Prosthetic Limbs Market Overview:

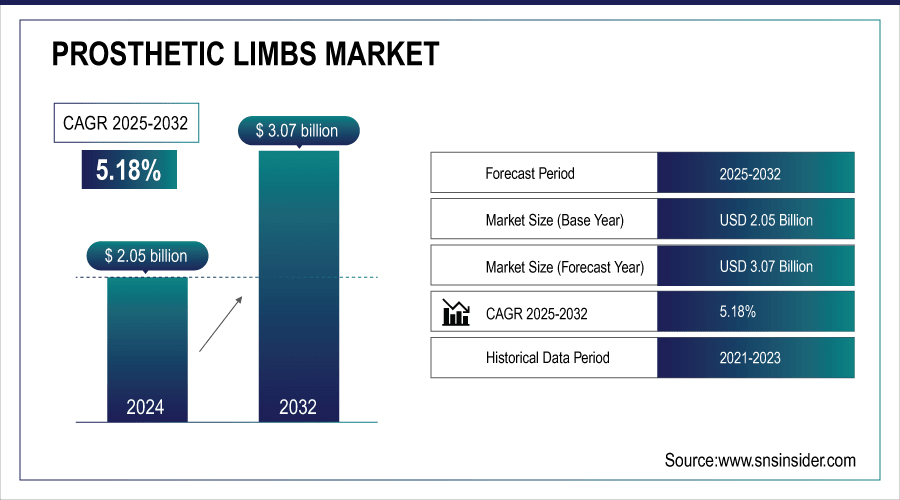

The Prosthetic Limbs Market was valued at USD 2.05 billion in 2024 and is expected to reach USD 3.07 billion by 2032, growing at a CAGR of 5.18% from 2025-2032.

The Prosthetic Limbs Market is fueled by both growing demand and rapid technological innovation. In developing countries, affordable, basic prosthetics are increasingly adopted to overcome financial constraints. Meanwhile, advanced, high-performance solutions drawing on aerospace and computing technologies such as myoelectric control, neural interfaces, and AI initially cater to athletes and well-funded users before wider accessibility. The use of advanced materials like carbon fiber and 3D printing enhances comfort, aesthetics, and functionality, allowing prosthetics to better mimic natural limbs and meet diverse user needs.

Initiatives such as NIH-funded brain-computer interfaces and the Limb Loss and Preservation Registry enhance prosthetic control, track outcomes, and provide valuable data, ultimately improving functionality and quality of life for amputees.

Innovative designs like textile-covered prosthetics and MIT’s muscle-reconnecting leg allow amputees to move faster, achieve more natural motion, and experience greater social inclusion and confidence in daily life.

To Get More Information On Prosthetic Limbs Market - Request Free Sample Report

Prosthetic Limbs Market Trends

-

Growing prevalence of amputations due to accidents, diabetes, and vascular diseases is driving demand.

-

Advancements in bionic and myoelectric prosthetics are improving mobility and user experience.

-

Adoption of lightweight, 3D-printed, and customizable prosthetic limbs is enhancing comfort and functionality.

-

Integration of AI and robotics is enabling smarter, adaptive prosthetic solutions.

-

Increasing awareness and government support programs are expanding accessibility in emerging markets.

-

Rising investment in rehabilitation technologies is complementing prosthetic adoption.

-

Collaboration between healthcare providers, tech companies, and research institutions is accelerating innovation.

Prosthetic Limbs Market Growth Drivers:

-

An Aging Population Fuels Demand For Upper Limb Prosthetic

A key driver of the prosthetic limb market is the growing geriatric population worldwide as people age, they become more susceptible to falls and injuries. This, coupled with the increasing desire for independence among older adults, is expected to significantly boost the market. Statistics show a rapid rise in the number of individuals over 65 globally, with over 610 million, or roughly 8% of the population, currently in this age bracket.

Furthermore, age-related conditions like bone tumors can necessitate limb-salvage surgery, which can sometimes lead to upper limb amputations. In children, over 3% of cancers are bone tumors, with Osteosarcoma being the most common. These amputations create a demand for prosthetic solutions like prosthetics limb to regain functionality after surgery.

Prosthetics limb market is constantly evolving, driven by advancements in technology and a focus on improving the quality of life for amputees. As new innovations emerge and the need for more lifelike and functional prosthetics increases, the prosthetic limb market is poised for continued growth.

-

Road Accidents And Technological Advancements Drive Prosthetic Limb Market

Road accidents are the leading cause of traumatic amputations, and with careless behavior contributing to these accidents, the number of amputations due to traffic incidents is expected to keep rising. According to the WHO, roughly 1.3 million people globally lose their lives yearly due to road accidents.

The field of prosthetic limb is experiencing exciting advancements that are making these devices more attractive options for amputees. This includes:

Development of hybrid nanomaterials has led to prosthetics that are more efficient and durable, improving the quality of life for users. Advancements in materials, manufacturing, and electronics have yielded more sophisticated and functional prosthetics. Examples include myoelectric prosthetics that utilize muscle signals for hand control and 3D printing for custom-designed prostheses.

Prosthetic Limbs Market Restraints:

-

Financial limitations remain the biggest hurdle in prosthetic rehabilitation.

Despite the clear benefits of advanced prosthetic devices, their high cost remains a major barrier to wider adoption. Prosthetists prescribe these custom-made devices, and the price tag soars with increasing complexity. A 2021 article by BionicsForEveryone revealed that bionic hands in the US can range from a staggering USD 8,000 to a jaw-dropping USD 100,000. Even with newer companies entering the market, the price range remains hefty, typically between USD 8,000 and USD 30,000.

Prosthetic Limbs Market Segmentation Analysis

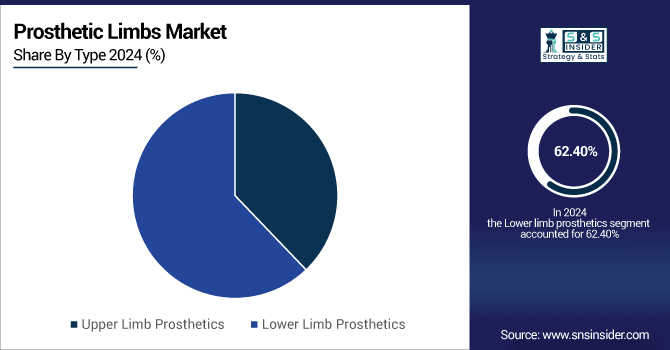

By Type Lower limb prosthetics led while Upper limb prosthetics is expected to grow fastest

The lower limb prosthetics dominated the market with 62.40% share in 2023 due to several factors such as globally, lower limb amputations are significantly more common compared to upper limb amputations. This creates a larger patient pool requiring these prosthetics. The segment is constantly innovating. For example, the recent development of an intelligent prosthetic knee by ISRO in India offers a more comfortable gait for above-knee amputees at a potentially lower cost. The increasing prevalence of diabetes and orthopedic diseases, which can lead to amputations, further fuels the growth of this segment.

The upper limb prosthetics segment held promise for future growth with more people are opting for upper limb prosthetics to regain functionality after amputations. The rising number of accidents and injuries that can lead to upper limb amputations will contribute to the demand for these prosthetics.

By Technology Conventional prosthetics dominated while Electric prosthetics is projected to grow fastest

Conventional Prosthetics, these body-powered devices dominated the market in 2024 with 63.23% share due to their significantly lower cost compared to other technologies.

Electric Prosthetics is expected to be the fastest growing segment in coming years, including myoelectric and micro-controlled devices, is experiencing a surge in demand. Reasons for this growth includes government and private insurance companies are increasingly covering electric prosthetics, making them more accessible to patients. Electric prosthetics offer significant advantages like reduced harnessing, effortless control, and more natural movements, leading to better patient experiences.

Key players are actively launching new electric prosthetics, further fueling market growth. For instance, Steeper Inc.'s launch of a new, reasonable myoelectric system in September 2021.

By Component Sockets held the largest share while Joints are expected to grow fastest

In 2024, sockets held the largest share of 41.08% in the prosthetic limbs market. Their dominance is driven by the need for frequent replacements every few years, ongoing research to enhance fit, comfort, and functionality, and growing adoption among amputees seeking improved mobility and daily usability.

The joint segment is witnessing the fastest growth, fueled by regular wear-and-tear requiring replacements. Increasing amputations due to trauma, diabetes, and vascular diseases further drive demand. Innovations in joint design, durability, and functionality are attracting users, making prosthetic joints a rapidly expanding segment in the market.

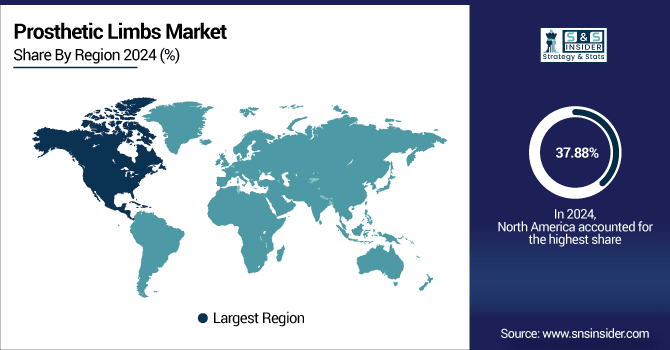

Prosthetic Limbs Market Regional Analysis

North America Prosthetic Limbs Market Insights

North America dominated in the limb prosthetics market with 37.88% share in 2024, driven by factors like high amputation rates, a strong focus on advanced technology, favorable reimbursement policies, and significant healthcare spending. The Amputee Coalition estimates that 3.6 million people in the US alone will require prosthetics by 2050.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Prosthetic Limbs Market Insights

The Asia Pacific region holds immense potential for future growth due to its rapidly aging population and rising prevalence of diseases like diabetes. This demographic shift, coupled with increasing awareness of prosthetics, is projected to propel the region to the highest Compound Annual Growth Rate (CAGR) in the coming years.

Europe Prosthetic Limbs Market Insights

The Europe Prosthetic Limbs Market is expanding due to advanced healthcare infrastructure, growing investments in R&D, and rising adoption of high-performance prosthetics. Technological innovations like myoelectric limbs, neural interfaces, and AI-driven solutions are increasingly integrated, enhancing functionality and user experience. Supportive government policies, awareness programs, and rehabilitation initiatives further drive market growth, catering to both aging populations and individuals with traumatic or medical limb loss.

Middle East & Africa and Latin America Prosthetic Limbs Market Insights

In the Prosthetic Limbs Market, the Middle East & Africa and Latin America are witnessing steady growth driven by rising awareness, increasing healthcare investments, and demand for affordable solutions. Limited access to advanced technologies encourages the adoption of cost-effective prosthetics, while governments and NGOs support initiatives to improve accessibility, rehabilitation services, and quality of life for amputees across these regions.

Prosthetic Limbs Market Competitive Landscape:

Ottobock

Ottobock is a leading player in the Prosthetic Limbs Market, renowned for its innovative and high-quality prosthetic solutions. The company specializes in advanced lower- and upper-limb prosthetics, including microprocessor-controlled knees, feet, and myoelectric arms, enhancing mobility and functionality. Ottobock combines cutting-edge technology, such as AI integration and ergonomic design, with personalized care, addressing diverse user needs. Its products improve quality of life, enabling amputees to achieve natural movement and greater independence.

-

May 2025: Introduced the Taleo Adapt, its first in-house hydraulic prosthetic foot featuring adjustable ankle resistance, smooth rollover, slope adaptability, and enhanced comfort for active users.

-

June 2025: Showcased latest innovations at ISPO World Congress, including the AI-driven Speedhand, Maverick junior foot for children, and the compact Movido hydraulic knee for improved pediatric mobility.

-

2024: Launched GreenLine, a sustainable range of prosthetic sockets and orthoses using eco-friendly materials like flax fiber and WOODCAST, reducing environmental impact.

-

2023: Released Taleo Adjust, a height-adjustable prosthetic foot allowing heel height adjustment up to 7 cm, enabling shoe flexibility and greater independence.

WillowWood

WillowWood is a prominent company in the Prosthetic Limbs Market, recognized for its innovative and highly customizable prosthetic solutions. The company specializes in advanced prosthetic feet, sockets, and components designed to enhance mobility, comfort, and overall functionality for amputees. By integrating cutting-edge materials, ergonomic designs, and user-focused engineering, WillowWood ensures improved fit, performance, and usability, enabling amputees to achieve greater independence, natural movement, and a higher quality of life in daily activities.

-

2023: Debuted Fiberglass META Shock X, featuring a META-Unibody platform and compact build height, providing versatile fitting options for varying limb lengths.

Fillauer LLC

Fillauer LLC is a prominent company in the Prosthetic Limbs Market, focusing on advanced upper- and lower-limb prosthetic devices that improve mobility, comfort, and functionality for amputees. The company emphasizes innovative materials, ergonomic designs, and user-centered development to meet diverse patient needs. By integrating cutting-edge technologies and sustainable solutions, Fillauer enhances prosthetic performance, ensures durability, and supports better quality of life, making its products highly adaptable and effective for a wide range of users.

-

2024: Fillauer announced its acquisition by Hanger, Inc., enabling enhanced R&D collaboration, improved patient outcomes, and leveraging nationwide clinic and manufacturing synergies for more efficient prosthetic development.

-

2024: Relocated its TRS upper-limb power products operations to Chattanooga, consolidating production, streamlining logistics, and focusing development on user-centered, high-performance prosthetic devices.

-

2023: Launched the world’s first bio-attributed prosthetic foot shell using BIOVYN™, a fully renewable, durable PVC material reducing greenhouse gas emissions by up to 90%.

Open Bionics

Open Bionics is a leading innovator in the Prosthetic Limbs Market, specializing in affordable, 3D-printed prosthetic arms and hands. The company’s solutions, including the Hero Arm, are lightweight, customizable, and designed for enhanced functionality and aesthetics. Open Bionics focuses on combining advanced technology with accessibility, enabling amputees especially children and young adults to regain mobility, independence, and confidence. Its user-centered designs make prosthetics more comfortable, adaptable, and socially inclusive.

-

2025: Open Bionics introduced the Hero PRO, a waterproof, wireless, 3D-printed bionic hand featuring ultra-fast fingers, IPX7 rating, touchscreen-capable fingertips, integrated battery, and customizable, powerful grip the lightest bionic hand available.

Leading Prosthetic Limbs Market Companies

-

Fillauer LLC (Fillauer Companies, Inc.)

-

Uniprox (Bauerfeind)

-

Hanger, Inc.

-

Steeper Inc.

-

Össur

-

Ottobock

-

WillowWood Global LLC.

-

Blatchford Limited

-

RSL Steeper Group Ltd.

-

Blatchford Group

-

Zimmer Biomet

-

Mobius Bionics

-

Open Bionics

-

Motorica

-

Endolite

-

Ultraflex Systems Inc.

-

Aether Biomedical

-

Immortal Cosmetic Art

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.95 billion |

| Market Size by 2032 | USD 3.07 Billion |

| CAGR | CAGR of 5.18% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Upper Limb Prosthetics, Lower Limb Prosthetics) • By Technology (Conventional Prosthetic Devices, Electric Prosthetic Devices, Hybrid Prosthetic Devices) •By Component (Socket, Appendage, Joint, Connecting Module, Others) • By End-user (Orthotists & Prosthetists (O&P) Clinics, Orthopedic Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Ortho Europe, Fillauer LLC (Fillauer Companies, Inc.), Uniprox (Bauerfeind), Hanger, Inc., Steeper Inc., Össur, Ottobock, WillowWood Global LLC., Blatchford Limited, RSL Steeper Group Ltd., Blatchford Group, Zimmer Biomet, Mobius Bionics, Open Bionics, Motorica, Endolite, Ultraflex Systems Inc., Aether Biomedical, Immortal Cosmetic Art |