Epoxy Resins Market Report Scope & Overview:

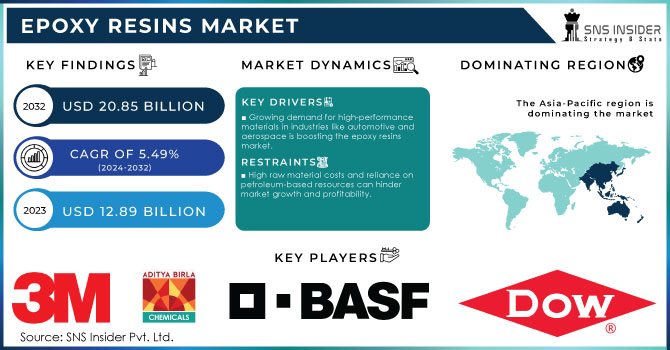

The Epoxy Resins Market Size was valued at USD 13.60 billion in 2024 and is expected to reach USD 20.85 billion by 2032 and grow at a CAGR of 5.49% over the forecast period 2025-2032.

The epoxy resins market is experiencing dynamic growth with growing applications in various industries like automobiles, aerospace, electronics, and construction. The unique properties of epoxy resins, particularly responsible for this rapid growth, are excellent adhesion, good chemical resistance, and mechanical strength. Besides this trend toward sustainable and eco-friendly products is also influencing the market, further driving the manufacturers into innovation and adaptation. The most recent innovations continue with an advanced trend of using renewable resources, orange peel waste as in this case, in producing epoxy resins. It indicates the further orientation of the industry in terms of the approach toward sustainability. A breakthrough regarding green epoxy resin from orange peels was reported in June 2024.

Get more information on Epoxy Resins Market - Request Sample Report

Key Epoxy Resins Market Trends:

-

Rising demand for high-performance coatings and adhesives is driving widespread adoption of epoxy resins across construction and industrial sectors.

-

Epoxy resins are increasingly used in composites for automotive, aerospace, and wind energy applications due to their superior mechanical strength and durability.

-

Growing adoption in electronics and electrical industries, particularly for insulation and encapsulation, is fueling market growth.

-

Advances in bio-based and environmentally friendly epoxy resins are gaining traction, supporting sustainability and regulatory compliance.

-

The surge in infrastructure development and industrial projects globally is boosting demand for epoxy-based flooring, paints, and coatings.

On 2 February 2024, breakthroughs in research and development in epoxy resins occurred that enhanced the performance characteristics of such products. Innovations in properties cutting across heat resistance and durability have made epoxy resins attractive for critical applications in the automotive and aerospace industries. These developments are important because manufacturers are looking to obey rigorous standards set by regulation while improving the performance of their products. The steady investment in R&D translates into efforts by companies to remain competitive in the ever-changing landscape of a market; this is to ensure the products meet consumers' immediate needs as well as foreseen future requirements.

Epoxy Resins Market Drivers:

-

Growing demand for high-performance materials in industries like automotive and aerospace is boosting the epoxy resins market.

Epoxy resins are being used extensively in the automotive and aeronautical industries with growing demand for high-performance materials, especially because epoxy resins carry exceptional properties important to high-performance advanced applications. With superior thermal and chemical resistance, lightweight nature, and strong mechanical strength, epoxy resins are increasingly used in the automotive industry as a structural component, coating, and adhesive. With the rising trend toward electrical vehicles, the automobile industry is increasingly looking for light-weighting materials to enhance fuel efficiency and emission cutting. Epoxy resins reduce weight without sacrificing the structural properties of a vehicle and are, therefore, highly important in EV battery enclosures and composite body parts. As a result, the aerospace industry relies heavily on epoxy resins to manufacture coatings for aircraft components as well as for protection purposes; the importance of reduction in weight and durability gets to enhance fuel efficiency and performance. Epoxy resins contribute to lightweight yet high-strength aircraft composite components used for wings and fuselage construction, thereby enabling aerodynamic efficiency with decreased fuel consumption. Besides, epoxy resins present anticorrosive coatings with resistance to extreme environmental conditions, critical in the long-term reliability of components in automotive and aerospace industries. Continuing strong demands for such high-performance materials have driven technology toward innovative applications and widespread commercial utilization in various engineering and manufacturing processes.

-

Increasing adoption of eco-friendly and sustainable materials is driving innovation and development in epoxy resin formulations.

Eco-friendly and sustainable materials adoption has also been a major driving force for innovation and development in epoxy resin formulations. Industries with strict environmental regulations already are, and consumer demand for greener products continues to grow, thus forcing manufacturers that traditionally based their product on petroleum raw materials to place a focus on producing alternatives bio-based and renewable. For example, some of the latest developments include epoxies based on renewable sources, such as vegetable oils and lignin-based materials. For example, they reduce dependence on fossil fuel stocks and also reduce carbon footprints while in production. These resins bio-based have the same performance as traditional synthetic ones: they have high strength, durability, and resistance to chemicals and heat, and thereupon are used in construction and automotive industries. Besides, companies do research work on the minimization of harmful emissions as well as ways of improving the recyclability of epoxy products. Reusing and recycling epoxy resin waste into new products for less waste and resource efficiency also reinforces the trend toward greener solutions, and with this, more attention is now given to circular economy principles. Epoxy coatings that are VOC-free and more sustainable are slowly gaining preference over conventional ones in construction because they have reduced impact on the environment and improved air quality. Sustainable epoxy resins help companies comply with environmental and regulatory requirements while enhancing their market position through reduced adverse impacts, thus satisfying the current environmentally conscious consumer. The epoxy resins market is experiencing rapid transformation due to eco-friendly innovations pushing growth and reorienting product offerings across various industries.

Epoxy Resins Market Restraints:

-

High raw material costs and reliance on petroleum-based resources can hinder market growth and profitability.

High raw material costs and dependence on petrochemical-based raw materials are two critical restrictive factors in the epoxy resins market since they could result in low profitability and hinder penetration of the market. Conventionally, epoxy resins have been based on petrochemical feedstocks, which has led to possible volatility in the cost of epoxy resins with crude oil price movements. Epoxy resins' production cost is increased due to escalations in oil prices, automatically bringing down the profit margins and subsequently the prices of the products to end-users. In addition, the environmental concerns of petroleum-based epoxy resin production have added a regulatory burden that makes it a complex issue and increases the operational costs. For example, manufacturers within the construction, automotive, or electronics industry using epoxy resins may be the most vulnerable to additional costs arising from increased price of raw materials due to the peak price, making it impossible to produce competitively while adhering to environmental regulations. Such financial and supply chain pressure would thus deter broader use, especially where markets are sensitive to price. This could, in turn, limit further growth of epoxy resin manufacturers.

Epoxy Resins Market Opportunities:

-

The rising trend of using bio-based epoxy resins presents a significant opportunity for manufacturers to capture the growing eco-conscious consumer market.

Bio-based epoxy resins are emerging rapidly as a significant trend are derived from renewable resources like plant oils and agricultural wastes-reducing the dependence on fossil fuels. Therefore, the more industries focus on seeking sustainable products, the more manufacturers can stand out in developing and advocating for bio-based alternatives. For instance, in the construction and automotive sectors, companies are focusing on greener material substitutes to adhere to environmental and carbon footprint legislations. Hence, there is great scope for bio-based epoxy resins here. The more excellent traits of bio-based epoxy resins are that they are nearly comparable in performance, including durability and resistance like their more conventional counterpart, but at the same time, they work towards global sustainability objectives, thus creating new market niches and brand value.

Epoxy Resins Market Challenges:

-

Intense competition and pricing pressures from global suppliers pose significant challenges for local manufacturers in maintaining market share and profitability.

The high pressure of competition and the competitive edge of global suppliers create challenges for local manufacturers in the epoxy resins market to sustain their share of the market and profitability level. Global suppliers, especially from regions with lower production costs, sell epoxy resins at affordable prices directly influencing local producers to lower their prices or lose business. For example, players in countries with high labor and raw materials will find it hard to match the pricing strategies of large international operators. At a greater level, the need for local producers to invest in innovations such as sustainable and high-performance epoxy formulations, which at the same time must be cost-friendly, increases the challenge. By their concurrence, these factors can therefore threaten the profitability of smaller, local producers and their ability to compete in a market that is becoming increasingly globalized.

Epoxy Resins Market Segmentation Analysis:

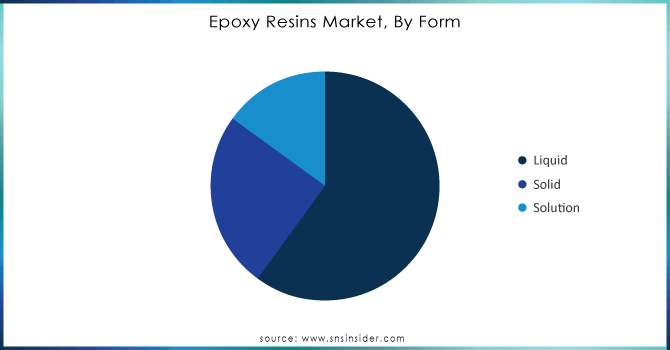

By Form, Liquid Epoxy Resins Lead Market Due to Versatility in Coatings, Adhesives, and Composites

The liquid epoxy resins market was dominated in 2024 with the estimated market share exceeding 60%. This is due to the versatility of liquid epoxy resins and their utilization in coatings, adhesives, and composites, mainly within the automotive and construction. Liquid epoxy resins provide excellent adhesion and ease of application that would represent the best option for protective coatings in harsh environments. For example, demand for such coatings in marine applications and industrial scenarios is increasing with good corrosion resistance and durability and thereby, triggering demand in various areas.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Raw Materials, DGBEA (Bisphenol A) Dominates Epoxy Resins Market for High-Performance Applications

The DGBEA (Bisphenol A) segment dominated the epoxy resins market in 2024 with above 50% of the market share. This may be due to the heavy usage of DGBEA in high-performance coatings, adhesives, and composites, especially in the automotive and electronics industries. Epoxy resins based on DGBEA have known high-strength mechanical properties, resistance to chemicals, and adhesion providing good protective coatings in harsh environments. This is shown in the extensive usage of electronic encapsulations and circuit boards where considerable application heightens their importance in ensuring durability and reliability in high-tech applications, thus enabling market leadership.

By Application, Paints & Coatings Segment Holds Largest Share Driven by Corrosion Resistance and Durability

In 2024, the paints & coatings segment dominated and accounted for a market share of more than 40% share in the epoxy resins market. This is attributed to the enormous utilization of epoxy resins in protective coatings for construction, automotive, and marine industries. Epoxy-based paints and coatings have been found to offer excellent corrosion resistance, durability, and adhesion characteristics, thereby making them highly suitable for protecting metal structures, pipelines, and machinery under very adverse conditions. For example, epoxy coatings have become on the rise in applications such as the marine sector as they can withstand immersion in saltwater, explaining their market dominance.

By End-User, Building & Construction Segment Leads Epoxy Resins Market with Extensive Flooring and Protective Applications

The building & construction segment dominated and accounted for a market share of more than 35% in 2024. This is because epoxy resins are extensively employed in construction applications such as flooring, coatings, and adhesives due to the strength, durability, and chemical resistance they offer. Epoxy resins are highly used for concrete reinforcement and protective coatings of steel structures in commercial and industrial buildings. For example, for a long time protection against degradation via environmental construction and skyscraper coats are also needed -from this perspective, the segment leads the market.

Epoxy Resins Market Regional Analysis:

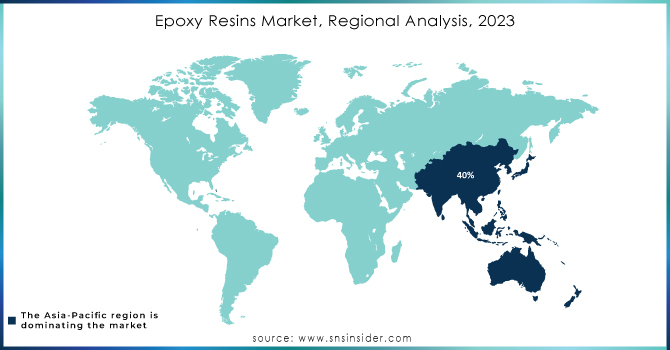

Asia Pacific Dominates Epoxy Resins Market in 2024

Asia Pacific is the dominant region in the Epoxy Resins Market, holding an estimated 38% market share in 2024. This leadership is driven by rapid industrialization, urban infrastructure development, and increasing automotive and electronics manufacturing, which accelerates demand for epoxy resins in coatings, adhesives, and composites.

-

China Leads Epoxy Resins Market in Asia Pacific

China dominates the Asia Pacific market due to its extensive manufacturing base, large-scale construction projects, and growing automotive and electronics industries. Government initiatives promoting industrialization, infrastructure expansion, and export-driven production further increase demand for high-performance epoxy resins. Local production capabilities allow China to supply a wide range of resins for coatings, adhesives, and composites efficiently. Rapid urbanization and rising industrial output make China the central hub for epoxy resin consumption in the region.

North America is the Fastest-Growing Region in Epoxy Resins Market in 2024

North America is the fastest-growing region in the Epoxy Resins Market, with an estimated CAGR of 7.5%. Growth is driven by increasing use of high-performance composites in aerospace, automotive, and renewable energy applications, which accelerates epoxy resin adoption.

-

United States Leads Epoxy Resins Market in North America

The United States dominates North America due to its mature aerospace, automotive, and electronics sectors requiring high-quality epoxy resins. Growth in renewable energy, including wind and solar, further drives demand for resin-based composites and coatings. Advanced R&D, innovation in resin formulations, and adoption of high-performance epoxy products by manufacturers position the U.S. as the central market leader. Strong industrial infrastructure and technological expertise ensure sustained market expansion.

Europe Epoxy Resins Market Insights, 2024

Europe maintains a significant share of the Epoxy Resins Market, supported by the automotive, aerospace, and construction industries. Driving Factor: Germany’s strict environmental and safety regulations increase the adoption of durable, high-performance epoxy resins, boosting overall demand.

-

Germany Leads Europe’s Epoxy Resins Market

Germany dominates Europe due to its advanced automotive and industrial manufacturing sectors, which rely heavily on epoxy resins for coatings, adhesives, and composites. Environmental and safety regulations favor high-quality, low-VOC epoxy formulations. Germany’s leadership in engineering, exports, and industrial innovation ensures strong resin consumption. The country’s chemical production infrastructure and R&D investments position it as Europe’s central hub for epoxy resin adoption.

Middle East & Africa and Latin America Epoxy Resins Market Insights, 2024

The Epoxy Resins Market in the Middle East & Africa and Latin America is emerging, driven by infrastructure projects, industrialization, and demand for corrosion-resistant coatings. Countries like Saudi Arabia, UAE, and Brazil invest in construction, automotive, and energy sectors, increasing epoxy resin consumption. Growing urbanization, industrial expansion, and local manufacturing capacities support gradual market growth. Although these regions are still developing compared to Asia Pacific, North America, and Europe, increasing industrial activity and adoption of high-performance coatings indicate steady expansion in the coming years.

Competitive Landscape of the Epoxy Resins Market:

3M

3M is a U.S.-based leader in epoxy resins and adhesives, offering products like Scotch-Weld Epoxy Adhesive DP100 and 3M Epoxy Adhesive 2216. With decades of expertise, the company develops high-performance epoxy solutions for industrial, automotive, and construction applications. 3M focuses on providing durable, chemical-resistant, and high-strength adhesives that meet stringent industry standards. Its role in the epoxy resins market is crucial, as it enables manufacturers to enhance product performance, ensure structural integrity, and comply with regulatory requirements across multiple sectors.

-

In 2024, 3M introduced advanced formulations of Scotch-Weld DP100 series with improved adhesion and faster curing times, optimizing industrial assembly efficiency.

Aditya Birla Chemicals

Aditya Birla Chemicals is an India-based chemical manufacturer specializing in epoxy resins, including Epoxy Resin A and Epoxy Resin B. The company provides high-quality epoxy solutions for coatings, adhesives, and composites in automotive, electronics, and construction industries. Its role in the epoxy resins market is significant, delivering durable and reliable products that enhance material performance and longevity. With strong production capabilities and technical expertise, Aditya Birla Chemicals supports large-scale industrial projects and contributes to the adoption of advanced epoxy solutions worldwide.

-

In 2024, Aditya Birla Chemicals launched a premium epoxy resin range with superior chemical resistance and thermal stability for industrial applications.

BASF SE

BASF SE, headquartered in Germany, is a global leader in epoxy resins and chemical solutions, offering products like Epoxy Resin EPOTEC and Epoxy Hardener. The company provides high-performance epoxy systems used in coatings, adhesives, and composites across automotive, construction, and electronics industries. BASF SE plays a pivotal role in the epoxy resins market by delivering innovative solutions that ensure durability, chemical resistance, and compliance with international standards. Its extensive R&D and global distribution network enable efficient supply to industrial and commercial customers.

-

In 2024, BASF SE unveiled advanced EPOTEC formulations with improved mechanical strength and enhanced environmental compliance for industrial coatings.

Dow Chemical Company

Dow Chemical Company is a U.S.-based leader in epoxy resins, providing solutions like D.E.R. Epoxy Resins and D.E.H. Hardener. The company serves automotive, construction, electronics, and marine industries with high-quality epoxy systems known for their strength, durability, and chemical resistance. Dow’s role in the epoxy resins market is essential, offering innovative products that meet stringent industrial requirements and support large-scale manufacturing. Through research and technological advancement, Dow enhances performance, safety, and sustainability in epoxy applications.

-

In 2024, Dow introduced a next-generation epoxy resin portfolio with faster curing times, improved adhesion, and enhanced environmental performance.

Epoxy Resins Market Key Players:

-

3M

-

Aditya Birla Chemicals

-

BASF SE

-

Dow Chemical Company

-

DIC Corporation

-

Huntsman Corporation

-

Kukdo Chemical Co., Ltd.

-

Macro Polymers

-

Mitsubishi Chemical Group Corporation

-

Nan Ya Plastics Corporation

-

Olin Corporation

-

Sinopec Corporation

-

Westlake Epoxy

-

Hexion Inc.

-

Cytec Solvay Group

-

Shin-Etsu Chemical Co., Ltd.

-

Eternal Chemical Co., Ltd.

-

Sika AG

-

Scott Bader Company Ltd.

-

Momentive Performance Materials Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 13.60 Billion |

| Market Size by 2032 | US$ 20.85 Billion |

| CAGR | CAGR of 5.49% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Liquid, Solid, Solution) • By Raw Materials (DGBEA, Novolac, Aliphatic, Glycidyl, Amine, Others) • By Application (Paints & Coatings, Composites, Adhesives & Sealants, Others) • By End-User (Building & Construction, Automotive, General Industrial, Consumer Goods, Wind Energy, Aerospace/Aircraft, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sinopec Corporation, BASF SE, Dow Chemical Company, Mitsubishi Chemical Group Corporation, 3M, Aditya Birla Chemicals, Westlake Epoxy, Kukdo Chemical Co., Ltd. , DIC Corporation, Nan Ya Plastics Corporation , Olin Corporation, Huntsman Corporation, Macro Polymers and other key players |