Propylene Glycol Market Report Scope & Overview:

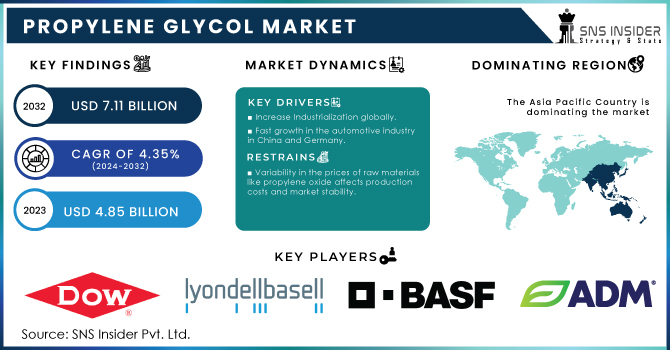

The Propylene Glycol Market size was valued at USD 4.12 billion in 2023 and is expected to reach USD 6.59 billion by 2032 and grow at a CAGR of 5.38% over the forecast period 2024-2032.

Get More Information on Propylene Glycol Market - Request Sample Report

The propylene glycol report provides a detailed analysis of production capacity and utilization rates by country, distinguishing between petroleum-based and bio-based variants in 2023. It examines feedstock price trends, including propylene oxide and glycerin, across major markets. The report highlights the impact of global regulations, such as EU REACH, U.S. FDA, and China’s environmental policies, on production and usage. Additionally, it covers environmental metrics, including CO₂ emissions, waste management practices, and sustainability initiatives by region. Innovation and R&D trends focus on bio-based propylene glycol advancements and glycerin-based production methods. The report also analyzes market adoption trends in pharmaceuticals, food & beverages, cosmetics, and automotive coolants. Overall, it provides a comprehensive view of key market trends shaping the global propylene glycol industry in 2023.

Propylene Glycol Market Dynamics

Drivers

-

Growing demand in pharmaceuticals and personal care drives the market share.

The demand is anticipated to drive growth supported by the multifunctional property of propylene glycol, which makes it an important ingredient in formulations such as pharmaceuticals and personal care. Abstract Propylene glycol is one of the widely used solvents, stabilizer and carrier for active ingredients in oral, injectable and topical pharmaceutical preparations, which ensures right drug delivery and shelf life. The approval of regulatory authorities like the U.S. FDA and European Medicines Agency (EMA) promotes its adoption in pharmaceutical formulations. Likewise, as a humectant and emollient, it is an essential ingredient in skin care, hair care, and oral hygiene products for moisture retention and texture enhancement for personal care and cosmetics. In line with this, rising demand for high-purity USP/Pharma grade propylene glycol is being further supplemented by the growing consumer ambition for high-net-worth skincare and hygiene goods and the always escalating global-to-local healthcare outlay, especially in North America, Europe and Asia-Pacific.

Restraint

-

Fluctuating feedstock prices may hamper the market growth.

The major propylene glycol market challenges are the variable nature of feedstock prices since feedstock costs are directly proportional to production costs and profit margins. The majority of petroleum-based propylene glycol is produced from propylene oxide, whose price are subject to the economic environment experiencing a wide variety of factors leading to volatility such as the crude oil price, the balance of refining, and so forth, not to mention the geopolitical aspects. Bio-substitute hesperetin, made by converting glycerin, also shows fluctuating prices as they correlate with biodiesel production capacity and supply of agricultural feedstock. Fluctuating costs of raw materials make it difficult for manufacturers to keep the price under control, and thus profit.

Opportunities

-

Increasing Demand for High-Performance Coolants & Heat Transfer Fluids creating an opportunity for the market.

The propylene glycol market is expected to gain strength from the increase in demand for high-performance coolants and heat transfer fluids in automotive, HVAC, aerospace and industrial processing applications. Propylene glycol's low toxicity, high thermal stability, and excellent heat transfer characteristics make it well-suited for use in engine coolants, antifreeze solutions, and heat transfer fluids. Propylene Glycol-based coolants are witnessing increased adoption as effective thermal management systems are compelled to maintain battery temperatures for an increasingly competitive electric vehicle (EV) industry. Besides, the growing HVAC (heating, ventilation, and air conditioning) sector supported by urbanization as well as increasing infrastructure development is also expected to drive the glycol-based heat transfer fluids market demand.

Challenges

-

Supply Chain Disruptions are major challenges for propylene glycol market.

Supply chain disruptions are a major threat against the propylene glycol market as it hinders the production and transportation of propylene glycol. Based on propylene oxide (for petroleum-based PG) and glycerin (for bio-based PG), the supply is dependent on the availability of related raw materials, which can be affected by supply chain bottlenecks, transportation delays and geopolitical conflicts. Moreover, insensitive to price fluctuations of crude oil derivatives makes petroleum-based PG vulnerable to price fluctuations; and bio-based PG production is sensitive to the fluctuations of biodiesel output and agricultural uncertainties. Such disruptions increase production costs, lower profit margins, and make it challenging for manufacturers to supply adequate products to meet the growing demand for such products. In order to combat this issue, companies are emphasizing on regional sourcing strategy, supply chain diversification, and raw material innovations to stabilize the market.

Propylene Glycol Market Segmentation Analysis

By Source

The Petroleum-based PG accounted for the highest revenue share of around 65% in 2023. It is owing to their availability, affordability and wide range of industrial applications. It is a widely used propylene oxide derivative for automotive uses including coolant, antifreeze, de-icing solution, solvents, and other personal care use in pharmaceutical and food & beverage industries. Petroleum-based PG has dominated the market due to high production efficiency and existing supply chains with a lower price than bio-based alternatives. It gives it even better thermal stability, viscosity control, and compatibility with most industrial formulations, making this material advantageous in HVAC systems, chemical processing, and industrial heat transfer fluids. While the global move towards bio-based PG is increasing due to environmental concerns, the price and extensive infrastructure surrounding petroleum-based PG are sustaining this region's market share for years to come, particularly in North America, Europe, and Asia-Pacific sustained by industrial and automotive demands.

By Grade

Industrial Grade held the largest market share around 63% in 2023. it has the broadest application in many industries, such as automotive, construction, HVAC & chemical processing. This is a major grade for use in coolants, antifreeze solutions, de-icing fluids, heat transfer fluids, and industrial coatings, where, in fairness, high purity is not as critical as in applications involving pharmaceutical or food-grade materials. The many advantages of industrial-grade PG, including its cost-effectiveness, high thermal stability, and excellent solvency properties make it a suitable choice for large-scale manufacturing and other industrial applications.

By End-Use Industry

Construction held the largest market share around 32% in 2023. It is owing to rapid growth in construction industry especially in emerging economies such as China, India and Brazil. Moreover, growing infrastructure development, rapid urbanization and supportive government initiatives to promote the construction of green and energy-efficient buildings are also stimulating the market growth. Its dominance is also propelled by the increasing adoption of green building materials and proven insulation technologies, in which the propylene glycol serves a key role.

Propylene Glycol Market Regional Outlook

Asia Pacific led the largest market share around 48% in 2023. It is attributed to booming industrial sector and urbanization along with solid ground demand in vital end use verticals including, construction, automotive, pharmaceuticals, and personal care. China, India, Japan and South Korea are a few countries that are undergoing expanding infrastructure developments along with growing automotive production rates, further supporting the demand for automotive propylene glycol-based coolants & antifreeze paints and coatings. Furthermore, it is one of the major centers for manufacturing and industrial activity for most of the chemical production in this region leading to rich supply of propylene glycol at economical prices. A booming pharmaceutical and personal care industry due to the increasing disposable income and a growing middle class is also driving the market. Additionally, governmental programs aimed at industrialization, green building materials, and bio-based chemical production are driving the consumption of petroleum-based and bio-based propylene glycol faster. Asia Pacific continues to be the world leader in propylene glycol market with high consumer base, rising investment in infrastructures, and supported by robust industrial ecosystem.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

The Dow Chemical Company (DOWFROST, Propylene Glycol Industrial Grade)

-

LyondellBasell Industries N.V. (Propylene Glycol USP/EP, Therminol 66)

-

BASF SE (Sensicare P, Plurasafe PG USP)

-

Archer Daniels Midland Company (ArcoCare PG, Evolution Chemicals PG)

-

Global Bio-chem Technology Group Co., Ltd. (GBE Propylene Glycol, BioGreen PG)

-

DuPont (Zemea Propylene Glycol, Tate & Lyle Susterra)

-

Tate & Lyle Bio Products, LLC (Zemea USP, Susterra PG)

-

Huntsman Corporation (JEFFCOOL P150, JEFFSOL PG)

-

SKC Co., Ltd. (EcoPrime PG, SKC PG USP)

-

Temix International S.R.L. (TemiCool PG, TemiTherm PG Industrial)

-

Ineos Oxide (Ineos Propylene Glycol USP, Propylene Glycol Industrial Grade)

-

Manali Petrochemicals Limited (Manali PG USP, Manali PG Technical Grade)

-

Shell Chemicals (Shell PG USP, Shell PG Industrial)

-

Repsol (Repsol PG Technical, Repsol PG Pharma)

-

Sumitomo Chemical (Sumika PG, Sumitomo Propylene Glycol)

-

Qingdao Shida Chemical Co., Ltd. (Shida PG USP, Shida PG Industrial)

-

Haike Chemical Group (Haike PG USP, Haike PG Technical)

-

Asahi Kasei Corporation (Asahi PG Pharma, Asahi PG Industrial)

-

Solventis Ltd. (Solventis PG Technical, Solventis PG USP)

-

Royal Dutch Shell plc (Caradol PG, Shell PG Pharma)

Recent Development:

-

In May 2023: ORLEN Południe, in partnership with BASF and Air Liquide Engineering & Construction, launched a state-of-the-art facility utilizing advanced technology to convert glycerol into renewable propylene glycol, with the goal of achieving CO₂ neutrality.

-

In Feb 2023, Archer Daniels Midland (ADM) invested more than USD 30 million in a new production facility in Valencia, Spain, to address the rising global demand for probiotics and postbiotics, reinforcing its growth in the health and wellness sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.12 Billion |

| Market Size by 2032 | USD 6.59 Billion |

| CAGR | CAGR of 5.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Petroleum-based PG, Bio-based PG) • By Grade (Industrial Grade, USP Grade) • By End-Use Industry (Transportation, Construction, Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Dow Chemical Company, LyondellBasell Industries N.V., BASF SE, Archer Daniels Midland Company, Global Bio-chem Technology Group Co., Ltd., DuPont, Tate & Lyle Bio Products, LLC, Huntsman Corporation, SKC Co., Ltd., Temix International S.R.L., Ineos Oxide, Manali Petrochemicals Limited, Shell Chemicals, Repsol, Sumitomo Chemical, Qingdao Shida Chemical Co., Ltd., Haike Chemical Group, Asahi Kasei Corporation, Solventis Ltd., Royal Dutch Shell plc. |