healthcare.

-

AI integration in EHRs allows early disease prediction, personalized medicine, and preventive care, reducing overall healthcare costs.

-

Studies, such as the National Institute on Aging 2024 research, show AI models using EHRs can predict Alzheimer’s with up to 85% accuracy.

-

EHRs improve clinical efficiency by providing complete patient histories, reducing paperwork, and supporting better diagnosis and treatment.

-

The COVID-19 pandemic highlighted EHRs’ role in public health management, including vaccine tracking and surveillance.

-

Barriers to growth include high implementation costs and shortage of skilled healthcare IT professionals, particularly in developing countries.

Investigating the biological mechanisms of some risk factors via linking Electronic Health Records data to genetic and biochemical databases also helped to enhance understanding. Although, above analysis favors the importance for advanced analytics within EHRs, which will propel Electronic Health Records vendors to develop AI algorithms or oversight growth of Artificial intelligence talents where needed consequently fostering a stronger vigour in Electronic Health Records market. Along with reducing cost, the projected healthcare savings from predicting and ideally preventing diseases like Alzheimer's signals a very important change in how health is seen by emphasizing preventive care over reactive treatment of symptoms in which EHRs will become crucial mechanisms for EHR-enabled risk assessments as well early detection.

For example, a study by the National Institute on Aging published in Metabolism – Clinical and Experimental June 2024 showed how based solely upon analysis of anonymous Electronic Health Records using an artificial-intelligence prediction model systems it was possible for scientists to accurately forecast Alzheimer´s with up to 85% reliability which illustrates personalized medicine built upon standard clinical data but twisted toward proactive forecasting. The Electronic Health Records market may be in for a big jump and better health outcomes if these progresses and the study highlighting that an expected increase of around 30% in Electronic Health Records market value in coming years.

Electronic Health Records [EHR] Market Drivers:

-

Revolutionizing Healthcare with Improved Care, Efficiency, and AI Integration

The Electronic Health Record (EHR) market is experiencing a boom driven by a wave of transformative benefits. A 2021 OECD survey highlights this growth, with many countries implementing EHR systems. EHRs are gaining traction due to multiple benefits. They provide a complete patient history, allowing for better diagnoses and treatment plans. EHRs not only improve care with a complete patient view, but also boost efficiency by saving time and reducing paperwork for everyone. This became even clearer during the COVID-19 crisis, where EHRs proved vital in managing public health emergencies. EHRs facilitated efficient vaccine tracking and post-market surveillance efforts, demonstrating their significance in crisis situations. As EHRs integrate with artificial intelligence, they unlock exciting possibilities for personalized medicine and advanced diagnostics. This integration has the potential to revolutionize healthcare by providing more tailored treatment plans and earlier disease detection.

Electronic Health Records [EHR] Market Restraints:

-

Even with Benefits, High Costs and Tech Challenges May Impede EHR Expansion

While many clinical and administrative use cases are being realized with Electronic Health Records (EHRs), some barriers to large-scale EHR implementation still exist. The high expense of implementing and maintaining EMRs is a major barrier The same is particularly difficult in developing nations where funds are comprehensively allocated for the poor and a $1,000-plus per patient EHR sounds impossible to digest.

In addition, most three-word software solutions experience the downside of having a dearth of capable healthcare IT experts in many developing countries. Lack of technical prowess leads to the amount and level in providing EHR being a roadblock which then has resulted with their non-adoption, resulting into imminent benefits.

Electronic Health Records [EHR] Market Segment Analysis:

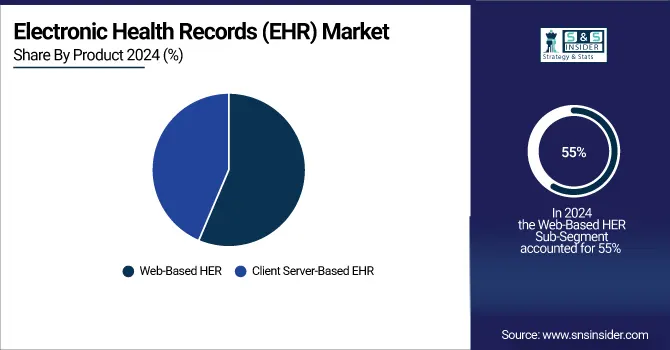

By Product

Web-Based EHR was the largest segment in 2024, representing over 55% of global revenue. This is the result of traditional use among downstream physicians and smaller facilities. Cloud EHRs can be deployed with no in-house servers and provide increased customization capability on an as needed basis.

The client-server-based EHR segment is anticipated to be the fastest growing in next few years. Because the data can be stored in-house, instead of one a Cloud-based platform hence cannot be stolen from - such EHRs are much safer for users. These systems are also adaptable, that allows modifying them to the exact requirements of a customer and thus makes them excellent products for multi-physician practices. Moreover, they do not rely on the internet connection and require web-based EHRs but are potent factors fostering electronic health records (EHR) market growth.

By Type

Use of electronic health records (EHR) in acute care (42.22%) settings, i.e. hospitals will have highest market share by 2024 and some of electronic health records (EHR) market share stems from government EHR grant programs (designed to entice even smaller hospitals into the field). For example, in the U.S., hospitals under the Medicare program can earn incentives for using them.

Ambulatory EHRs, or those designed for small practices and outpatient clinics are also on the rise. Compared to traditional inpatient systems, genealogy EMRs are more user-friendly since they maintain information for a standalone practice and its patients but not an entire hospital network. Post-acute care EHRs, like those used in rehabilitation centers or home health agencies, are finally taking off but the growth is most likely connected with rising spending on such facilities.

By Business Models

By business model, the market is divided into licensed software, technology resale, subscriptions and professional services. The professional services segment held the largest market share 41.98% in 2024. The company delivers these services to help healthcare systems not only implement information systems, but even interpret the latest regulatory requirements (like MACRA), optimize clinical processes and help with end user training for designing & implementing EHRs.

When it comes to technology resale, licensed software is bundled with the intellectual property of third-party companies as sublicenses for complete healthcare systems. Licensed software includes application, architecture executable knowledge and referential data algorithms applications. Different business models that exist in the market are managed service, support & maintenance and much more.

By End Use

By 2024, hospitals have the largest portion of EHR as they own a double-digit share holding up to 78% adoption rate and this dominance results from volume of data created within hospitals and much lower cost to install EHR there compared with ambulatory care settings. Hospitals may still be king, but the ambulatory EHR market is booming which is being driven by increasing adoption levels, particularly in ambulatory surgical centers (ASCs). A whopping 54.6% of Ambulatory Surgery Center Association survey respondents reported using EHRs in a 2021 study Indeed, the more than 3-in-5 physician-owned ASCs at 62.2% that have already implemented this technology are also those who are newer and thus even likelier ante up for it right from launch. These numbers also bode well for the future of EHR adoption among outpatient care facilities.

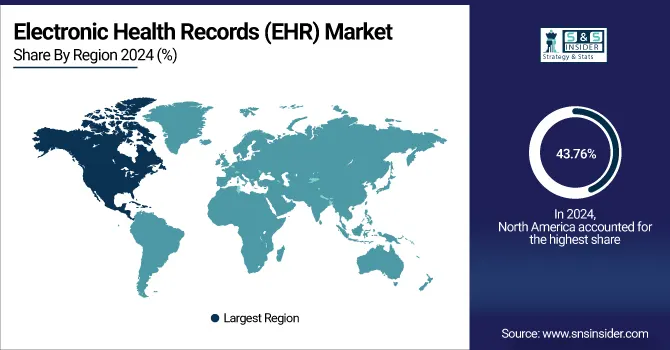

Electronic Health Records [EHR] Market Regional Analysis:

North America remains the global leader in these zones for at least 43.76% share of revenue from HER in 2024, but Europe and China are on catch-up strategy sooner or later to likely have a neck-to-neck competition as rivalries overall increase their footprint in future. This dominance is supported by government policies that enable the inclination of EHR adoption, a cost-effective healthcare infrastructure along with digitally literate people. Market expansion is facilitated by favorable regulations, such as the US Federal Health IT Strategic Plan 2020-2025 requiring use of EHR.

Need any customization research on Electronic Health Records Market - Enquiry Now

The US market on its own is incredibly competitive, with a number of contributory factors including the increasing demand for more innovative healthcare technology, legislation restrictions and dearth in mechanisms to facilitate data flow across all EHR systems. Epic Systems, NextGen Healthcare and Cerner Corporation are amongst the key players competing against each other for a foothold in this market based on features providing user-friendliness & cost support.

Market Trends in the Asia Pacific region, digitization has sparked an increased interest in quality healthcare and lead to a market which is expected to witness considerable growth over this forecast period. This is a bold move by the Chinese Ministry of Health in promoting health e-services across China from healthcare services, insurance plans to most importantly deploying EHR on national level for data sharing. Sitting right on North America's bumper is Europe, and its mature economies demand attention - especially in light of the European Commission Digital Single Market Strategy. It enables online services and products to be accessed throughout Europe more easily, which in turn will ensure a strong digital infrastructure that can support the market development of EHR.

Electronic Health Records [EHR] Market Key Players:

-

NextGen Healthcare, Inc.

-

McKesson Corporation

-

Cerner Corporation (Oracle)

-

CureMD Healthcare

-

GE Healthcare

-

AdvancedMD, Inc.

-

Veradigm LLC (Allscripts Healthcare, LLC)

-

CPSI

-

Epic Systems Corporation

-

Health Information Management Systems

-

eClinicalWorks

-

Medical Information Technology, Inc. (Meditech)

-

Greenway Health, LLC

-

Athenahealth, Inc.

-

Practice Fusion

-

Allscripts Healthcare Solutions, Inc.

-

Philips Healthcare

-

Siemens Healthineers

-

Netsmart Technologies

-

IBM Watson Health

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 34.66 Billion |

| Market Size by 2032 | USD 57.63 Billion |

| CAGR | CAGR of 6.56% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NextGen Healthcare, Inc., McKesson Corporation, Cerner Corporation (Oracle), CureMD Healthcare, GE Healthcare, AdvancedMD, Inc., Veradigm LLC (Allscripts Healthcare, LLC), CPSI, Epic Systems Corporation, Health Information Management Systems, eClinicalWorks, Medical Information Technology, Inc. (Meditech), Greenway Health, LLC |