Air Conditioning System Market Report Scope & Overview:

To get more information on Air Conditioning System Market - Request Free Sample Report

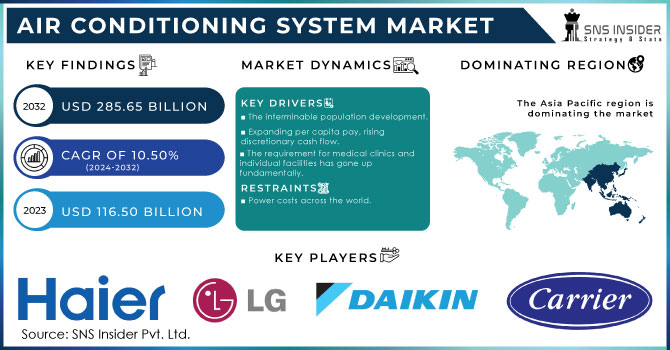

The Air Conditioning System Market size was valued at USD 116.50 Billion in 2023. It is expected to grow to USD 285.65 Billion by 2032 and grow at a CAGR of 10.50 % over the forecast period of 2024-2032.

The air conditioning system market has witnessed substantial growth in recent years, driven by rising global temperatures, increasing urbanization, and the growing demand for energy-efficient solutions. The market's expansion is primarily fueled by the escalating need for temperature control in homes and offices. As of 2023, the U.S. air conditioning system market is valued at approximately USD 27 billion, encompassing residential, commercial, and industrial sectors. This growth is largely driven by an increasing demand for energy-efficient and smart HVAC systems. In terms of market segmentation, residential air conditioning systems represent about 60% of the total market revenue. This category includes central air conditioners, ductless systems, and window units. Conversely, commercial air conditioning systems account for roughly 30% of the market, covering larger installations used in office buildings, shopping malls, and industrial applications. As urban populations grow and disposable incomes increase, more households are investing in air conditioning systems, especially in regions with hot climates. In the commercial sector, businesses are prioritizing the comfort of their employees and customers, leading to higher adoption of air conditioning solutions.

Traditional air conditioning units are notorious for their high energy consumption and environmental impact. However, technological advancements have led to the development of more efficient systems that reduce energy use and minimize greenhouse gas emissions. Innovations such as inverter technology, which adjusts the speed of the compressor to match cooling needs, have become increasingly popular. For Example, Carrier Global Corporation has made significant strides in air conditioning technology with its innovative solutions. The company’s air conditioning units are equipped with advanced inverter technology, which features variable-speed compressors. This technology enhances energy efficiency by adjusting the cooling output precisely to match the specific needs of the space, resulting in reduced energy consumption. Additionally, Carrier’s Infinity Series air conditioners integrate smart technology through the Carrier Cor Wi-Fi thermostat. This system allows users to control their air conditioning units remotely, offering real-time monitoring and management of energy usage. These systems not only offer convenience but also enhance energy efficiency by allowing users to monitor and adjust their energy usage in real time.

Air conditioning System Market Dynamics

Drivers

- The requirement for medical clinics and individual facilities has gone up fundamentally.

The increase in requests for air conditioning units in healthcare centers and private establishments is due to the essential requirement of preserving specific environmental conditions to guarantee patient safety and operational effectiveness. In medical settings, it is essential to closely regulate temperature and humidity levels to avoid contamination, control infection risks, and maintain ideal conditions for patients and delicate medical equipment. Air conditioning systems are essential in medical clinics for keeping a clean environment, managing air contaminants, and ensuring the comfort of patients and staff. In surgical theaters, it is crucial to keep a stable temperature and humidity level to prevent bacterial growth and ensure the effectiveness of sterile procedures. Sophisticated HVAC systems are utilized to meet these requirements and also ensure cost-effective energy usage. Moreover, diagnostic centers and private practices are also increasingly incorporating advanced air conditioning systems to improve patient satisfaction and protect their equipment. For instance, radiology facilities with MRI machines and other imaging equipment must control temperature to avoid overheating and maintain the effective operation of these expensive devices. Likewise, dental clinics need accurate temperature regulation to ensure patient comfort during treatments and to preserve the lifespan of dental tools.

- Major mechanical advancements are presently being initiated to make AC frameworks.

Significant mechanical advancements are causing major changes in the Air Conditioning (AC) System Market, resulting in more efficient, environmentally friendly, and technologically advanced systems. One important development is the inverter technology advancement that enables AC units to regulate their cooling output based on the room's temperature requirements. This technology improves both energy efficiency and reduces strain on the compressor, extending the unit's lifespan. Furthermore, there is a growing popularity in smart AC systems that are connected to IoT, allowing users to remotely manage and oversee their devices through smartphones or other connected gadgets. This new development enables improved energy efficiency and individualized temperature regulation, with advantages for both home and business environments. Advancements in Variable Refrigerant Flow (VRF) systems are transforming the cooling operations of large-scale industrial applications. VRF technology enables accurate temperature regulation in various areas of a structure, enhancing comfort and reducing energy consumption. These systems are being more and more utilized in office buildings, hotels, and shopping malls to effectively manage different cooling requirements.

Restraints

- The cost of environmentally sustainable items is still prohibitively expensive.

The expensive nature of environmentally friendly products continues to be a major obstacle in the Air Conditioning System Market. Although consumers are becoming more aware of and wanting eco-friendly air conditioning options, the high costs associated with these products are preventing them from being widely accepted. Air conditioning systems that are environmentally sustainable, including ones that utilize natural refrigerants like R-32 or CO2, or integrate energy-efficient technologies like variable speed compressors and smart controls, come with increased production expenses. The expenses are increased due to cutting-edge research and development, specific materials, and more rigorous adherence to environmental regulations. For example, switching from traditional HFC-based refrigerants to more eco-friendly alternatives may lead to a 10-20% increase in the total system cost. Furthermore, energy-efficient air conditioning units, which can lower long-term operational expenses, usually come with a higher initial cost, limiting access for budget-conscious consumers and small businesses.

Air conditioning System Market Segment Analysis

By Type

The unitary segment led the air conditioning market in 2023 with a market share of 40%, due to its broad use in residential, commercial, and industrial areas. Unitary air conditioning systems are small, self-contained units made for use in a single area, which is why they are commonly used in residences and small businesses. Their dominant presence is fueled by their flexibility and simple installation process, particularly in areas experiencing urban population growth and rising disposable incomes. For example, Carrier and Daikin provide unitary systems designed for homes, offering energy-efficient options customized for different climate requirements.

The rooftop sector is experiencing a rapid growth rate during 2024-2032 in the air conditioning systems market, largely due to its widespread utilization in commercial and industrial settings. Roof-mounted units are commonly placed on the top of big structures like malls, stores, and office buildings to offer centralized cooling for various areas. The rising need for cooling solutions that are energy-efficient and save space in urban areas has driven the expansion of this sector. Lennox and Trane provide specialized rooftop units with advanced features such as variable speed fans and energy recovery ventilators, tailored for the unique requirements of large-scale facilities.

By Technology

The inverter segment held a market share of over 60% in 2023 and dominated the market. This technology improves energy efficiency by reducing power usage during times of low demand, resulting in notable decreases in electricity costs. Compared to non-inverter models, inverter ACs provide accurate temperature control, operate more quietly, and have a longer lifespan. They are especially ideal for residential and commercial uses where energy efficiency and comfort are top priorities. An example is Daikin, which provides a variety of inverter-based air conditioners known for their excellent energy efficiency and advanced features, making them a favored option for households and businesses seeking affordable and environmentally friendly cooling options.

Non-inverter segment accounted for a faster CAGR during 2024-2032, as it consists of conventional air conditioning systems that use a compressor with a set speed that runs at maximum power or is completely shut down. This repeated switching can lead to increased energy usage and less accurate temperature regulation in contrast to inverter versions. Non-inverter air conditioners are typically more affordable initially and are commonly utilized in scenarios where the initial expense is a major consideration. They are typically seen in smaller residential settings or locations with a steady and predictable need for cooling. LG offers non-inverter air conditioners for customers on a budget who require dependable, simple cooling solutions without the added expense of inverter technology.

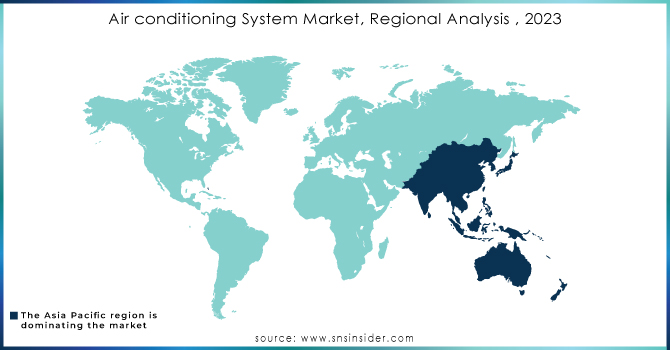

Air conditioning System Market Regional Analysis

Asia-Pacific dominated the market in 2023 with a market share of 40%. Rapid urbanization, rising incomes, and extreme weather conditions are driving the Asia-Pacific region to become the most expanded market for air conditioning systems. China and India are seeing a rise in residential and commercial building projects, which is increasing the need for more advanced cooling systems. Daikin Industries and LG Electronics are actively broadening their range of products and improving their distribution channels in this area. The increase in middle-class families and infrastructure advancements in developing nations drive strong market expansion, making Asia-Pacific a central target for international air conditioning companies.

North America is to become the fastest-growing segment during 2024-2032, due to its strong infrastructure and high living standards. Extreme weather conditions in the area, specifically scorching summers, play a big role in the high demand for energy-efficient cooling technologies. Major companies such as Carrier Global Corporation and Trane Technologies have a dominant presence, providing advanced solutions like intelligent thermostats and environmentally friendly systems. Furthermore, the focus on upgrading older buildings with contemporary, energy-saving air conditioning systems contributes to the expansion of the market. The area is also advantageous due to strict rules that encourage the implementation of cutting-edge and eco-friendly cooling technologies.

Need any customization research on Air Conditioning System Market - Enquiry Now

KEY PLAYERS

The major key players of these sectors are Haier Group Corporation, LG Electronics Inc., Daikin Industries Ltd., United Technologies Corporation, Hitachi-Johnson Controls Air Conditioners Inc., Carrier Corporation, Mitsubishi Electric Corporation, Mahle GmbH, Denson Corporation, Calsonic Kansei Corporation, Sanden Holdings Corporation, Eberspaecher Holding GmbH & Co., Valeo SA, Keihin Corporation, Subros Limited.

Recent Development

-

In March 2023, Daikin introduced a new range of Variable Refrigerant Volume air conditioning system VRV 5 S-series. The S-series is characterized by environmental friendliness, as it uses refrigerant R-32 with a low global warming potential. The unit is also compact, which is suitable for urban populations.

-

In June 2023, Carrier announced a new AquaEdge springless centrifugal chiller, which possesses outstanding efficiency and environmental performance. 19DV offers excellent full- and part-load performance, has a low global warming potential refrigerant, and advanced controls. This chiller is designed for large commercial use.

-

In April 2023, Mitsubishi Electric launched a new type of residential air conditioning system ZTL series. The series is highly efficient, and uses a refrigerant R-32 with a low global warming potential. The unit is also equipped with advanced airflow control.

| Report Attributes | Details |

| Market Size in 2023 | USD 116.50 Billion |

| Market Size by 2032 | USD 285.65 Billion |

| CAGR | CAGR of 10.50 % From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Unitary, Rooftop, PTAC) • by Technology (Inverter and Non-inverter) • by End use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Haier Group Corporation, LG Electronics Inc., Daikin Industries Ltd., United Technologies Corporation, Hitachi-Johnson Controls Air Conditioners Inc., Carrier Corporation, Mitsubishi Electric Corporation, Mahle GmbH, Denson Corporation, Calsonic Kansei Corporation, Sanden Holdings Corporation, Eberspaecher Holding GmbH & Co., Valeo SA, Keihin Corporation, Subros Limited. |

| Key Drivers |

• The requirement for medical clinics and individual facilities has gone up fundamentally. • Major mechanical advancements are presently being initiated to make AC frameworks. |

| Restraints |

• The cost of environmentally sustainable items is still prohibitively expensive. |