Protein Crisps Market Report Scope & Overview:

Get More Information on Protein Crisps Market - Request Sample Report

The Protein Crisps Market size was USD 3.01 billion in 2023 and is expected to Reach USD 8.62 billion by 2032 and grow at a CAGR of 12.4% over the forecast period of 2024-2032.

Protein crisps are a type of low-calorie snack food high in protein. They contain a variety of nutrients, including protein powder, cereals, and veggies. Protein crisps have a crunchy experience and are often baked or air-fried.

Based on Product Type, the Gluten-free protein crisps segment has a major share of 40% in 2022. The gluten-free protein crisps have increased the number of consumers who adhere to gluten-free diets. Vegan protein crisps are protein crisps prepared without the use of any animal ingredients. Plant-based proteins, such as pea protein, soy protein, or hemp protein, are commonly used to make them. Other plant-based components, such as chickpeas, lentils, or beans, can also be used to make vegan protein crackers.

Based on end users, athletes are the major segment as athletes are the major end-users of protein crisps. This is due to athletes need a high-protein diet to support muscle growth and repair. Protein crisps are a convenient and easy way for athletes to increase their protein intake.

MARKET DYNAMICS

KEY DRIVERS

-

Increased awareness of fitness and health

Nowadays people are conscious about health due to their busy lifestyle. Protein crisps are nutritious snacks that can help meet daily protein needs. The high protein content of these crisps makes them ideal snacks for health-conscious consumers looking to build lean muscle, avoid unhealthy salty snacks, and manage hunger. According to a 2022 survey by the International Food Information Council, 57% of consumers include high-protein foods in their diet. The popularity of high-protein diets like keto, paleo, and flexitarian will continue to drive the demand for protein-rich foods including protein crisps.

RESTRAIN

-

High competition from other snack foods

Protein crisps compete with other snack items such as chips, cookies, and candy. These other snacks are frequently less expensive and more commonly available, and they may have more appealing flavors and textures. Protein crisp manufacturers must work on designing goods that are high in protein, low in calories and sugar, and have a variety of enticing flavors and textures in order to compete with other snack foods. They must also ensure that their items are reasonably priced and widely available.

OPPORTUNITY

-

Marketing as protein meal additions

Many consumers want to boost their protein intake, but they may not have the time to prepare complicated meals or snacks. Protein crackers are an easy and convenient way to add protein to any meal. Athletes and fitness fanatics use protein snacks to fuel their exercises and meals in various campaigns. A promotion aimed at parents with young children, emphasizing the benefits of including protein crackers in their children's meals. Also included is a promotion emphasizing the nutritional benefits of protein crisps, such as their capacity to help consumers lose weight, build muscle, and enhance their overall health. Marketing protein crackers as protein meal supplements is a prospective market growth approach.

-

Expanding e-commerce distribution channels

CHALLENGES

-

High cost of Protein Crisps

Protein crisps are frequently more expensive than other types of snacks, such as chips and cookies. This is because the materials used to manufacture protein crisps, such as protein powder and whey protein isolate, are expensive. Plant-based proteins could be used instead of whey protein isolate by manufacturers. They could also use cheaper components like rice flour and tapioca starch. Protein crackers could be sold in bulk to shops or directly to customers by manufacturers. This can assist in lowering the cost per unit. Manufacturers could lower production costs by investing in new production equipment or procedures.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia’s invasion of Ukraine has impacted on protein crisps market. The sales are predicted to fall by 5% in 2023 as a result of the war. The war has disrupted the supply of raw materials used in the production of protein crisps and raised transportation expenses. The war has raised the costs of transportation making it more expensive for protein crisps manufacturers to bring their products to market. This has increased the cost of protein crisps manufacturers sourcing ingredients and distributing their products. Furthermore, the war has caused higher inflation, making protein crisps less inexpensive for customers.

IMPACT OF ONGOING RECESSION

The recession had decreased the supply of protein crisps market. Due to rising inflation from the conflict, protein crisps are now more expensive for customers in several nations. The market is anticipated to suffer from a recession, with sales falling by 4% in 2023. A recession may result in higher unemployment and reduced disposable incomes. Customers may be less likely to buy protein crisps and other discretionary items as a result. The battle has affected the producers' supply systems, making it more challenging to find ingredients and ship goods.

MARKET SEGMENTATION

By Product Type

-

Gluten-Free Protein Crisps

-

Soy Free Protein Crisps

-

Vegan Protein Crisps

By Flavor

-

Vanilla

-

Chocolate

-

Peanut Butter

-

Mocha

By Packaging

-

Pouches

-

Boxes

-

Cans

-

Other

By Distribution Channel

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Specialty Stores

By End User

-

Athletes

-

Bodybuilders

-

Casual Exercisers

-

Lifestyle Users

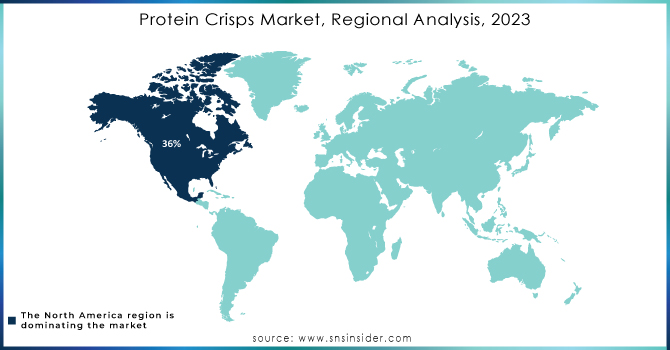

REGIONAL ANALYSIS

North America is the largest market for Protein Crisps Market accounting for over 36% of the market share in 2023. The growth is attributed to the increased popularity of healthy and convenient snacks with protein content and rising disposable incomes. The United States is the region's largest market for protein crisps, followed by Canada, owing to increasing consumer awareness of health and wellbeing.

The Europe market has a substantial Protein Crisps market share of over 25% in 2023. The increased demand for premium and novel protein snacks in the region is driving the market's expansion. The countries are focusing on developing high-protein snacks with lower sugar and calorie content, expanding into new retail channels, and marketing protein crisps as a healthy and convenient way to boost protein intake.

The Asia Pacific market is predicted to be the fastest-growing market with a CAGR of 16% in the upcoming period. The growth is attributed to increasing disposable incomes and growing awareness about protein-rich foods in the region. Increasing awareness of the health benefits of protein crisps, rising disposable incomes, increased urbanization, and changing dietary habits are all contributors.

Need any customization research on Protein Crisps Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Protein Crisps Market are Johnson & Johnson, Medtronic plc, Zimmer Biomet Holdings, Inc., Stryker Corporation, Smith & Nephew plc, Globus Medical, Inc., NuVasive Inc., Wright Medical Group N.V., DJO Global, Inc., CONMED Corporation, Orthofix Medical Inc., Bioventus LLC, and other key players.

RECENT DEVELOPMENTS

In September 2022, Kellogg's introduced the new Kashi GO Protein Wafer Crisps, a crunchy wafer snack containing pea protein. The plant-based protein snacks include 5g per serving.

In July 2022, Kerry and Recycled Culinary Inc. partnered to create a recycled protein crisp to provide texture and nutrition to food items. According to Upcycled Food, upcycled foods are manufactured from products that would otherwise end up in a food waste destination. Upcycled Food's ReGrained SuperGrain+ ingredients are created from brewer's "spent" grain (BSG).

In July 2022, Think! Products is expanding its protein-packed line with the introduction of new High Protein Crisp Bars. The bars, which come in chocolate and lemon flavors, have a soft cake-like layer on top of a crunchy center. The protein combination in the bars includes soy protein crisps, milk protein isolate, whey protein, calcium caseinate, and casein. Each gluten-free bar includes 140 to 150 calories, 15 grams of protein, and 2 grams of sugar and is sweetened with stevia.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.01 Billion |

| Market Size by 2032 | USD 8.62 Billion |

| CAGR | CAGR of 12.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Gluten-Free Protein Crisps, Soy Free Protein Crisps, Vegan Protein Crisps), • By Flavor (Vanilla, Chocolate, Peanut Butter, Mocha) • By Packaging (Pouches, Boxes, Cans, others) • By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Specialty Stores) • By End User (Athletes, Bodybuilders, Casual Exercisers, Lifestyle Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Johnson & Johnson, Medtronic plc, Zimmer Biomet Holdings, Inc., Stryker Corporation, Smith & Nephew plc, Globus Medical, Inc., NuVasive Inc., Wright Medical Group N.V., DJO Global, Inc., CONMED Corporation, Orthofix Medical Inc., Bioventus LLC |

| Key Drivers | • Increased awareness of fitness and health |

| Market Restrain | • High competition from other snack foods |