Performance Coatings Market Report Score & Ovevriew:

Get E-PDF Sample Report on Performance Coatings Market - Request Sample Report

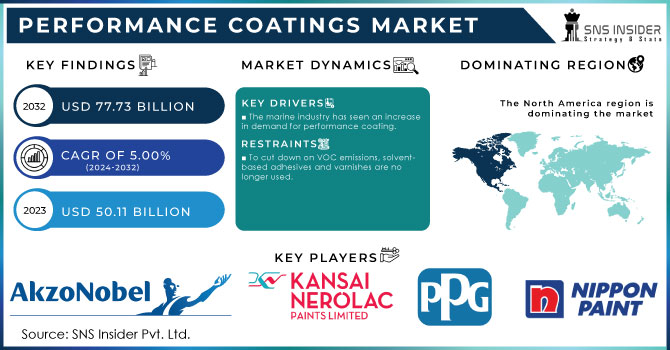

The Performance Coatings Market Size was valued at USD 50.11 billion in 2023 and is expected to reach USD 77.73 billion by 2032 and grow at a CAGR of 5.00% over the forecast period 2024-2032.

In developing regions, the rapid increase in construction activities is the major factor contributing to the demand for performance coatings. Urbanization is placing a certain amount of pressure on developing regions, causing them to grow and, thus, contribute to the increased number of developments. Industrial, residential, and commercial construction projects require suitable protection from UV, moisture, and corrosion, which is where performance industrial coatings are indispensable, designed to protect structures from the impact of the environment and weather conditions of a specific region. As a result, the newfound interest in urbanization, construction, and development in general is bound to drive forward the demand for performance coatings. At the current pace, the trend will be gaining momentum, especially since a more sustainable type of performance coatings is now gaining recognition among construction companies.

For instance, in emerging nations, construction investment has increased over the last ten years at an average annual pace of over 5%, according to the World Bank. For instance, the Smart Cities Mission's infrastructure projects and affordable housing initiatives propelled India's construction spending growth in 2022, according to the Ministry of Housing and Urban Affairs.

One of the core factors contributing to the demand for industrial performance coatings is the rapid growth of manufacturing sectors all over the world. With the ongoing industrialization, especially in emerging economies, various facilities have started to arise in order to accommodate the guidelines of such related areas as automobile Industry, electronics, heavy machinery, etc. The distinguished feature of their working environment is that pieces of equipment and structures operating there have to face particularly hazardous conditions, including ultra-high and low temperatures, different chemicals, as well as constant pressure either during use or due to the immense weight of the materials processed or developed.

For instance, in 2023 Targeting the automotive and heavy equipment production industries, Axalta unveiled its newest line of high-performance, low-VOC industrial coatings. This new product range offers improved protection against chemical exposure and mechanical wear while complying with strict environmental laws.

Additionally, with the rise of advanced manufacturing techniques and the need for higher precision and durability, the demand for specialized coatings that can withstand these rigorous conditions is increasing. This trend highlights the critical role of industrial performance coatings in supporting the continuous growth and sustainability of the global manufacturing sector.

Market Dynamics:

Drivers

The marine industry has seen an increase in demand for performance coating.

The primary reason why demand for performance coatings in the marine industry is growing is the necessity to protect vessels and offshore structures more effectively against harsh marine conditions. They play an important role in limiting regular touch-up or full reapplications demanded by intense exposure to saltwater, ultraviolet radiation, and mechanical damage. The rise in investment in the marine sector is encouraged by governments worldwide that see the purpose of preserving infrastructure.

According to the International Maritime Organization, global spending on maintenance and repair of vessels was growing each year. In 2022 it registered a 4.20% growth, which was primarily attributed to new regulations in the area of environmental protection and vessel maintenance.

Moreover, a company focused on using new technology such as, in 2022, Hempel introduced its hempaguard max coating system, which offers enhanced fuel efficiency and extended service intervals for marine vessels. The system has been shown to reduce fuel consumption by up to 10%, contributing to both cost savings and environmental benefits. These developments highlight the marine industry's growing reliance on advanced performance coatings to meet the increasing demands for durability, efficiency, and environmental compliance.

Restrain

To cut down on VOC emissions, solvent-based adhesives and varnishes are no longer used.

To reduce the environmental impact of volatile organic compounds (VOCs), the use of solvent-based adhesives and varnishes has significantly declined across various industries. VOCs are harmful chemicals that can evaporate into the air during the application and drying processes, contributing to air pollution and posing health risks. In response to stricter environmental regulations and growing awareness of sustainability, industries have shifted towards water-based or low-VOC alternatives that offer similar performance without the harmful emissions.

Market Segment:

By Type

The polyurethane, type held the largest market share around 34.45% in 2023. This dominance is due to their superior properties, which make them highly desirable across various industries. It offers excellent durability, resistance to abrasion, and flexibility, making it ideal for demanding applications in aerospace, automotive, and industrial settings. Their ability to withstand harsh environmental conditions, including UV radiation and chemical exposure, further contributes to their widespread use. This versatility and performance advantage have positioned polyurethane as the leading choice in the performance coatings segment, overshadowing other types like silicon, polyester, acrylic, alkyd, and fluoropolymer coatings.

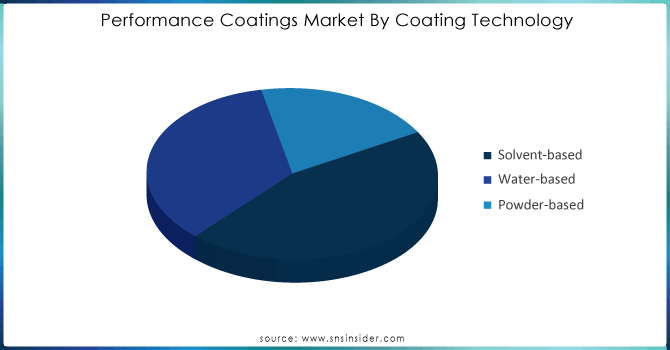

By Coating Technology

The water-based held the largest market share around 40.13% in 2023. This preference is primarily driven by increasing environmental regulations and a growing emphasis on sustainability. Waterborne coatings are favored for their lower volatile organic compound (VOC) emissions compared to solvent-based options, making them more environmentally friendly. They also offer advantages such as easier cleanup, reduced health risks, and compatibility with a broad range of substrates.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By End-user Industry

The Industrial sector held the largest share among end-user industries. This dominance is attributable to the broad application of performance coatings in various industrial settings, where they are used to protect and enhance equipment, machinery, and infrastructure. Industrial environments often expose surfaces to harsh conditions, including high levels of wear, chemical exposure, and extreme temperatures, necessitating robust coating solutions that provide durability and longevity. Performance coatings used in industrial applications include those for anti-corrosion, chemical resistance, and high-performance finishes.

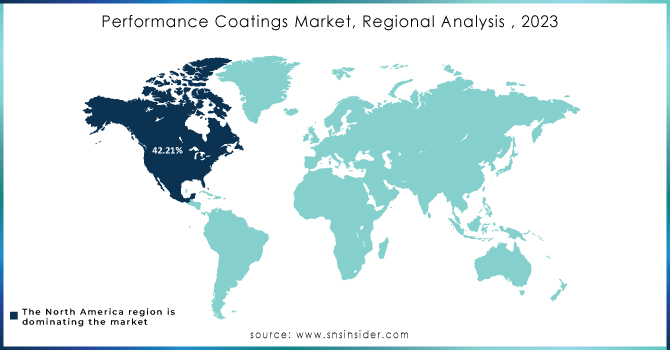

Regional Analysis:

North America held the highest market share in the performance coatings market around 42.21% in 2023.It is due to several key factors, including strong demand across diverse industries such as automotive, aerospace, marine, and construction. The region's advanced manufacturing infrastructure and high investment in research and development have enabled the production of innovative, high-performance coatings that meet stringent regulatory standards. The automotive and aerospace sectors, in particular, have driven demand for performance coatings, as manufacturers seek to enhance durability, corrosion resistance, and aesthetic appeal. Additionally, the region's focus on sustainability has accelerated the adoption of eco-friendly coatings, supported by government regulations and incentives. The presence of major industry players like PPG Industries, Sherwin-Williams, and Axalta Coating Systems, which are continuously investing in new technologies and expanding their product portfolios, has also reinforced North America's leadership in the market.

Key Players:

PPG Industries Inc. (US), Nippon Paint Holdings Co. Ltd (Japan), Kansai Nerolac Paints Limited (India), Akzo Nobel NV (Netherlands), Metal Coatings Corp. (US), Endura Coatings LLC (US), The Chemours Company (US), Toefco Engineered Coating Systems Inc. (US), Beckers Group (Germany), AFT Fluorotec Ltd (UK), The Sherwin-Williams Company (US), Hempel Group (Denmark).

Recent Development:

-

In 2023, AkzoNobel introduced a new line of sustainable marine coatings aimed at reducing carbon emissions and improving vessel efficiency.

-

In 2023, BASF introduced a bio-based performance coating for the packaging industry, utilizing renewable raw materials. This innovation underscores BASF's commitment to sustainability and provides a solution that meets the industry's increasing demand for eco-friendly packaging materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 50.11 Billion |

| Market Size by 2032 | US$ 77.73 Billion |

| CAGR | CAGR of 5.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Silicon, Polyester, Acrylic, Alkyd, Polyurethane, Fluoropolymer, Other) • By Coating Technology (Solvent-based, Water-based, Powder-based) • By End-user Industry (Automotive and Transportation, Industrial, Aerospace & Defense, Marine, Other End- user Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PPG Industries Inc. (US), Nippon Paint Holdings Co. Ltd (Japan), Kansai Nerolac Paints Limited (India), Akzo Nobel NV (Netherlands), Metal Coatings Corp. (US), Endura Coatings LLC (US), The Chemours Company (US), Toefco Engineered Coating Systems Inc. (US), Beckers Group (Germany), AFT Fluorotec Ltd (UK), The Sherwin-Williams Company (US), Hempel Group (Denmark) |

| Key Drivers | • Rising demand coming from the automobile sector. • The marine industry is seeing an increase in demand for performance coating. |

| RESTRAINTS | • To cut down on VOC emissions, solvent-based adhesives and varnishes are no longer used. |