Serial Device Server Market Size & Growth:

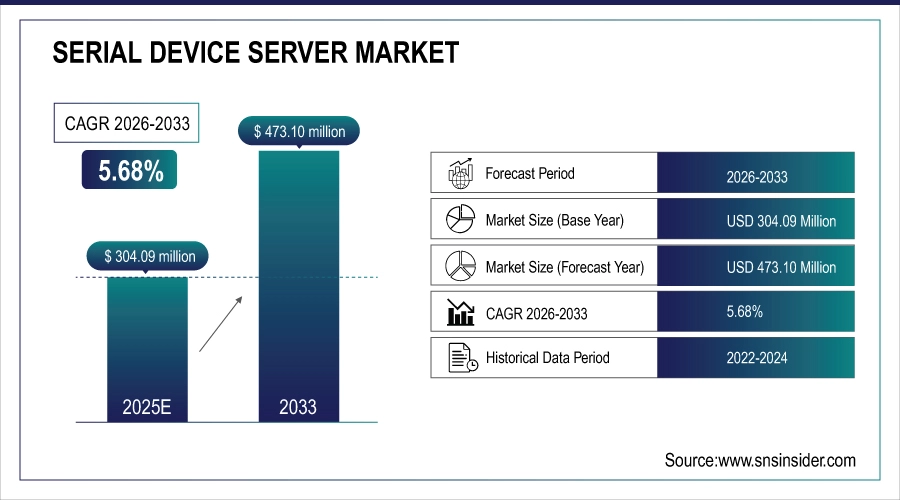

The Serial Device Server Market size was valued at USD 304.09 Million in 2025E and is projected to reach USD 473.10 Billion by 2033, at 5.68% CAGR from 2026-2033.

Rising industrial automation, IoT integration and demand for remote device management is driving the serial device server market. Smart factory initiatives, rising demand for data acquisition, and growing applications in the healthcare, energy, and transportation sectors are fueling growth.

Apart from industrial automation and IoT, the growth of the Serial Device Server Market can also be attributed to the increasing demand for legacy equipment connectivity with contemporary networks. Although it is the twenty-first century, some industries still have a dependence on devices that communicate based on RS-232/422/485 signaling, and serial servers connects these to Ethernet. Increasing cybersecurity awareness also demands secure serial-to-IP solutions. Demand is also fueled by the movement of utilities toward smart grid systems and real-time monitoring. In addition, the long-term market growth is bolstered by increased uptake in smart cities and infrastructure modernization initiatives globally.

-

In June 2024, Lantronix launched its EDS5000 series rackable serial device servers (8‑, 16‑, 32‑port) enabling remote control of RS‑232/422/485 devices in sectors like medical, POS, and security systems

Serial Device Server Market Size and Forecast:

-

Market Size in 2025E: USD 304.09 Million

-

Market Size by 2033: USD 473.10 Million

-

CAGR: 5.68% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Serial Device Server Market - Request Free Sample Report

Serial Device Server Market Highlights:

-

Rising demand driven by Industry 4.0 adoption, legacy device integration, and growing cybersecurity requirements.

-

Increasing deployment in industrial automation, remote monitoring, and real-time data communication across manufacturing, utilities, and transportation.

-

Continued need for serial-to-Ethernet/IP conversion (RS-232/422/485) for legacy devices fuels market growth.

-

Market faces challenges from the shift to wireless, native Ethernet, and digital solutions, causing compatibility issues with older serial devices.

-

Opportunities in smart cities, emerging markets, and cloud-enabled serial device server solutions, particularly in Asia-Pacific, Latin America, and Africa.

-

Rising security standards, with 89% of enterprise buyers requiring FIPS 140‑2 Level 3 certification for critical infrastructure edge devices.

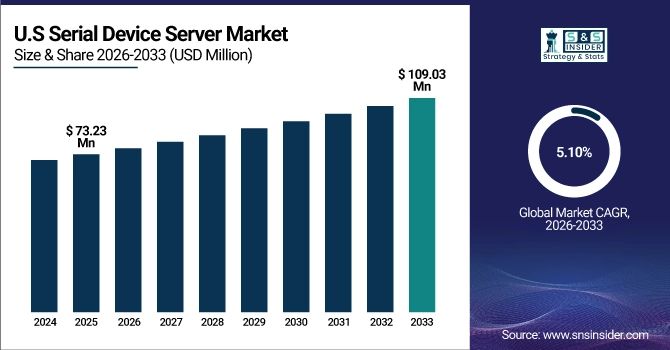

The U.S. Serial Device Server Market size is estimated to be valued at USD 73.23 million in 2025E and is projected to grow at a CAGR of 5.10%, reaching USD 109.03 million by 2033. The U.S. serial device server market growth is driven by booming industrial automation (Industry 4.0), modernization of legacy serial equipment, smart infrastructure expansion, increasing remote monitoring needs, and adoption of secure Ethernet standards.

Serial Device Server Market Drivers:

-

Rising Demand for Serial Device Servers Driven by Industry 4.0 Legacy Integration and Cybersecurity Needs

Growth of the global Serial Device Server market trends is primarily attributable to increasing deployments of industrial automation, remote monitoring, and real-time data communication between varied sectors. One of the most significant forces is the continued requirement to interface legacy serial-based devices (RS-232/422/485) to new Ethernet/IP networks, in particular in manufacturing, utilities, and transportation. Growing prevalence of Industry 4.0 and smart grid technologies is fueling demand for encapsulation support for serial-to-IP conversion systems. Further, rising concerns regarding cybersecurity are compelling enterprises to deploy device servers that feature encryption and be firewall-compatible.

July 2024 Reddit discussions by field engineers noted widespread use of serial‑to‑Ethernet gateways (Moxa and Lantronix) across VFDs, energy meters, weighers, scales, SCADA controllers, even in new deployments.

Serial Device Server Market Restraints:

-

Serial Device Server Market Faces Pressure from Wireless Shift and Compatibility Issues in Modern Networks

The serial device server market may face a challenge in the form of technological revolution eliminating serial-based communication protocols in favor of fully digital and wireless alternatives. The transition to native Ethernet, Wi-Fi, and cellular-based solutions to replace legacy RS-232/422/485 infrastructure is becoming more popular as industries modernize, minimizing dependence on serial devices in the long term. Multiple generations of serial communication firmware led to interoperability problems between older serial devices and newer Ethernet/IP systems needing a customized solution.

Serial Device Server Market Opportunities:

-

Smart Cities and Emerging Markets Drive Growth Opportunities for Cloud Enabled Serial Device Server Solutions

Increasing smart city integration, widespread infrastructure upgrade, and emerging edge computing also serves up opportunities for serial device servers, and enabling real-time data acquisition and transmission. These are dynamic markets in Asia-pacific, Latin America, and Africa that are still to realize the benefit of industrial digitization or public sector automation. In addition, development of wireless serial device server and cloud-integrated solution poses potential growth opportunities for vendors.

As of Q2 2024, 89% of enterprise buyers require FIPS 140‑2 Level 3 certification for serial device servers handling critical infrastructure, reflecting the need for secure edge devices.

Serial Device Server Market Segment Analysis:

By Type

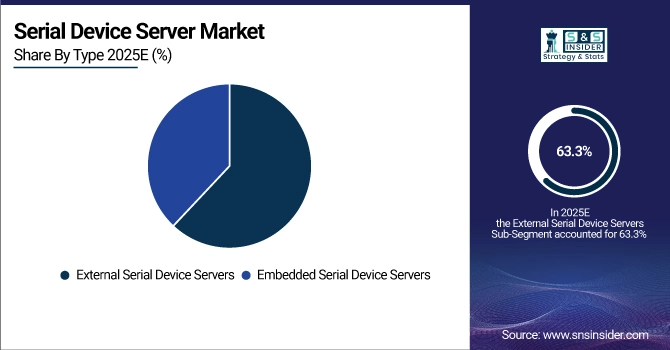

External Serial Device Servers represented the largest share of the global market in 2025E at 63.3%. This has led to their popularity due to ease of installation, flexibility, and support for sizeable number of legacy devices. These outside units are largely employed in commercial automation, retail, and energy spaces exactly where fast deployment and minimal disruption to current systems are essential. Their stand-alone nature also allows the kits to be deployed in different environments without requiring extreme integration in current hardware.

Over 2026-2033, Embedded Serial Device Servers are expected to have the highest growth in terms of CAGR due to the growth for small, integrated solutions in domestic, medical and industrial control centers. This form factor, being smaller and more directly integrable into original equipment, is perfect for OEMs and IoT applications as well. With the growing demand for connectors that are efficient, space-saving, and scalable, embedded servers will have a significant market share.

By Application

In the year 2025E, the Industrial Control Systems held the largest market share in the Serial Device Server market by accounting for 39.7%. The primary reason for its dominance is the escalating demand for automation and remote-control technologies in industries, such as manufacturing, energy, and utilities. Serial device servers are valuable in linking legacy PLCs, sensors, and controllers to Ethernet networks for real-time communication, monitoring, and control. The devices are useful in increasing operational efficiency and mitigating downtime and, therefore, their adoption in industries transitioning to digital operations.

The fastest-growing segment during 2025-2033 is expected to be the data acquisition segment. The vital driver for the rapid growth of this segment is the increasing requirement for real-time data collection and its employment in every sphere in research, process monitoring, and smart infrastructure. With the rapid development and wider deployment of the IoT devices, the market is expected to witness a sharp rise in the demand for the quick and reliable data acquisition systems capable of interfacing with industrial serial devices.

By Port

Multi-Port Serial Device Servers led the global market in 2025E with an overwhelming 67.3% market share as they are used in industrial and commercial applications of larger scale, connecting multiple serial devices (PLCs, sensors, barcode scanners, and meters) to a network. This makes them best-suited for applications in manufacturing plants, energy facilities and logistics hubs where there is a requirement to simplify complex system integration, cabling and provide optimal centralized control. These models are also scale-out and affordable for mass/higher density deployments because you already have a greater number of ports in them.

Single-Port Serial Device Servers are expected to register the highest CAGR from 2026 to 2033 due to increasing adoption in small systems, retail, healthcare, and building automation applications. What makes these devices popular are their simplicity, low power consumption, and cost-effectiveness, especially when space is limited, and the need for connectivity is minimal. Network adoption at smaller businesses and edge computing systems will drive further demand for single-port solutions over the next few years.

By End-Use

The industrial sector was the biggest segment with 33.8% share of the global Serial Device Server market in 2025E. The major share is attributed to the adoption of serial device servers in the field of industrial automation, manufacturing lines, SCADA and process control. The serial servers allow legacy serial equipment to communicate effectively, in real time with Ethernet-based systems which increases efficiency and minimizes operational downtime. Many industries still use RS-232/422/485 interfaces for machine-to-machine communications, so serial connectivity is essential for modernizing without replacing existing infrastructure.

The healthcare sector is projected to show the highest CAGR during the span of 2026 to 2033 with a rising digitization in hospitals, diagnostic labs, and medical device integration. Web based medical instruments and connected medical devices, including imaging system, patient monitor, and lab analyzer are some of the critical examples where the focus is towards adopt serial device servers to network enable them. Growing demand for secure, real-time data transmission, regulatory compliance, and centralized monitoring in healthcare settings will propel the market growth during the forecast period.

Serial Device Server Market Regional Analysis:

North America Serial Device Server Market Trends:

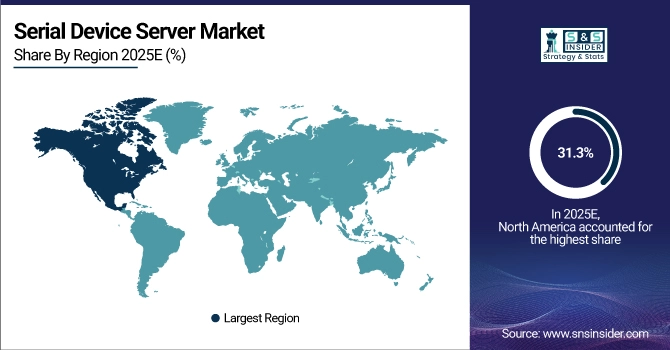

In 2025, North America led the global Serial Device Server market in terms of revenue, accounting for 31.3% of global revenue, with developed industrial base, increased adoption of automation technologies, and early adoption of IoT and other advanced technologies in each end user vertical driving the market forward in North America. With substantial investments in digital infrastructure, the region is experiencing the need for legacy serial-based equipment to be connected to modern Ethernet/IP networks within industries from Manufacturing, Energy, Transportation, and Healthcare.

In addition, the stringent need for operational efficiency and data security is enhancing the adoption of advanced serial device servers, which supports encrypted communication and remote management. This, coupled with the presence of prominent players with technologically advanced solutions, makes North America dominant in this market. In addition to that, the demand for dependable serial-to-network connectivity is further driven by the advancing smart infrastructure projects, edge computing, and real-time asset monitoring solutions.

Industrial automation combined with advanced IT infrastructure has led the U.S. to dominate North American Serial Device Server market share, along with growing demand for integrating legacy systems with new modern networks.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Serial Device Server Market Trends:

Asia Pacific is expected grow rapidly the fastest CAGR of 6.61% over 2026-2033 as compared to other regions. Several factors including rapid industrialization followed by infrastructure modernization and rise in smart city development are driving the growth of the Serial Device Server market across this region. Growing number of countries in the region are embracing industrial automation and IOT technologies to implement greater operational efficiencies in manufacture, utilities and transportation domains. Apart from this, increasing investments in digital transformation projects, particularly in developing economies, are driving the need for serial-to-Ethernet connectivity for legacy system integration.

In 2024, the leading country in the Asia Pacific Serial Device Server market is China due to the large presence of industrial automation on a massive scale, rapid urbanization and large manufacturing base, high installations of intelligent infrastructure and IoT systems.

Europe Serial Device Server Market Trends:

With major focus on the industrial automation, smart manufacturing and infrastructure modernization, Europe is still be seen as one of the really important markets for Serial Device Servers. Serial connectivity is a key enabler for connecting legacy equipment with Ethernet/IP networks, and the region has an established automotive, energy, and transportation sectors which depend on such connectivity. High demand for real-time monitoring and device management is boosting adoption of Industry 4.0 practices particularly in Germany, France, and the Nordic countries. Moreover, the increased implementation of stringent regulations regarding cybersecurity and data integrity is also driving the organizations to adopt secure serial-to-network communication solutions.

Latin America Middle East & Africa Serial Device Server Market Trends:

Latin America and Middle East & Africa are new growth markets for Serial Device Server owing to long-term process of industrial modernization, smart city projects, and smart devices among others. Sectors, such as energy, utilities, and transport are ramping up investments on connectivity solutions to unify legacy infrastructure within the Latin American market. At the same time, oil & gas, manufacturing and public sector automation are creating demand for the Middle East & Africa. In addition, government-led digital transformation programs and infrastructure upgrades further support steady market expansion across both regions.

Serial Device Server Market Competitive Landscape:

Moxa, established in 1987 in Taipei, Taiwan, is a leading provider of industrial networking, computing, and automation solutions. The company specializes in serial-to-Ethernet device servers, industrial switches, and edge computing platforms, serving sectors like rail, energy, and manufacturing with secure, reliable, and high-performance connectivity solutions worldwide.

- On October 2025, Moxa expanded its rail portfolio, introducing EN 50155-certified switches, onboard computers, wireless access points, and IP cameras to support digitalized and secure rail operations. The products enable high-performance connectivity, predictive maintenance, TCMS, PIS, and cybersecurity compliance under NIS2, TSA directives, and upcoming FRMCS standards.

Advantech, established in 1983 in Taipei, Taiwan, is a global leader in industrial edge computing and IoT solutions. The company provides AI-enabled platforms, embedded systems, industrial PCs, and automation solutions for manufacturing, robotics, transportation, and smart cities, enabling secure, real-time, and scalable digital transformation across diverse industries worldwide.

- On Jan 2026 Advantech unveiled its AI Brain platform powered by NVIDIA Jetson T4000, delivering data-center-class AI at the edge for robotics and autonomous systems. The scalable platform enables real-time perception, reasoning, and decision-making, supporting industrial-grade reliability, multi-modal AI workloads, and next-generation Physical Intelligence applications.

Serial Device Server Market Key Players:

-

Moxa

-

Advantech

-

Lantronix

-

Digi International

-

Perle Systems

-

Westermo

-

Sealevel Systems

-

ATEN Internationa

-

Sena Technologies

-

B&B Electronics

-

ICP DAS

-

EtherWAN Systems

-

NPort (by Moxa)

-

Gemalto (now Thales Group)

-

Comtrol Corporation

-

Black Box Network Services

-

NetBurner

-

ORing Industrial Networking

-

SerialComm

-

CMC Electronics

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 287.45 Million |

| Market Size by 2032 | USD 445.88 Million |

| CAGR | CAGR of 5.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (External Serial Device Servers, and Embedded Serial Device Servers) • By Application (Remote Management, Data Acquisition, Point-of-Sale (POS) Systems, and Industrial Control Systems) • By Port (Single-Port Serial Device Servers, and Multi-Port Serial Device Servers) • By End Use (Industrial, Retail, Telecommunications, Healthcare, Energy and Utilities, Transportation, and Others (Government, Education, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Moxa, Advantech, Lantronix, Digi International, Perle Systems, Westermo, Sealevel Systems, ATEN, Sena Technologies, and B&B Electronics. |