Connected Enterprise Market Report Scope & Overview:

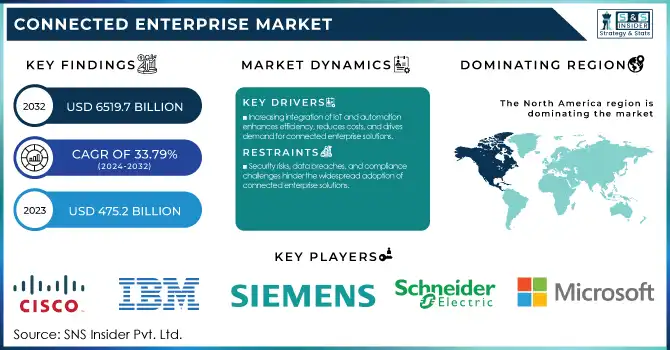

The Connected Enterprise Market was valued at USD 475.2 Billion in 2023 and is expected to reach USD 6519.7 Billion by 2032, growing at a CAGR of 33.79% from 2024-2032.

To Get more information on Connected Enterprise Market - Request Free Sample Report

Adoption of connected enterprise solutions varies by industry, with manufacturing, healthcare, and retail leading due to IoT integration and automation. Investment in these technologies is rising, particularly in North America and Asia-Pacific, fueled by digital transformation efforts. While cloud deployments are gaining traction for scalability, some industries opt for on-premises solutions due to security concerns. The rise of 5G is accelerating adoption by enabling faster data processing, low-latency applications, and improved connectivity for industrial automation and smart infrastructure.

Connected Enterprise Market Dynamics

Drivers

-

Increasing integration of IoT and automation enhances efficiency, reduces costs, and drives demand for connected enterprise solutions.

The growing adoption of IoT and automation across several industries like manufacturing, healthcare, and retail along with increasing demand from organizations for a connected enterprise is a key factor driving the growth of the connected enterprise market, As stated in the report. With the help of IoT-enabled devices and automation solutions, organizations are achieving operational efficiency, elimination of costs, and improved decision-making. Connected enterprises are changing business processes with the help of smart factories, predictive maintenance, and real-time data analytics. Also, AI and machine learning innovations are also boosting connectivity and automation technology, allowing companies to boost workflow efficiency and productivity. The global digital transformation is driving the world move toward seamless connectivity to facilitate real-time data exchange for various end-use industries which is the primary market growth factor worldwide.

Restraints

-

Security risks, data breaches, and compliance challenges hinder the widespread adoption of connected enterprise solutions.

Although connected enterprise solutions offer various benefits, data security and privacy concerns are a major factor hindering the market growth. With hundreds of connected systems generating vast amounts of sensitive data, enterprises are at risk of advanced cyber threats and breaches. This risk of data breaches, leaks, hacks raises concerns within companies, especially those in the finance or healthcare industries, where regulations are stricter. There is also the need to comply with regulations like GDPR and CCPA that mandate high levels of data protection. It must invest in better cybersecurity, which tends to increase operational expenses and delay adoption.

Opportunities

-

5G and edge computing enable faster, low-latency communication, enhancing IoT applications and real-time enterprise connectivity.

As 5G and edge computing networks deploy rapidly, they will open up one of the largest opportunities for the connected enterprise market. 5G facilitates super-low latency, high-speed data transmission, and high reliability, enabling real-time connectivity for devices and enterprise systems. On the other hand, edge computing enables processing closer to where the data is coming from, reducing reliance on centralized cloud infrastructure and improving latency. These improvements enrich IoT applications, and predictive analytics and facilitate AI-driven automation across verticals. 5G Edge integration is also predicted to open up immense new enterprise solutions, as businesses utilize high-speed connectivity for mission-critical operations, resulting in new business models, efficiencies, and enterprise solutions advancements.

Challenges

-

Legacy system compatibility, high investment costs, and interoperability issues slow down connected enterprise adoption.

Integration of diverse technologies and legacy systems is the biggest challenge in the connected enterprise market. Numerous organizations continue to perform in an older IT landscape not suitable for the modern connected enterprise solution. Migration to a complete integrated system is an expensive business involving different types of hardware, software, and skilled workforce, which increases the deployment cost. Lastly, interoperability problems among different platforms, devices, and vendors make adoption even trickier. Enterprises need to have a well-planned digital transformation strategy that can be quickly adopted and transform seamlessly, and less disruptive integration. Addressing these challenges will necessitate sound enterprise architecture as well as a combination of collaboration between partners and the implementation of open and established standards that allow different enterprise ecosystems to connect smoothly.

Connected Enterprise Market Segmentation analysis

By Component

In 2023, the solutions segment dominated the market and accounted for 46% of revenue share, which held a revenue share of 44.2%. Segment growth is propelled by the expanded necessity for holistic and end-to-end solutions that integrate and orchestrate different facets of organizational operations. With the help of the technology like IoT, Cloud Computing, and making the use of the solutions with Mobile devices, businesses are now able to receive enormous data and analyze it through a single unified platform to manage both their operations and workforce.

Service segment is anticipated to grow at a considerable CAGR during the forecast period. This component is meeting massive adoption across the connected enterprise industry as the rising need for assistance and experience as connected enterprise solutions are managed. Growing inclination toward connected technologies across industries like IoT and cloud platforms has further fueled demand for connected enterprise services such as maintenance and managed services.

By Application

The Manufacturing segment dominated the market and accounted for significant revenue share in 2023, manufacturing units have adopted Industry 4.0 practices when manufacturers make use of IoT, automation, and analytics to enhance functional efficacy, reduce equipment downtime, and increase product quality. Furthermore, connected solutions facilitate real-time overview & management of different manufacturing activities, allowing for continuous production and predictive maintenance by cutting time.

The IT & telecom segment is expected to register the fastest CAGR during the forecast period. Some of the important market driving factors include enterprises towards next-generation communication technologies, and increasing investments in 5G infrastructure, an upsurge in demand for high-speed data connectivity. Cloud-based telecom services facilitate seamless communication and collaboration, spurring their annual increasing adoption.

Regional Analysis

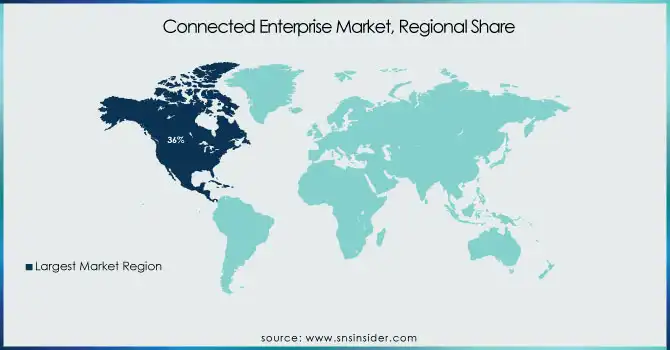

North America dominated the market and accounted for 36% of revenue share in 2023. The growth of this market can be attributed to the presence of a large number of technology companies all operating in the area, a high degree of focus on innovation, and a high early adoption rate of digital technologies.

The Asia Pacific region is expected to register the fastest CAGR during the forecasted period. Other factors contributing to the growth include rising industrialization with urbanization in the region, opening of numerous global companies, and a high tendency toward digital innovation adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

Cisco Systems, Inc. – Cisco IoT Control Center

-

IBM Corporation – IBM Maximo Application Suite

-

Siemens AG – Siemens MindSphere

-

Schneider Electric – EcoStruxure

-

Microsoft Corporation – Microsoft Azure IoT

-

Rockwell Automation, Inc. – FactoryTalk InnovationSuite

-

General Electric (GE) – GE Digital Predix

-

SAP SE – SAP Leonardo

-

Honeywell International Inc. – Honeywell Forge

-

Oracle Corporation – Oracle IoT Cloud Service

-

Bosch Software Innovations – Bosch IoT Suite

-

PTC Inc. – ThingWorx

-

Hitachi, Ltd. – Lumada

-

Amazon Web Services (AWS) – AWS IoT Core

-

Hewlett Packard Enterprise (HPE) – HPE Edgeline

Recent Developments

-

November 2024: C3.ai announced a strategic partnership with Microsoft's Azure to provide cloud computing services targeting enterprise customers, aiming to accelerate AI adoption in various sectors.

-

October 2024: Optus partnered with Elon Musk's Starlink to offer enterprise-level internet services in remote Australian regions, enhancing connectivity for businesses with up to 500 employees.

-

September 2024: HPE announced plans to finance its $14 billion acquisition of Juniper Networks through a combination of term loans and a seven-part bond deal, aiming to double its networking business and strengthen its position in the AI-driven market.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 475.2 Billion |

|

Market Size by 2032 |

USD 6519.7 Billion |

|

CAGR |

CAGR of 33.79% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services, Platform) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Cisco Systems, Inc., IBM Corporation, Siemens AG, Schneider Electric, Microsoft Corporation, Rockwell Automation, Inc., General Electric (GE), SAP SE, Honeywell International Inc., Oracle Corporation, Bosch Software Innovations, PTC Inc., Hitachi, Ltd., Amazon Web Services (AWS), Hewlett Packard Enterprise (HPE) |