Protective Coatings Market Report Scope & Overview:

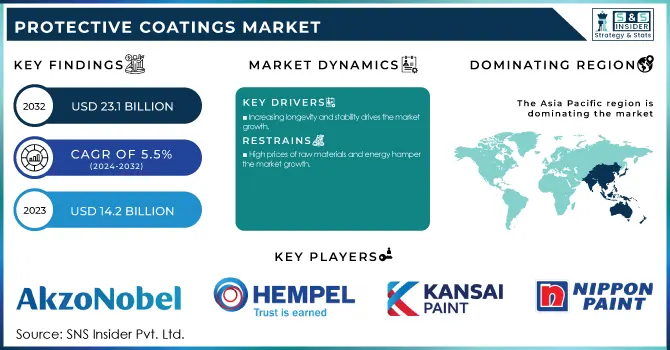

The Protective Coatings Market size was USD 14.2 billion in 2023 and is expected to reach USD 23.1 billion by 2032 and grow at a CAGR of 5.5% over the forecast period of 2024-2032.

Get More Information on Protective Coatings Market - Request Sample Report

Increasing demand for protective coatings from the infrastructure and construction industry, across the globe, is a major factor contributing to the growth of the market. The growing urbanization and the rising demand for concrete structures to be tough and long-lasting have increased the demand for high-performance coatings to protect buildings, bridges, tunnels, and other infrastructure from corrosion, UV radiation, and extreme weather conditions. With the population and economy rising, billions are being poured into building new infrastructure systems like roads, railroads, and commercial structures by governments and private entities across the globe. Example provided are, China by way of the Belt and Road Initiative (BRI) and India through the Smart Cities Mission are offering huge opportunities for protective coatings. The Time-Sensitive Coatings Market provides these coatings, which are important for extending the life and life of infrastructure to keep things safe while reducing overall life-cycle costs.

In the United States, the Inflation Reduction Act (2022) provides USD 369 billion in funding over ten years to promote clean energy and emission reduction, significantly boosting infrastructure for renewable energy production and transmission.

The adoption of advanced coating technologies is a key trend fueling the expansion of the protective coatings market. Novel technologies like nano-coatings, self-healing coatings, and UV-cured coatings are disrupting the sector by providing unprecedented levels of protection and performance. Such tempered neo-coating enhances resistance to corrosion, weathering, and chemical exposure, hence prolonging the life of major infrastructure and industrial equipment.

For instance, nano-coatings offer ultra-thin, high-performance superimposed layers, projected particularly in the fields of aerospace, automotive, and products. Usually, those types of self-repairing paints are filled with microcapsules of sol-gel material, which autonomously heals small scratches, reducing service costs and downtime. Also, the global trend of strict environmental regulation has increased the adoption of UV-cured coatings due to their low environmental effect and fast curing time.

These technologies are being adopted more quickly than ever in part due to the growing emphasis on sustainability and energy efficiency. Industries are encouraged to switch to environment-friendly coatings like waterborne or powder coatings as governments and regulatory bodies are pushing standards for lower VOC emissions. This trend is in sync with worldwide green efforts along with rigorous emission standards in the European Union, the United States, and China.

Protective Coatings Market Dynamics

Drivers

- Increasing longevity and stability drives the market growth.

A major factor driving the protective coatings market is the rising emphasis on extending the durability and stability of the coatings. Today, the protective coatings are designed to resist the most severe environmental conditions like extreme temperatures, humidity, and UV exposure, thereby improving the durability of the structure or equipment. Long-lasting materials imply less maintenance and repairs, which translates into cost savings for construction, automotive, and marine industries.

Technological advancements, for example, the underlying advances industry opened up to the world, for covered gatekeepers and cutting-edge epoxy covers have been one of the basic components in growing the life expectancy of key resources. These innovations are especially important in industries such as oil and gas where equipment faces heavy environmental stresses. Also ensuring the coatings are stable for long-term use is important to identify which are required fields and for industrial solutions making aye in one of the best materials used in numerous globally built infrastructures.

The consistent and lasting nature of such coatings because of polymerization upon UV exposure has prompted adoption, supported by regulatory readiness in line with ASTM International and ISO standards on durability and performance. Additionally, the growing adoption of eco-friendly materials and novel formulations at both ends not only meets environmental criteria but also improves the functional lives of such products, thereby making protective coatings a crucial foundation for industrial sustainability in the contemporary era.

Restraint

- High prices of raw materials and energy hamper the market growth.

High prices of raw materials and energy sources are major restraints to the growth of the protective coatings market. Prices of crucial raw materials have increased, including resins, pigments, and additives, owing to supply chain disruptions, geopolitical conflicts, and the rising demand for these materials in other industrial processes. As an example, the cost of epoxy resins and titanium dioxide–two base raw materials used in protective coatings–have skyrocketed, applying margin pressure on manufacturers.

Also, the production processes for coatings are very energy-hungry. Production costs are driven higher still by increasing energy costs, especially in heavy fossil fuel-dependent locations. Such a challenge is exacerbated in Europe, with increased energy prices as a result of lower gas imports as well as the energy transition.

Protective Coatings Market Segmentation Analysis

By Resin

Epoxy resin held the largest market share around 38% in 2023. Due to their great adhesion, and durability, epoxy coatings are often preferred for industrial facilities, marine structures, and oil and gas pipelines as they provide excellent resistance to various chemical stresses. The substrate protection as it creates a strong protective layer that prevents corrosion and enhances the life of the substrate is crucial in industries where maintenance costs and downtime must be reduced.

Moreover, the growing applicability of epoxy coatings over a range of substrates such as concrete, metal, and wood would complement their demand in the construction and infrastructure sectors. Due to their high mechanical properties and excellent abrasion resistance, they are also commonly used as a floor coating in areas of high traffic including warehouses and hospitals.

By Technology

The solvent-based held the largest market share around 38% in 2023. These coatings provide superior adhesion, high durability, and resistance to abrasion, moisture, and chemicals, making them invaluable properties for the construction, automotive, and marine industries. In extreme climates/environments, where waterborne alternatives may underperform, the high-performance properties of solvent-based coatings guarantee that they will remain effective. Solvent-based coatings have a rapid drying time and can be applied across wider temperature and humidity ranges, making them convenient for year-round application. This benefit is especially useful for large infrastructure projects and industrial resources which require that they cannot experience any downtime. They can stick to several substrates and this also includes metal and concrete, which is why they are widely used.

By Application

The construction segment held the largest market share around 24% in 2023. In the construction industry, protective coatings are crucial for the durability of structures, preventing damage by environmental effects like corrosion, moisture, and UV exposure. These coatings are used for durability and enhancing the aesthetic look of metal concrete and wooden substrates with a large base in all types of construction (residential, commercial, and even industrial).

The pace of urbanization especially for developing economies has paved the way for immense investment in infrastructure investments mainly bridges, highways and public buildings.

Protective Coatings Market Regional Outlook

Asia Pacific held the largest market share around 49% in 2023. Asia Pacific, with its rapid industrialization, infrastructure development, and expanding high-performance coatings demand across industries, drives the market growth. This dominant factor has primarily been driven by large-scale construction projects, manufacturing activities, and automotive production in countries such as China, India, Japan, and South Korea which is a significant contributor to driving demand for protective coatings. Furthermore, the presence of the middle-class population in the Asia Pacific is growing which is increasing the need for residential, commercial, and industrial construction, thereby contributing to the growth of the protective coatings market over the forecast period. In Japan and South Korea, automotive and electronics are the significant end-use industries driving these coatings, on account of the requirements for durable, weather-resistant, and environmental-resistant products.

Government programs in the region, which include India's "Smart Cities Mission" to develop modernized urban infrastructure and China's focus on industrial development, have been supportive of the introduction of protective coatings. Moreover, increasing adoption of sustainable and green coating solutions in the region as environmental regulations become stringent has propelled investment in advanced coating technologies. Thus, Asia Pacific remains dominant in the global protective coatings market in terms of demand and market share.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Akzonobel N.V. (Dulux, Interpon)

-

Hempel A/S (Hempel Marine, Hempel Decorative)

-

Kansai Paints Co., Ltd (Dulux, Polymaster)

-

NIPPON PAINTS CO. LTD. (Nippon Paint, Aleshin)

-

The Dow Chemical Company (Dow Coating Materials, Dow Corning)

-

Wacker Chemie Ag (Silres, Wacker® Silicone Coatings)

-

3m Co. (Scotchgard, 3m™ Automotive Coatings)

-

THE SHERWIN-WILLIAMS COMPANY (Superpaint, Emerald)

-

Ppg Industries Inc (Coraflon, Sigmaguard)

-

Basf Se (Basf Paints, Masterbond)

-

Akzo Nobel Coatings (Sikkens, Monopol)

-

Jotun (Jotun Marine, Jotun Decorative)

-

Kukdo Chemicals Co., Ltd. (Resins, Epoxy Coatings)

-

Tikkurila Oyj (Tikkurila, Temacoat)

-

Rheinzink (Zinc Coating, Rheinzink Preweathered)

-

Gardner-Gibson (Gardner Coatings, Gardner Asphalt)

-

Henkel Ag & Co. Kgaa (Loctite, Teroson)

-

Sabic (Sabic Coatings, Lexan)

-

Dupont (Corian, Teflon Coatings)

-

Bayer AG (Bayer Coating, Bayferrox)

Recent Development:

-

In 2023: Evonik has launched a new leveling agent under the name TEGO Flow 380 designed especially for high-grade automotive clear coats. The TEGO Flow 380 is perfect for use in solvent-borne coatings, especially clear coats. It is characterized by better anti-pop characteristics and wider compatibility. Main applications include automotive & general industrial coating.

-

In 2023: Akzo Nobel N.V. announced a new super-durable Interpon D powder coating. That gives aluminum surfaces the natural look and feel of stone but without the challenges and costs of the actual material. Its launch is focused on the Indian market and designers and architects.

-

In 2023: The Sherwin-Williams Company released these coatings to alleviate the dangerous corrosion below insulation (CUI) situation via the introduction of its latest technology of heat-flex c-ui-mitigation coatings. According to the company, this coating is the most effective in combating CUI of all the formulations currently offered on the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 14.2 Billion |

| Market Size by 2030 | US$ 23.1 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Solvent Based, Water Based, Powder Coatings And Others) • By Resin Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Others) • By End-Use Industry (Offshore Structures, Petrochemical, Marine, Cargo Containers, Power Generation, Water & Wastewater Treatment, Civil Building & Infrastructure, Food & Beverages, Others) • By Application (Abrasion Resistance, Chemical Resistance, Fire Protection, Heat Resistance, Corrosion Resistance, Pipe Coatings, Tank Linings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AKZONOBEL N.V. HEMPEL A/S, KANSAI PAINTS CO., LTD, NIPPON PAINTS CO. LTD., THE DOW CHEMICAL COMPANY, WACKER CHEMIE AG, 3M CO., THE SHERWIN-WILLIAMS COMPANY, PPG INDUSTRIES INC, BASF SE, and others. |

| Drivers | • Use in civil building & infrastructure industry • Increasing the longevity and stability |

| Opportunities | • High prices of raw materials and energy |