Precision Fermentation Ingredients Market Report Scope & Overview:

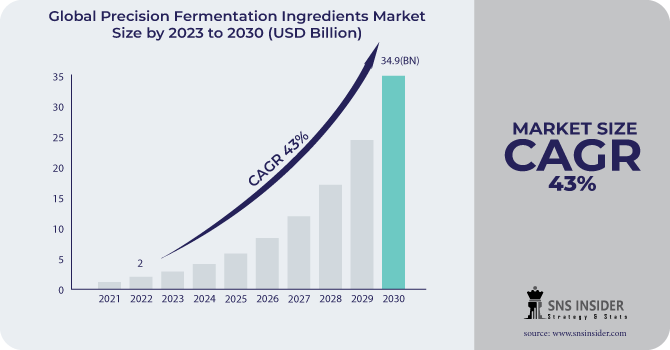

The Precision Fermentation Ingredients Market size was USD 2 billion in 2022 and is expected to Reach USD 34.9 billion by 2030 and grow at a CAGR of 43% over the forecast period of 2023-2030.

Precision fermentation is a process that uses microorganisms, such as yeast and bacteria, to produce specific food ingredients. The expanding number of start-ups coming into the precision fermentation business, fueled by increased investor interest from corporations such as ADM and Cult Food, can be credited to the market's growth.

Based on segmentation by Ingredient, the whey & casein protein has the second-largest market share. Whey protein, noted for its high digestibility and amino acid balance, can be used in a variety of products. Precision fermentation technology meshes with changing consumer preferences by providing whey and other components without the use of traditional animal sources.

Based on Application, the food & beverages segment holds the largest share of the precision fermentation ingredients market. Precision fermentation components are widely employed in the food and beverage industries. Plant-based dairy products, plant-based meat alternatives, baked goods, beverages, spices, and snacks are all examples of products that contain these ingredients. Precision fermentation enables the manufacturing of proteins, enzymes, tastes, and other functional components that improve the nutritional profile, taste, texture, and overall quality of food and beverage products. During the forecast period, the pharmaceutical segment is expected to account for the second-highest market share.

MARKET DYNAMICS

KEY DRIVERS

-

Changing consumer preferences towards veganism

Veganism is becoming increasingly popular around the world. A variety of factors are driving this growth, including growing awareness of the environmental and ethical implications of animal agriculture, as well as the health benefits of a plant-based diet. Precision fermentation ingredients are driving the expansion of the vegan food business. Precision fermentation can be used to make a variety of vegan foods, including plant-based milk, eggs, meat, and cheese. These products taste and feel the same as regular dairy products, but they are more environmentally friendly and have a lower carbon footprint.

RESTRAIN

-

High manufacturing costs associated

Precision fermentation is a relatively new technology, and producing precision-fermented foods at scale is currently prohibitively expensive. This is due to a variety of variables, including raw material costs, specialized equipment like bioreactors and purification systems, and regulatory compliance. These raw resources are costly, especially if they come from sustainable sources.

OPPORTUNITY

-

Lower production and supply chain costs

Precision fermentation is a biotechnology method that produces precise food ingredients using microorganisms such as yeast and bacteria. It is a sustainable and effective method of producing ingredients derived from animal sources, such as milk, eggs, and meat. Precision fermentation has the primary advantage of lowering manufacturing and supply chain costs. This is because precision fermentation technologies are more easily scaled up than traditional agriculture practices. Furthermore, unlike traditional components, precise fermentation materials are not subject to supply chain disruptions such as weather events and animal diseases.

CHALLENGES

-

Customer acceptance of precision fermented products

When analyzing products and ingredients, bioavailability, allergic reactions, ease of digestion, and biological equivalent must all be evaluated. This is an important consideration if customers are transitioning from nutritionally complete food items to modified food products with specific additional proteins. As a result, accepting precision-fermented food items is expected to be one of the market's most difficult challenges.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine serve as significant exporters of wheat, corn, and other agricultural products utilized in the manufacture of precise fermentation components. The war has disrupted the supply of key raw commodities, resulting in greater prices and scarcity. The war has prompted large increases in energy prices, putting strain on the profitability of precision fermentation enterprises. Since the beginning of the conflict, the average increase in energy expenses for precision fermentation companies has been 30%. Expensive food imports can be substituted by local precision fermentation (PF) production hubs, which enable individuals to program microorganisms to produce proteins with precise taste, texture, and nutritional properties. These hubs can be fuelled by clean electricity via SWB, which, if implemented properly by overbuilding solar and wind, will provide massive amounts of excess energy at near-zero marginal costs for most of the year.

IMPACT OF ONGOING RECESSION

The Precision Fermentation Ingredients Market had been hit by the recession. High energy expenses account for a significant portion of the cost of creating precise fermentation components. The war has prompted large increases in energy prices, putting strain on the profitability of precision fermentation enterprises. According to the report, the average increase in raw material costs for precision fermentation companies since the start of the war has been 20%. A recession may also result in increased investment in research and development of new precision fermentation technologies, which may boost market growth in the long run.

MARKET SEGMENTATION

by Ingredient

-

Whey & Casein Protein

-

Collagen Protein

-

Egg White

-

Heme Protein

by Microbe

-

Yeast

-

Fungi

-

Algae

-

Bacteria

by End User

-

Food & Beverage

-

Pharmaceutical

-

Cosmetics

-

other

.png)

REGIONAL ANALYSIS

North America is the largest market for precision fermentation ingredients. This growth is attributed to rising consumer awareness, consumption of healthy food ingredients, the veganism trend, and other factors. Around 39% of American adults, or over 90 million people, are prepared to embrace precision fermentation products, which are expected to reach 132 million consumers by 2027.

The European precision fermentation ingredients market is anticipated to be worth USD 12.5 billion by 2030, growing at a 45% CAGR during the forecast period. The region's expanding population, shifting consumer preferences toward sustainable and plant-based products, rising demand for high-quality ingredients in various industries, and supportive rules and regulations promoting biotechnology and creation all contribute to market growth.

Asia Pacific region is predicted to grow at a high CAGR for the precision fermentation ingredients market in 2022. The region has seen a trend toward meat-free meals, and demand for precision-fermented egg substitutes is increasing as vegetarian diets become more popular and egg prices rise. The region's emphasis on technical innovation and developments in conjunction with cutting-edge nature, and precise ingredients supports a healthy ecosystem for R&D.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Precision Fermentation Ingredients Market are Geltor (US), Melt&Marble, Perfect Day, Inc, The Every Co., Impossible Foods Inc., Mycotechnology, Inc, Helaina Inc., Eden Brew, Formo Bio, Fybraworks Foods, Imagindairy Ltd., Motif Foodworks, Inc., Mycorena, New Culture, and other key players.

Impossible Foods Inc-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, EVERY Company and Alpha Foods formally signed a Joint Development Agreement with the goal of bringing next-generation alt-meat products to market. This collaboration intends to expedite breakthroughs in flavor and texture for non-animal products by leveraging EVERY's pioneering knowledge in animal-free protein manufacturing and Alpha Cuisine's famous chef-crafted plant-based cuisine.

In 2023, Perfect Day strengthened its market position and led the Precision Fermentation Alliance. The Hartman Group, Perfect Day, and Cargill collaborated to provide Perfect Day with significant insights into consumer attitudes and preferences about precision fermentation ingredients.

| Report Attributes | Details |

| Market Size in 2022 | US$ 2 Billion |

| Market Size by 2030 | US$ 34.9 Billion |

| CAGR | CAGR of 43 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Ingredient (Whey & Casein Protein, Collagen Protein, Egg White, Heme Protein) • By Microbe (Yeast, Fungi, Algae, Bacteria) • By End User (Food & Beverage, Pharmaceutical, Cosmetics, and other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Geltor (US), Melt&Marble, Perfect Day, Inc, The Every Co., Impossible Foods Inc., Mycotechnology, Inc, Helaina Inc., Eden Brew, Formo Bio, Fybraworks Foods, Imagindairy Ltd., Motif Foodworks, Inc., Mycorena, New Culture |

| Key Drivers | • Changing consumer preferences towards veganism |

| Market Restrain | • High manufacturing costs associated |