Signals Intelligence Market Report Scope & Overview:

To Get More Information on Signals Intelligence Market - Request Sample Report

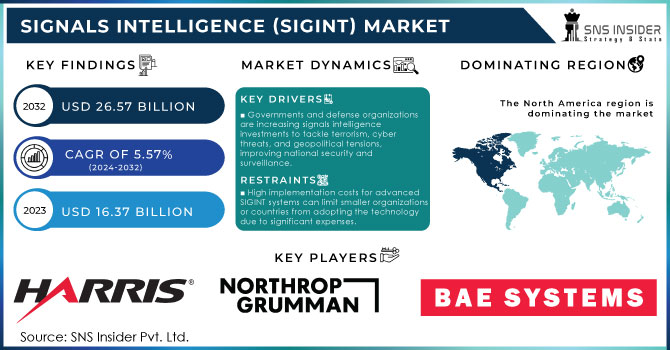

The Signals Intelligence (SIGINT) Market Size was USD 16.37 Billion in 2023 and is expected to Reach USD 26.57 Billion by 2032 and grow at a CAGR of 5.57% over the forecast period of 2024-2032.

The Signals Intelligence Market prominence is driven by the increasing reliance on digital communication technologies and the growing need for advanced surveillance solutions. Organizations in defense and intelligence sectors leverage SIGINT to enhance situational awareness and inform decision-making processes. There is also a notable surge in the development of advanced technologies such as artificial intelligence and machine learning, improving signal processing and data analysis efficiency. This evolution enables SIGINT systems to process vast amounts of data swiftly and accurately. However, the SIGINT market faces challenges, including the complexity of modern communication networks and the necessity for compliance with legal and ethical standards in data collection. The rise of encrypted communication, expected to exceed 80% of internet traffic by 2024, presents significant hurdles, necessitating advanced decryption techniques. Despite these challenges, the market is expanding due to technological advancements and the rising demand for effective intelligence-gathering solutions.

Recent trends indicate significant investments in cybersecurity, projected to exceed USD 200 billion in 2023, driven by threats to digital networks, which further enhances the SIGINT market as organizations seek sophisticated capabilities. Military expenditures often allocate 10-15% of defense budgets to intelligence, surveillance, and reconnaissance (ISR) capabilities reliant on SIGINT technologies. Furthermore, approximately 70% of organizations plan to incorporate AI into their data analysis by 2025, improving real-time processing and intelligence accuracy. The drone sector's anticipated growth, with UAVs increasingly utilized for SIGINT operations, underscores the evolving landscape of this critical field.

Signals Intelligence Market Dynamics

DRIVERS

-

Governments and defense organizations are boosting investments in signals intelligence to address rising concerns over terrorism, cyber threats, and geopolitical tensions for enhanced national security and surveillance.

Heightened global security concerns have significantly increased the demand for signals intelligence (SIGINT) among governments and defense organizations. In recent years, the rise of terrorism and cyber threats has underscored the critical need for advanced surveillance and intelligence-gathering capabilities. Furthermore, geopolitical tensions, such as territorial disputes and power shifts among global superpowers, have led to an intensified focus on intelligence operations to gain strategic advantages. In response to these threats, defense budgets worldwide have seen substantial allocations toward SIGINT capabilities. In 2021, the global defense expenditure reached approximately USD 2 trillion, with a significant portion directed toward modernizing intelligence and surveillance technologies. Governments are investing in advanced SIGINT systems that leverage artificial intelligence and machine learning to analyze vast amounts of data swiftly and effectively. This investment not only enhances national security but also improves the ability to preemptively address potential threats. Additionally, collaboration between nations has increased, leading to shared intelligence initiatives that utilize SIGINT to combat transnational crime and terrorism. As the landscape of global threats evolves, the demand for robust signals intelligence systems will continue to rise, making it a pivotal component of national security strategies.

-

Technological advancements like AI, machine learning, and big data analytics are significantly improving the efficiency and effectiveness of SIGINT systems.

Technological advancements are fundamentally transforming the Signals Intelligence (SIGINT) landscape, significantly enhancing its efficiency and effectiveness. Key innovations, such as artificial intelligence (AI) and machine learning (ML), enable SIGINT systems to process vast amounts of data with unprecedented speed and accuracy. AI algorithms can analyze patterns and detect anomalies in real time, allowing for faster decision-making and improved threat identification. AI can sift through enormous data sets generated by electronic communications, satellite transmissions, and other signals, identifying potential security threats that might go unnoticed by human analysts. Additionally, big data analytics tools have revolutionized how organizations gather, store, and analyze intelligence. By leveraging these technologies, SIGINT systems can now correlate disparate data sources, providing a more comprehensive understanding of potential threats. The integration of automation in these systems further reduces the burden on human analysts, enabling them to focus on interpreting intelligence rather than being overwhelmed by data processing tasks. According to a recent study, approximately 70% of security leaders reported that AI-driven analytics significantly improved their organization's ability to identify and respond to security incidents. Furthermore, as technology continues to evolve, SIGINT capabilities are expected to advance further, leading to more proactive and predictive intelligence operations. This not only strengthens national security efforts but also provides commercial entities with tools to enhance their operations, risk management, and strategic planning. In summary, technological advancements are pivotal in shaping the future of SIGINT, driving improved performance and more robust intelligence capabilities.

RESTRAIN

-

High implementation costs for advanced SIGINT systems can be a barrier for smaller organizations or countries, limiting their ability to adopt such technologies due to substantial initial and ongoing expenses.

The high implementation costs associated with sophisticated Signals Intelligence (SIGINT) systems present a significant barrier to entry for many organizations, particularly smaller ones and developing countries. These systems require substantial initial investments, not only in terms of the hardware and software needed to collect and analyze signals but also for the infrastructure to support them. Advanced SIGINT solutions often involve sophisticated technologies like satellite communications, data processing units, and secure communication channels, which can lead to expenses that are hard to justify for organizations with limited budgets.

Additionally, ongoing maintenance costs can add another layer of financial burden. Regular updates, system upgrades, and the continuous need for training personnel to manage and analyze the data effectively contribute to overall expenditures. According to industry experts, the total cost of ownership for these systems can be three to five times the initial purchase price over their operational lifetime. This financial strain can deter potential adopters, forcing them to rely on less effective, lower-cost alternatives that may not provide the same level of intelligence or operational capabilities. Furthermore, research indicates that nearly 60% of organizations cite budget constraints as a major reason for not investing in advanced SIGINT technologies. The perception that SIGINT systems are primarily a defense or intelligence community investment can exacerbate the issue, as many smaller organizations may feel that these tools are beyond their reach or not applicable to their specific needs. As a result, the disparity in access to advanced SIGINT technologies can hinder overall market growth and innovation.

Signals Intelligence Market Segmentation Overview

By Type

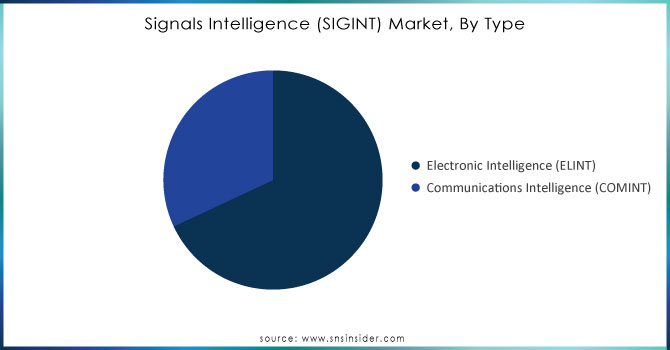

The ELINT (Electronic Intelligence) segment dominated the market with a substantial revenue share of 72.5% in 2023, reflecting the growing reliance on electronic equipment across military and civilian applications. This demand surge stems from the increasing sophistication of military operations, where electronic systems play a critical role. Around 70% of military decision-making relies on real-time electronic data. ELINT systems are crucial for detecting enemy radar and communication signals, with over 60% of military engagements now requiring electronic warfare capabilities. The integration of advanced technologies like artificial intelligence and machine learning enhances ELINT capabilities, leading to a reported 50% improvement in threat assessment accuracy. In civilian sectors, ELINT systems contribute significantly to telecommunications, with an estimated 40% of network security measures relying on electronic intelligence for threat detection

Do You Need any Customization Research on Signals Intelligence Market - Enquire Now

By Mobility

The fixed segment emerged as a leader in the market, capturing a significant revenue share of 73.12% in 2023. This dominance is largely due to the increasing demand for long-range monitoring and passive data collection capabilities. Fixed SIGINT (Signals Intelligence) systems are designed to passively gather intelligence without actively emitting signals, which enhances their stealth and effectiveness. By minimizing the risk of detection, these systems provide a strategic advantage in intelligence operations. In contrast, portable SIGINT systems often emit signals for interception, which can inadvertently reveal their presence to adversaries. The growing emphasis on covert intelligence-gathering methods, coupled with advancements in technology, has propelled the adoption of fixed SIGINT systems across various sectors, including defense and national security.

Signals Intelligence Market Regional Analysis

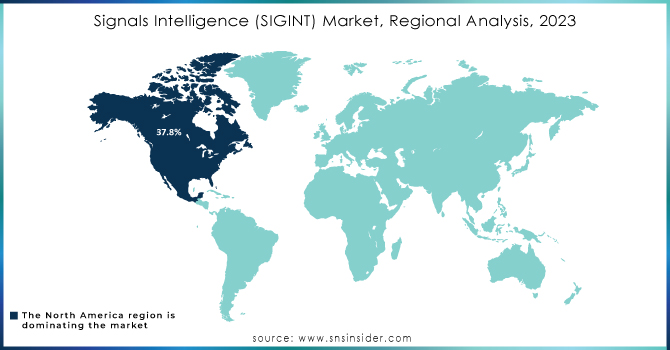

North America region dominated the market share over 37.8% in 2023. This leadership is largely driven by an increasing defense budget and the rapid advancements in artificial intelligence (AI). The U.S. government has responded to escalating geopolitical tensions, particularly concerning adversaries like China and Russia, by intensifying its focus on enhancing intelligence capabilities. This urgency has resulted in substantial investments in SIGINT technologies, enabling more sophisticated signal processing, data analytics, and decision-making processes. The growing complexity of global security threats necessitates a proactive approach to intelligence gathering and analysis. These efforts underscore the critical importance of SIGINT in national security strategies, ensuring that North America remains at the forefront of intelligence innovation amidst increasing global competition.

Asia Pacific region is poised for the fastest growth in the SIGINT market, driven by a myriad of geopolitical factors. The region is characterized by diverse and complex dynamics, including territorial disputes, military tensions, and regional rivalries that compel nations to enhance their intelligence capabilities. Countries in the Asia Pacific are increasingly recognizing the necessity of advanced SIGINT systems to monitor, assess, and respond to emerging threats that could jeopardize national security and regional stability. In 2023, China exemplified this trend with significant investments in SIGINT for domestic surveillance, reflecting its commitment to expanding capabilities not just for national defense but also for internal social control. This includes monitoring communications, internet activities, and electronic transactions to identify and suppress dissent against the ruling Communist Party. As a result, the development of SIGINT infrastructure and capabilities in China is not only contributing to market growth but also shaping the broader strategic landscape in the Asia Pacific.

KEY PLAYERS

Some of the major key players of Signals Intelligence Market

-

Harris Corporation (Communication Systems, Electronic Warfare)

-

Northrop Grumman Corporation (Cybersecurity Solutions, Surveillance Systems)

-

BAE Systems (Electronic Warfare, Cyber Intelligence)

-

Raytheon Company (Radar Systems, Electronic Warfare Solutions)

-

Lockheed Martin Corporation (Advanced Communications, Surveillance Technologies)

-

Mercury Systems Inc. (Sensor Processing Solutions, Electronic Warfare)

-

Elbit Systems Ltd. (Intelligence, Surveillance and Reconnaissance Solutions)

-

Thales Group (Cybersecurity, Electronic Warfare Systems)

-

Rheinmetall AG (Defense Electronics, Surveillance Solutions)

-

General Dynamics Corporation (Cybersecurity, Communication Systems)

-

L3Harris Technologies (Communication and Electronic Warfare Solutions)

-

Cisco Systems Inc. (Network Security, Cyber Intelligence Solutions)

-

Leonardo S.p.A. (Electronic Warfare, Intelligence Solutions)

-

Saab AB (Electronic Warfare, Cyber Defense Solutions)

-

AeroVironment, Inc. (Unmanned Aircraft Systems, Surveillance Technologies)

-

Kongsberg Gruppen (Defense Systems, Surveillance Solutions)

-

Cubic Corporation (Training and Simulation Systems)

-

Rohde & Schwarz GmbH & Co. KG (Radio Communication, Electronic Test and Measurement)

-

Inmarsat plc (Satellite Communication Solutions)

-

Viasat Inc. (Satellite Communication, Cybersecurity Solutions)

Suppliers for Networking and Cybersecurity Supplier to Signals Intelligence:

-

BAE Systems

-

Northrop Grumman Corporation

-

Hewlett Packard Enterprise

-

Dell Technologies

-

Cisco Systems Inc.

-

L3Harris Technologies

-

General Dynamics Corporation

-

Thales Group

-

Rohde & Schwarz GmbH & Co. KG

-

Rockwell Collins

RECENT DEVELOPMENT

In Aug 2024: BAE Systems announced that it had been awarded a USD 48 Million contract from the Air Force Research Laboratory to further advance the Insight system. Insight is a next-generation Intelligence, Surveillance, and Reconnaissance (ISR) exploitation and resource management system that uses multiple intelligence signal processing, domain analysis multi-level fusion, predictive analytics, machine learning, and automation to fill gaps in today’s military intelligence analysis capability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.37 billion |

| Market Size by 2032 | USD 26.57 billion |

| CAGR | CAGR of 5.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solutions (Airborne, Ground, Naval, Space, Cyber) • By Type (Electronic Intelligence (ELINT), Communications Intelligence (COMINT)) • By Mobility (Fixed, Portable) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Harris Corporation, Northrop Grumman Corporation, BAE Systems, Raytheon Company, Lockheed Martin Corporation, Mercury Systems Inc., Elbit Systems Ltd., Thales Group, Rheinmetall AG, General Dynamics Corporation, L3Harris Technologies, Cisco Systems Inc., Leonardo S.p.A., Saab AB, AeroVironment, Inc., Kongsberg Gruppen, Cubic Corporation, Rohde & Schwarz GmbH & Co. KG, Inmarsat plc, Viasat Inc. |

| Key Drivers | • Governments and defense organizations are boosting investments in signals intelligence to address rising concerns over terrorism, cyber threats, and geopolitical tensions for enhanced national security and surveillance. • Technological advancements like AI, machine learning, and big data analytics are significantly improving the efficiency and effectiveness of SIGINT systems. |

| RESTRAINTS | • High implementation costs for advanced SIGINT systems can be a barrier for smaller organizations or countries, limiting their ability to adopt such technologies due to substantial initial and ongoing expenses. |