Same-Day Delivery Market Report Scope & Overview:

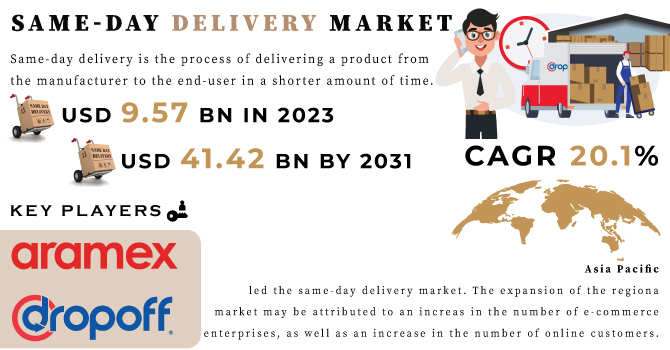

The Same-Day Delivery Market size was valued at USD 9.57 Bn in 2023 and is expected to reach USD 41.42 Bn by 2031, and grow at a CAGR of 20.1% over the forecast period 2024-2031.

Same-day delivery is the process of delivering a product from the manufacturer to the end-user in a shorter amount of time. Same-day delivery services have grown in popularity in the logistics industry because they allow service providers to build and expand their businesses profitably. Furthermore, as a result of the rising demand for products in a shorter time frame, manufacturers have chosen for speedy product delivery, which has created attractive market growth potential. Same-day delivery services also provide several benefits, such as increasing customer experience and lowering logistical costs, which contributes to the worldwide same-day delivery market's development.

Get More Information on Same-day Delivery Market - Request Sample Report

In metro markets, Pickrr has announced same-day deliveries. The logic-tech company is presently delivering more than 90% of orders the next day after they are placed. based on pickrr's point of view "Due to changing client needs, the e-commerce sector has seen a lot of changes." Last-mile operations have long been a source of frustration and a key impediment to same-day delivery. As a result of their attempts to satisfy client expectations, merchants have been compelled to adopt techniques that have pushed them toward their aim of achieving maximal same-day delivery in metro areas. Pickrr will continue to provide new technology that will assist companies in overcoming logistical challenges."

MARKET DYNAMICS

KEY DRIVERS:

-

Consumer behavior is shifting as the e-commerce business expands.

-

Drones and self-driving delivery trucks are becoming more common for same-day deliveries.

RESTRAINTS:

-

A lack of infrastructure, as well as greater logistical costs.

-

manufacturers and merchants have no influence on logistics services.

OPPORTUNITY:

-

The logistics industry's ongoing efforts to provide efficient and fast same-day deliveries

-

Last-mile deliveries are becoming more common, while logistics automation is becoming more common.

-

The deployment of a multi-modal system has resulted in a reduction in lead time.

IMPACT OF COVID-19

Flight cancellations, travel restrictions, and quarantines have all been imposed as a result of the COVID-19 epidemic, causing huge delays in the supply chain and logistical activities throughout the world. Important supply chains in the logistics and transportation business have been impacted as a result of the coronavirus pandemic, but in varied ways in the air, freight, and maritime sectors. The COVID-19 outbreak has had a direct impact on logistics firms that handle product transit, storage, and movement. Movement limitations, border controls, closures, and health screening are the most prevalent causes of the reduction in growth. Due to the closing of national and international borders, which has restricted the movement of freight carriers, the same-day delivery industry has also seen a drop-in activity.

MARKET ESTIMATION

The B2B sector led the market in terms of revenue in 2023. Manufacturers, merchants, and distributors are among the end-user consumers served by the B2B category. Market expansion is being aided by the introduction of online B2B e-commerce platforms. Furthermore, the B2B segment's revenue share is larger due to the bigger weight of the goods, which results in higher transportation expenses.

From 2024 to 2031, the B2C category is expected to grow at the quickest rate. Consumers' increasing preference for e-commerce platforms is responsible for this increase. Due to the advantages of same-day delivery services, such as rapid product delivery, the C2C industry is likely to increase significantly in the coming years.

The domestic sector led the market in terms of revenue in 2023. The existence of a significant number of local e-commerce platforms operating within the country is credited with this rise. Furthermore, increased internet penetration combined with an increase in the number of e-shoppers is expected to drive category growth throughout the projection period. Customers' purchase selections are influenced by shipping times; hence e-commerce platforms have begun to provide same-day delivery options. Over the projection period, the international service category is expected to increase significantly. The industry is seeing growth potential as cross-border e-commerce trade expands. As a result, internet retailers provide worldwide delivery to entice customers from other nations. International packages, on the other hand, have far higher delivery charges than domestic deliveries.

KEY MARKET SEGMENTS

On The Basis of Type

-

B2B

-

B2

-

C2C

On The Basis of Service

-

International

-

Domestic

On The Basis of Application

-

Retail

-

E-commerce

-

Healthcare

-

Others

REGIONAL ANALYSIS

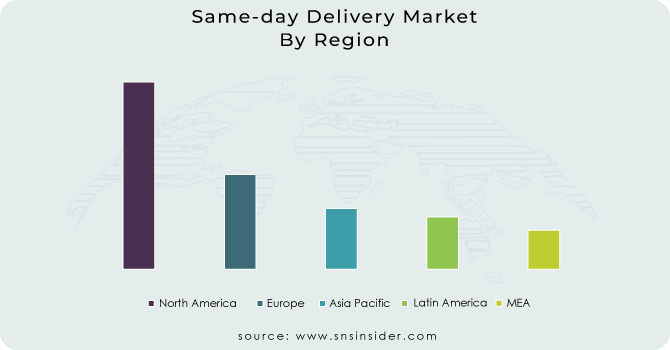

In 2023, Asia Pacific led the same-day delivery market. The expansion of the regional market may be attributed to an increase in the number of e-commerce enterprises, as well as an increase in the number of online customers. Furthermore, regional market development is expected to be fueled by rising internet penetration, smartphone use, and increasing urbanization. Over the projection period of 2024-2031, North America is predicted to increase significantly. The existence of key businesses is credited to this expansion, and these companies are offering same-day delivery services to increase their service offerings in the region. Furthermore, the region's robust e-commerce business is expected to provide doors for the market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The major key players are A1 Express Services Inc., Aramex, DHL, Dropoff, Inc., FedEx Corp., Jet Delivery, Inc., Power Link Expedite, United Parcel Service of America, Inc., USA Couriers, XPO Logistics, Inc. & Other Players

A1 Express Services Inc-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.57 Billion |

| Market Size by 2031 | US$ 41.42 Billion |

| CAGR | CAGR 20.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (B2B, B2, C2C) • by Service (International and Domestic) • by Application (Retail, E-commerce, Healthcare, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | A1 Express Services Inc., Aramex, DHL, Dropoff, Inc., FedEx Corp., Jet Delivery, Inc., Power Link Expedite, United Parcel Service of America, Inc., USA Couriers, XPO Logistics, Inc. |

| Key Drivers | •Consumer behavior is shifting as the e-commerce business expands. •Drones and self-driving delivery trucks are becoming more common for same-day deliveries. |

| Market Restraints | •A lack of infrastructure, as well as greater logistical costs. •manufacturers and merchants have no influence on logistics services. |