Seed Coating Market Report Scope & Overview:

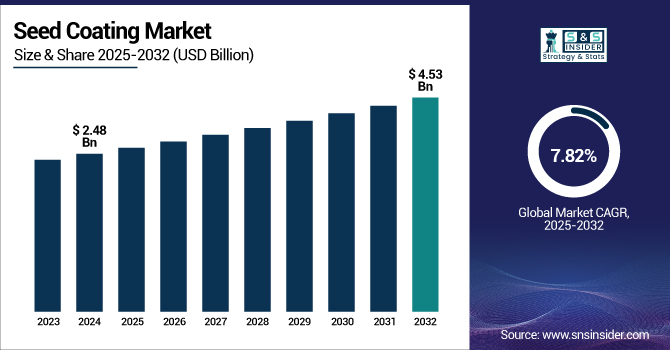

The Seed Coating Market size was valued at USD 2.48 Billion in 2024 and is expected to reach USD 4.53 Billion by 2032, growing at a CAGR of 7.82% over the forecast period of 2025-2032.

To Get more information on Seed Coating Market - Request Free Sample Report

The seed coating market is capitalizing on growing agricultural learning and an increasing demand for sustainable crop protection. Seed coatings improve seed quality, digitize germination rates, and minimize the usage of harmful chemical inputs. Emerging trends comprise organic farming, biocontrol agents, and technology advancements in biopolymer-based coatings.

For instance, A coating composition to prolong seed viability and shield it against storage pests, developed by the Indian Institute of Seed Research (IISR), was patented by IISR in April 2025.

Germains Seed Technology and Precision Laboratories are among the companies growing their offerings to meet increased demand. The USDA believes these sustainable seed treatments are crucial in driving productivity increases with less environmental impact.

Seed Coating Market Dynamics

Drivers

-

Precision Agriculture and Government Support Drive Expansion of Advanced Seed Coating Technologies in Farming

The seed coating market is witnessing a boost due to precision agriculture as it allows the application of micronutrients and crop protection at the seed level, thus accelerating growth for the seed coating manager.

With 68% of large-scale farms utilizing yield monitors and mapping technologies in 2023, it is clear that the USDA Economic Research Service reflects an important transition in agricultural practices, with efficient, integrated seed treatment becoming the mainstream.

With the scaling of these technologies to mid-sized and small farms, the market for sophisticated seed coatings will only increase. This evolution will improve resource efficiency, reduce waste, and increase crop yield. Also, with the rolling out of agricultural training programs governments, seed coating solutions adoption is being promoted among multiple farming operations.

-

Integration of Biopolymer Innovations Accelerates Seed Coating Market Growth

A recent development in the seed coating market is biopolymer-based dual-action seed coatings that enable nutrient mobilization and microbial protection in one treatment cycle.

In November 2024, the Indian Institute of Oilseeds Research developed biopolymer-based technology on a license for private companies to use. This trend was continued in April 2025, when the Indian Institute of Seed Research patented a novel seed coating composition, preparing a "Sustainable & multifunctional Seed Treatment".

These trends represent a microcosm of a broader evolution in the market, where R&D-led innovation is detoxifying and trimming down product pipelines, ultimately steering a greater number of producers toward the greener side of the spectrum. Compounding this trend is collaboration between academia and seed coatings companies seeking sustainable innovations.

Restraints

-

Regulatory Complexities and Approval Timelines Hamper Seed Coating Industry Advancement

Seed coating market players face considerable challenges with regulatory compliance pertaining to multilayered frameworks in different jurisdictions, resulting in delayed product launches and higher costs of development.

In the US, the National Pollutant Discharge Elimination System mandates registrations be filed with the program 180 days ahead of time, with individual registrations taking as long as six months. Furthermore, the decisions on active ingredient approvals under the Pesticide Registration Improvement Act often take longer than the 12–18 months target timeframe due to data delays.

These lengthy review times hinder companies from quickly responding to emerging threats and agronomic needs. This creates unnecessary uncertainty and delays that stifle market growth and impede investment in expanded formulations, as regulatory environments diverge and delays stack up.

-

High Production Costs of Advanced Coating Materials Limit Seed Coating Market Share

The high prices of specialized coating polymers and additives have restricted the growth of the seed coating market owing to the impossibility of small and mid-tier producers to purchase.

For instance, according to the USDA Economic Research Service, seed prices increased by 263%, and chemical input costs increased by 149% from 1996 to 2016. Production costs and time are further increased by the use of high-performance polymers, nanoparticles, and binders. This compels seed coating companies to find a balance between performance and cost, especially in price-sensitive areas of the globe.

The USDA ERS, the rising agricultural input prices are going to affect the market until new, affordable innovations come along.

Seed Coating Market Segmentation Analysis

By Additive

The polymers segment accounted for the highest market share of 45.2% in the seed coating market in 2024. The dominance is attributed to their extensive utilization of polymer-based coatings, which are used to increase seed protection during germination and, subsequently, seed growth. Durable layers that polysaccharides such as cellulose derivatives and synthetic polymers create contribute to the efficacy of fertilizers and pesticides, enhanced seed germination, and protection against stress factors. Due to these environmental advantages, the U.S. Environmental Protection Agency (EPA) recommends these coatings, which will help to ensure that the coatings will maintain their market share. The polymer segment is projected to continue leading as sustainable agriculture practices grow in popularity.

The colorants segment is projected to grow the fastest during the forecast period due to the demand for seeds that are visually identifiable and traceable. Colorants enhance the visibility of seed treatment to both clients and farmers, giving a guiding marker during planting about the application of the treatment and informing of any issues during and post planting. Support from organizations like the USDA provides an incentive for their use in sustainable agriculture. With the advent of precision farming, the sub-segment colorants are projected to continue to grow at a fast pace, ensuring seed distribution and lessening contamination.

By Crop Type

In 2024, the cereals & grains segment held a high revenue share of 40.5% in the seed coating market. Moreover, maize and rice are major crops primarily due to their importance to world food security and as a mainstay of agricultural economies. Such seed coatings improve seedling vigor, germination, and disease resistance by aiding growth in harsh environments for these crops. The Food and Agriculture Organization (FAO) discusses their role in food production, thus reinforcing their supremacy. Growth in the cereal and grain seed coating market is driven as farmers engage to improve yield and quality, in particular across the Asia-Pacific region

The fruits & vegetables segment is projected to be the fastest-growing crop type during the forecast period from 2025 to 2032. The increase is also due to the increasing demand for organic products, especially in the US and European countries. By protecting seeds from nasty pests and diseases they improve health in crops when insects are transferred away from plants and the need for pesticides is reduced. This will be a fast-growth segment due to sustainability progress and growing worldwide demand, but will be aided primarily by USDA funded market development of novel seed treatments.

By Form

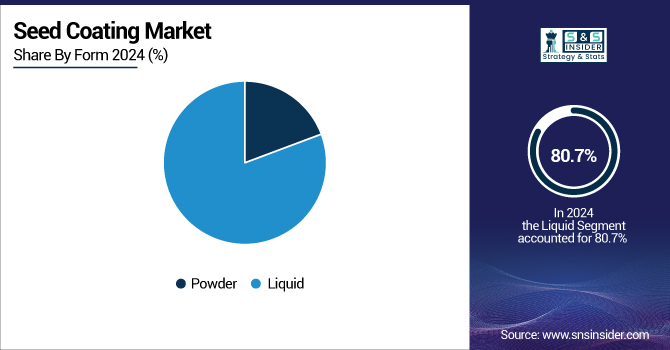

Based on the form, the liquid segment dominated the seed coating market in 2024, with a market share of about 80.7%. Liquid coatings are the preferred selection among large-scale agricultural avenues as these coatings can lead to even surface distribution among the plants and have a higher cost efficiency. The European Crop Protection Association (ECPA) supports liquid coatings for their environmental and applicatory efficiency. Their leadership is further propelled by the ability to stack different seed treatments, such as fungicides and micronutrients.

The powder segment was the fastest-growing in the seed coating market in 2024. This growth is fueled by the demand for economical and high-performance coatings. They also have a long list of advantages for manufacturers: Powder coatings are easier to apply, provide greater control, and are more eco-friendly than liquid paints. Additionally, the increasing adoption of powder coatings that the U.S. EPA recommends for bio-degradability has complemented this segment's healthy growth at expansive rates in eco-friendly markets.

By Process

The film coating accounted for the largest share of 55.1% in 2024. The film coatings give a smooth coating, protecting the granulated material and allowing uniform distribution of active ingredients and controlled release of pesticides and fungicides. Validated by the European Seed Association (ESA), they increase the vitality and germination of seeds. As the demand for high-performance seeds and precision agriculture continues to see sustainable growth, film coatings are gaining ground for large-scale as well as precision farming. This segment is anticipated to provide high growth owing to the advantage it offers over its counter-part.

The pelleting segment is projected to be the fastest-growing in the seed coating market. The process makes it easier to handle the seed while planting more accurately and increasing the wastage of seeds. Pelleted seed demand gets a boost from planting tech improvements and USDA reports of higher adoption for expensive crops. With mechanized farming methods and the pelleting process, this will be implemented further at great speed, ensuring optimum sowing.

Seed Coating Market Regional Outlook

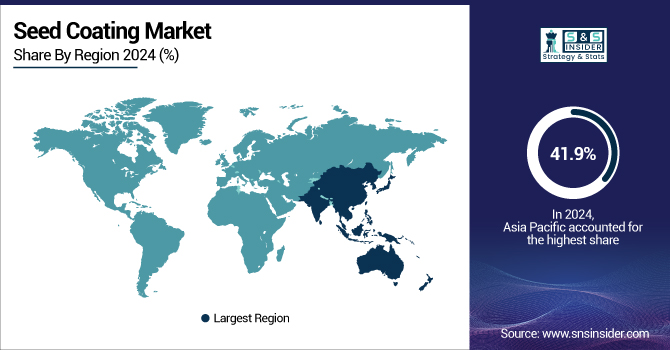

The Asia Pacific dominated the market with a 41.9% share in 2024 due to an increase in food demand, government subsidies, and sophisticating agriculture. In India, the adoption of seed treatment is supported through the National Food Security Mission. Precision farming trends in Australia also drive growth. The partnership of a multinational organization with the local distributor to strengthen the regional distribution accounts for regional distribution in the seed coating market that is led by Asia Pacific, followed by Europe.

North America, expected to be the fastest-growing region in the seed coating market in 2024, contributing to 15.3%, derives its advantages from high R&D investment and precision agriculture. The U.S. dominated the North American seed coating market with a market size of USD 258.2 Million in 2024, whereas Canada plays by the book of sustainable farming. USDA is making an effort to decrease pesticide use and improve soil health. High-performance seeds and AI in farming facilitate greater adoption, while collaborations push material innovations, all of which bolster North America's lead in advanced seed coating tech and its sustainable agriculture goals.

The second largest market share was captured by Europe, with 25.2% in 2024 on the foundation of sustainable agricultural policies and integrated pest management. With an emphasis on sustainable practices, Germany, France, and the Netherlands take the lead. Spurring a reduced pesticide strategy, the EU CAP provides incentives for seed-coating. The uptake of bio-based coatings and anti-disease innovations and advancements in climate-adaptive seed coatings are being established through public-private research initiatives and with the support provided by regulatory bodies. The need for bio-degradable materials is impelling Europe to cement solid footing in the seed coating market.

In 2024, Latin America accounted for 9.7% of the market share, with Brazil and Argentina among the largest agricultural exporting countries. While Brazil's Low-Carbon Agriculture (ABC) Plan and similar government programs in other developing countries encourage sustainable farming practices around the world, even multinational companies are partly transforming the situation by offering coatings for disease resistance and drought tolerance. Argentina works with seed coating makers to enhance crop quality. Latin America shows the potential for a fast-growing seed coating industry supported by a pleasant climate and the development of input focus for productivity and climate-responsive agriculture.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major competitors of the seed coating market include Germains Seed Technology, Precision Laboratories LLC, BrettYoung Seeds Limited, Centor Oceania, Universal Coating Systems, Chromatech Incorporated, Seed Dynamics, Inc., Summit Seed Coatings, Smith Seed Services, Seedpoly Biocoatings Pvt. Ltd.

Recent Developments

-

October 2024: 90% of U.S. soybean farmers utilize seed treatments, such as fungicides and insecticides, while 34% use nematicides for early-season protection and lowered pesticide applications.

-

December 2024: Biopolymer-assisted oilseed seed coating technology was developed and licensed to private companies by the Indian Institute of Oilseeds Research, enhancing sustainable multifunctional seed treatments and enabling product differentiation in the sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.48 Billion |

| Market Size by 2032 | USD 4.53 Billion |

| CAGR | CAGR of 7.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Additive (Polymers, Colorants, Binders, Minerals/Pumice, Active Ingredients, Others) •By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Flowers & Ornamentals, Others) •By Form (Powder, Liquid) •By Process (Film Coating, Encrusting, Pelleting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Germains Seed Technology, Precision Laboratories LLC, BrettYoung Seeds Limited, Centor Oceania, Universal Coating Systems, Chromatech Incorporated, Seed Dynamics, Inc., Summit Seed Coatings, Smith Seed Services, Seedpoly Biocoatings Pvt. Ltd. |