Property Management Software Market Report Scope & Overview:

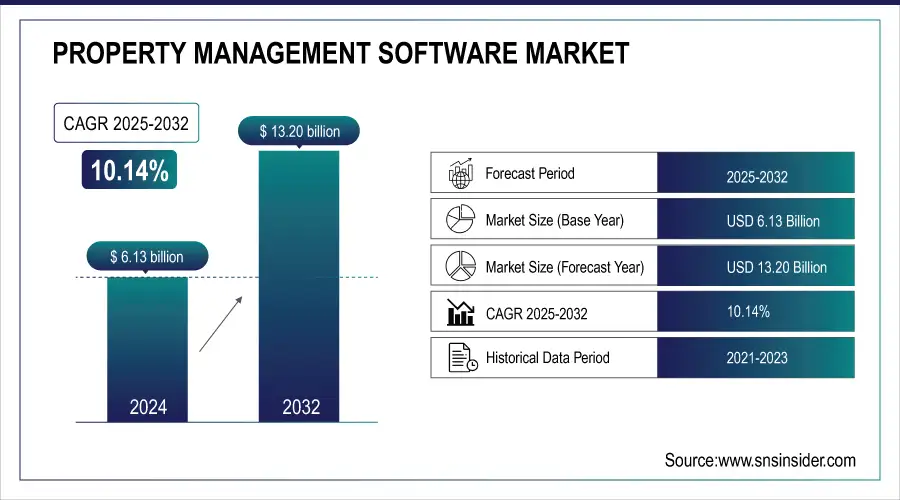

The Property Management Software Market size was valued at USD 6.13 billion in 2024 and is expected to reach USD 13.20 billion by 2032, growing at a CAGR of 10.14% during 2025-2032.

The Property Management Software (PMS) Market is growing due to of rising demand for automation in maintenance, accounting, and leasing. Adoption is driven by real estate sector growth, smart home adoption and scalable large portfolio solutions. The cost-effectiveness, accessibility and real-time data management of the cloud-based software is driving the growth of the market.

A report from AppFolio indicates that property managers utilizing AI has increased from 21% in 2020, to 34% in 2023, suggesting a trend toward wisdom, automation. Moreover, property managers have embraced the innovation and all things for tenant-centric approaches, with 33% of property managers offering flexible rent options, and 25% of property managers offering security deposit alternatives which also proves the point mentioned earlier.

To Get more information on Property Management Software Market - Request Free Sample Report

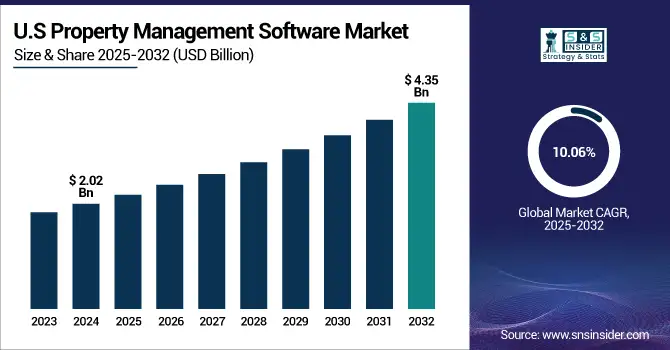

The U.S. Property Management Software Market size was valued at USD 2.02 billion in 2024 and is expected to reach USD 4.35 billion by 2032, growing at a CAGR of 10.06% over 2025-2032.

The U.S. property management software market development is driven by the growing demand for automation, scalability, and real-time data management in property operations. Real estate industry growth, cloud-based solution availability, and smart home integrations all have a significant impact on market growth.

Yardi Systems, a U.S.-based property management software provider, helped a 5,000-unit multifamily portfolio increase occupancy to 95%, boost rent yield by 6%, and reduce paper workflows by 90% using tools including Voyager, RentCafe, and Elevate.

As of 2024, approximately 57% of U.S. households have embraced smart home appliances, including technologies such as smart thermostats, lighting, and security systems. Such broad adoption demonstrates an increasing shift toward networked living spaces.

Property Management Software Market Dynamics:

Drivers:

-

Increasing Automation Needs Drive Adoption of Property Management Software Across Real Estate and Rental Businesses

With the rise in need for automation of real estate operations, property management software is becoming increasingly in demand. Such tools make rent collection, maintenance management, and communication easier and less error-prone to manage. They provide central dashboards, reminders and reporting capabilities, which increases the efficiency and satisfaction of residents. These platforms scale and integrate seamlessly, and offer the same benefits to any multi-manager portfolio, large or small. With companies adopting the concepts of digital transformation, the property management automation has been in full swing to ensure time-saving as well as a competitive edge.

According to research, property managers report up to 50% time savings on administrative tasks through PMS adoption. Additionally, 84% of the property managers think that the implementation of PMS enhances tenant satisfaction. These companies are implementing PMS solutions at 25% growth per year, looking for scalable and cost-effective management tools.

According to research, Software users report a 40% reduction in tenant turnover rates, indicating enhanced tenant retention through streamlined communication and services.

Restraints:

-

Data Privacy Concerns and Cybersecurity Risks Discourage Widespread Use of Digital Property Management Platforms

Data security and privacy challenges are some of the roadblocks to mass adoption of property management software. Such platforms are stuffed with sensitive tenant information such as payment, lease agreements, and identity documents making them a perfect target for a cyberattack. In the absence of strong encryption, compliance measures and incident response protocols, breaches can cause serious reputational and financial damage. Global Players need to take into account regulatory frameworks including the GDPR and local data laws, which increase complexity. As a result, even though the security system in the cloud now is part of the most developed, many property managers are still hesitant to store their core data in the cloud to fully adopt these technologies.

The latest Cyber Security Breaches Survey 2023 provided by the UK Government shows that 32% of businesses and 24% of charities said they had experienced a cyberattack or cyber breach over the last 12 months. Interestingly, this percentage hit 69% for larger business segments, which speaks to the most vulnerable organizations who deal with sensitive information.

International standards, such as ISO/IEC 27001 and ISO/IEC 27018 provide frameworks for establishing, implementing and maintaining information security management systems. These standards are key for organizations such as property management companies to safeguard personal data and comply with data protection regulations.

Opportunities

-

Rising Adoption of Smart Building Technologies Creates Integration Opportunities for Property Management Software Vendors

IoT sensors, automated energy systems, and digital access controls of smart building technologies are necessitating demand for integrated software technologies. Property managers want platforms that integrate with HVC systems, security devices and energy dashboards to manage devices in a singular focus point, facilitating predictive maintenance and remote run operations. With smart features, on the other hand, software vendors are taking the value proposition beyond the simple leasing or billing functions. Sustainable, tech-enabled properties are in increasing demand, and as demand for seamless use of integrated smart infrastructure rises, developers in both commercial and residential real estate have much to gain with the right investments.

In support of this trend, the Bureau of Energy Efficiency (BEE) in India has introduced the nZEB program with an Energy Performance Index (EPI) of less than 15 kWh/m²/year, while trying to achieve energy efficiency equipped with smart technologies.

Meanwhile, U.K. is utilizing smart home technologies in 45.8% of households at the time of 2024, supported by digital infrastructure and the government promoting energy efficiency by the year.

Challenges

-

Difficulty Integrating Property Management Software with Legacy Systems Hampers Smooth Implementation and Operational Continuity

Many real estate companies still use antiquated systems that are difficult to incorporate with contemporary property management software. Adoption attempts for new platforms frequently result in downtime, data silos, and redundant processes, which interfere with day-to-day operations. These difficulties increase complexity and expenses by requiring more IT support and specialized middleware. Cross-platform functionality is further hampered by inconsistent data formats and inadequate API support. Concerns about operational disruption may make property managers hesitant to upgrade systems. Businesses are deterred from implementing sophisticated, scalable property management solutions by this lack of smooth integration, which also slows software deployment.

Property Management Software Market Segment Analysis

By Solution

The software segment held the dominant share in the Property Management Software Market in 2024, accounting for approximately 65% of total revenue. The rise of this dominance is due to the growing level of digitization across the real estate industry, where owners and managers of properties look for greater efficiencies via automated platforms. Greater adoption of tenant tracking, lease management and maintenance scheduling functionalities have made their way into a larger market due to the need for footprint centralization and real-time data visibility in developed markets.

The services segment is expected to grow at the highest CAGR of 11.28% from 2025 to 2032 due to the rise in demand for property management platforms customization, training, integration, and technical support. With increased software adoption, enterprises are also looking for value-added services to help them integrate software seamlessly and optimize it post-deployment. with the transition to cloud-native and AI-enabled solutions, there is a need for continuous support, which drives the growth of on-demand managed and professional service offerings in the years ahead.

By Deployment

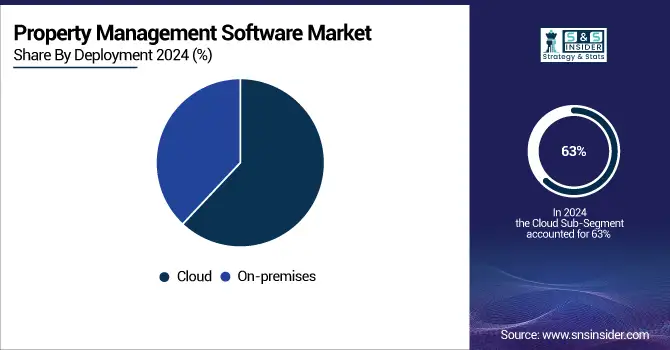

The cloud segment accounted for the largest revenue share of approximately 63% in the Property Management Software Market in 2024 and is projected to grow at the fastest CAGR of 10.88% from 2025 to 2032. This supremacy and exponential growth is powered by the growing demand for distributed, economically scalable and remote-friendly solutions. Cloud-based solutions come with real-time data access, easy updates, lower upfront infrastructure costs and improved security. Cloud deployment models are growing in demand amongst small firms and large enterprises since remote work, mobile management and multi-location property oversight is becoming standard these days.

By Application

The residential segment led the Property Management Software Market share in 2024, commanding a 66% revenue share. The main cause of this is the increasing complexity of managing homeowners' associations, single-family rentals, and multi-unit housing. The growing urbanization, the emergence of the newly generated rental housing markets, and the higher turnover of tenants have all contributed to the urgency of having effective software tools to automate leasing, maintenance, rent collection, and compliance processes for residential property managers and landlords at scale.

The commercial segment is expected to experience the fastest CAGR of 11.41% from 2025 to 2032, driven by the increasing complexity of managing a variety of asset types, including retail establishments, office buildings, and industrial parks. There is a growing requirement for analytics-based solutions to manage the optimization of occupancy, lease administration, energy, and space usage. With an increased focus on operational efficiency and sustainability, commercial property owners are turning to smart management platforms to optimize performance and create value.

By End-use

Property Managers/Agents dominated the Property Management Software Market in 2024 with a 44% revenue share, as they are at the core of day-to-day property management. But this estate management middle man wants such power, they need software that is robust and plans for the growth of your actual estate business, giving you resources to rein in the chaos that is tenants, maintenance requests, and lease agreements across massively disparate portfolios. Third, increased digital-first operations and competition with the rental market has encouraged property managers to look for integrated platforms to better serve tenants.

The Property Investors segment is expected to grow at the fastest CAGR of 12.21% from 2025 to 2032, due to the momentum of Individual & institutional real estate investments. As investors oversee assets more widely dispersed across the globe, they seek technology solutions to support visibility into financial performance, risk and asset tracking. Improved data analytics, portfolio insights and ROI monitoring tools are equipping investors to adapt quicker and smarter decisions, further promoting adoption in this sector.

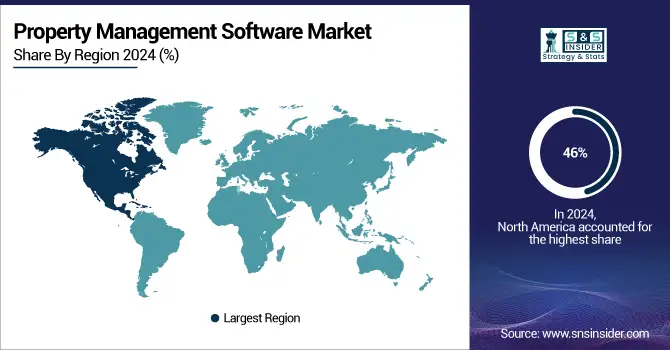

Property Management Software Market Regional Outlook

North America dominated the Property Management Software Market in 2024, capturing around 46% of the total revenue share. This leadership is driven by a developed real estate market, early digital adoption, and the presence of a number of strong software vendors. The combination of high rental activity, regulatory compliance needs and property managers are seeking automation tools, has driven steady investment in sophisticated platforms.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. dominated the Property Management Software Market due to high property digitization rates, strong tech adoption, and established real estate infrastructure.

Asia Pacific is expected to register the fastest CAGR of 12.06% from 2025 to 2032, driven by factors such as rapid urbanization, growing residential and commercial real estate sectors, and rising digital transformation initiatives. Developer and landlord demand for scalable solutions in the cloud, combined with increasing internet penetration is driving adoption within this fast-growing region.

China is dominating the Market in the Asia Pacific region due to rapid urbanization, a large real estate sector, and increasing adoption of digital property solutions.

The property management software market in Europe is expected to grow in the coming years due to rising digital transformation in real estate, increasing demand for automation, regulatory compliance requirements, and the adoption of cloud-based property management solutions in various segments of commercial and residential sectors.

In Europe, 45% of businesses utilized cloud computing services by 2023, and 8% implemented artificial intelligence (AI) technologies integral to the development of smart buildings, enhancing both automation and efficiency.

The U.K. is dominating the Property Management Software trend in Europe, driven by advanced digital infrastructure, high real estate investment, and early adoption of proptech solutions.

The Middle East & Africa and Latin America is expected to show steady growth in the Property Management Software industry driven by urgent urbanization initiatives, rising awareness for automated property solutions, and increasing investments for modernization of real estate sector in both commercial & residential spaces.

Key Players:

Property Management Software Market companies include, AppFolio, Inc., Console Australia Pty Ltd, CoreLogic, Entrata, Inc., MRI Software LLC, RealPage, Inc., REI Master, Yardi Systems Inc., Zillow Group, Inc., ManageCasa, SAP, ResMan, Archibus, Inc., IBM Corporation, MAISONETTE, Oracle Corporation, CoStar Group

Recent Developments:

-

In October 2024, AppFolio launched FolioSpace, a next-generation resident experience platform, and acquired LiveEasy to integrate moving and home services, enhancing convenience for property managers and residents.

-

In August 2024, RealPage launched GenAI innovations powered by Lumina, integrating advanced automation, personalized insights, and AI-driven decision-making across its property management platforms to enhance operational efficiency and resident engagement.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.13 Billion |

| Market Size by 2032 | USD 13.20 Billion |

| CAGR | CAGR of 10.14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Cloud, On-premises) • By Solution (Software, Services) • By Application (Residential, Commercial) • By End-use (Housing Associations, Property Managers/Agents, Property Investors, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AppFolio, Inc., Console Australia Pty Ltd, CoreLogic, Entrata, Inc., MRI Software LLC, RealPage, Inc., REI Master, Yardi Systems Inc., Zillow Group, Inc., ManageCasa, SAP, ResMan, Archibus, Inc., IBM Corporation, MAISONETTE, Oracle Corporation, CoStar Group |