Global Rosacea Treatment Market Size & Overview:

To get more information on Rosacea Treatment Market - Request Free Sample Report

The Rosacea Treatment Market size was valued at USD 2.07 billion in 2023 and is expected to reach USD 3.70 billion by 2032, growing at a CAGR of 6.64% from 2024 to 2032.

The prevalence of rosacea is increasing as a result of urbanization, environmental changes, and lifestyle alterations, especially in fair-skinned patients. With an increase in diagnoses and a growing population, this demand has converted into, a search for effective treatment options. Approximately 415 million people globally are affected by rosacea. Rosacea has a worldwide prevalence of 5%, primarily affecting individuals aged 30 to 50. Symptoms visible on the face such as redness, pimples, and visible blood vessels often have cosmetic and psychological ramifications that increase the demand for treatments that can improve appearance, thereby increasing self-esteem. Non-invasive treatments such as laser therapy and Intense Pulsed Light (IPL) treatments are also becoming popular and these are helping to boost the growth of the market.

Novel treatments for rosacea focused on individual pathologies, exciting oral therapies, and new topical medications providing practical and targeted treatments for patients. Combination therapies, which may include antibiotics in conjunction with topical treatments or light therapy with oral medications, are becoming more frequent as they treat multiple symptoms at once and are beneficial for patients. In more recent adult acne developments, Galderma's EPSOLAY Cream, a topical formulation with 5% benzoyl peroxide was found in June 2022 with evidence of a 70% reduction in lesions at 12 weeks for sample participants having previously used topical anti-acne medications; signifying the much-needed evolution that is required in this space.

The growing awareness about skin health affects Campaigns such as Rosacea Awareness Month hosted by the National Rosacea Society (NRS) are educating patients on emerging novel therapies and adherence to recommended treatment. According to the NRS, rosacea affects an estimated 5.46% of the global population, and estimates suggest that it is more prevalent among fair-skinned individuals, especially in North America and Europe.

The importance of expanding dermatology portfolios has also been emphasized by recent news including Mayne Pharma's closure of a deal to acquire Rhofade Cream in September 2023. The rosacea treatment market is expected to witness continued growth as awareness increases, new therapies come into play, and new patients enter the pipeline.

Rosacea Treatment Market Dynamics

Drivers

-

The rising prevalence of rosacea and other skin disorders is a key factor driving growth in the treatment market.

Studies show that rosacea is prevalent in about 5–10% of the world population, although higher prevalences are noted in North America and Europe. According to the National Rosacea Society, over 16 million Americans are currently suffering from rosacea, indicating a strong need for effective treatment.

New research and awareness campaigns have highlighted just how crucial it is to get diagnosed and receive treatment as soon as possible. Another example includes the launch of EPSOLAY Cream in June 2022, a first-of-its-kind type of rosacea topical treatment that utilizes 5% benzoyl peroxide as an active microencapsulated formulation, proving to reduce lesions by 43.7% at the two-week mark during clinical trials. This is just the latest sign of a growing focus on effective, patient-friendly therapies to help meet increasing demand.

-

Innovation and market growth have been dependent on a shift towards targeted therapies for individual and specific symptoms of rosacea, such as erythema and pustules.

The rosacea treatment market is experiencing significant growth, driven by advancements in targeted therapies that address specific symptoms such as erythema (redness) and pustules (pimples). Traditionally, rosacea treatments were broad and generalized, but recent innovations have allowed for more precise and individualized therapies. These targeted treatments focus on the underlying causes of rosacea symptoms, such as inflammation and blood vessel dilation, leading to more effective and tailored solutions for patients. For instance, the development of brimonidine, a medication that constricts blood vessels to reduce redness, and doxycycline, an oral antibiotic to reduce inflammation and pustules, has greatly improved symptom management. As consumer awareness of rosacea grows, the demand for these specialized treatments continues to rise, propelling market expansion. Additionally, as personalized medicine gains traction across the healthcare industry, the rosacea market is expected to experience further growth, with new innovations continuing to emerge, offering more effective and convenient solutions.

Moreover, at the closing of September 2023, Mayne Pharma obtained global rights for RHOFADE Cream, a strategic move aiming to enhance its dermatological portfolio. The acquisition illustrates the increasing investment in rosacea-specific drugs, which some firms have recognized as an eager and treatment-seeking patient population.

Restraint

-

The rosacea treatment market faces a crucial challenge, which is the lack of awareness and high rates of misdiagnosis of the condition.

With an alarming lack of knowledge about rosacea (which is now considered one of the most common skin disorders) and confusion about acne, sunburn, and other dermatoses, there is still much to be done in terms of education. Studies indicate that more than half of people with rosacea either do not have the condition or do not receive appropriate treatment, meaning that treatment for these individuals can be delayed and future market penetration in this area could be limited.

In the case of low-income regions, healthcare providers therein might lack continued education for even basic conditions like rosacea, resulting in inconsistent treatment regimens. This issue is further complicated by the fact that rosacea’s symptoms can vary greatly, making standardized diagnosis a challenge.

This restraint is exacerbated by the efforts of organizations such as the National Rosacea Society, which has implemented awareness campaigns targeting both the public and healthcare professionals. However, the growth of the market is expected to remain restrained as a result of lower awareness and diagnostic accuracy until widespread awareness and diagnostic accuracy improve.

Rosacea Treatment Market Segmentation Analysis

By Drug Class

In 2023, the antibiotics segment dominated the rosacea treatment market, accounting for a significant revenue share of 50%. This is because they have become established as the first-line therapies for rosacea, and drugs such as metronidazole and doxycycline have been shown to improve inflammation and bacterial load—the main characteristics of the condition. Their established position in therapeutic regimens is due to their long-standing use and proven efficacy. In addition, the high prescription rates and strong patient compliance associated with antibiotic therapies further bolster this segment's market presence. Raising awareness of rosacea and treatment options also strengthened the demand for antibiotics among healthcare providers.

The alpha agonists segment is expected to grow at the fastest CAGR of 8.14% during the forecast period. Mirvaso and Rhofade offer patients targeted relief from redness, with quick visible subside of symptoms. These agents are emerging as treatment options, and their use is being adopted by dermatologists. Increasing patient pool demanding specific solutions for chronic redness will also propel the alpha agonists segment considerably, showcasing a move toward tailored solutions in the rosacea landscape.

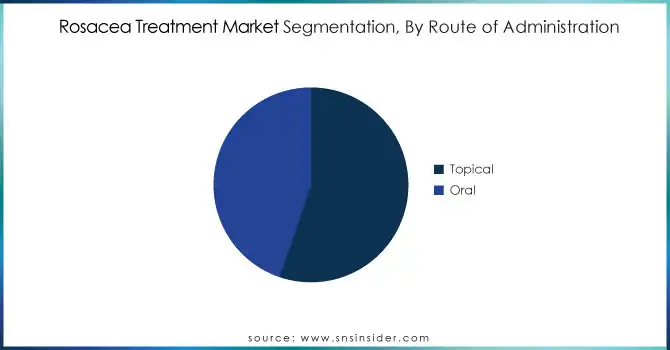

By Route of Administration

Topical Segment dominated the Rosacea treatment market with a 55% market share in 2023. This superiority is mostly a function of its convenience and effectiveness in treating localized symptoms. Patients and physicians alike prefer topical agents, including gels and creams, because they are easy to apply and act locally on the affected areas. The range of effective combinations in a single product also adds to their attraction. Moreover, incoming innovations in the development of novel topical agents further expand treatment options, reinforcing the segment's lead position in the rosacea treatment market.

The oral segment is expected to register the fastest CAGR over the forecast period owing to its ability to treat more severe types of rosacea. Oral antibiotics offer systemic control of inflammation and bacterial infection, useful for patients with widespread or bundle-resistant symptoms. The rising stringency of rosacea across numerous populations drives the oral therapies segment as a component of combination treatment plans. Oral treatments are expected to gain traction along with topical options as healthcare workers focus more on combination therapy.

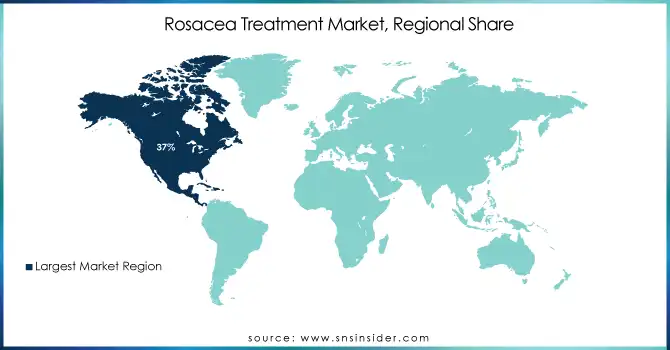

Rosacea Treatment Market Regional Outlook

In 2023, North America dominated the market with 37% of market share. This dominance can be ascribed to various factors, including improved consumer awareness and highly advanced healthcare infrastructure in this region. Fortunately, the area has a strong network of dermatology specialists trained and experienced in the proper diagnosis and management of rosacea. Further, continuous improvement in treatment alternatives and the number of drug approvals foster market growth. The National Rosacea Society (NRS) estimates that at a minimum, 16 million individuals in the United States suffer from rosacea. This concerns roughly 1 out of every 10 adults in the US. Additionally, increasing cases of rosacea are expected to propel the demand for effective remedies owing to high exposure to environmental triggers.

The Asia Pacific rosacea treatment market is estimated to register the fastest CAGR of 8.49% during the forecast period. This is mainly driven by the growth of its healthcare infrastructure and increasing disposable incomes throughout the region. Growing awareness of health issues and increasing accessibility to health services as economies grow also means patients are more inclined to seek treatment, for example for rosacea. Additionally, the rising incidence of skin diseases owing to environmental conditions drives demand for effective treatments. Improved access to dermatological services also drives the market growth for dermatological products in this area.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Galderma (Mirvaso, Oracea)

-

Revance Therapeutics (DaxibotulinumtoxinA, RHA Collection)

-

Hugel (Botulax, The RHA Collection)

-

Valeant Pharmaceuticals (Soolantra, Ziana)

-

Nestlé Skin Health (Cetaphil, Proactiv+)

-

Bausch Health (Astepro, Soolantra)

-

L’Oréal (La Roche-Posay Rosaliac AR Intense, Eau Thermale Avène Antirougeurs)

-

Meda Pharmaceuticals (Rozex, Finacea)

-

Allergan (Botox, Juvéderm)

-

Sun Pharmaceutical Industries (Tretinoin cream, Ciclopirox)

-

Pfizer (Accutane, Erythromycin)

-

Dr. Reddy's Laboratories (Clindamycin phosphate gel, Tretinoin topical cream)

-

Aclaris Therapeutics (KX2-391, Ecosporin)

-

AbbVie (Dupixent, Humira)

-

Johnson & Johnson (Neutrogena Rosacea Therapy, Aveeno Ultra-Calming Daily Moisturizer)

-

Medline Industries (Alocane, Actinoid)

-

Sientra (Silimed, BOTOX Cosmetic)

-

Kerry Group (Valtisol, Rosacea Rebalance)

-

Merz Pharmaceuticals (Belotero Balance, Radiesse)

-

Perrigo Company (Finacea Gel, Oracea)

Key suppliers:

These suppliers provide the active pharmaceutical ingredients (APIs), raw materials, and services that enable the manufacturing and development of the rosacea treatments offered by the companies listed earlier.

-

Lonza Group Suppliers

-

Biologics Suppliers

-

WuXi AppTec Suppliers

-

BASF Suppliers

-

Evonik Industries Suppliers

-

Albemarle Corporation Suppliers

-

Syngenta Suppliers

-

HaptaTek Pharmaceuticals Suppliers

-

Merck & Co. Suppliers

-

Fagron Suppliers

Recent Developments

-

May 2024: Dr. Reddy's Laboratories launched Doxycycline Capsules in the U.S. market, a therapeutic generic equivalent to Galderma Laboratories’ ORACEA Capsules. This product launch is expected to strengthen Dr. Reddy’s dermatology portfolio and contribute significantly to its revenue growth in the coming years.

-

September 2023: Mayne Pharma announced a strategic reorganization of its business to focus on dermatology and other core segments. As part of this effort, the company entered into an asset purchase agreement to acquire the global rights to RHOFADE Cream (oxymetazoline hydrochloride), a rosacea treatment, from Novan and its subsidiary EPI Health. This acquisition reinforces Mayne Pharma's commitment to expanding its dermatology portfolio.

-

October 2023: AbbVie announced that its drug Upadacitinib (RINVOQ) achieved the primary endpoint in a Phase 2 clinical trial for the treatment of vitiligo. The trial showed significant improvements in skin repigmentation among participants, representing a breakthrough in managing this autoimmune condition. Building on these positive results, AbbVie confirmed plans to advance the program to Phase 3 trials to further assess the drug's efficacy and safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.07 Billion |

| Market Size by 2032 | US$ 3.70 Billion |

| CAGR | CAGR of 6.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Drug Class (Antibiotics, Alpha agonists, Retinoids, Corticosteroids, Immunosuppressants, Other drug classes) •By Route of Administration (Topical, Oral) •By Type (Erythematotelangiectatic rosacea, Papulopustular rosacea, Ocular rosacea, Phymatous rosacea) •By Distribution Channel (Hospitals Pharmacies, Retail pharmacies, Online pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Galderma, Revance Therapeutics, Hugel, Valeant Pharmaceuticals, Nestlé Skin Health, Bausch Health, L’Oréal, Meda Pharmaceuticals, Allergan, Sun Pharmaceutical Industries, Pfizer, Dr. Reddy's Laboratories, Aclaris Therapeutics, AbbVie, Johnson & Johnson, Medline Industries, Sientra, Kerry Group, Merz Pharmaceuticals, Perrigo Company, and other players. |

| Key Drivers | •The rising prevalence of rosacea and other skin disorders is a key factor driving growth in the treatment market. •Innovation and market growth have been dependent on a shift towards targeted therapies for individual and specific symptoms of rosacea, such as erythema and pustules. |

| Restraints | •The rosacea treatment market faces a crucial challenge, which is the lack of awareness and high rates of misdiagnosis of the condition. |