Fire Suppression Market Scope & Overview:

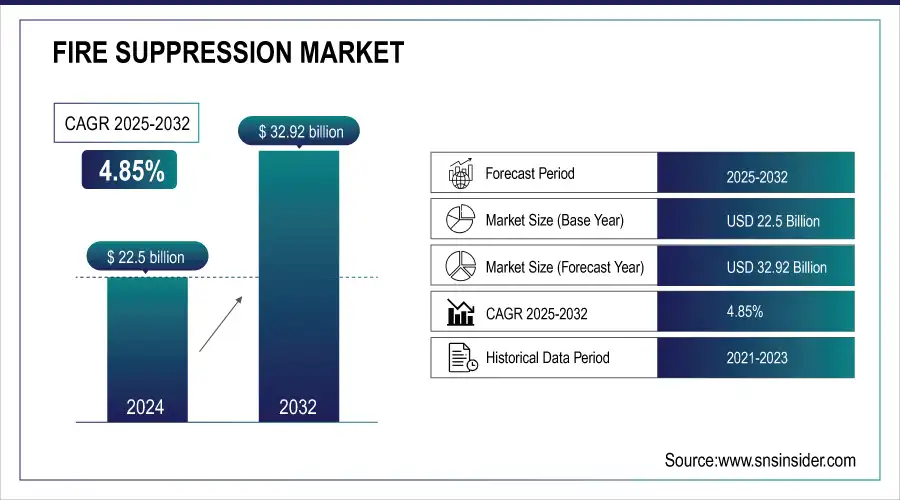

The Fire Suppression Market Size was valued at USD 22.5 billion in 2024 and is expected to reach USD 32.92 billion by 2032 and grow at a CAGR of 4.85% over the forecast period 2025-2032.

To get more information on Fire Suppression Market - Request Sample Report

The Fire Suppression Market is driven by a growing thought of safeguarding lives and property. According to, National Fire Protection Association (NFPA), in 2024, approximately 3790 people died and 13250 were injured. The key players of the market, with their capacity to deal with consequences like employee injuries and operational disruptions to significant financial losses, are important to establish a fire protection system. According to the National Fire Protection Association (NFPA), an average of 358,500 homes has structural fires annually. Fire-related deaths have decreased by 42% compared to 1980. This improvement is due to the fire safety advancements. However, there's a recent cause for concern.

Key Trends in the Fire Suppression Market

-

Regulatory mandates and rising safety awareness are increasing the adoption of advanced fire suppression systems across residential, commercial, and industrial sectors.

-

Technological innovation is reshaping the market, smart, IoT-enabled systems offer real-time monitoring, predictive maintenance, and remote control.

-

AI and machine learning are enhancing fire detection accuracy, enabling early hazard prediction and reducing false alarms.

-

There's a growing shift to environmentally friendly suppression agents, such as eco-safe clean agents and water mist systems, replacing older, harmful chemicals.

-

The residential segment is expanding quickly, thanks to increased affordability, awareness of home fire safety, and interest in smart home integration.

Fire Suppression Market Driver:

-

The increase in urbanization, industry, and construction rises the demand of fire suppression systems.

-

In developing nations, there is an increasing need for fire protection infrastructure as economies grow and cities expand, creating growth potential.

-

Fire suppression systems in commercial buildings, industrial facilities, and transportation sectors and the rise in public awareness about fire safety and associated risks.

Fire suppression systems are essential in commercial buildings, industrial facilities, and transportation are the major drivers of the market growth. These sectors face high fire risks due to factors like large occupant numbers, flammable materials, and regulations. The need to protect lives, property, and ensure business continuity fuels demand for advanced fire suppression systems, propelling market growth. The increase in public awareness rises the growth of the market. People have increase in thought of safeguard lives and property rises the need of Fire suppression systems which leading to rise the growth of the market.

For Instance, Kerala's government has set fire safety protocols for its buildings. This includes mandating fire protection equipment and requiring offices to digitize documents for better preservation.

Fire Suppression Market Restraints:

-

The rise in pricing pressure in the competitive fire suppression industry because there are numerous companies selling comparable goods.

-

Installing and maintaining fire suppression systems can be costly, particularly for complex systems at large industrial sites.

Complex fire suppression systems for large industrial sites have high price tag, for both installation and ongoing maintenance. This can deter companies, especially budget-conscious ones, from implementing these crucial safety measures. The competition between many companies offers similar products and keeps costs in check for basic systems, large industrial sites have a different reality. These facilities always require complex fire suppression systems to address specific hazards present in their operations. The intricate design, specialized equipment, and extensive piping networks needed for such systems translate to significant installation and maintenance costs. This price can create a barrier for some industrial facilities that need to implement the most advanced fire protection measures.

Fire Suppression Market Opportunities:

-

In developing nations, there is an increasing need for fire protection infrastructure as economies grow and cities expand, creating growth potential.

-

Including a smart system Smart building management systems can be integrated with fire suppression systems to increase monitoring, control, and reactivity.

The fire suppression market is evolving with the integration of smart building management systems, enabling advanced monitoring, control, and reactivity. These intelligent systems connect fire suppression equipment—such as sprinklers, alarms, and clean agent systems—with IoT-enabled platforms to deliver real-time alerts and predictive analytics. As a result, facility managers can remotely monitor fire risks, detect system failures, and initiate rapid responses, minimizing damage and downtime. The growing emphasis on smart cities, sustainable infrastructure, and connected workplaces is fueling demand for these integrated solutions. Moreover, regulatory pressure for safety compliance and reduced false alarms further accelerates adoption. By merging automation with safety, smart-enabled fire suppression systems are becoming central to modern commercial, residential, and industrial building operations.

Fire Suppression Market Segmentation Analysis:

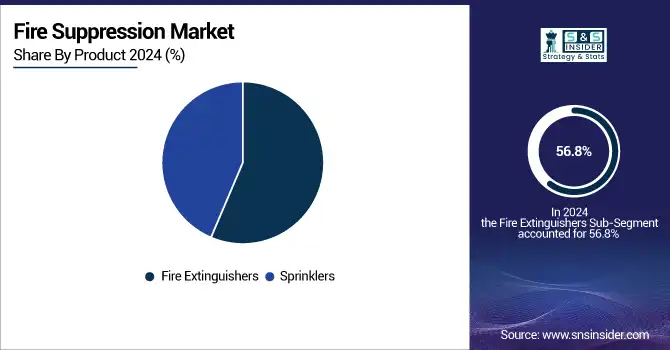

By Product, Fire Extinguishers Lead the Fire Suppression Market with Over 56.8% Share in 2024

In 2024, the fire extinguishers segment dominated the fire suppression market, securing more than 56.8% of the global share. This leadership stems from a combination of regulatory enforcement, workplace safety awareness, and increasing fire risks across commercial, industrial, and residential sectors. Governments worldwide are tightening fire code compliance, requiring organizations to install and maintain extinguishers as a mandatory first line of defense. Their cost-effectiveness, portability, and ability to tackle small-scale fires quickly make them indispensable compared to other systems that may require higher investment. The rise of high-density workplaces, warehouses, and manufacturing units further reinforces demand, as extinguishers are easy to deploy and provide immediate protection. Additionally, technological advancements such as eco-friendly extinguishing agents and smart-connected extinguishers, which monitor pressure and readiness, are driving wider adoption. As a result, fire extinguishers remain the most relied-upon product in ensuring fire safety globally.

By Application, Industrial Segment Dominates Fire Suppression Market with Over 48% Share in 2024

In 2024, the industrial segment emerged as the dominant application area in the fire suppression market, capturing more than 48% of the total share. Industrial facilities such as factories, warehouses, oil & gas plants, and data centers face significantly higher fire risks compared to residential or commercial buildings. This is primarily due to the constant handling of hazardous materials, flammable liquids, chemicals, and heavy machinery, which substantially elevate fire hazards. As a result, stringent fire safety regulations mandate the deployment of advanced suppression systems across industrial environments to ensure worker safety and minimize operational downtime. Data centers, in particular, have fueled demand for clean agent systems that protect sensitive electronic equipment without causing damage. Additionally, industries are increasingly adopting smart fire suppression technologies, which provide real-time monitoring and rapid response, further reinforcing the sector’s reliance on robust fire protection solutions. This makes the industrial segment the cornerstone of global fire suppression demand.

Fire Suppression Market Regional Analysis:

North America Dominates the Fire Suppression Market in 2024

North America is the dominant region in the Fire Suppression Market, holding an estimated 38% market share in 2024. This leadership is driven by strict fire safety regulations, high adoption of smart suppression technologies, and strong demand across industrial, commercial, and residential sectors, which accelerates market deployment in the region.

Need any customization research on Fire Suppression Market - Enquiry Now

-

United States Leads North America’s Fire Suppression Market

The United States dominates due to its well-established regulatory framework, widespread adoption of advanced suppression systems, and strong presence of manufacturing and oil & gas sectors. High-risk industries such as energy, data centers, and manufacturing facilities increasingly integrate automatic sprinklers, clean agents, and IoT-enabled systems for rapid detection and suppression. Government fire codes and NFPA standards ensure compliance, while investments in smart building infrastructure drive innovation. The U.S. remains central to North America’s fire suppression market, setting safety benchmarks and driving regional growth.

Asia Pacific is the Fastest-Growing Region in Fire Suppression Market in 2024

Asia Pacific is the fastest-growing region, with an estimated CAGR of 9.8% during 2024–2032. Growth is fueled by rapid industrialization, urbanization, and rising construction activities, which increase fire risk and accelerate the adoption of advanced suppression solutions.

-

China Leads Fire Suppression Market Growth in Asia Pacific

China dominates due to its expanding industrial base, high-rise infrastructure projects, and government initiatives enforcing strict fire safety compliance. Rapid growth in manufacturing, warehousing, and commercial buildings creates significant demand for sprinklers, gas-based systems, and portable extinguishers. Additionally, China’s strong focus on integrating smart fire detection and suppression technologies into new urban projects positions it as the hub for fire safety innovation. International players and local manufacturers are actively investing in the market, ensuring China remains the leading driver of Asia Pacific’s fire suppression growth.

Europe Fire Suppression Market Insights, 2024

Europe accounts for a significant share of the Fire Suppression Market, supported by advanced safety regulations, industrial automation, and sustainable infrastructure initiatives. Germany’s strict fire safety codes and advanced adoption of smart suppression technologies enhance efficiency, ensuring strong regional demand. Germany dominates due to its industrial strength, widespread use of automated suppression systems, and government-backed sustainability goals. Its leadership fosters innovation, especially in clean agent and environmentally friendly solutions, positioning Germany as the benchmark for fire safety across Europe.

Middle East & Africa and Latin America Fire Suppression Market Insights, 2024

The Fire Suppression Market in the Middle East & Africa and Latin America is expanding steadily, driven by rising construction projects, oil & gas investments, and the modernization of industrial infrastructure. Countries like Saudi Arabia, the UAE, Brazil, and Mexico are increasingly adopting suppression systems in commercial, industrial, and residential spaces. Growing awareness of fire safety, coupled with government-led initiatives to align with international fire codes, is fueling demand. While these regions trail behind North America,

Competitive Landscape of the Fire Suppression Market:

Johnson Controls

Johnson Controls is a global leader in building technologies and solutions, with a strong presence in fire suppression systems. The company provides advanced fire detection, suppression, and sprinkler systems integrated with smart building management platforms. Its broad portfolio covers industrial, commercial, and residential applications, ensuring safety and compliance with international fire codes. Johnson Controls plays a pivotal role in the Fire Suppression Market by driving innovation in intelligent, automated suppression systems designed to enhance responsiveness and efficiency.

-

In 2024, Johnson Controls expanded its fire suppression product line with next-generation smart sprinklers featuring IoT-enabled monitoring and predictive maintenance.

Honeywell International Inc.

Honeywell International Inc. delivers cutting-edge fire suppression systems, leveraging its expertise in sensing and control technologies. The company designs advanced detection and suppression solutions for industries such as aerospace, oil & gas, data centers, and commercial buildings. Its focus on integrating IoT and AI-driven monitoring systems enhances real-time fire prevention and risk management. Honeywell’s role in the Fire Suppression Market is significant, offering scalable solutions that balance safety, sustainability, and compliance with global standards.

-

In 2025, Honeywell introduced an eco-friendly fire suppression agent with reduced GWP, aligning with global environmental regulations while maintaining high efficiency.

Siemens AG

Siemens AG is a key player in the global fire suppression landscape, offering integrated fire safety solutions that combine suppression, detection, and building automation. Its portfolio includes sprinklers, gas-based systems, and water mist technologies tailored to critical infrastructure, healthcare, and industrial facilities. Siemens leverages its smart building expertise to deliver fully connected suppression systems that improve safety while reducing operational costs. Its role in the market is central, as it sets benchmarks for digitalized, sustainable, and reliable fire protection systems worldwide.

-

In 2024, Siemens launched AI-powered fire suppression controllers designed to reduce false alarms and improve emergency response times in smart buildings.

Robert Bosch GmbH

Robert Bosch GmbH is a global technology company with a strong foothold in the fire suppression sector, delivering reliable and advanced systems for commercial and industrial use. Bosch’s portfolio spans sprinklers, extinguishing systems, and intelligent fire detection units. By integrating IoT and connected technologies, Bosch enhances monitoring and real-time control in critical environments. Its role in the Fire Suppression Market is vital, as it emphasizes precision, sustainability, and efficiency across multiple applications.

-

In 2025, Bosch unveiled a cloud-based fire suppression monitoring platform, enabling remote diagnostics and faster response for industrial clients.

Fire Suppression Market, key players:

-

Johnson Controls

-

Honeywell International Inc.

-

Siemens AG

-

Robert Bosch GmbH

-

Carrier Global Corporation

-

Minimax Viking GmbH

-

Tyco Fire Protection Products

-

Securiton AG

-

Hochiki Corporation

-

United Technologies Corporation

-

Fike Corporation

-

Gentex Corporation

-

Halma plc

-

Firetrace International, LLC

-

Marioff Corporation (a UTC company)

-

Kidde Fire Systems

-

Amerex Corporation

-

Buckeye Fire Equipment Company

-

Rotarex S.A.

-

Viking Group Inc.

| Report Attributes | Details |

| Market Size in 2024 | US$ 22.5 Bn |

| Market Size by 2032 | US$ 32.92 Bn |

| CAGR | CAGR of 4.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fire Extinguisher, Fire Sprinkler) • By Type (Gas, Water, Dry Chemical Powder, Others) • By Application (Commercial, Industrial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fike Corp, Minimax USA LLC, Gentex Corp, Halma Plc, HOCHIKI America Corp, Honeywell International Inc, Johnson Controls, Robert Bosch GmbH, Siemens AG, ORR, Raytheon Technologies Corp |