3D Printed Prosthetics Market Report Scope & Overview:

Get More Information on 3D Printed Prosthetics Market - Request Sample Report

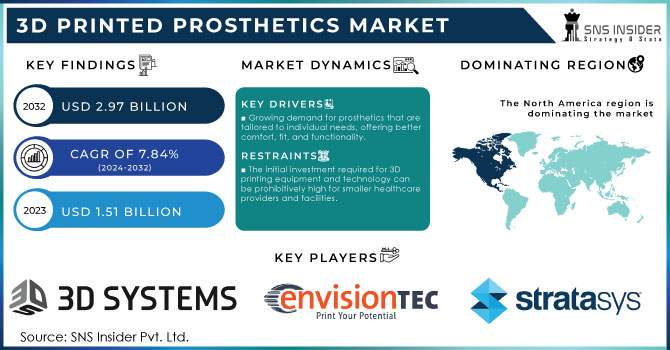

The 3D Printed Prosthetics Market Size was valued at USD 1.51 Billion in 2023 and is expected to reach USD 2.97 Billion by 2032, growing at a CAGR of 7.84% over the forecast period 2024-2032.

Growing demand for uniquely designed prosthetic products catering to personal need and preference in the healthcare industry propels the 3D printed prosthetics market. Most patients were looking for components to help restore limb function but also cater to individual needs and preferences. Today, however, most patients are demanding prosthetics that respond to their individual need and preference. Orthopaedic in patients, for instance, demand 3-D printed prosthetic implants. Orthopaedic surgeons customize these implants to cater to patient necessity and preferences. The market is further fueled by the growing incidence of road accidents, sports injuries, and diabetic-related amputations, particularly in regions with high diabetes rates, creating a need for advanced, customizable prosthetics. All these factors combined mean a lucrative 3D printed prosthetics market. Key players like Össur and Stratasys have responded by integrating 3D printing technology into their production lines, with Stratasys introducing innovative materials and printers for durable, lightweight prosthetics, and Össur developing smart prosthetics with 3D printed components for better customization.

The number of patients requiring amputation due to disease and accident has increased demand for advanced prosthetics. The current evidence from the CDC (Centers for Disease Control and Prevention) reports that about 73,000 people in America undergo amputation due to diabetes. Increasing road accidents drive the demand for market. The NHTSA survey report reveals that 4.4 million injuries per year are through road journey accidents. For instance, the FDA has established guidelines for 3D printed medical devices. The EMA goes a step further in establishing guidelines and regulatory frameworks. The WHO report shows the potential this innovation can play in solving health problems worldwide.

Market Dynamics

Drivers

-

Growing demand for prosthetics that are tailored to individual needs, offering better comfort, fit, and functionality.

-

Continuous improvements in 3D printing technology, including new materials and faster printing processes, leading to higher-quality prosthetic products.

-

A growing number of amputations due to diabetes, vascular diseases, accidents, and injuries are driving the demand for advanced prosthetics.

-

3D printing can significantly reduce the cost of prosthetic production, making it more accessible for a broader population.

-

Increased regulatory approvals and government initiatives promoting the adoption of 3D printing in healthcare.

One of the leading drivers of the 3D printed prosthetics market is the growing demand for customization and personalization of prosthetic devices. This trend is reshaping the healthcare industry, as patients now prioritize prosthetics that not only restore function but also fit their unique anatomical and lifestyle needs. For example, Stratasys uses advanced 3D printing solutions, enabling the development of custom prosthetics. The new products are produced almost 40% faster than five years ago and more than twice as fast as traditional methods. This is crucial for patients who need a prosthetic device urgently, such as after a car accident. The FDA helps these products get to the market quickly due to giving companies comprehensive advice on how to get approval through the fast Clearance Review program. These guidelines ensure that personalized prosthetic solutions meet safety and efficacy standards, thereby fostering innovation in the market. The NIH recognizes this and offers significant financial support to 3D printing research due to its potential impact on patient accessibility.

Restraints

-

The initial investment required for 3D printing equipment and technology can be prohibitively high for smaller healthcare providers and facilities.

-

lack of awareness and adoption, particularly in developing regions, due to limited access to advanced healthcare technology.

-

Navigating complex regulatory landscapes across different regions can delay the introduction and approval of 3D printed prosthetic products.

Lack of awareness of advanced 3D-printed prosthetic implants is a major market restraint. Many patients and healthcare providers are not aware of the advantages and possibilities of 3D printing technology. This hinders their willingness to use novel solutions. Lack of awareness can be a consequence of limited access to knowledge about recent achievements, reduced opportunities, and benefits of 3D-printed prosthetics, and preference for traditional methods. This translates into potential customers and patients’ lack of understanding of the fact that 3D printing enables the creation of high-quality personalized prostheses at a reasonable cost. Moreover, healthcare providers who are not aware of this solution will not recommend it to their patients. Therefore, it is necessary to counteract the shortage of awareness through training and educational activities, thanks to which the target group can learn about the real benefits related to 3D-printed prosthetics.

Segment Analysis

By Type

The limbs segment accounted more than 32% of the global market revenue in 2023 and is expected to lead the market by 2032. Several factors are driving the growth of this market segment and continue doing so during the forecast period. There is a rapidly increasing demand for 3D printed prosthetic limbs across the globe, fuelled by the growing rate of accidental injuries and the rapid advancement of 3D printing technology. Moreover, the rapidly increasing number of amputation cases drives that demand, especially in the US, which reports over 73,000 diabetes-related amputations per year. Market players are focusing their efforts on developing waterproof 3D printed prosthetic limbs to enable users’ movement flexibility, especially in sports. Advanced prosthetic limbs provide the maximum level of user comfort, eliminate pain, and can be fully customized for each patient. The rapid alteration of 3D printing technology makes prosthetic limbs more adjustable and user-friendly and contributes to the segment’s growth in popularity. These initiatives are critical as they allow manufacturers to respond to the market demand and diversify their offers to reach a broader target audience.

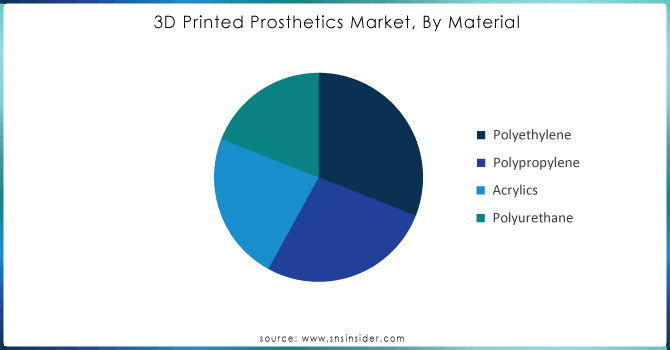

By Material

The polypropylene segment dominated the global market which held revenue share of more than 31% in 2023. It is projected to witness massive progress over the forecast period 2024-2032. The segment is expected to receive a significant boost from driving forces that include an increase in the use of polypropylene for enhancing the 3D printed prosthetics. Polypropylene is the preferred material during the manufacturing of prosthetics due to its cost-effective process and long life. It also helps reduce the weight of the prostheses, which guarantees maximum user comfort and free movement. Additionally, polypropylene’s sterilizability without compromising its properties makes it ideal for medical applications. There is also increased funding for R & D, which results in innovations that enhance polypropylene performance. For example, recent science demonstrates that the mechanical properties of polypropylene enhance the strength and flexibility. Therefore, there is a global increase in the preference for polypropylene, and the same trend is an essential driver for expanded market size.

Need any customization research on 3D Printed Prosthetics Market - Enquiry Now

By End-Use

In 2023, hospitals dominated the global 3D printed prosthetics market, accounting for over 38.5% of total revenue share. The dominance of this sector is primarily driven by the growing prevalence of patient admissions and accidents, leading to a greater number of hospital visits. In addition, significant investment in research and development activities related to 3D printing is contributing to the steady growth seen in the robotic prosthetics market. Factors such as an increasing number of hospitals, small and large, and increased adoption of 3D printed prosthetics in several developed countries are supplying to this trend.

In the future, prosthetic clinics are expected to grow with significant growth rate. Factors such as growing demand for 3D printed prosthetics in these specialized hospitals and a growing number of patients searching for affordable prosthetic alternatives are driving the expansion. Increased occurrence of amputees and other chronic diseases worldwide is expected to grow due to the increasing need for cost-effective and patient-specific prosthetics. Recent data show that the demand for patient-specific robotic prosthetics is growing, and the prosthetic clinics market is expected to be driven by this demand.

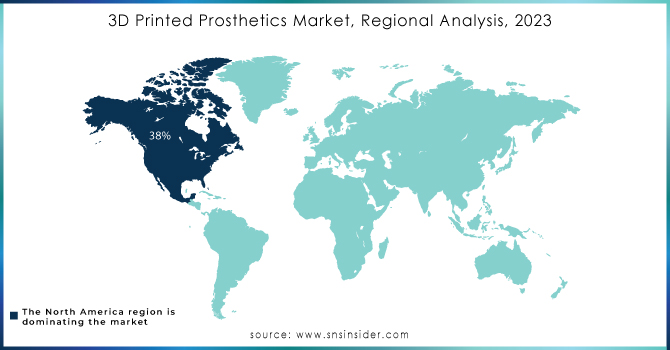

Regional analysis

North America dominated the market and accounting revenue share of more than 38% In 2023. This high market share is supported by multiple factors, such as a growing number of sports injuries and the population’s increased demand for high-quality services. The region is characterized by well-developed healthcare infrastructure that allows market players to develop and implement innovative technologies. Moreover, the presence of a large base of key stakeholders and favourable government policies, such as R&D funding and prosthetics-subsidizing products made with 3D printing methods, contribute to market growth in North America.

The Asia-Pacific is expected to experience the fastest growth throughout the forecast period. This trend is mostly facilitated by the major players’ extensive investment in R&D. increasing number of accidents and a large middle-income population, the countries of Asia-Pacific demonstrate a high demand for novel and cost-effective 3D printed prosthetics. Hence, many key players start targeting the region, planning to expand market share there. Recent data show that Asia- Pacific’s commitment to affordable healthcare products and prosthetic technological advancements will support the region’s growth and will make it a crucial part of the global 3D printed prosthetics market.

Key Players

The major players in market are 3D Systems Corporation, 3T RPD Ltd., EnvisionTEC, Stratasys Ltd., Create Prosthetics, Bionicohand, YouBionic, UNYQ, Formlabs, Mecuris, LimbForge, Inc., Open Bionics, Prodways Group, Bio3D Technologies, Laser GmbH, and others in final Report.

Recent Developments

-

Össur, has introduced its “Smart 3D Printed Prosthetics” line in 2023 which includes more advanced, customizable prosthetic limbs with integrated sensors and smart technologies. These prosthetics can provide the user with real-time data on limb usage and adjust their performance based on the user’s activity to improve comfort and functionality. This development is consistent with Össur’s goal of improving the quality of life of prosthetic users by integrating advanced technologies.

-

In 2023, Stratasys has launched its “J750 Digital Anatomy Printer” which significantly improves the precision and customization of 3D-printed prosthetics. This new printer allows producing prosthetics with highly detailed anatomical features and improved mechanical properties to make them functional and personalized according to the needs of individual patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.51 Billion |

| Market Size by 2032 | USD 2.97 Billion |

| CAGR | CAGR of 7.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sockets, Limbs, Joints, Others) • By Material (Polyethylene, Polypropylene, Acrylics, Polyurethane) • By End-use (Hospitals, Rehabilitation Centers, Prosthetic Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3D Systems Corporation, 3T RPD Ltd., EnvisionTEC, Stratasys Ltd., Create Prosthetics, Bionicohand, YouBionic, UNYQ, Formlabs, Mecuris, LimbForge, Inc., Open Bionics, Prodways Group, Bio3D Technologies, Laser GmbH |

| Key Drivers | • Growing demand for prosthetics that are tailored to individual needs, offering better comfort, fit, and functionality. • Continuous improvements in 3D printing technology, including new materials and faster printing processes, leading to higher-quality prosthetic products. |

| RESTRAINTS | • The initial investment required for 3D printing equipment and technology can be prohibitively high for smaller healthcare providers and facilities. |