Pumps Market Report Scope & Overview:

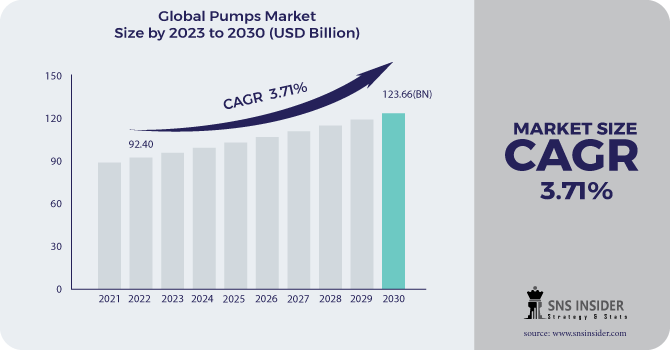

The Pumps Market size was valued at USD 95.8 Billion in 2023. It is expected to grow to USD 128.25 Billion by 2031 and grow at a CAGR of 3.71% over the forecast period of 2024-2031.

Pumps serve two primary functions elevating fluid pressure or enhancing the fluid transfer rate. In sectors like oil and gas exploration and chemical manufacturing, pumps play a crucial role in boosting fluid pressure and precisely metering reagents and reactants during chemical synthesis. The thriving oil and gas exploration industry are anticipated to drive the demand for pumps in the foreseeable future. Pumps are devices that employ mechanical action to transfer fluids (liquids or gases) and slurries. Pumps are categorized according to their functioning mechanism, although they all operate on the same concept of using energy and moving fluid by mechanical action. Pumps can be operated manually or with the help of electricity Apart from the many industries where pumps are used, such as agriculture, pharmaceuticals, chemicals, and others, the primary application sector that is driving the Pump Market revenue is oil and gas. Pumps are growing more crucial as infrastructure and other key functions such as wastewater treatment and energy generation become more developed. Furthermore, the number of end-user applications has grown in recent years, and the worldwide Pump Market value is expected to grow in tandem with the oil and gas industry's continued rise. Pumps employ kinetic energy, which can originate from wind power, electricity, and a number of other sources, particularly in industries, to move fluid.

To get more information on Pumps Market - Request Free Sample Report

Market Dynamics

Drivers

-

Water conservation and wastewater treatment improvements.

-

Increased industrial activity and infrastructural renovation.

-

Agricultural Sector Development.

The pump market is significantly influenced by a growing emphasis on water conservation and wastewater treatment. As concerns about water scarcity and environmental sustainability rise, there is an increasing demand for pumps in water and wastewater treatment facilities. These pumps play a crucial role in efficiently managing water resources, treating wastewater for reuse, and ensuring compliance with environmental regulations. Technological Advancements: Advances in pump technologies, including the development of energy-efficient and intelligent pumps, contribute to more effective water conservation practices. Intelligent pump systems with real-time monitoring capabilities enable precise control over water usage and enhance the overall efficiency of water treatment processes. The surge in industrial activity globally fuels the demand for pumps in various sectors, including manufacturing, mining, and energy production. Pumps are integral for fluid handling in industrial processes, such as chemical manufacturing, oil refining, and power generation. The need for reliable and efficient pumps is heightened during periods of increased industrialization.

Restraint

-

Heavy losses in the agricultural sector were unexpected.

-

Raw material costs that fluctuate.

The agricultural sector's susceptibility to unforeseen weather events, such as droughts, floods, or extreme temperatures, can lead to unexpected losses. Pumps play a critical role in agricultural irrigation systems, and disruptions in water availability due to adverse weather conditions can impact crop yields and result in financial losses for farmers. The pump market can be influenced by the performance of the agricultural sector. If there are unexpected losses in the agricultural sector due to factors like poor crop yields or damage to crops, it can affect the purchasing power of farmers and, subsequently, their investment in agricultural machinery, including pumps. Fluctuations in the costs of raw materials, such as metals, plastics, and energy, directly impact the manufacturing costs of pumps. The pump market is sensitive to changes in material prices, and significant fluctuations can influence the pricing strategies of pump manufacturers. Unexpected changes in raw material costs may result from supply chain disruptions, geopolitical events, or shifts in global demand. These disruptions can affect the availability and pricing of materials essential for pump manufacturing, potentially leading to challenges for manufacturers in managing production costs and pricing structures.

Opportunities

-

Increased awareness of the importance of producing energy-efficient goods

-

Many small pump manufacturers are actively offering excellent alternatives at competitive prices

Growing global awareness of environmental issues, energy conservation, and climate change has prompted increased emphasis on producing energy-efficient goods, including pumps. Governments, industries, and consumers are actively seeking ways to reduce energy consumption and carbon footprints. In response, the pump market has witnessed a shift towards the development and adoption of energy-efficient pump technologies. Regulatory Standards and Certification: Stringent energy efficiency standards and certifications, imposed by regulatory bodies in various regions, have further accelerated the trend towards energy-efficient pump manufacturing. Pump manufacturers are now compelled to comply with these standards, driving innovation in pump design and technology to meet or exceed energy efficiency requirements.

Challenges

-

Chemical assaults and a constant flow of chemicals via the pumps drastically diminish the pumps' lifetime.

-

Market participants are not working on new products.

Chemical assaults refer to the exposure of pumps to corrosive substances, which can lead to severe damage over time. Corrosive chemicals can erode pump components, affecting their structural integrity and performance. This is particularly significant in industries such as chemical processing, where pumps are exposed to a variety of aggressive chemicals during fluid handling processes. The statement suggests a lack of innovation or product development efforts within the pump market. This can be detrimental to industry progression, as new products often bring advancements in efficiency, durability, and adaptability to specific challenges. Stagnation in product development may hinder the market's ability to address emerging needs and challenges effectively.

Impact of Russia-Ukraine War:

The conflict may disrupt the global supply chain for pump components, affecting manufacturing processes and leading to shortages or delays in pump production. Geopolitical tensions can contribute to fluctuations in energy prices, including oil and gas. As pumps are vital in various energy-related applications, changes in energy costs can impact the operational expenses of pump users. Geopolitical instability can contribute to economic uncertainty, affecting investment decisions and infrastructure projects that may rely on pumps. Uncertain economic conditions may lead to delays or cancellations of projects, impacting the demand for pumps. Changes in currency exchange rates due to geopolitical events can influence the cost of imported pump components and finished products, potentially affecting pricing and competitiveness in the market. The impact on the Pump Market may vary by region. For example, if either Russia or Ukraine is a significant market for pump manufacturers or users, the conflict could directly affect demand in those regions.

Impact of Economic Downturn:

During an economic downturn, businesses may cut back on capital expenditures, including investments in new equipment like pumps. Industries that heavily rely on pumps, such as construction, manufacturing, and infrastructure development, may postpone or scale down projects, leading to decreased demand for pumps.

Economic recessions often result in a decline in industrial activity. Industries that use pumps for fluid handling, such as manufacturing and mining, may experience reduced production levels. This can impact the demand for pumps as manufacturers may delay or cancel orders for new equipment. Infrastructure projects, which often involve the use of pumps for tasks like water management, sewage systems, and construction processes, may face delays or cancellations during a recession. Government budgets may be constrained, leading to a slowdown in public infrastructure projects that utilize pumps. Companies facing financial challenges during an economic downturn may find it difficult to invest in new equipment, including pumps. Limited access to credit and a focus on cost-cutting measures may result in a reduced appetite for capital-intensive purchases.

Market Segmentation

By Type

-

Centrifugal Pumps

-

Centrifugal Pumps By Configuration

-

Single Stage

-

Multistage

-

Centrifugal Pumps By Design

-

Radial Flow Pump

-

Mixed Flow Pump

-

Axial Flow Pump

-

Positive Displacement Pumps

-

Rotary Pumps By Type

-

Gear Pumps

-

Screw Pumps

-

Vane Pumps

-

Lobe Pumps

-

Others

-

Reciprocating Pumps By Type

-

Diaphragm Pumps

-

Piston Pumps

-

Plunger Pumps

The revenue dominance in 2023 was held by the centrifugal pumps segment, capturing a substantial share of 66.9%. Centrifugal pumps are the preferred choice in applications where the emphasis is on the flow rate rather than the pressure requirements for a specific fluid. Widely utilized in urban water systems, these pumps play a crucial role in delivering clean water to communities, ensuring a consistent and dependable supply of fresh water. Additionally, they contribute significantly to agricultural irrigation, efficiently transporting water from sources to fields and crops.

This category of pumps utilizes reciprocating motion of a piston within a cylinder to transfer fluids. Renowned for their versatility, reliability, and proficiency in handling challenging fluids, positive displacement pumps emerge as a valuable choice across various industries, including water and wastewater treatment, agriculture, and chemical processing.

By End-Use

-

Agriculture

-

Water & Wastewater

-

Construction & Building Services

-

Oil & Gas

-

Chemical

-

Power Generation

-

Others

The agricultural end-use segment secured the largest share of revenue, accounting for 20.2% in 2023. The prosperity of agriculture hinges on the efficient distribution of water, and pumps play a pivotal role in facilitating this process. They generate the necessary pressure to transport water from sources such as wells, rivers, or reservoirs to fields for irrigation. A key driver of market growth is the pumps' capability to ensure a consistent and ample water supply. Additionally, their capacity to maintain high discharge rates makes them invaluable for sustaining water distribution in arid regions.

Regional Analysis:

The Asia Pacific region commanded the largest revenue share, accounting for 47.2% in 2023, and is poised for significant growth at the swiftest Compound Annual Growth Rate (CAGR) throughout the forecast period. The region's rapid industrialization and urbanization, coupled with an escalating demand for fluid handling and safe drinking water, particularly in countries such as China and India, are key factors expected to amplify market potential. Additionally, sustained economic growth in the Asia Pacific, driven by increased governmental investments in agriculture, construction, and water and wastewater treatment industries, is anticipated. The continuous expansion of end-use sectors like the chemical industry and hydrocarbon exploration is set to drive the demand for liquid handling equipment, contributing to the global market's expansion.

In the Middle East & Africa region, a substantial growth trajectory is predicted with the second-highest CAGR of 4.7% over the forecast period, propelled by thriving industries such as oil & gas and water & wastewater treatment. The Middle East & Africa serves as a major hub for oil & gas production, where pumps play a crucial role in crude oil transfer and refining processes. Furthermore, significant investments in water treatment facilities to convert saline water into potable water have been a focus in Middle Eastern countries. Pumps are extensively used for seawater intake, reverse osmosis, and brine disposal in these facilities.

Pump technology advancements in the Middle East have not only enhanced core process operations but have also increased pump reliability, leading to long-term savings in routine operating procedures. These innovative pumps find applications across various industries, including agriculture, electricity, industrial wastewater, and chemicals, contributing to a sustained demand throughout the forecast period.

.png)

Need any customization research on Pumps Market - Enquiry Now

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of the Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

KEY PLAYERS:

The major key players are Aqua Group, Best Engineers Pumps, Commitment Reliability Innovation (C.R.I), CNP Pumps, Deccan, Duke Plasto Technique, ELLEN, Endura Pumps, Falcon Pumps, Grundfos and Other Players

Best Engineers Pumps-Company Financial Analysis

Recent Trends in the Pump Market:

The pump market is currently witnessing several noteworthy trends that are shaping its trajectory. One significant trend is the increasing demand for water and wastewater treatment plants, driven by a growing awareness of environmental concerns and the need for sustainable water management. As populations rise and urbanization accelerates, the necessity for efficient water treatment processes becomes more pronounced. Another key trend is the surge in infrastructure projects in developing economies. Rapid urbanization and industrialization in these regions are propelling the construction of various infrastructure facilities, including water supply systems, transportation networks, and energy projects, thereby boosting the demand for pumps.

The rise in modular construction projects is also contributing to the dynamics of the pump market. Modular construction methods, which involve assembling pre-fabricated components off-site, are becoming increasingly popular due to their efficiency and cost-effectiveness. Pumps play a crucial role in the fluid management systems of these modular constructions. The demand for energy-efficient pumps is on the rise as industries and consumers increasingly prioritize sustainability and energy conservation. Energy-efficient pumps not only reduce operational costs but also align with global efforts to promote environmentally friendly practices.

Recent Development:

In December 2022: EBARA Pumps Europe S.p.A., based in Gambellara, Italy, unveiled its latest in-line pump model 3E/3ES for global markets, excluding Japan. The EBARA Group, with a commitment to advancing efficiency and innovation, will prioritize ongoing product development initiatives.

In March 2023: Gorman Rupp Europe disclosed the introduction of its innovative rental pump platform. This platform, initially launched in February in the Netherlands, aims to streamline and enhance the process of pump rentals, ensuring a "faster, easier, and more reliable" experience. Notably, the platform features a sophisticated 10-step pump picker tool designed to recommend the most suitable pump for specific project requirements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 95.8 Billion |

| Market Size by 2031 | US$ 128.25 Billion |

| CAGR | CAGR 3.71% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Centrifugal Pumps, Positive Displacement Pumps) • By End-use (Agriculture, Water & Wastewater, Construction & Building Services, Oil & Gas, Chemical, Power Generation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aqua Group, Best Engineers Pumps, Commitment Reliability Innovation (C.R.I), CNP Pumps, Deccan, Duke Plasto Technique, ELLEN, Endura Pumps, Falcon Pumps, and Grundfos. |

| Key Drivers |

• Water conservation and wastewater treatment improvements. • Increased industrial activity and infrastructural renovation. • Agricultural Sector Development. |

| Restraints | •Heavy losses in the agricultural sector were unexpected. •Raw material costs that fluctuate. |